|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Jerome Powell Dismisses Speculations That the Fed May Add Bitcoin to Its Reserves

Dec 20, 2024 at 10:00 am

At the end of the its two-day meeting, Powell stated that the Fed isn’t allowed to own Bitcoin and doesn’t desire to get involved in any government

Jerome Powell, chair of the US Federal Reserve, has recently dismissed speculations that the Fed may add Bitcoin to its reserves. At the end of the its two-day meeting, Powell stated that the Fed isn’t allowed to own Bitcoin and doesn’t desire to get involved in any government initiative to create a stockpile of digital assets.

The Bitcoin announcement comes after the Fed announced rate cuts while signaling uncertain monetary policies in the next few months. Powell’s announcement was surprising when President Donald Trump announced key appointments of crypto-friendly personalities. The market immediately reacted to Powell’s statement, sending Bitcoin’s price down by 5.7%. Other top altcoins like XRP also shed value.

The debates on whether it’s time to create a stockpile of Bitcoin gained traction after Donald Trump secured a win and another presidency. Trump used Bitcoin and crypto as part of his campaign to attract support from crypto personalities and commentators. And by appointing key crypto-friendly personalities to top government positions and promising to revamp the SEC leadership, many expect to predict a Bitcoin stockpile soon.

However, Powell has categorically stated that the US banking system cannot hold Bitcoin. He argued that according to the Federal Reserve Act, there are rules on what banks can own, and Bitcoin is not included in the list.

He announced that they’re not looking to change the law soon, and it’s up to Congress to decide.

Meanwhile, there has been growing attention on Bitcoin as a potential reserve asset. During the elections, Trump supported the proposal and even suggested that the US should become the center for crypto developments. Other pro-Bitcoin policymakers, like Wyoming Senator Cynthia Lummis, have been campaigning for Bitcoin to be considered a reserve.

Early this year, Lummis filed a bill asking the US Treasury to buy and add Bitcoin to the reserve. Under the Lummis bill, the US Treasury will adopt a program to buy 20,000 BTC annually for five years until the reserve holds 1 million tokens.

The market reacted negatively to Powell’s statement, with Bitcoin’s price dropping to $100,300, down by roughly 5.7% compared to the previous day’s close. As of press time, Bitcoin’s 24-hour trading value is between $98,839 and $105,306.

Other top cryptos followed Bitcoin’s lead, with Ethereum dropping by 6.8%, Solana by 8.1%, and Binance Coin shedding 4.6% in value. Dogecoin was the worst performer among the top altcoins, dropping to $0.348, or an 11% loss. Also, the stock market tumbled after the Fed official’s statement. The Nasdaq 100 dipped by 2%, and S&P ended the trading day with a 1.55% loss.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Ethereum (ETH) and Lunex Network (LNEX) Prepare For Huge Rallies

- Dec 20, 2024 at 07:45 pm

- Driven by Ethereum’s (ETH) supremacy in the DeFi area and positive technical signs, investors are looking at an ambitious $10,000 target this cycle. Though Ethereum (ETH) shows significant momentum, a new competitor called Lunex Network (LNEX) is drawing interest with its innovative DeFi ecosystem and shockingly high return on investment potential.

-

-

-

- Tether (USDT) Inflows Surge as Stablecoins Drive Bitcoin's (BTC) Rally

- Dec 20, 2024 at 07:40 pm

- Recent on-chain data highlights a surge in Tether [USDT] inflows to centralized exchanges, averaging $40 million per day. This trend suggests that stablecoins may be the driving force behind Bitcoin's ongoing rally.

-

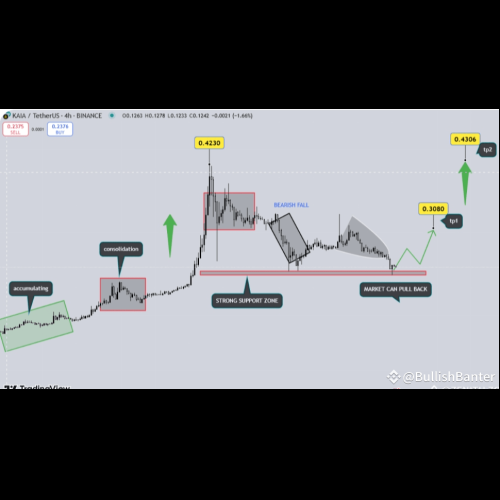

- Kaia Chain: Revolutionizing Web3 with LINE Mini Dapps

- Dec 20, 2024 at 07:40 pm

- Kaia Chain is spearheading a transformative shift in blockchain by seamlessly integrating Web3 technology into everyday digital platforms. Born from the collaboration between Klaytn and Finschia, the blockchain ventures of Kakao and LINE, Kaia is bridging decentralized innovation with mainstream digital ecosystems. With access to over 270 million users across LINE and Kakaotalk, Kaia is redefining the digital experience by offering groundbreaking Mini Dapps that merge Web2 simplicity with Web3 functionality.

-

-

- Ripple (XRP) Retests Historic Support, Prepares for Rally Above $3

- Dec 20, 2024 at 07:35 pm

- The price of Ripple (XRP) dipped to the $2.0 range as the crypto market plunged in a surprise flash crash. Nevertheless, it is not something to be worried about; the altcoin only retested the 2021 high, in turn preparing the coin for an explosive rally above $3 in a few days ahead.

-

-

- Cryptocurrency Market Bloodbath: XRP and Cardano (ADA) Experience Staggering Losses, Leading to a $1.2 Billion Liquidation

- Dec 20, 2024 at 07:35 pm

- In a shocking turn of events for the cryptocurrency market, major altcoins such as XRP and Cardano (ADA) experienced staggering losses, leading to a $1.2 billion liquidation