|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

DeFi Yields Skyrocket, Sparking Renaissance Hopes

Mar 28, 2024 at 01:02 am

DeFi yields have surged, exceeding returns from conventional investments and sparking renewed interest. MakerDAO's DAI Savings Rate offers a 15% yield, while ventures like Ethena Labs yield up to 27% in DeFi's higher-risk domains. These yields are attracting attention as the crypto market recovers, reminiscing the excitement of 2020's "DeFi Summer." Experts attribute the rise to institutional demand for tokenization of real-world assets and the shift in Fed's interest rate policies, making traditional investments less appealing. However, the sustainability of DeFi's high yields remains a topic of debate, with concerns about immature market conditions and unsustainably high loan-to-value ratios.

DeFi Yields Surge Past Traditional Investments, Igniting Hopes of a Renaissance

In a striking reversal from the doldrums of 2023, decentralized finance (DeFi) yields have soared, eclipsing returns offered by conventional investments such as U.S. Treasuries. This resurgence has rekindled optimism for a resurgence of DeFi activity, potentially heralding a new "DeFi Summer" akin to the halcyon days of 2020.

Yields Skyrocket, Outpacing Treasuries

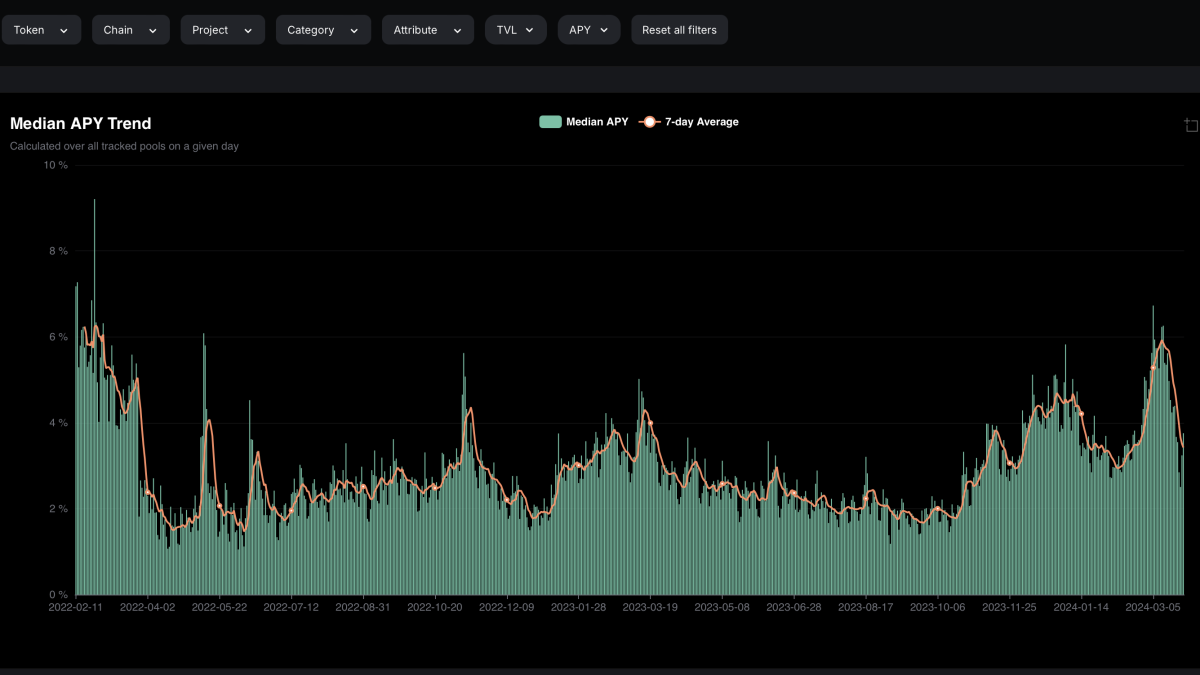

MakerDAO's DAI Savings Rate now provides users with a 15% yield, while riskier DeFi corners offer even more tantalizing returns, with Ethena Labs enticing depositors with a 27% return. By contrast, the median DeFi yield languished below 3% for most of 2023, dipping below 2% on several occasions.

According to data from DefiLlama, the current DeFi yield average has jumped to nearly 6%, a significant increase from its recent lows. This surge has surpassed the Secured Overnight Financing Rate (SOFR), the benchmark interest rate used by banks to price U.S. dollar-denominated derivatives and loans, which currently hovers around 5.3%.

Institutional Tailwinds Fuel Crypto Bull Market

The renewed crypto bull market, which ignited with the arrival of spot bitcoin exchange-traded funds from BlackRock and Fidelity in January, has been bolstered by strong institutional support. Traditional financial firms have also shown keen interest in tokenizing real-world assets, representing ownership of conventional assets via blockchain-traded tokens.

DeFi Regains Allure

Over the past year, fixed-income products have offered competitive yields, prompting firms like JPMorgan, BlackRock, and Ondo Finance to focus their crypto efforts on tokenizing higher-yielding assets such as U.S. Treasuries and money-market funds.

However, in October, crypto and DeFi sentiment began to shift, as DeFi rates surpassed SOFR. Crypto-native DeFi products, rather than tokenized conventional financial products, regained their appeal.

Market Volatility Impacts Rates

The approval of spot bitcoin ETFs has accelerated this trend, mirroring the rise in interest rates that followed the Covid-19 crisis in early 2020. According to Lucas Vogelsang, CEO of Centrifuge, the market has undergone two complete reversals since then.

"The bull market saw prices slowly start going up, and now, two months later, it's completely opposite again, in terms of looking at rates in DeFi and TradFi," Vogelsang said.

Immaturity Reflects Funding Dynamics

The crypto industry's relatively small size limits the availability of capital for lending, resulting in high borrowing rates for those seeking leverage. Institutions, while interested in crypto, have not fully filled market demand.

"A money market off-chain wouldn't yield 12% just because there's a lack of supply; someone would fill it. On-chain, that's not the case," Vogelsang said. "It's a sign of immaturity in that way."

High Yields May Not Be Sustainable

While some DeFi lending rates appear unsustainably high, evoking memories of failed crypto projects, the loan-to-value (LTV) ratio remains relatively low on platforms like Morpho Labs.

Rob Hadick, general partner at Dragonfly, believes that deposits, not lending, are driving the current yield surge. "I think that's because people want yield," Hadick said. "But there's not as much rehypothecation happening right now as there was a few years ago."

Hadick, whose firm invests in Ethena Labs, emphasizes that the high yields on that platform stem from a basis trade, rather than excessive leverage. "As the markets change, the rate might come down. But it's not like leverage in the traditional sense," Hadick said. "People are just going to unwind the trade when it's no longer economic, as opposed to 'I'm going to blow up and my collateral is gonna get liquidated.' That's not a thing that happens in this type of trading."

Conclusion

The resurgence of DeFi yields has ignited hopes for a revival of the burgeoning ecosystem. While the sustainability of these yields remains uncertain, the renewed enthusiasm for crypto and DeFi underscores the potential for the industry to continue its transformative journey.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.