|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

美联储主席鲍威尔在12月美联储会议后的周三新闻发布会上采取鹰派立场,引发市场大屠杀

Federal Reserve Chair Jerome Powell adopted a hawkish stance during his Wednesday press conference after the December Fed meeting, sparking a market bloodbath as the New York session headed to the close.

美联储主席杰罗姆·鲍威尔在 12 月美联储会议后的周三新闻发布会上采取了鹰派立场,在纽约时段收盘时引发了市场大屠杀。

Although the Federal Reserve lowered interest rates by 0.25% to a range of 4.25%-4.5%, as widely anticipated, the updated economic projections suggest just two potential rate cuts in 2025 — down from four projected in September and fewer than the three anticipated by markets before the meeting.

尽管正如普遍预期的那样,美联储将利率下调了 0.25%,至 4.25%-4.5% 的范围,但最新的经济预测表明 2025 年可能只会降息两次——低于 9 月份预测的四次,也少于 2025 年预测的 3 次。会议前的市场。

Powell described the shift as “a new phase” for monetary policy, emphasizing that after 100 basis points of rate cuts in 2024, rates are now significantly closer to a neutral stance.

鲍威尔将这一转变描述为货币政策的“新阶段”,并强调在 2024 年降息 100 个基点之后,利率目前已明显接近中性立场。

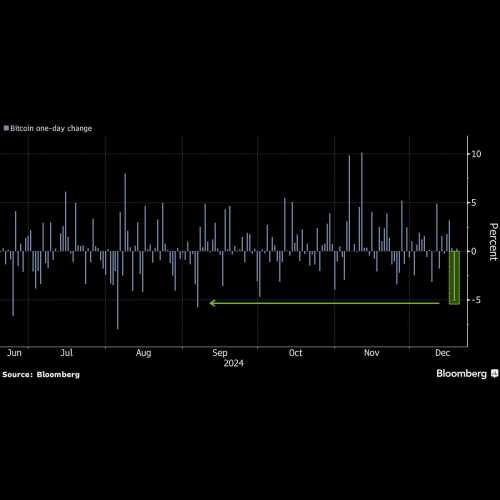

Stocks tumbled across the board, the U.S. dollar soared to two-year highs and Bitcoin BTC/USD cratered over 5%, as investors digested the reality of a shift in the monetary policy stance by the Federal Reserve.

随着投资者消化美联储货币政策立场转变的现实,股市全线暴跌,美元飙升至两年高点,比特币(BTC/USD)暴跌超过 5%。

The CBOE Volatility Index, known as the VIX and Wall Street’s fear gauge, skyrocketed 58% to 25, reflecting a spike in investor uncertainty and heightened anxiety over the future of interest rates.

被称为 VIX 和华尔街恐惧指标的 CBOE 波动率指数飙升 58% 至 25,反映出投资者的不确定性激增以及对利率未来的焦虑加剧。

Wall Street Wipeout: Major Indices Slammed

华尔街遭受重创:主要股指遭受重挫

The Dow Jones Industrial Average, as tracked by the SPDR Dow Jones Industrial Average ETF DIA, dropped 1,123 points, falling 2.6% to close at 42,326, marking its worst one-day drop since September 2022. Amazon.com Inc. AMZN recorded the worst performance among blue-chip stocks, down 4.6%.

SPDR道琼斯工业平均指数ETF DIA追踪的道琼斯工业平均指数下跌1,123点,跌幅2.6%,收于42,326点,创下2022年9月以来最严重单日跌幅。亚马逊公司AMZN录得最差单日跌幅。表现蓝筹股中,下跌4.6%。

The S&P 500 index — tracked by the SPDR S&P 500 ETF Trust SPY — fell 178 points, down 2.9% to 5,872, also marking its worst day since September 2022. Paycom Software Inc. PAYC was the major laggard within the S&P 500, down 10%.

由 SPDR S&P 500 ETF Trust SPY 追踪的标准普尔 500 指数下跌 178 点,跌幅 2.9% 至 5,872 点,也创下 2022 年 9 月以来最糟糕的一天。 Paycom Software Inc. PAYC 是标准普尔 500 指数中的主要落后者,下跌 10 %。

The tech-heavy Nasdaq 100, tracked by the Invesco QQQ Trust, Series 1 QQQ, experienced an even sharper drop of 3.6%, closing at 21,209 as interest rate-sensitive technology stocks took a beating. Tesla Inc. TSLA tumbled 8.1%, marking the worst performance within the Nasdaq 100.

Invesco QQQ Trust(系列 1 QQQ)追踪的以科技股为主的纳斯达克 100 指数跌幅更大,下跌 3.6%,收于 21,209 点,原因是对利率敏感的科技股遭受重挫。特斯拉股价下跌 8.1%,成为纳斯达克 100 指数中表现最差的公司。

Every Magnificent Seven company ended the day in the red, collectively erasing more than $600 billion in market value on Wednesday.

七大七巨头的所有公司均以亏损收盘,周三市值总计蒸发超过 6000 亿美元。

Small caps in the Russell 2000 posted the steepest losses, plummeting 4.7% to 2,225. With Wednesday’s move, the iShares Russell 2000 ETF IWM has fully erased the post-election rally.

罗素 2000 指数中的小盘股跌幅最大,暴跌 4.7% 至 2,225 股。随着周三的走势,iShares Russell 2000 ETF IWM 完全抹去了选举后的涨势。

All major U.S. equity sectors finished in the red.

美国所有主要股票板块均出现亏损。

Consumer Discretionary stocks suffered the most, plunging 4.5%, followed by Real Estate, which dropped 4% as rising rates weigh heavily on growth-oriented and interest-rate-sensitive industries.

非必需消费品股票跌幅最大,下跌 4.5%,其次是房地产股,因利率上升对增长型和利率敏感行业造成沉重压力,房地产股下跌 4%。

Technology, the largest sector by market capitalization, fell 3.2%, with chipmakers and software companies bearing the brunt of the selloff.

市值最大的科技板块下跌 3.2%,其中芯片制造商和软件公司首当其冲。

Communications and Materials both declined 2.9%, while Financials dropped 3%, reflecting pressure across cyclical areas of the market.

通信和材料板块均下跌 2.9%,金融板块下跌 3%,反映出市场周期性领域面临的压力。

Even traditionally defensive sectors failed to escape the selloff. Utilities and Consumer Staples fell 2.4% and 1.5%, respectively.

即使是传统的防御性板块也未能逃脱抛售。公用事业和必需消费品分别下跌 2.4% 和 1.5%。

Dollar Surges To 2-Year Highs, Hammers Gold And Bitcoin

美元飙升至两年高位,重创黄金和比特币

The U.S. dollar emerged as the day's clear winner, with the dollar index (DXY), as followed by the Invesco DB USD Index Bullish Fund ETF UUP, climbing 1.2% to reach its highest level since November 2022.

美元成为当日明显的赢家,美元指数 (DXY) 上涨 1.2%,创 2022 年 11 月以来的最高水平,景顺 DB 美元指数看涨基金 ETF UUP 紧随其后。

As the greenback rallied, gold failed to provide a safe haven, falling 2.1% to $2,580 per ounce, while silver dropped 3.5%.

随着美元上涨,黄金未能提供避风港,下跌 2.1% 至每盎司 2,580 美元,而白银则下跌 3.5%。

Risk-off sentiment extended into alternative assets. Bitcoin plunged 5.5%, trading just above $101,500.

避险情绪延伸至另类资产。比特币暴跌 5.5%,交易价格略高于 101,500 美元。

During the press conference, Powell was asked whether the U.S. government should consider building a strategic reserve of Bitcoin. Powell quickly dismissed the idea, making it clear that such a move is not on the Fed’s radar.

在新闻发布会上,鲍威尔被问及美国政府是否应该考虑建立比特币战略储备。鲍威尔很快驳回了这个想法,并明确表示此举不在美联储的考虑范围内。

"We're not allowed to own Bitcoin," Powell said, emphasizing the legal and structural limitations of the Federal Reserve. "The Federal Reserve Act dictates what we can own, and we're not seeking any changes to that law."

鲍威尔表示:“我们不被允许拥有比特币。”他强调了美联储的法律和结构限制。 “美联储法案规定了我们可以拥有什么,我们不寻求对该法律进行任何修改。”

Illustration generated with AI via Dall-E.

通过 Dall-E 使用 AI 生成插图。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- 卡尔达诺(ADA)鲸鱼行为数据揭示了市场的优柔寡断立场

- 2024-12-19 10:45:01

- 卡尔达诺(ADA)过去几周波动剧烈,反映出更广泛市场的不可预测走势和精明资金的战略布局。

-

-

- 美联储主席鲍威尔削弱比特币涨势,称央行“无意”储存加密资产

- 2024-12-19 10:45:01

- 美联储主席杰罗姆·鲍威尔周三表示,美国央行无意参与政府储存大量比特币的任何行动。

-

- 美联储发出警告信号后,比特币创下三个多月来最大跌幅

- 2024-12-19 10:45:01

- 周三超过 5% 的跌幅将最大的数字资产推向 10 万美元,这是一个备受关注的水平。

-

- XRP 价格预测:随着代币飙升至 5.85 美元,需要关注的关键水平

- 2024-12-19 10:45:01

- 最近的 XRP 价格走势再次显着飙升,继 12 月飙升 9% 后再次短暂升至略高于 2.7 美元

-

-