|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

暗号通貨のニュース記事

Bitcoin (BTC) Options Signal Bullish Bias as SPX Options Skew Reflects Greater Downside Risk

2025/01/07 20:00

Bitcoin Deribit-listed options show a bullish bias, while S&P 500 options reflect greater downside risk.

After a turbulent 2024, mainstream financial markets are setting the stage for a new year. While inflation remains stubbornly high and a recession still looms, risk-taking has picked up across financial markets in the past two months.

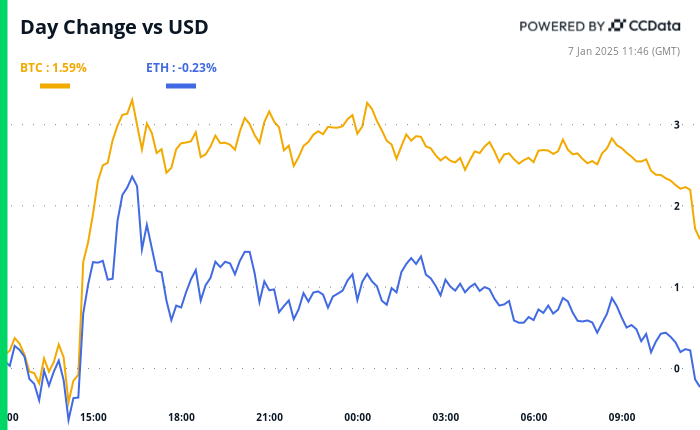

In the crypto markets, BTC is looking to secure a foothold above $100,000, while ETH breached the $3,800 level during morning trade in Asia.

The broader stock market, meanwhile, has a history of providing risk-on/off cues to risk assets, including BTC. So, what are the options markets saying about the S&P 500 and how could that impact bitcoin?

According to Cboe data, the SPX options skew now reflects greater downside risk than it did a year ago.

The defensive positioning in stocks perhaps stems from concerns that President-elect Donald Trump's Jan. 20 inauguration could be a "sell-the-news" event.

"Broadly speaking, we see some cracks in the data and think that Trump’s inauguration later this month has a decent chance of being a ‘sell the news’ event after nearly three months of unbridled economic optimism across most sectors," Bruce J Clark, head of rates America at Informa Connect, said on LinkedIn.

That raises the question: How will BTC react?

After all, expectations of regulatory clarity under Trump have already seen the cryptocurrency rally to over $100,000 from $70,000 in just two months. A Jan. 20 broader market sell-off could pull down the dollar index and the bond yields, potentially supporting BTC.

For now, there are several factors supporting BTC.

For instance, the $400 billion in liquidity sucked out of the system in the final two weeks of 2024 is likely to return, greasing asset prices, according to the LondonCryptoClub newsletter. Plus, some of the capital flows from China could find a home in cryptocurrencies.

Bitcoin is again trading at a premium on Coinbase, reflecting stronger Stateside demand while miners are expected to cut back on sales.

"The Net Unrealized Profit and Loss (NUPL) for miners remains very positive, hovering around 0.5, suggesting that miners are still in a strong position, with substantial unrealized profits and a preference to hold onto their BTC at this stage," analysts at Bitfinex told CoinDesk.

In the broader market, some traders are dabbling with December 2025 ETH calls at strikes as high as $11,000. Ether is currently trading below $4,000. Over 70 of the top 100 coins by market value were up on a 24-hour basis at press time. Need more evidence of risk-on?

That said, keep an eye on the bond market rout, which is fast spreading outside the U.S. Early today, the Japanese 10-year bond yield rose to a 13-year high while its 30-year British counterpart was on the verge of hitting the highest since the late 1990s. That can suck the wind out of risk assets. Stay alert!

What to Watch

Token Events

Conferences:

Token Talk

By Shaurya MalwaEthereum co-founder Vitalik Buterin has offloaded a stash of memecoins sent to him by various communities to fund a charity, on-chain data shows.

In the past two days, Buterin has sold $940,900 worth of lesser-known memecoins for the USDC stablecoin and ether. The NEIRO, ESTEE, MARVIN, EBULL, MSTR, and TERMINUS tokens brought in at least $57,000 worth of USDC, while other tokens were sold for less than $40,000.

Just over $916,000 was whisked away to a multisign wallet, likely tied to the charity Kanro, according to SpotOnChain.

Communities often send tokens to Buterin mainly to gain exposure and leverage his influence in the crypto space.

But Buterin’s known philanthropy also plays a role. Communities send tokens expecting him to donate them, indirectly supporting charity. Back in October, Buterin said he would donate any tokens sent to him to charitable causes, though he added that he didn’t support the act.

I appreciate all the memecoins that donate portions of their supply directly to charity.(eg. I saw ebull sent a bunch to various groups last month)Anything that gets sent to me gets donated to charity too (thanks moodeng! The 10B from today is going to anti-airborne…

“Anything that gets sent to me

免責事項:info@kdj.com

提供される情報は取引に関するアドバイスではありません。 kdj.com は、この記事で提供される情報に基づいて行われた投資に対して一切の責任を負いません。暗号通貨は変動性が高いため、十分な調査を行った上で慎重に投資することを強くお勧めします。

このウェブサイトで使用されているコンテンツが著作権を侵害していると思われる場合は、直ちに当社 (info@kdj.com) までご連絡ください。速やかに削除させていただきます。