|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

AMP Super's Bitcoin investment decision has really set the cat among the pigeons in the superannuation sector

Dec 16, 2024 at 07:13 am

While AMP (ASX: AMP) will conceivably get a marketing and first mover advantage by fulfilling strong investor appetite for the crypto asset

Superannuation fund AMP (ASX:AMP) has made history by becoming the first mainstream fund in Australia to invest directly in Bitcoin.

The fund will make an initial investment of $27 million in the flagship cryptocurrency, which will be around 0.05% of the total funds under management.

The move comes amid increasing demand from members for exposure to digital assets, and follows the launch of several crypto ETFs in the US.

However, the move is also likely to ignite further debate within the super sector, with several investment managers having already expressed strong reservations about the suitability of Bitcoin for retirement savings.

Vanguard blasts Bitcoin role in long-term portfolios

The strongest reaction came from Vanguard Australia, which blasted Bitcoin as having “no appropriate role” in long-term investment portfolios.

The fund manager said the asset class is risky and lacks intrinsic value, and noted that while speculators have made money on cryptocurrencies, many have also made losses and it predicted many more would lose money in the future.

“The investment merits of bitcoin and other cryptocurrencies are, in our view, weak. They are highly risky and speculative assets that are driven largely by demand and supply dynamics,” Vanguard’s Asia-Pacific chief investment officer Duncan Burns said.

“This stands in contrast to traditional asset classes like equities, bonds and property, which generate income or cash flows and have an underlying fundamental value.”

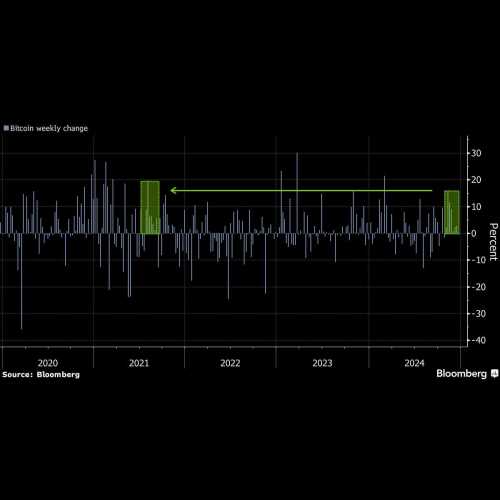

Burns added that crypto assets are also highly illiquid, especially in a downturn, and said that many investors who bought the assets at high prices in 2021 are now sitting on losses.

“We believe that many of those who bought the assets at lower prices in the past will sell, particularly if prices continue to rise,” he said.

“This will leave later buyers exposed to the potential for large losses if prices fall sharply, as they did in 2022.”

Other concerns that have been raised by investment managers within the super sector are the possibility of links between Bitcoin profits and criminal activity and also the highly speculative and non-fundamental nature of crypto investments.

Valuing crypto assets is also a mystery, given the lack of underlying cash flows.

Crypto demand is there

But there is little doubt that there is a demand from investors for crypto assets in their super and already large international fund managers including Goldman Sachs (NYSE:GS) and BlackRock (NYSE:BLK) have been in discussions with Australian super funds about the best way they can integrate crypto investments.

It is interesting to note that AMP’s first crypto foray is quite a conservative one.

That lies well within BlackRock’s recommendation that no more than 2% of a portfolio should be invested in cryptocurrency.

AMP already sitting on big profits

It also means that AMP is already sitting on some excellent profits given the strong performance of Bitcoin since the election of President Trump on November 5.

Bitcoin has risen by around 30% over that period, while the S&P 500 index has gained 12%.

AMP’s chief investment officer Anna Shelley said the investment was made after “testing and careful consideration” and said it was a “small and risk-controlled position”.

Bloomberg has reported that the investment was made through futures, which would enable AMP to hedge the position.

Ms Shelley said the move “recognises the structural changes in the industry over the past year, including the launch of exchange-traded funds by leading international investment managers.”

“While our super members have benefited from the exposure, we fully appreciate the risk and volatility characteristics of this emerging asset class and will continue to carefully manage our holding, which is a fractional component of a highly diversified asset mix.”

Several large international pension funds have already invested in crypto assets with many citing the ability of crypto to preserve purchasing power and to offer an asymmetric risk-return profile that is not related to other asset classes.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- WallitIQ (WLTQ): The AI Coin Redefining Crypto Trading, Offering 40,000% ROI Potential

- Dec 16, 2024 at 10:25 am

- The crypto market is on fire this December, with the Dogecoin price surging amid renewed investor enthusiasm. Speculation is rampant as the famed meme coin edges closer to the $2 mark, a milestone that's sure to dominate headlines. But beneath the noise of Dogecoin price rise lies a stealthier, more lucrative opportunity. Enter WallitIQ (WLTQ), an AI coin that's quickly capturing the attention of smart crypto traders.

-

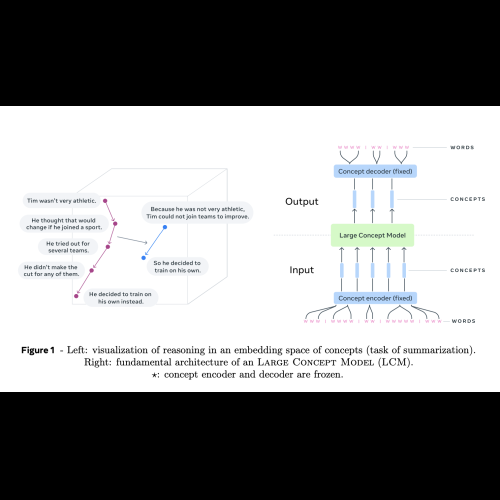

- Large Concept Models: A New Architecture for AI-Driven Communication

- Dec 16, 2024 at 10:25 am

- Large Concept Models (LCMs) represent a shift from traditional LLM architectures. LCMs bring two significant innovations: a hierarchical structure that enables reasoning at different levels of abstraction and a modality-agnostic processing pipeline that supports multilingual and multimodal applications.

-

- Quantum Computers Are Not a Threat to Bitcoin (BTC), CryptoQuant Founder Ki Young Ju and Blockstream CEO Adam Back Argue

- Dec 16, 2024 at 10:05 am

- CryptoQuant founder Ki Young Ju has taken to Twitter to assure his followers that quantum computers cannot break Bitcoin (BTC). His tweet agrees with an earlier post from Blockstream CEO Adam Back.

-

- Jack Mallers Stuns Timcast Host Tim Pool With President-elect Donald Trump's Plan to Establish a Strategic Bitcoin Reserve on His Very First Day in Office via an Executive Order

- Dec 16, 2024 at 10:05 am

- The buzz around a strategic bitcoin reserve for the U.S. has picked up steam lately, especially with new laws and nods from politicians.

-