|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Crypto Prices Slide on Thursday, Building on Wednesday's Market-Wide Selloff

Dec 20, 2024 at 03:38 am

Bitcoin's (BTC) attempt to bounce back above $100,000 quickly faded earlier during the day and slid to the low-$97,000s during the U.S. day.

Crypto asset prices fell sharply on Thursday, extending a broader market selloff sparked by Federal Reserve Chair Jerome Powell's comments, which disappointed investors expecting U.S. interest rate cuts next year.

Bitcoin's attempt to quickly rebound above $100,000 earlier in the day fizzled out, and the cryptocurrency fell to the low-$97,000s during U.S. trading hours. It briefly recovered to around $98,000 before another slide brought prices below $96,000, marking a 4.8% decline over the past 24 hours.

Altcoins, meanwhile, suffered steeper losses, with the CoinDesk 20 Index (CC20) for a basket of the largest cryptocurrencies dropping by over 10% during the same period.

Ether fell 10.8% to below $3,500, while ADA, LINK, APT, AVAX and DOGE all declined in the range of 15%-20%. Notably, SOL fell to its weakest price since Nov. 7 — nearly erasing its post-election rally following a 26% plunge from its record high hit less than a month ago.

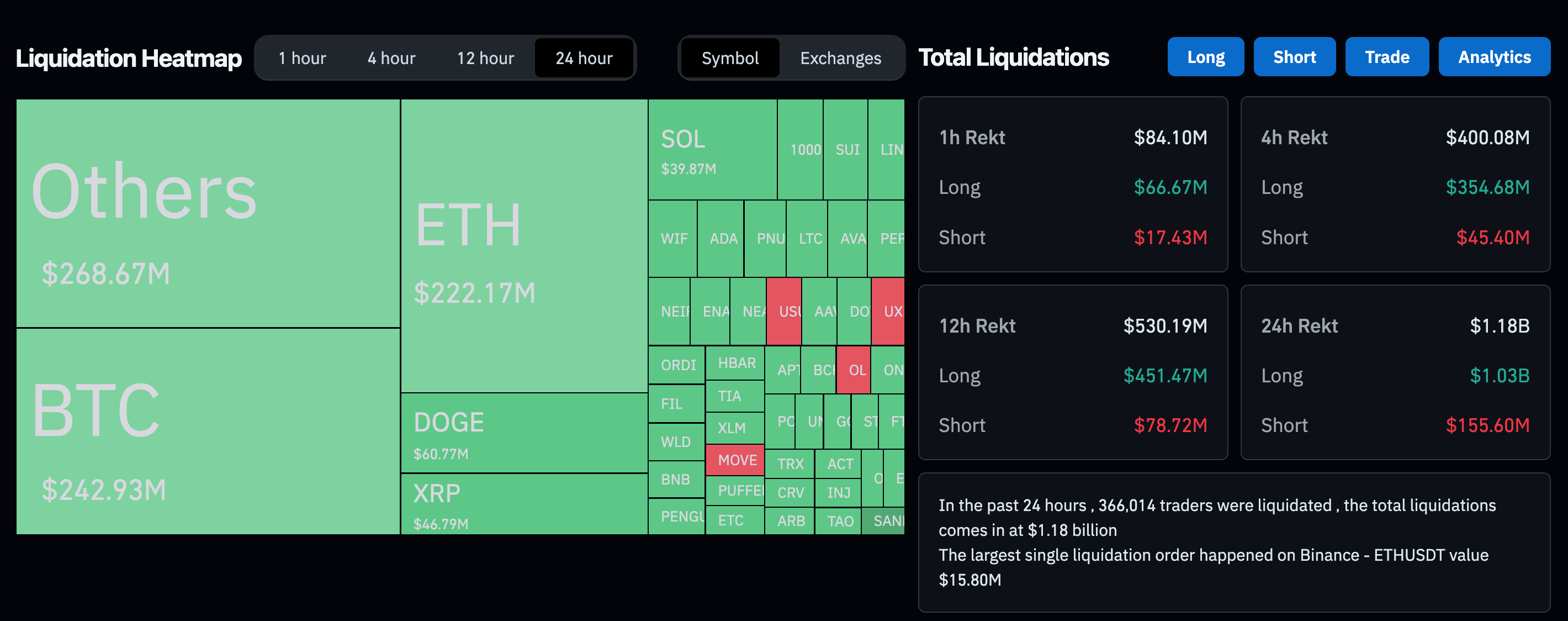

Over the past 24 hours — roughly since the Fed policy makers' rate decision on Wednesday – nearly $1.2 billion worth of leveraged crypto derivatives trading positions were liquidated across all assets, according to data from CoinGlass. Of those, over $1 billion were long positions, which are essentially bets that prices will rise.

In traditional markets, U.S. stock indexes rose slightly from Wednesday's lows but pared some of the pre-market gains during the session. The S&P 500 and the tech-heavy Nasdaq both clocked gains of 0.5% from the Wednesday close.

Crypto prices had risen almost vertically since Donald Trump's presidential election victory in early November, buoyed by hopes of pro-crypto policies from his incoming administration. However, Wednesday's Fed projection of a slower pace of rate cuts for next year and Powell's hawkish tone on rising inflation expectations caught many investors off guard, triggering a broad-market selloff across crypto, equities and even gold.

The U.S. dollar index (DXY) surged above 108, its strongest level since November 2022, while 10-year U.S. Treasury yields also rose sharply above 4.6%, the highest since May.

"The crypto market has already been on pins and needles around the possibility for a correction following the record run in the price of bitcoin through $100,000," Joel Kruger, market strategist at LMAX Group, wrote in a Thursday note. "We got that catalyst from the world of traditional markets. … Fallout from Wednesday’s Fed decision was simply too much to ignore."

"When you zoom out and consider the year-over-year growth, a pullback like this feels healthy," Azeem Khan, co-founder and COO of layer-2 network Morph, told CoinDesk in an email.

"It’s also worth noting that, historically, year-end selloffs in securities can occur as investors offset losses against gains to lower their tax liabilities," Khan added. "While it’s hard to say how much of this is driving the current trend, it could be a contributing factor."

UPDATE (Dec. 19, 2024, 20:22 UTC): Updates bitcoin prices in headline and story.

This story originally appeared on Coindesk

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Christmas 2024: Ethereum (ETH) and XRP Price Predictions Signal a Bullish Holiday Season, Making RCO Finance (RCOF) a Prime Investment Opportunity

- Dec 20, 2024 at 01:25 pm

- As the holiday season draws near, market analysts are buzzing with predictions of a bullish surge for Ethereum (ETH) and the XRP price, making these altcoins prime investment opportunities for Christmas 2024.

-

-

- Combined Bitcoin and Ethereum ETFs Approved by the SEC after Consecutive Delays

- Dec 20, 2024 at 01:25 pm

- The SEC has approved combined Bitcoin and Ethereum ETFs from Hashdex and Franklin Templeton. This move expands combined institutional access to the two largest cryptocurrencies via spot-based investment vehicles.

-

-

-

-

-

- XRP (XRP) Price Prediction 2025: Is It a Wise Bet?

- Dec 20, 2024 at 01:25 pm

- In the ever-evolving world of cryptocurrency, the current trajectory of XRP's price is catching the eye of investors worldwide. As we step into the era where blockchain technology integrates with cutting-edge innovations, XRP seems to be emerging as a token with significant potential yet again.

-