|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在一项开创性的裁决中,加利福尼亚州联邦法院裁定,根据州法律,去中心化自治组织 (DAO) Lido DAO 可以被归类为普通合伙企业,使其成员可能对其决定承担责任。

A California court has ruled that Lido DAO, the decentralized autonomous organization (DAO) governing the popular liquid staking protocol, could be classified as a general partnership under state law. This decision has raised concerns about the potential liability of DAO members.

加州一家法院裁定,根据州法律,管理流行的流动性质押协议的去中心化自治组织 (DAO) Lido DAO 可以被归类为普通合伙企业。这一决定引起了人们对 DAO 成员潜在责任的担忧。

The lawsuit against Lido DAO was filed by a group of investors led by Andrew Samuels. The investors claimed that Lido's native LDO tokens were sold to them as unregistered securities. Several venture capital firms, including Paradigm Operations, Andreessen Horowitz, and Dragonfly Digital Management, were named as general partners in the case.

针对 Lido DAO 的诉讼是由 Andrew Samuels 领导的一群投资者提起的。投资者声称 Lido 的原生 LDO 代币作为未注册证券出售给他们。 Paradigm Operations、Andreessen Horowitz 和 Dragonfly Digital Management 等多家风险投资公司被指定为该案的普通合伙人。

The court's analysis focused on whether Lido DAO met the definition of a general partnership under the California Uniform Partnership Act (UPA). The UPA defines a partnership as "an association of two or more persons to carry on as co-owners a business for profit."

法院的分析重点是 Lido DAO 是否符合《加州统一合伙法》(UPA) 中普通合伙企业的定义。 UPA 将合伙企业定义为“两个或两个以上的人作为共同所有者以营利为目的开展业务的协会”。

The court found that Lido DAO members met this definition. The DAO's purpose is to operate a liquid staking service, which generates profits in the form of staking rewards. Token holders participate in the DAO's decision-making and receive these rewards based on their token holdings.

法院认定 Lido DAO 成员符合这一定义。 DAO 的目的是运营流动性质押服务,以质押奖励的形式产生利润。代币持有者参与 DAO 的决策,并根据其持有的代币获得这些奖励。

"The evidence in this case demonstrates that the Lido token holders are co-owners of a business for profit and that they share in the profits, losses, and liabilities of the business," the court wrote. "The Court concludes that the Lido token holders are general partners in a partnership governed by the UPA."

法院写道:“本案的证据表明,Lido 代币持有者是一家以营利为目的的企业的共同所有者,他们分享该企业的利润、损失和负债。” “法院的结论是,Lido 代币持有者是 UPA 管辖的合伙企业中的普通合伙人。”

This conclusion has significant implications for decentralized organizations. While DAOs are often designed to be decentralized and autonomous, this ruling suggests that they may still be subject to traditional legal frameworks.

这一结论对于去中心化组织具有重大意义。虽然 DAO 通常被设计为去中心化和自治的,但这一裁决表明它们可能仍受传统法律框架的约束。

If this decision is upheld, it could set a precedent for holding DAO members liable under partnership laws. This could, in turn, influence the structure, governance, and legal strategies of decentralized organizations in the future.

如果这一决定得到维持,它可能会开创根据合伙企业法追究 DAO 成员责任的先例。反过来,这可能会影响未来去中心化组织的结构、治理和法律策略。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 狗狗币 (DOGE) – Memecoin 的典型代表

- 2024-11-20 11:40:01

- Meme 加密货币被视为以狗狗币 (DOGE) 为主——memecoin 的典型代表于 2013 年创建。

-

- Lido DAO裁决:对去中心化治理的巨大打击

- 2024-11-20 11:40:01

- 去中心化自治组织 (DAO) 最初构想于 2016 年,它是加密货币对如何指导去中心化协议事务问题的回应。

-

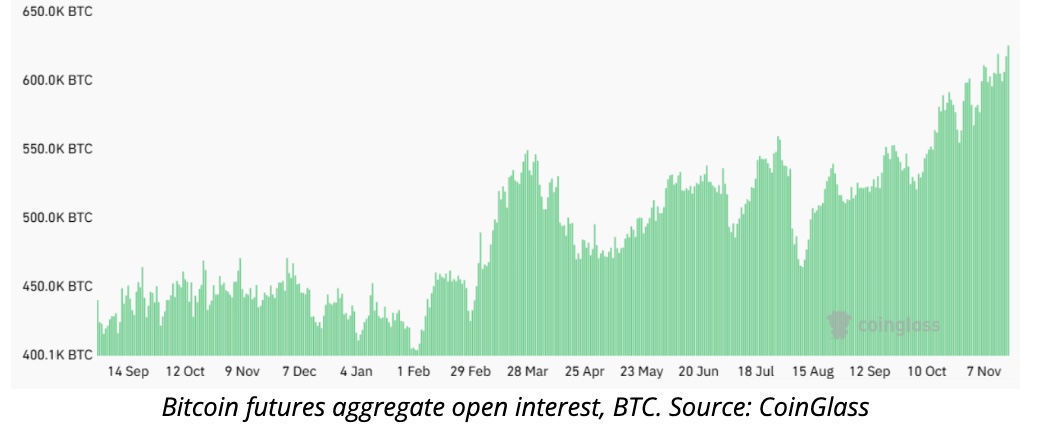

- 比特币 (BTC) 期货未平仓合约接近 $60B,价格逼近 $100K

- 2024-11-20 11:30:17

- 随着比特币 (BTC) 的价格逐渐接近 10 万美元的心理里程碑,其对衍生品市场的影响正成为焦点。

-

-

-

-

- Toncoin (TON) 年底前可能触及 7 美元

- 2024-11-20 10:25:23

- Toncoin 最近的表现表明,尽管其基础稳定,但它可能很难重新回到十大加密货币之列。

-

- 开国元勋约翰·亚当斯 (John Adams) 家族拥有的极为罕见的 17 世纪硬币以 252 万美元成交

- 2024-11-20 10:25:23

- 1652 年铸造的三便士银币周一创下了硬币拍卖的新世界纪录。