|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

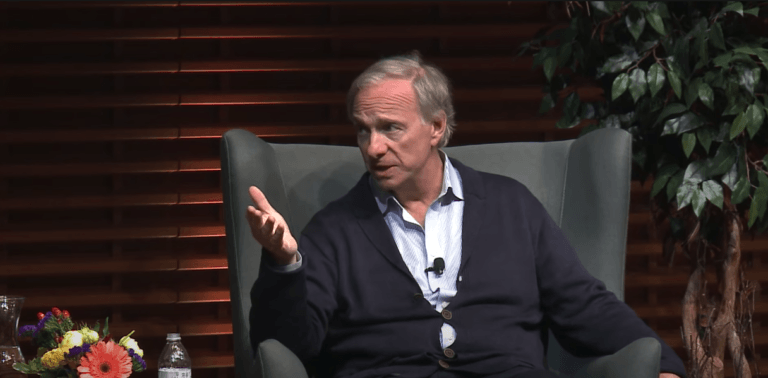

Ray Dalio 是 Bridgewater Associates 的创始人,担任首席信息官导师,并且仍然是该公司董事会的活跃成员。

Billionaire investor Ray Dalio has warned of an approaching global debt crisis, which he believes could lead to a significant drop in the value of fiat money.

亿万富翁投资者雷·达里奥(Ray Dalio)警告称,全球债务危机即将来临,他认为这可能会导致法定货币价值大幅下跌。

Speaking on Tuesday during the Abu Dhabi Finance Week (ADFW) in the United Arab Emirates, Dalio advised investors to avoid debt-based investments such as bonds and instead focus on tangible assets like gold and Bitcoin.

周二,达利奥在阿拉伯联合酋长国阿布扎比金融周(ADFW)期间发表讲话,建议投资者避免债券等债务投资,转而关注黄金和比特币等有形资产。

"I think there's a debt crisis approaching, and I think that people should be preparing for a scenario where the value of fiat money will go down substantially,” said Dalio, the Founder of Bridgewater Associates, where he serves as a CIO Mentor and remains an active member of the firm’s board.

桥水基金创始人达利奥表示:“我认为债务危机即将来临,人们应该为法定货币价值大幅下跌的情况做好准备。”公司董事会的积极成员。

"I would be advising people to be decreasing their exposure to debt-like instruments, and I would be advising them to be increasing their exposure to non-debt-like instruments. I would be advising them to be thinking in terms of the very long run rather than reacting to the news of each day."

“我会建议人们减少对债务类工具的敞口,并建议他们增加对非债务类工具的敞口。我会建议他们从长期角度考虑跑步而不是对每天的新闻做出反应。”

Despite once being skeptical about Bitcoin, Dalio now sees it as a reliable asset, comparable to gold. He suggests allocating 1-2% of investment portfolios to Bitcoin as a hedge against inflation, while still promoting diversification.

尽管达里奥曾经对比特币持怀疑态度,但现在将其视为一种可靠的资产,可与黄金相媲美。他建议将 1-2% 的投资组合分配给比特币,以对冲通胀,同时仍促进多元化。

"I used to think that Bitcoin was like Beanie Babies, but I've changed my mind over the last few years,” said Dalio. "I now believe that it's more like gold. I think it's a miracle that over 13 years, despite all the ups and downs, Bitcoin has never been hacked. I believe that you should be putting 1-2% of your portfolio in Bitcoin as an inflation hedge, but remember to diversify your investments."

达里奥说:“我曾经认为比特币就像豆豆宝宝,但在过去几年里我改变了主意。”“我现在认为它更像黄金。我认为 13 年来,尽管经历了种种风风雨雨,比特币从未遭到黑客攻击,这真是一个奇迹。我认为你应该将投资组合的 1-2% 投资于比特币作为通胀对冲,但请记住投资多元化。”

On April 18, Dalio published a LinkedIn post titled “Do You Have Enough Non-Debt Money?, ” in which he began by defining good money as being both a good medium of exchange and a good storehold of wealth that is widely accepted around the world.

4 月 18 日,达里奥在 LinkedIn 上发表了一篇题为“你有足够的非债务货币吗?”的帖子,其中他首先将好货币定义为既是良好的交换媒介,又是良好的财富储存手段,这一点在全球范围内得到了广泛接受。世界。

He went on to identify the dollar, euro, yen, and Chinese renminbi as the most globally recognized and accepted currencies, before noting that they are all debt-backed monies.

他接着指出美元、欧元、日元和人民币是全球最受认可和接受的货币,然后指出它们都是债务支持货币。

"When you hold these monies, you are holding debt liabilities, which are promises to deliver you money,” wrote Dalio. "These debt liabilities are good as long as there is a high probability that the debts will get paid back to you in a good currency, meaning a currency that other people want."

达利奥写道:“当你持有这些钱时,你就持有债务负债,这些债务是给你带来钱的承诺。”“只要债务很有可能在一定时间内偿还给你,这些债务负债就是好的。”好的货币,意味着其他人想要的货币。”

However, Dalio cautioned that when there are significant risks of debts not being paid back or being paid back with money of depreciated value, the debt and the money become unattractive.

不过,达利奥警告说,当存在债务无法偿还或用贬值的钱偿还的重大风险时,债务和金钱就会变得没有吸引力。

"When a government has too much debt to be paid, its central bank is likely to print money to pay the debts, which will lead to inflation and cause the value of the currency to go down,” he explained.

他解释说:“当政府有太多债务需要偿还时,其央行可能会印钞票来偿还债务,这将导致通货膨胀并导致货币贬值。”

"In contrast to debt-backed currencies, gold is a non-debt-backed form of money. You can think of it as being like cash, except cash and bonds are devalued by risks of default and inflation, while gold is supported by risks of debt defaults and inflation."

“与债务支持的货币相比,黄金是一种非债务支持的货币形式。你可以将其视为现金,只不过现金和债券会因违约和通胀风险而贬值,而黄金则受到风险的支撑债务违约和通货膨胀。”

Dalio highlighted that gold is the third-most-held reserve currency by central banks, surpassing the yen and renminbi.

达里奥强调,黄金是央行持有的第三大储备货币,超过日元和人民币。

"It's interesting to note that some people might argue that gems and art act in a way that is similar to gold due to their non-debt nature, portability, and wide acceptance as storeholds of wealth,” he added.

“有趣的是,有些人可能会认为,宝石和艺术品的行为方式与黄金类似,因为它们的非债务性质、便携性以及作为财富储藏手段的广泛接受,”他补充道。

"When the financial system is functioning well, with borrower-debtor governments meeting their obligations without resorting to money printing and devaluation, debt assets and other financial assets are good to hold."

“当金融体系运转良好,借款人和债务人政府在不诉诸印钞和贬值的情况下履行其义务时,债务资产和其他金融资产就值得持有。”

"However, when debt and inflation crises arise, gold becomes a valuable asset to own. This is the main reason that gold is a good diversifier and why I have some in my portfolio."

“然而,当债务和通胀危机出现时,黄金就成为一种值得拥有的宝贵资产。这是黄金是良好的分散投资工具的主要原因,也是我在投资组合中持有黄金的主要原因。”

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 特朗普的世界自由现在持有价值 5500 万美元的以太坊 (ETH)

- 2024-12-13 04:00:02

- 以太坊是按市值计算的第二大加密货币,作为去中心化金融(DeFi)和智能合约的领先区块链,一直受到关注

-

- 矮胖企鹅 NFT 在 Solana 空投炒作下飙升至 10 万美元以上

- 2024-12-13 04:00:02

- 深入了解矮胖企鹅 NFT 的有趣旅程,因为它们激发想象力并激发收藏家和投资者的好奇心。

-

-

-

- CYBRO 飙升 450% 预售 700 万美元后提前上市

- 2024-12-13 03:55:01

- 人工智能驱动的多链平台CYBRO在预售表现出色后,正在加快在主要交易所的上市时间表。

-

-

-

-