|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Should investors start taking Bitcoin seriously?

Mar 17, 2025 at 03:00 am

Paul Tudor Jones, the billionaire hedge fund manager who famously called the ’87 crash, made a bold bet on Bitcoin in 2020.

If you're reading this, chances are you've encountered the swirling rumors of Bitcoin's ascent. But should investors finally start taking it seriously, just as we should have taken tech stocks more seriously in the 2010s?

Paul Tudor Jones, the billionaire hedge fund manager who famously called the ’87 crash, made a bold bet on Bitcoin in 2020. Since then, it’s surged over 1,200%. His reasoning? If beating inflation is a race, Bitcoin is the fastest horse.

Yet, many investors remain skeptical. Unlike traditional assets, Bitcoin has no cash flows, no earnings, and no tangible value - making it easy to dismiss. But are we making the same mistake with Bitcoin that skeptics made with Amazon and Apple decades ago?

With cryptocurrency markets maturing, institutional adoption accelerating, and Bitcoin hitting record highs (until the recent dip), the case for including it in a portfolio is stronger than ever. Is it time to move past old biases and rethink its place in a portfolio?

To break it down, we’re joined by Charlie Viola from Viola Private Wealth and Adam Dawes from Shaw and Partners.

Other ways to listen:

Edited Transcript:

Vishal Teckchandani: Welcome to Buy, Hold, Sell. My name is Vishal Teckchandani, and in this episode, we're going to ask an important question: Is it time to take Bitcoin seriously?

To challenge our thinking, I'm joined by Charlie Viola from Viola Private Wealth and Adam Dawes from Shaw and Partners. Will they warn us to steer clear of crypto and explore better alternatives, or is this an asset class you might want to consider, even as a small satellite position?

Adam, I'll start with you. Charlie, welcome. Does crypto as an asset class belong in an investor's portfolio - yay or nay? Why or why not?

Dawes says crypto has a place, but Viola isn't convinced

Adam Dawes: Yes, I think it does. Even though it's been around for over a decade, it's still in its infancy. I see it as part of an investment case. We're seeing larger fund managers and institutional buyers coming in. That said, there have been some disasters - Mt. Gox and the Trump meme coin are classic examples of pump-and-dump schemes. You have to be cautious. Cold storage wallets are probably the safest way to go - taking Bitcoin out of the system and keeping it secure. But yes, I do consider it an asset class that should be considered, albeit in a small allocation within a portfolio.

Vishal Teckchandani: Okay. Well, Adam's clearly a fan. Charlie, what about you?

Charlie Viola: No, not really. I'll be honest. We advise high-net-worth clients, and our stance is that if they want exposure, it should be a very small part of a well-diversified portfolio. But we don't specifically allocate to it. The lack of regulation, extreme volatility, and uncertainty around its price drivers - whether it's sentiment, Elon Musk tweeting, or Trump launching a coin - make it difficult to justify as a core investment. Over the years, we've also seen that it doesn’t function as a hedge; it tends to correlate with financial markets. So while we won’t stop clients from investing in it, we're certainly not building portfolios around crypto.

Major names are backing crypto, why isn't Viola?

Vishal Teckchandani: So, Charlie, while you'll execute trades for clients, let me play devil’s advocate. Looking at recent events - Donald Trump wants the U.S. to be the crypto capital of the world, Larry Fink has been vocal about Bitcoin, and ETF providers like VanEck, Monochrome, and Betashares are putting their name behind it - what would it take to convince you to allocate Bitcoin in Viola Private Wealth’s portfolios?

Charlie Viola: More robust regulation would be a good start. Also, safer ways to invest in it. To Adam’s point, some of the new ETFs are appealing - Monochrome’s Bitcoin ETF (CBOE: IBTC), for example, closely tracks the price of Bitcoin, with minimal tracking error. If we were to allocate to Bitcoin, we’d do it through a vehicle like that. But we need greater regulatory oversight and a clearer understanding of its underlying use case. Unlike tech companies, which generate earnings and add value, Bitcoin doesn’t produce revenue - it's purely speculative.

Vishal Teckchandani: Fair point. Now, Adam, Bitcoin does do something - it goes up, it goes down, and then it goes up again. What convinced you to include it in portfolios? And if I may ask, what is your asset allocation within portfolios for digital assets?

Adam Dawes:

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Fetch.ai (FET) Token Rallies 30% as the Company Unveils ASI-1 Extended, Its Most Advanced Web3-native LLM to Date

- Apr 22, 2025 at 12:25 am

- Fetch.ai (FET) is making headlines this week with a sharp 30% rally over the past seven days, supported by strong market momentum and the highly anticipated launch of ASI-1 Extended, its most advanced Web3-native large language model (LLM) to date. The token climbed nearly 8% in the last 24 hours alone, with the price now sitting around $0.6511.

-

-

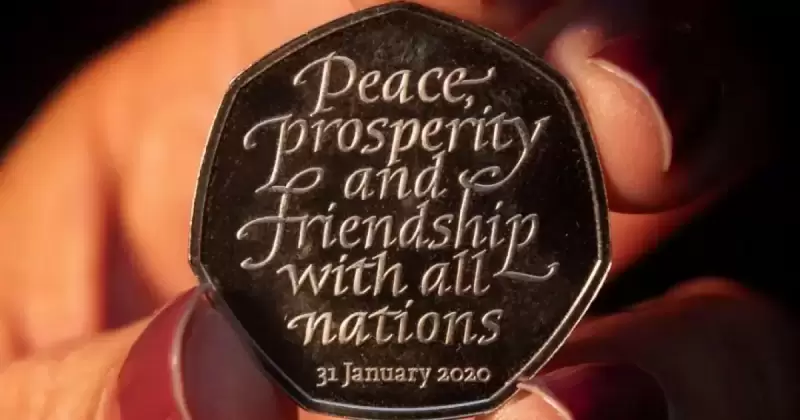

- 2020 Brexit 50p coin sells for £9900 on eBay

- Apr 22, 2025 at 12:20 am

- The silver 50p coin, which was part of a collection first introduced by Sajid Javid in 2020, to mark Britain's departure from the EU, bears the inscription “Peace, prosperity and friendship with all nations” and the date of January 31.

-

- China keeps benchmark loans unchanged in order to block the one-year set to 3.1% and the five-year sentence to 3.6%

- Apr 22, 2025 at 12:15 am

- Input: China kept his benchmark credit rates unchanged on Monday for the sixth month in a row and blocked the one-year loan rate by 3.1% and the five-year sentence at 3.6%.

-

-

-

-