|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

可以想象,AMP(ASX:AMP)将通过满足投资者对加密资产的强烈兴趣来获得营销和先发优势

Superannuation fund AMP (ASX:AMP) has made history by becoming the first mainstream fund in Australia to invest directly in Bitcoin.

养老金基金 AMP(ASX:AMP)创造了历史,成为澳大利亚第一支直接投资比特币的主流基金。

The fund will make an initial investment of $27 million in the flagship cryptocurrency, which will be around 0.05% of the total funds under management.

该基金将对旗舰加密货币进行 2700 万美元的初始投资,约占管理资金总额的 0.05%。

The move comes amid increasing demand from members for exposure to digital assets, and follows the launch of several crypto ETFs in the US.

此举是在会员对数字资产敞口的需求不断增加以及美国推出数个加密货币 ETF 之后做出的。

However, the move is also likely to ignite further debate within the super sector, with several investment managers having already expressed strong reservations about the suitability of Bitcoin for retirement savings.

然而,此举也可能引发超级行业内的进一步争论,一些投资经理已经对比特币作为退休储蓄的适用性表示强烈保留。

Vanguard blasts Bitcoin role in long-term portfolios

先锋集团抨击比特币在长期投资组合中的作用

The strongest reaction came from Vanguard Australia, which blasted Bitcoin as having “no appropriate role” in long-term investment portfolios.

最强烈的反应来自澳大利亚先锋集团,该公司抨击比特币在长期投资组合中“没有适当的作用”。

The fund manager said the asset class is risky and lacks intrinsic value, and noted that while speculators have made money on cryptocurrencies, many have also made losses and it predicted many more would lose money in the future.

该基金经理表示,该资产类别存在风险,缺乏内在价值,并指出,虽然投机者在加密货币上赚钱,但许多人也遭受了损失,并预计未来会有更多人亏损。

“The investment merits of bitcoin and other cryptocurrencies are, in our view, weak. They are highly risky and speculative assets that are driven largely by demand and supply dynamics,” Vanguard’s Asia-Pacific chief investment officer Duncan Burns said.

“我们认为,比特币和其他加密货币的投资优点较弱。它们是高风险和投机性资产,主要由需求和供应动态驱动,”先锋集团亚太区首席投资官邓肯·伯恩斯(Duncan Burns)表示。

“This stands in contrast to traditional asset classes like equities, bonds and property, which generate income or cash flows and have an underlying fundamental value.”

“这与股票、债券和房地产等传统资产类别形成鲜明对比,这些资产类别产生收入或现金流,并具有潜在的基本价值。”

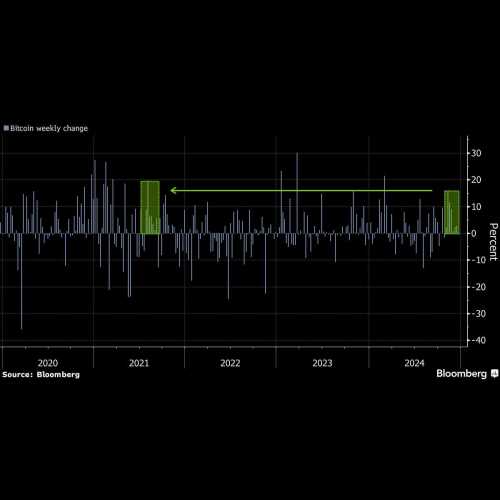

Burns added that crypto assets are also highly illiquid, especially in a downturn, and said that many investors who bought the assets at high prices in 2021 are now sitting on losses.

伯恩斯补充说,加密资产的流动性也非常低,尤其是在经济低迷时期,并表示许多在 2021 年以高价购买这些资产的投资者现在正遭受损失。

“We believe that many of those who bought the assets at lower prices in the past will sell, particularly if prices continue to rise,” he said.

他表示:“我们相信,许多过去以较低价格购买资产的人将会出售资产,特别是如果价格继续上涨的话。”

“This will leave later buyers exposed to the potential for large losses if prices fall sharply, as they did in 2022.”

“如果价格大幅下跌,就像 2022 年那样,这将使后来的买家面临巨大损失的风险。”

Other concerns that have been raised by investment managers within the super sector are the possibility of links between Bitcoin profits and criminal activity and also the highly speculative and non-fundamental nature of crypto investments.

超级行业内的投资经理提出的其他担忧包括比特币利润与犯罪活动之间存在联系的可能性,以及加密货币投资的高度投机性和非基本性质。

Valuing crypto assets is also a mystery, given the lack of underlying cash flows.

鉴于缺乏基础现金流,对加密资产进行估值也是一个谜。

Crypto demand is there

加密货币需求是存在的

But there is little doubt that there is a demand from investors for crypto assets in their super and already large international fund managers including Goldman Sachs (NYSE:GS) and BlackRock (NYSE:BLK) have been in discussions with Australian super funds about the best way they can integrate crypto investments.

但毫无疑问,投资者对超级基金中的加密资产有需求,并且已经是大型国际基金管理公司,包括高盛(NYSE:GS)和贝莱德(NYSE:BLK)一直在与澳大利亚超级基金讨论最佳选择。他们可以整合加密投资的方式。

It is interesting to note that AMP’s first crypto foray is quite a conservative one.

有趣的是,AMP 的第一次加密尝试是相当保守的。

That lies well within BlackRock’s recommendation that no more than 2% of a portfolio should be invested in cryptocurrency.

这完全符合贝莱德的建议,即投资加密货币的投资组合不应超过 2%。

AMP already sitting on big profits

AMP 已经坐享巨额利润

It also means that AMP is already sitting on some excellent profits given the strong performance of Bitcoin since the election of President Trump on November 5.

这也意味着,鉴于自 11 月 5 日特朗普总统当选以来比特币的强劲表现,AMP 已经坐拥一些丰厚的利润。

Bitcoin has risen by around 30% over that period, while the S&P 500 index has gained 12%.

比特币在此期间上涨了约 30%,而标准普尔 500 指数上涨了 12%。

AMP’s chief investment officer Anna Shelley said the investment was made after “testing and careful consideration” and said it was a “small and risk-controlled position”.

AMP首席投资官安娜·雪莱(Anna Shelley)表示,这项投资是在“测试和仔细考虑”之后做出的,并表示这是一个“小规模且风险可控的头寸”。

Bloomberg has reported that the investment was made through futures, which would enable AMP to hedge the position.

彭博社报道称,这项投资是通过期货进行的,这将使 AMP 能够对冲头寸。

Ms Shelley said the move “recognises the structural changes in the industry over the past year, including the launch of exchange-traded funds by leading international investment managers.”

雪莱女士表示,此举“认可了过去一年该行业的结构性变化,包括领先的国际投资管理公司推出的交易所交易基金”。

“While our super members have benefited from the exposure, we fully appreciate the risk and volatility characteristics of this emerging asset class and will continue to carefully manage our holding, which is a fractional component of a highly diversified asset mix.”

“虽然我们的超级会员从风险敞口中受益,但我们充分认识到这一新兴资产类别的风险和波动性特征,并将继续谨慎管理我们的持股,这是高度多元化资产组合的一小部分。”

Several large international pension funds have already invested in crypto assets with many citing the ability of crypto to preserve purchasing power and to offer an asymmetric risk-return profile that is not related to other asset classes.

几家大型国际养老基金已经投资了加密资产,其中许多基金认为加密货币能够保持购买力并提供与其他资产类别无关的不对称风险回报状况。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- 比特币攀升至历史新高,特朗普的支持引发涨势扩大

- 2024-12-16 10:51:41

- 周一,这一最大的代币在亚洲一度上涨超过 3%,达到史无前例的 106,493 美元,超过了 12 月 5 日以来的峰值。

-

-

- 确保您的席位:Arbitrum 空投指南已发布

- 2024-12-16 10:45:02

- 开始使用:很高兴通过 DappRadar 获得 Arbitrum 空投吗?您来对地方了。空投在全球范围内非常受欢迎

-

-

- 代币解锁活动和币安收益计划为投资者带来市场机会

- 2024-12-16 10:45:02

- 一系列重要的代币解锁活动将在加密货币交易领域的主要参与者币安平台上发生。

-