|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DeFi 收益率飙升,超过了传统投资的回报,并重新引发了人们的兴趣。 MakerDAO 的 DAI Savings Rate 提供 15% 的收益率,而像 Ethena Labs 这样的企业在 DeFi 高风险领域的收益率高达 27%。随着加密货币市场的复苏,这些收益率正在引起人们的关注,让人回想起 2020 年“DeFi 之夏”的兴奋。专家将这种增长归因于机构对现实世界资产代币化的需求以及美联储利率政策的转变,使得传统投资的吸引力下降。然而,DeFi 高收益的可持续性仍然是一个争论的话题,人们担心市场条件不成熟和不可持续的高贷款价值比。

DeFi Yields Surge Past Traditional Investments, Igniting Hopes of a Renaissance

DeFi 收益率飙升超越传统投资,点燃复兴的希望

In a striking reversal from the doldrums of 2023, decentralized finance (DeFi) yields have soared, eclipsing returns offered by conventional investments such as U.S. Treasuries. This resurgence has rekindled optimism for a resurgence of DeFi activity, potentially heralding a new "DeFi Summer" akin to the halcyon days of 2020.

与 2023 年的低迷相比,去中心化金融 (DeFi) 的收益率飙升,超越了美国国债等传统投资的回报。这种复苏重新点燃了人们对 DeFi 活动复苏的乐观情绪,有可能预示着类似于 2020 年太平日子的新“DeFi 夏天”。

Yields Skyrocket, Outpacing Treasuries

收益率飙升,超过国债

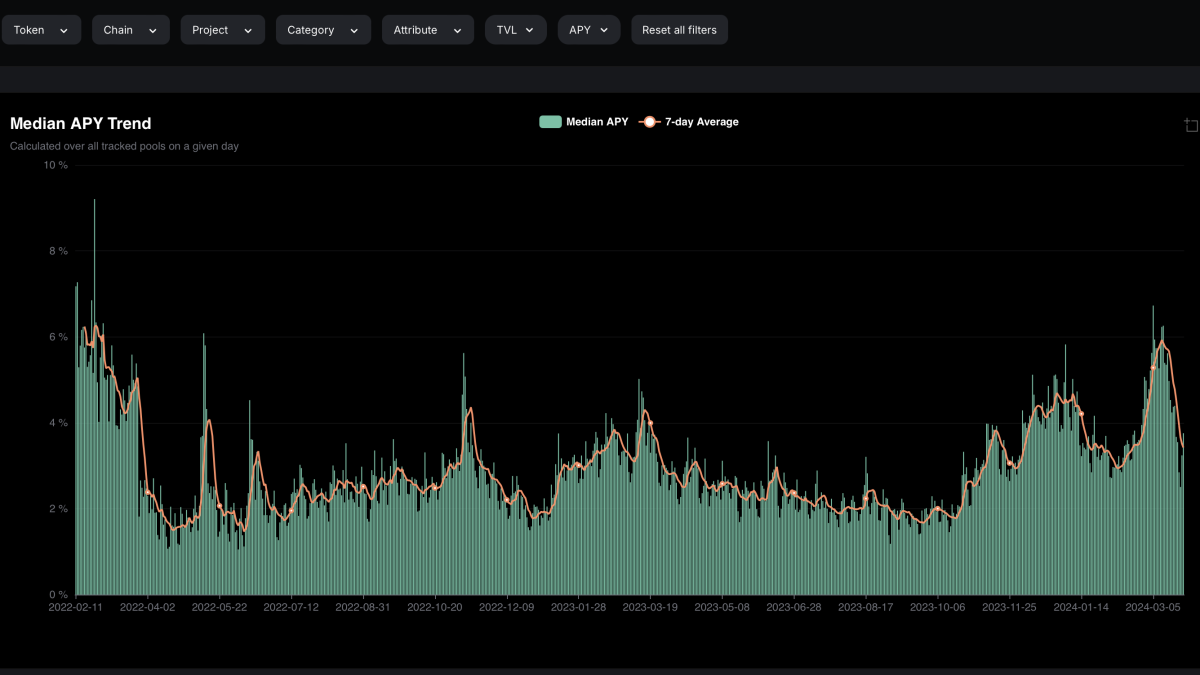

MakerDAO's DAI Savings Rate now provides users with a 15% yield, while riskier DeFi corners offer even more tantalizing returns, with Ethena Labs enticing depositors with a 27% return. By contrast, the median DeFi yield languished below 3% for most of 2023, dipping below 2% on several occasions.

MakerDAO 的 DAI Savings Rate 现在为用户提供 15% 的收益率,而风险较高的 DeFi 角落则提供更诱人的回报,Ethena Labs 则以 27% 的回报吸引储户。相比之下,2023 年大部分时间 DeFi 收益率中值徘徊在 3% 以下,多次跌破 2%。

According to data from DefiLlama, the current DeFi yield average has jumped to nearly 6%, a significant increase from its recent lows. This surge has surpassed the Secured Overnight Financing Rate (SOFR), the benchmark interest rate used by banks to price U.S. dollar-denominated derivatives and loans, which currently hovers around 5.3%.

根据 DefiLlama 的数据,目前 DeFi 收益率平均已跃升至近 6%,较近期低点大幅上涨。这一飙升已经超过了有担保隔夜融资利率(SOFR),这是银行用来为美元计价衍生品和贷款定价的基准利率,目前该利率徘徊在 5.3% 左右。

Institutional Tailwinds Fuel Crypto Bull Market

机构顺风推动加密货币牛市

The renewed crypto bull market, which ignited with the arrival of spot bitcoin exchange-traded funds from BlackRock and Fidelity in January, has been bolstered by strong institutional support. Traditional financial firms have also shown keen interest in tokenizing real-world assets, representing ownership of conventional assets via blockchain-traded tokens.

随着一月份贝莱德和富达的现货比特币交易所交易基金的到来,新一轮的加密货币牛市得到了强有力的机构支持的支撑。传统金融公司也对现实世界资产代币化表现出浓厚的兴趣,通过区块链交易代币代表传统资产的所有权。

DeFi Regains Allure

DeFi 重拾吸引力

Over the past year, fixed-income products have offered competitive yields, prompting firms like JPMorgan, BlackRock, and Ondo Finance to focus their crypto efforts on tokenizing higher-yielding assets such as U.S. Treasuries and money-market funds.

在过去的一年里,固定收益产品提供了具有竞争力的收益率,促使摩根大通、贝莱德和 Ondo Finance 等公司将加密货币工作重点放在美国国债和货币市场基金等高收益资产的代币化上。

However, in October, crypto and DeFi sentiment began to shift, as DeFi rates surpassed SOFR. Crypto-native DeFi products, rather than tokenized conventional financial products, regained their appeal.

然而,到了 10 月份,随着 DeFi 利率超过 SOFR,加密货币和 DeFi 情绪开始发生转变。加密原生 DeFi 产品,而不是代币化的传统金融产品,重新获得了吸引力。

Market Volatility Impacts Rates

市场波动影响利率

The approval of spot bitcoin ETFs has accelerated this trend, mirroring the rise in interest rates that followed the Covid-19 crisis in early 2020. According to Lucas Vogelsang, CEO of Centrifuge, the market has undergone two complete reversals since then.

现货比特币 ETF 的批准加速了这一趋势,反映出 2020 年初 Covid-19 危机后利率的上升。 Centrifuge 首席执行官 Lucas Vogelsang 表示,自那时以来,市场经历了两次彻底的逆转。

"The bull market saw prices slowly start going up, and now, two months later, it's completely opposite again, in terms of looking at rates in DeFi and TradFi," Vogelsang said.

Vogelsang 表示:“牛市期间价格开始缓慢上涨,而两个月后的现在,就 DeFi 和 TradFi 的利率而言,情况再次完全相反。”

Immaturity Reflects Funding Dynamics

不成熟反映了融资动态

The crypto industry's relatively small size limits the availability of capital for lending, resulting in high borrowing rates for those seeking leverage. Institutions, while interested in crypto, have not fully filled market demand.

加密行业规模相对较小,限制了借贷资本的可用性,导致寻求杠杆的人的借贷利率较高。机构虽然对加密货币感兴趣,但尚未完全满足市场需求。

"A money market off-chain wouldn't yield 12% just because there's a lack of supply; someone would fill it. On-chain, that's not the case," Vogelsang said. "It's a sign of immaturity in that way."

“链下货币市场不会仅仅因为供应不足就产生 12% 的收益率;有人会填补它。链上则不是这样,”Vogelsang 说。 “这就是不成熟的表现。”

High Yields May Not Be Sustainable

高收益可能无法持续

While some DeFi lending rates appear unsustainably high, evoking memories of failed crypto projects, the loan-to-value (LTV) ratio remains relatively low on platforms like Morpho Labs.

虽然一些 DeFi 贷款利率似乎高得不可持续,让人想起失败的加密货币项目,但在 Morpho Labs 等平台上,贷款价值 (LTV) 比率仍然相对较低。

Rob Hadick, general partner at Dragonfly, believes that deposits, not lending, are driving the current yield surge. "I think that's because people want yield," Hadick said. "But there's not as much rehypothecation happening right now as there was a few years ago."

Dragonfly 的普通合伙人罗布·哈迪克 (Rob Hadick) 认为,推动当前收益率飙升的是存款,而不是贷款。 “我认为这是因为人们想要收益,”哈迪克说。 “但现在发生的再抵押并不像几年前那么多。”

Hadick, whose firm invests in Ethena Labs, emphasizes that the high yields on that platform stem from a basis trade, rather than excessive leverage. "As the markets change, the rate might come down. But it's not like leverage in the traditional sense," Hadick said. "People are just going to unwind the trade when it's no longer economic, as opposed to 'I'm going to blow up and my collateral is gonna get liquidated.' That's not a thing that happens in this type of trading."

Hadick 的公司投资了 Ethena Labs,他强调该平台的高收益源于基础交易,而不是过度杠杆化。 “随着市场的变化,利率可能会下降。但这不像传统意义上的杠杆,”哈迪克说。 “当交易不再经济时,人们就会平仓,而不是‘我会崩溃,我的抵押品会被清算’。”在这种类型的交易中不会发生这种情况。”

Conclusion

结论

The resurgence of DeFi yields has ignited hopes for a revival of the burgeoning ecosystem. While the sustainability of these yields remains uncertain, the renewed enthusiasm for crypto and DeFi underscores the potential for the industry to continue its transformative journey.

DeFi 收益率的复苏点燃了新兴生态系统复兴的希望。尽管这些收益率的可持续性仍不确定,但对加密货币和 DeFi 的新热情凸显了该行业继续其变革之旅的潜力。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- 布雷特 (BRETT) 价格预测 - 2024 年 11 月 5 日

- 2024-11-05 14:25:02

- 根据我们的 Brett 价格预测,未来 5 天内 BRETT 价格预计上涨 30.05%

-

-

- 罕见的 2 英镑硬币可以让你在圣诞节前夕赚到一笔方便的闲钱 - 这一切都归功于印刷错误

- 2024-11-05 14:25:02

- 2019 年发行的 2 英镑硬币的设计缺陷可能使其价值达到原值的 50 倍。

-

-

- 币安在资产上市成本政策相关指控后重新成为人们关注的焦点

- 2024-11-05 14:25:02

- 雅加达 - 币安是世界上最大的加密货币交易所之一,在受到与其资产上市成本政策相关的指控后,再次成为人们关注的焦点。

-

-