|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Ethena's USDe Is Destined to Surpass DAI as the Leading Decentralized Stablecoin

Nov 29, 2024 at 08:02 am

Crypto KOL

Ethena's USDe is quickly becoming a favorite among crypto enthusiasts, thanks to its unique ability to generate income for stakers. But what exactly makes USDe so special, and why is it believed to be destined to surpass DAI as the leading decentralized stablecoin? In this article, we'll delve into the current stablecoin landscape, examine USDe's token economics, and conduct a valuation and scenario analysis of ENA to uncover the possibilities.

The Present Stablecoin Landscape

Several key trends are unfolding within the stablecoin realm:

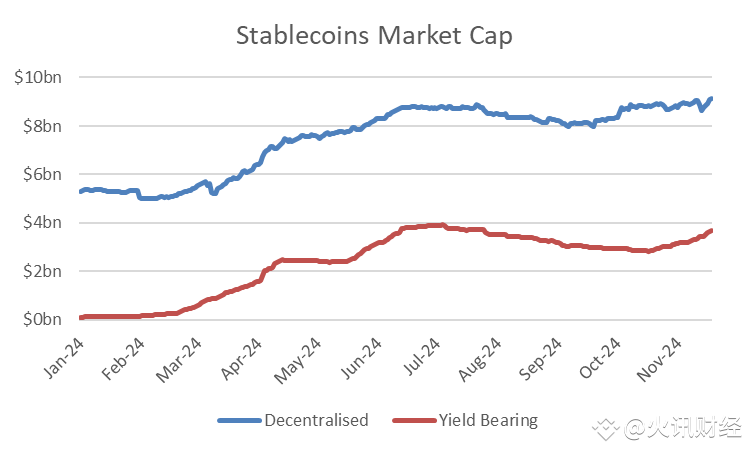

- The market share of decentralized stablecoins is on the rise, increasing from 4.1% at the start of the year to 5% in November.

- Income-generating stablecoins are experiencing a surge in popularity, with their market share expanding from 0.1% at the beginning of the year to 2.1% in November.

While these shifts may appear incremental, they are significant considering the overall 40% growth experienced by stablecoins this year, reaching a total market capitalization of $183 billion.

As both a decentralized and income-generating stablecoin, USDe has witnessed remarkable growth, surging from $85 million at the start of the year to $4 billion at present. With the possibility of Trump winning the election and stablecoin regulations expected to pass this year, it's not unreasonable to anticipate the market capitalization of stablecoins reaching $1 trillion by the end of the century. This presents vast growth opportunities for Ethena.

Token Economics of USDe

The token economics of USDe can be categorized into two primary components:

- Returns to USDe stakers: These returns are determined based on the total supply of USDe, the staking ratio, and the returns generated by the Ethena protocol. According to data, USDe stakers have enjoyed an average yield of 19.4% thus far this year, with approximately 45% of USDe being staked.

- The diagram below illustrates the payment of over $100 million in returns to USDe stakers alone:

- Collateral yield: When users mint USDe, they deposit one of several other stablecoins. Ethena subsequently converts these stablecoins into one of several types of collateral, which are then sold short using futures. In this way, Ethena maintains collateral delta neutrality while earning both the basis and funding rates.

- Assuming a specific collateral breakdown (shown below) and obtaining the yield from Ethena's dashboard (https://app.ethena.fi/dashboards/hedging/BTC), we can derive the returns obtained by the protocol:

Combining these two aspects, we can arrive at Ethena's total profit and loss (PNL): an estimated annualized profit of $62 million:

This brings ENA's MC/revenue multiple to 26 times, making it more attractive than several other leading DeFi projects (note that this is not based on FDV; token unlocks present a significant resistance for the project).

Valuation of ENA: A Scenario Analysis

Drawing upon the above, we can make certain assumptions to estimate the valuation of ENA by the end of next year. These assumptions will serve as the foundation for the upcoming analysis.

It's worth noting that Ethena's business model relies on a certain proportion of USDe not being staked. This enables them to pay returns to USDe investors that exceed the returns earned from collateral, while still maintaining an operating revenue margin of $0.04 per $1 USDe market value.

Note: Collateral yield is based on the collateral breakdown shown above and applied over the year. Actual numbers may vary slightly.

Ethena's growth is dictated by two metrics:

- Growth of total market capitalization of stablecoins

- USDe's market share

The baseline scenario is highlighted in blue: USDe's market share doubles, and stablecoins grow by 75% over the next year. The author considers this estimate quite conservative, and the bullish scenario (orange) is also very reasonable: USDe grows to a 5% market share, with total stablecoins growing by 150%, bringing USDe's market capitalization close to $23 billion. Green represents the bearish scenario, where USDe's market share does not grow, while total stable market capitalization increases slightly by 25%.

Based on the above assumptions of a $0.04 income margin, ENA's income situation for next year is as follows:

Using a hypothetical 30 times revenue multiple, the market capitalization of ENA can be derived in the following table. Please note, the author expects 2025 to be a very strong year for crypto assets, with valuations exceeding fundamentals. 30 times is only slightly higher than ENA's current 26 times, so the potential upside in the following scenario analysis is much higher:

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Cango, a publicly traded Chinese conglomerate, has agreed to sell its legacy China operations to an entity associated with peer Bitmain

- Apr 04, 2025 at 09:35 am

- Cango agreed to sell its legacy Chinese auto financing business to Ursalpha Digital Limited in a $352 million deal, according to the report.

-

-

-

- Move Over DOGE and PEPE, There's a New Meme Coin in the Market: InfluencerPepe

- Apr 04, 2025 at 09:30 am

- The meme coin world has seen its share of legends—Dogecoin with its Shiba Inu charm and PEPE with its viral frog frenzy. But every reign ends, and a new leader is rising to claim the throne: InfluencerPepe (INPEPE).

-

-

-