|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

自上週短暫成為全球最有價值公司以來,Nvidia 市值已縮水超過 5,000 億美元(4,330 億英鎊)

Nvidia stock price today: Shares fell again in pre-market trading on Monday after shedding $550bn in market value last week following a record high valuation

英偉達股價今天:在估值創下歷史新高後,上週市值縮水 5500 億美元,週一盤前交易中該股再次下跌

Shares of Nvidia (NVDA) fell again in pre-market trading on Monday after the semiconductor manufacturer shed more than $550bn (£433bn) in market value last week.

半導體製造商英偉達 (Nvidia) (NVDA) 上週市值縮水超過 5,500 億美元(4,330 億英鎊),週一盤前交易中該公司股價再次下跌。

The stock price dropped by almost 7% on Monday morning, continuing a sell-off that began after the company briefly became the world’s most valuable firm on Thursday.

週一上午,該公司股價下跌近 7%,延續了該公司週四短暫成為全球市值最高公司後開始的拋售行情。

Nvidia shares were trading down by 2.2%, or $14.36, at $631.64 before the opening bell.

開盤前,Nvidia 股價下跌 2.2%,或 14.36 美元,至 631.64 美元。

It comes as many investors are thought to be taking profits after Nvidia’s valuation surged by more than $1trn this year alone.

在此之際,許多投資者被認為在 Nvidia 的估值僅今年就飆升了 1 萬美元以上就開始獲利了結。

The sell-off began after Nvidia reached a record high valuation of $3.4trn on Thursday, surpassing Apple (AAPL) and Microsoft (MSFT) to become the most valued company in the world.

週四,英偉達估值達到 3.4 兆美元的歷史新高,超越蘋果 (AAPL) 和微軟 (MSFT),成為全球估值最高的公司,隨後拋售開始。

However, by the close of trading on Friday the company's market capitalisation had dropped to $2.91trn.

然而,到週五收盤時,該公司的市值已跌至 2.91 兆美元。

David Morrison, senior market analyst at Trade Nation, said: “Some profit-taking here seems entirely reasonable given NVIDIA’s meteoric rise.

Trade Nation 高級市場分析師 David Morrison 表示:「鑑於 NVIDIA 的快速崛起,一些獲利了結似乎完全合理。

“The stock was up over 180% this year alone. But if it continues to lose ground, then there’s a danger of contagion, with selling spreading to other big tech names. If that were the case, then the market could be in for a deeper and more protracted pull-back.

「光是今年該股就上漲了 180% 以上。但如果它繼續失勢,那麼就有蔓延的危險,拋售會蔓延到其他大型科技公司。如果是這樣,那麼市場可能會出現更深、更持久的回檔。

“Yet, there are few indications that investors are even thinking along these lines.”

“然而,幾乎沒有跡象表明投資者正在沿著這些思路思考。”

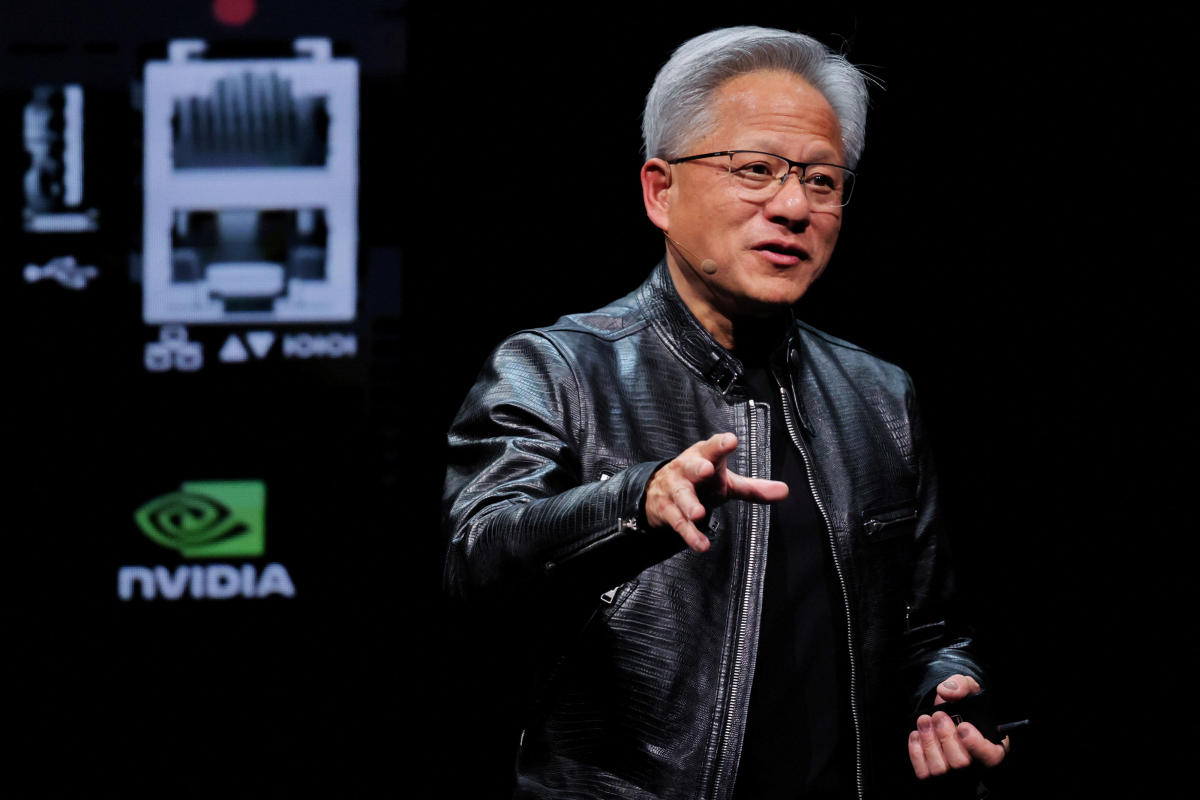

Another factor weighing on Nvidia is that CEO Jensen Huang has been selling stock this month, through a trading plan. That has focused attention on whether the stock was somewhat overvalued.

影響英偉達的另一個因素是執行長黃仁勳本月透過交易計畫出售股票。這讓人們關注該股是否被高估了。

Richard Hunter, head of markets at Interactive Investor, said: “The stellar rise of tech and AI-related stocks in particular inevitably gets to the stage where investors pause for breath and recalculate valuation levels.”

Interactive Investor市場主管理查德·亨特(Richard Hunter)表示:“尤其是科技和人工智慧相關股票的大幅上漲,不可避免地會導致投資者停下來喘口氣,重新計算估值水平。”

The AI darling recently became the third company ever to achieve a market valuation of more than $3tn, surpassing Apple and Microsoft to become the most valued company in the world.

這家人工智慧寵兒最近成為第三家市值超過 3 兆美元的公司,超越蘋果和微軟,成為全球估值最高的公司。

Its market capitalisation has now dropped to $2.91trn (£2.29trn).

其市值現已降至 2.91 兆美元(2.29 兆英鎊)。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- Sui網路中斷引發人們對可靠性的擔憂

- 2024-11-22 09:10:01

- Layer-1 區塊鏈 Sui 因其強勁的性能和快速擴展的生態系統而成為今年的後起之秀之一。

-

- 據報道,川普的過渡著眼於比特幣儲備,希夫回擊財政失誤

- 2024-11-22 09:05:02

- 根據路透社報道,當選總統川普即將上任的加密貨幣顧問委員會正在考慮建立戰略比特幣儲備。

-

-

-

-

-

-

- 亞馬遜目前體育和健身器材的終極銷售

- 2024-11-22 08:40:01

- 想要強身健體嗎?以下是亞馬遜家庭健身房和健身器材的驚人銷售,可提供最佳的家庭鍛鍊。

-

- 在川普重返白宮之前,比特幣飆升至 99,000 美元以上

- 2024-11-22 08:40:01

- 比特幣的生態系統隨著創新的第 2 層應用程式而擴展。比特幣的極端主義是否阻礙了區塊鏈的潛力?