|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Ray Dalio Warns of Approaching Global Debt Crisis, Advises Investors to Focus on Tangible Assets like Bitcoin

Dec 12, 2024 at 10:36 pm

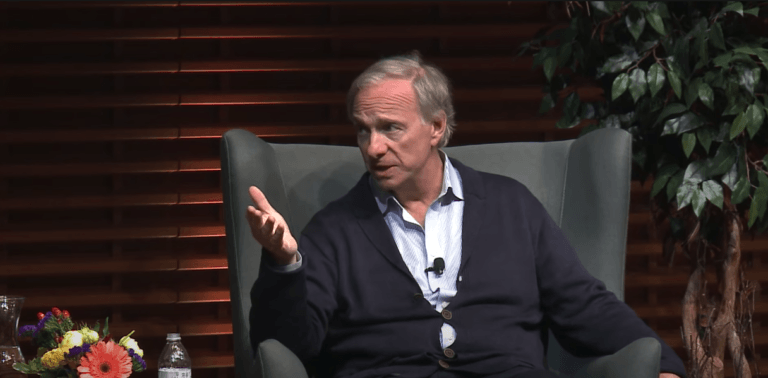

Ray Dalio is the Founder of Bridgewater Associates, where he serves as a CIO Mentor and remains an active member of the firm's board.

Billionaire investor Ray Dalio has warned of an approaching global debt crisis, which he believes could lead to a significant drop in the value of fiat money.

Speaking on Tuesday during the Abu Dhabi Finance Week (ADFW) in the United Arab Emirates, Dalio advised investors to avoid debt-based investments such as bonds and instead focus on tangible assets like gold and Bitcoin.

"I think there's a debt crisis approaching, and I think that people should be preparing for a scenario where the value of fiat money will go down substantially,” said Dalio, the Founder of Bridgewater Associates, where he serves as a CIO Mentor and remains an active member of the firm’s board.

"I would be advising people to be decreasing their exposure to debt-like instruments, and I would be advising them to be increasing their exposure to non-debt-like instruments. I would be advising them to be thinking in terms of the very long run rather than reacting to the news of each day."

Despite once being skeptical about Bitcoin, Dalio now sees it as a reliable asset, comparable to gold. He suggests allocating 1-2% of investment portfolios to Bitcoin as a hedge against inflation, while still promoting diversification.

"I used to think that Bitcoin was like Beanie Babies, but I've changed my mind over the last few years,” said Dalio. "I now believe that it's more like gold. I think it's a miracle that over 13 years, despite all the ups and downs, Bitcoin has never been hacked. I believe that you should be putting 1-2% of your portfolio in Bitcoin as an inflation hedge, but remember to diversify your investments."

On April 18, Dalio published a LinkedIn post titled “Do You Have Enough Non-Debt Money?, ” in which he began by defining good money as being both a good medium of exchange and a good storehold of wealth that is widely accepted around the world.

He went on to identify the dollar, euro, yen, and Chinese renminbi as the most globally recognized and accepted currencies, before noting that they are all debt-backed monies.

"When you hold these monies, you are holding debt liabilities, which are promises to deliver you money,” wrote Dalio. "These debt liabilities are good as long as there is a high probability that the debts will get paid back to you in a good currency, meaning a currency that other people want."

However, Dalio cautioned that when there are significant risks of debts not being paid back or being paid back with money of depreciated value, the debt and the money become unattractive.

"When a government has too much debt to be paid, its central bank is likely to print money to pay the debts, which will lead to inflation and cause the value of the currency to go down,” he explained.

"In contrast to debt-backed currencies, gold is a non-debt-backed form of money. You can think of it as being like cash, except cash and bonds are devalued by risks of default and inflation, while gold is supported by risks of debt defaults and inflation."

Dalio highlighted that gold is the third-most-held reserve currency by central banks, surpassing the yen and renminbi.

"It's interesting to note that some people might argue that gems and art act in a way that is similar to gold due to their non-debt nature, portability, and wide acceptance as storeholds of wealth,” he added.

"When the financial system is functioning well, with borrower-debtor governments meeting their obligations without resorting to money printing and devaluation, debt assets and other financial assets are good to hold."

"However, when debt and inflation crises arise, gold becomes a valuable asset to own. This is the main reason that gold is a good diversifier and why I have some in my portfolio."

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- Alternative Digital Currencies Market Hints at a Period of Strong Performance

- Dec 13, 2024 at 03:45 am

- A wave of momentum is building in the cryptocurrency market, hinting at a significant rise in alternative digital currencies. Certain market signals suggest that a period of strong performance for these assets may be on the horizon.

-

-

- Shiba Inu (SHIB) Investors See Profits Despite Stagnant Price, See Resistance Ahead

- Dec 13, 2024 at 03:45 am

- Shiba Inu (SHIB) has seen significant price action recently, though it has struggled to break past a crucial resistance level. Despite the lack of sharp gains, investor confidence remains high.

-