|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Solana 的原生代币 SOL 为 243.91 美元,自 11 月 26 日跌至 222 美元以来,已飙升 8%。尽管出现这种复苏,但一些投资者仍持怀疑态度

Solana's ( SOL ) native token has largely remained stagnant over the past week, surging 8% compared to a 12% gain in the broader altcoin market capitalization. However, onchain and derivatives data suggest that SOL still holds significant upside potential.

Solana (SOL) 的原生代币在过去一周基本保持停滞状态,与更广泛的山寨币市值 12% 的涨幅相比,飙升 8%。然而,链上和衍生品数据表明 SOL 仍然具有巨大的上涨潜力。

Despite the recent price appreciation, some investors have expressed skepticism due to SOL's modest gain and the sharp correction from its all-time high of $263.80 on Nov. 23.

尽管最近价格上涨,但由于 SOL 的涨幅不大,且较 11 月 23 日创下的历史高点 263.80 美元大幅回调,一些投资者仍对此表示怀疑。

However, zooming out to a broader time frame reveals that Solana has solidified its position as the second-largest programmable blockchain by developer activity and user engagement, a remarkable feat considering the competitive nature of the Web3 landscape.

然而,从更广泛的时间范围来看,Solana 通过开发者活动和用户参与度巩固了其作为第二大可编程区块链的地位,考虑到 Web3 格局的竞争性质,这是一项了不起的壮举。

Further bolstering this growth, Solana's total value locked soared by an impressive 48% in the 30 days leading up to Nov. 27.

截至 11 月 27 日的 30 天内,Solana 的锁定总价值飙升了 48%,进一步推动了这一增长。

To put this into perspective, deposits on the BNB Chain increased by a more modest 14% over the same 30-day period, while Tron network's total value locked grew by a relatively smaller 13%.

从这个角度来看,BNB 链上的存款在同一 30 天内增长了 14%,而 Tron 网络的锁定总价值相对较小,增长了 13%。

Solana's standout performers include the Jito liquid staking solution at $3.4 billion (+44%), the Jupiter decentralized exchange at $2.4 billion (+50%), and Raydium at $2.2 billion (+58%). This surge in deposits is largely attributed to the growing demand for SOL, spurred by Solana's expanding decentralized application ecosystem.

Solana 表现出色的包括 Jito 流动性质押解决方案,价值 34 亿美元(+44%),Jupiter 去中心化交易所,价值 24 亿美元(+50%),以及 Raydium,价值 22 亿美元(+58%)。存款激增很大程度上归因于 Solana 不断扩大的去中心化应用生态系统刺激了对 SOL 的需求不断增长。

While some analysts suggest that SOL competes with Ether ( ETH ), data indicates that both networks can grow independently. Onchain activity on Ethereum increased by 47% in the last 30 days, according to DappRadar. Uniswap volumes on Ethereum surged by 62% during the period, while CoW Swap recorded a gain of 71% over the same duration.

虽然一些分析师认为 SOL 与以太坊 (ETH) 存在竞争,但数据表明这两个网络都可以独立发展。根据 DappRadar 的数据,过去 30 天内以太坊的链上活动增加了 47%。在此期间,以太坊上的 Uniswap 交易量飙升了 62%,而 CoW Swap 同期增长了 71%。

While Solana dominates memecoin launches and trading, Ethereum maintains its edge as the network of choice for decentralized finance opportunities. Notably, three of the top five highest-grossing DApps belong to Solana — Raydium, Jito, and Pump.fun — outperforming Lido, Unispec, and Aave in this metric.

虽然 Solana 主导着 memecoin 的发行和交易,但以太坊仍然保持着作为去中心化金融机会的首选网络的优势。值得注意的是,收入最高的前 5 个 DApp 中的 3 个属于 Solana——Raydium、Jito 和 Pump.fun——在这个指标上表现优于 Lido、Unispec 和 Aave。

Solana and Ethereum can grow independently without directly competing for the same user base. However, Solana's greater reliance on memecoins introduces more risk, as the speculative frenzy surrounding tokens like BONK, POPCAT, MEW, and SPX6900 — some of which surged over 100% in three months — may not be sustainable in the long term.

Solana 和以太坊可以独立发展,无需直接竞争同一用户群。然而,Solana 对 memecoin 的更大依赖带来了更多风险,因为围绕 BONK、POPCAT、MEW 和 SPX6900 等代币的投机狂潮(其中一些代币在三个月内飙升超过 100%)从长远来看可能无法持续。

To assess whether traders have shifted sentiment on SOL following the 10% decline between Nov. 23 and Nov. 27, the futures premium provides valuable insight. In stable markets, monthly futures typically trade at a 5% to 10% annualized premium over spot prices to account for the time value of money and the cost of carry. This premium usually turns negative in bear markets or during periods of extreme fear.

为了评估交易者对 SOL 在 11 月 23 日至 27 日期间下跌 10% 后的情绪是否发生了转变,期货溢价提供了宝贵的见解。在稳定的市场中,考虑到货币时间价值和持有成本,月度期货的交易价格通常比现货价格高 5% 至 10%。在熊市或极度恐惧时期,这种溢价通常会变成负值。

Currently, SOL futures indicate traders are paying an annualized 23% premium to maintain long (buy) positions, marking the highest level in seven months. While this suggests optimism, excessive bullishness can push this metric above 40%, increasing the risk of cascading liquidations during unexpected price corrections.

目前,SOL 期货显示交易者需要支付 23% 的年化溢价来维持多头(买入)头寸,创下七个月以来的最高水平。虽然这表明乐观情绪,但过度看涨可能会使该指标超过 40%,从而增加意外价格调整期间出现级联清算的风险。

Based on Solana's onchain activity and derivatives market data, further price appreciation appears likely. At its current $113.7 billion market capitalization, SOL trades at a hefty 73% discount compared to Ethereum's $429.4 billion, indicating significant room for growth.

根据 Solana 的链上活动和衍生品市场数据,价格可能会进一步上涨。目前 SOL 的市值为 1137 亿美元,与以太坊的 4294 亿美元相比,其交易价格大幅折扣 73%,这表明其增长空间巨大。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 2024 年 12 月最值得购买的加密货币:Qubetics、XRP 和 FIL

- 2024-11-28 12:25:02

- 随着 12 月的到来,加密货币市场一片热闹。 Ripple的XRP已飙升至三年来的最高点

-

-

- UVA Health 向非营利组织捐赠数千美元以庆祝节日

- 2024-11-28 12:20:02

- 为了庆祝节日,并作为对员工的谢意,UVA Health 向五个非营利组织各捐赠了数千美元。

-

- 比特币(BTC)近期价格调整后出现反弹,投资者获利了结行为消退

- 2024-11-28 12:20:02

-

-

-

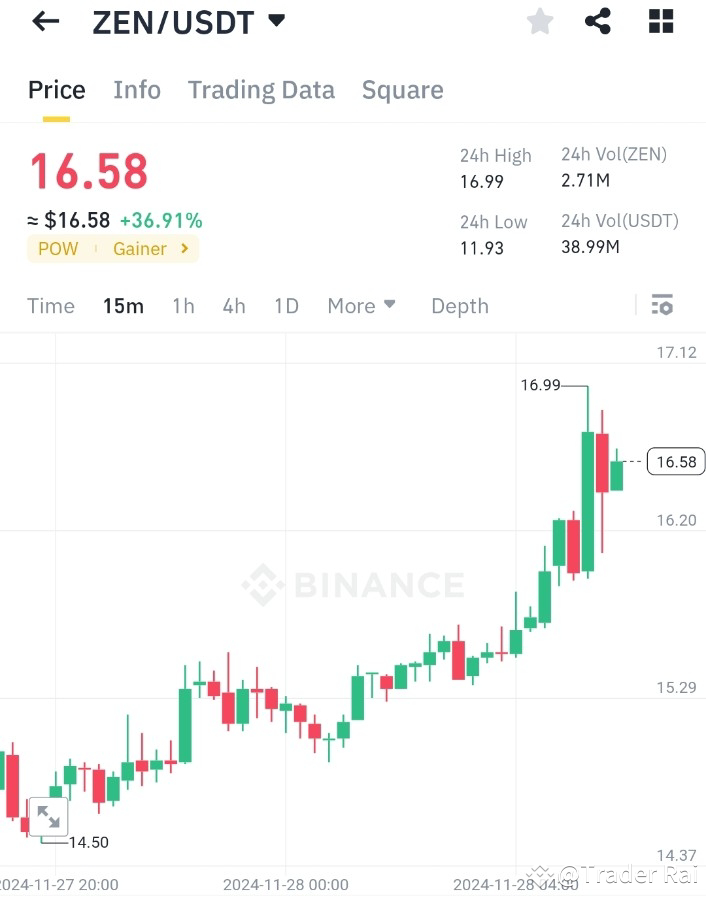

- 🚀 $ZEN /USDT POW 增益 | +36.91% 激增! 💥

- 2024-11-28 12:15:01

-

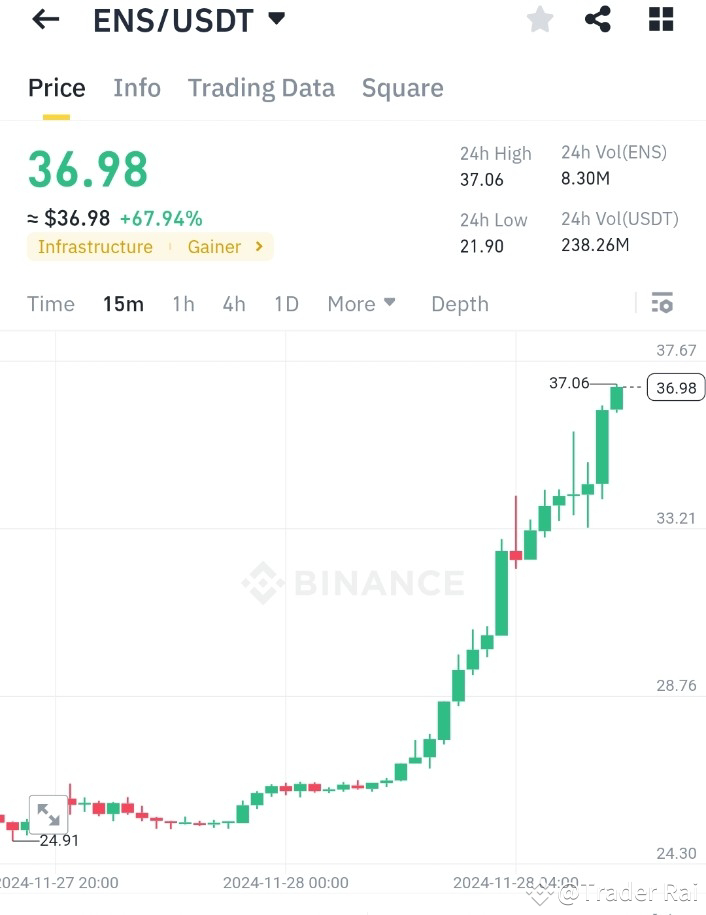

- ENS(以太坊名称服务)飙升,成为基础设施的领头羊 | +67.94% 激增!

- 2024-11-28 12:15:01

- ENS(以太坊名称服务)以惊人的 67.94% 增长,成为基础设施增长最快的领域。

-