|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

The Kimchi Premium: Why Bitcoin and Other Cryptocurrencies Trade at a Hefty Markup in South Korea

Nov 15, 2024 at 08:39 pm

(Bloomberg) -- In most of the world, crypto trading remains a niche pursuit, limited to those investors with the highest tolerance for risk.

In most of the world, crypto trading remains a niche pursuit, limited to those investors with the highest tolerance for risk. In South Korea, it’s all the rage, and has been for years. In fact, there’s now more trading activity in Bitcoin and other virtual currencies on Korean crypto exchanges than there is in the companies on the national benchmark Kospi share index.

That huge demand can only be satisfied by local exchanges, as currency controls and anti money-laundering rules bar Koreans from easily converting their local-currency savings in order to trade on international crypto markets. For this reason, Bitcoin and other cryptocurrencies change hands in South Korea at a significant premium to elsewhere.

Disgraced crypto entrepreneur Sam Bankman-Fried once claimed that this “Kimchi Premium” (named after the popular Korean side-dish) inspired the crypto arbitrage trading strategy that made him rich. But those who try to profit from the phenomenon can find themselves in trouble with the authorities.

What’s the origin of the Kimchi Premium?

It’s not known who coined the term, which emerged during a 2017 Bitcoin bull run that pushed the token above $19,000.

In today’s globalized financial system, prices of the same asset should eventually converge as investors quickly exploit and trade away any price discrepancy that emerges across national markets. Traders could, for example, buy Bitcoin in the UK, transfer it to a Korean exchange, sell it in Korean won, then convert the won to US dollars for an instant profit.

But won-dollar trading has been strictly curtailed since the Global Financial Crisis of 2008 to avoid the risk of capital flight and keep the local currency stable.

Some of those who’ve attempted to exploit the crypto price differential — moving money overseas to buy tokens and sell them back in South Korea at a premium — found themselves on trial, according to local media reports.

What can we learn from the Kimchi Premium?

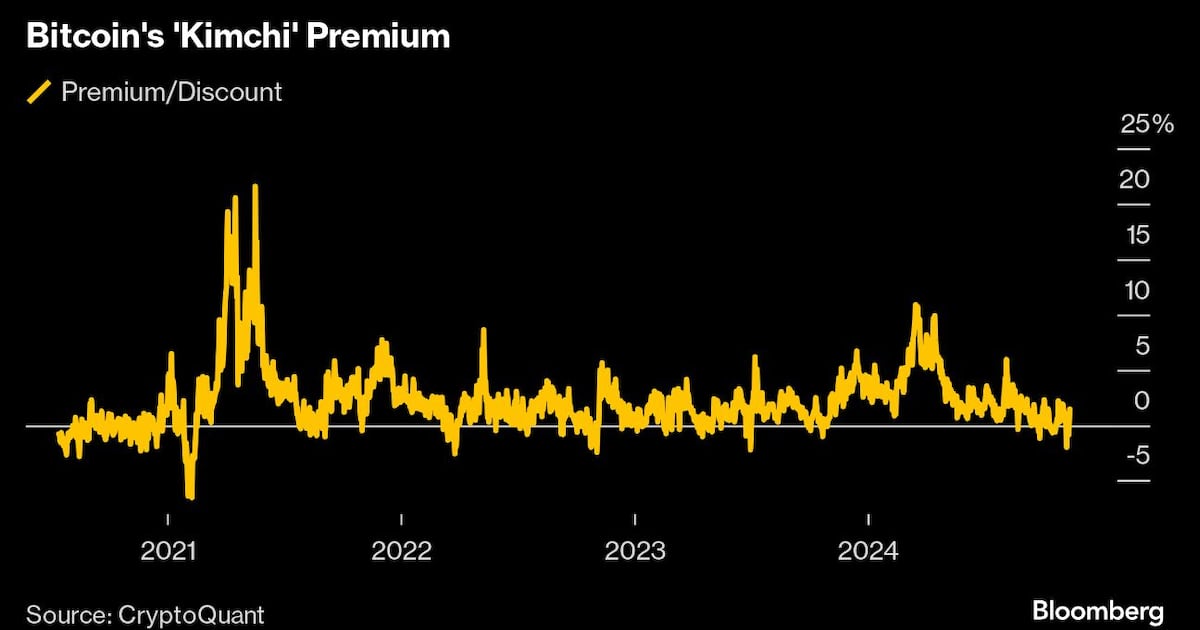

It fluctuates over time, and occasionally goes into reverse (see the chart below). As South Korea’s crypto scene is dominated by individuals rather than big financial institutions, market watchers have come to view the Kimchi Premium as an indicator of broader retail investor sentiment.

How did crypto get so big in South Korea?

Crypto mania took off in South Korea in 2017 amid the Bitcoin surge and a flurry of new coin offerings. In 2018, the central bank even had to ask its own staff to refrain from trading crypto, especially during work hours.

South Koreans stuck with the asset class through a bout of market turmoil in 2022. Today, more than 7 million of them — almost 15% of the population — are registered to trade on a crypto exchange. The Korean won overtook the US dollar this year as the most popular currency for crypto transactions.

There are various theories as to why crypto has so many ardent fans in South Korea. One is that it allows them to skirt around the currency controls so they can invest their savings abroad. (Some citizens are wary of investing in their own country given the lingering risk of conflict with the Communist North.) A simpler explanation is that there’s long been a substantial local appetite for risky, speculative investing.

After Donald Trump’s victory in the November US presidential election triggered a selloff on the Korean stock market, traded volume on the largest local crypto exchange, Upbit, overtook trading in Kospi index stocks.

The trend is, to some extent, self-perpetuating. With many Koreans profiting from Bitcoin’s mammoth 970% rally in the past five years — in contrast to a 12% combined return from investing in the Kospi — others have piled in after them for fear of missing out.

Is that a problem?

Past governments tried to rein in the country’s crypto frenzy due to concerns over potential money laundering, tax evasion and excessive speculation. Former Prime Minister Lee Nak-yon went as far as to say that cryptocurrencies might corrupt the nation’s youth.

In 2021, the government toughened regulation of crypto, and many smaller exchanges closed down. But officials never followed through on threats to ban crypto entirely. In fact, pledges to protect the asset class proved to be a vote winner in elections this year.

Does the Kimchi Premium just apply to Bitcoin?

No. Other crypto assets, including Dogecoin, often trade at a premium on Korean platforms. Secondary tokens — known as altcoins and memecoins — make up four-fifths of crypto trading activity in South Korea, and their prices tend to be more volatile than those of big, established virtual currencies such as Bitcoin and Ether.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- DeSci Suddenly Becomes a Hot Topic Again, Binance Labs Invests in BIO Protocol, and Meme Tokens RIF and URO Increase by 20 Times in Two Days

- Nov 16, 2024 at 02:30 am

- In the past week, DeSci has suddenly become a hot topic of discussion again. Since Binance Labs announced its investment in BIO Protocol, tokens in the DeSci field such as VITA, GROW, and RSC have all seen significant increases, maintaining strong performance even during the recent market correction.

-

-

-

-

-

- BlockDAG (BDAG) Positions Itself as a Strong Contender in the Upcoming Altseason as Bitcoin Nears $100K

- Nov 16, 2024 at 02:30 am

- Bitcoin is fast approaching the remarkable price point of $100,000, drawing considerable attention from the investment community. This surge is not only noteworthy for Bitcoin but also signifies potential massive gains for various altcoins.

-

- Crypto Whales Load Up on Solana, JetBolt, XRP, and Toncoin Ahead of Trump Takeover

- Nov 16, 2024 at 02:30 am

- Crypto whales are making swift moves ahead of the Trump administration's anticipated crypto pivot. Solana's (SOL) DeFi dominance, XRP's legal optimism, Toncoin's (TON) Telegram integration, and JetBolt's (JBOLT) presale triumph are driving a frenzy.

-

- HKMA Warns That Misleading Use of the Word “Bank” by Crypto Firms Not Only Deceives Consumers but also Breaches Hong Kong’s Banking Ordinance

- Nov 16, 2024 at 02:30 am

- On November 15, 2024, the Hong Kong Monetary Authority (HKMA), the region's de facto central bank, issued a stern warning about two overseas cryptocurrency