|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 由于中国经济措施表现不佳以及周末公布疲软的通胀数据,亚洲股市早盘交易可能会陷入困境。在当选总统唐纳德·特朗普横扫美国七个战场州后,比特币价格突破 81,000 美元。

Asian stocks may struggle in early trading after underwhelming Chinese economic measures and anemic inflation data over the weekend, while Bitcoin topped $81,000 after President-elect Donald Trump took a clean sweep of the seven US battleground states.

在周末中国经济措施平淡和通胀数据疲软之后,亚洲股市早盘可能会陷入困境,而在当选总统唐纳德·特朗普横扫美国七个战场州后,比特币突破 81,000 美元。

Australian shares fell and futures in Tokyo and Hong Kong signaled losses after China’s 10 trillion yuan ($1.4 billion) plan to help local governments deal with hidden debt stopped short of including new measures to boost domestic demand. US futures edged higher after the S&P 500 rose 0.4% on Friday to cap stocks’ best week this year in anticipation of Trump’s pro-growth agenda.

在中国帮助地方政府处理隐性债务的 10 万亿元人民币(14 亿美元)计划没有包括刺激内需的新措施后,澳大利亚股市下跌,东京和香港期货出现下跌。由于预期特朗普的促增长议程,周五标准普尔 500 指数上涨 0.4%,创下股市今年表现最好的一周,美国期货小幅走高。

A softer start is expected in Asia after the region’s stocks jumped 2.4% last week amid improved sentiment following the Federal Reserve’s rate cut and hopes for more stimulus in China. Investors are now shifting to assess how quickly Trump will implement his fiscal and protectionist trade policies, including proposed tariffs on China.

亚洲股市上周上涨 2.4%,因美联储降息后市场人气有所改善,且希望中国出台更多刺激措施,预计亚洲股市开局会较为疲软。投资者现在开始评估特朗普将多快实施其财政和保护主义贸易政策,包括拟议的对中国征收关税。

“The market’s next move will hinge on whether Trump prioritizes cutting taxes or raising tariffs, each having vastly different impact,” Tony Sycamore, an IG Markets analyst in Sydney, wrote in a note. “This clarification may still be months away and it’s worth remembering that back in 2016, Trump’s first move was to cut taxes which sent stock markets surging before tariffs on China caused headwinds.”

IG Markets驻悉尼分析师托尼·西卡莫尔(Tony Sycamore)在一份报告中写道:“市场的下一步行动将取决于特朗普是否优先考虑减税或提高关税,两者的影响截然不同。” “这一澄清可能还需要几个月的时间,值得记住的是,早在 2016 年,特朗普的第一个举措就是减税,这导致股市飙升,然后对中国的关税造成了阻力。”

Bitcoin surged past $81,000 for the first time in early Asia hours, after hitting a record $80,000 on Sunday, fueled by the incoming president’s support for digital assets and the election of pro-crypto lawmakers.

在即将上任的总统对数字资产的支持和支持加密货币的立法者当选的推动下,比特币在周日触及创纪录的 80,000 美元后,在亚洲早盘时段首次飙升至 81,000 美元以上。

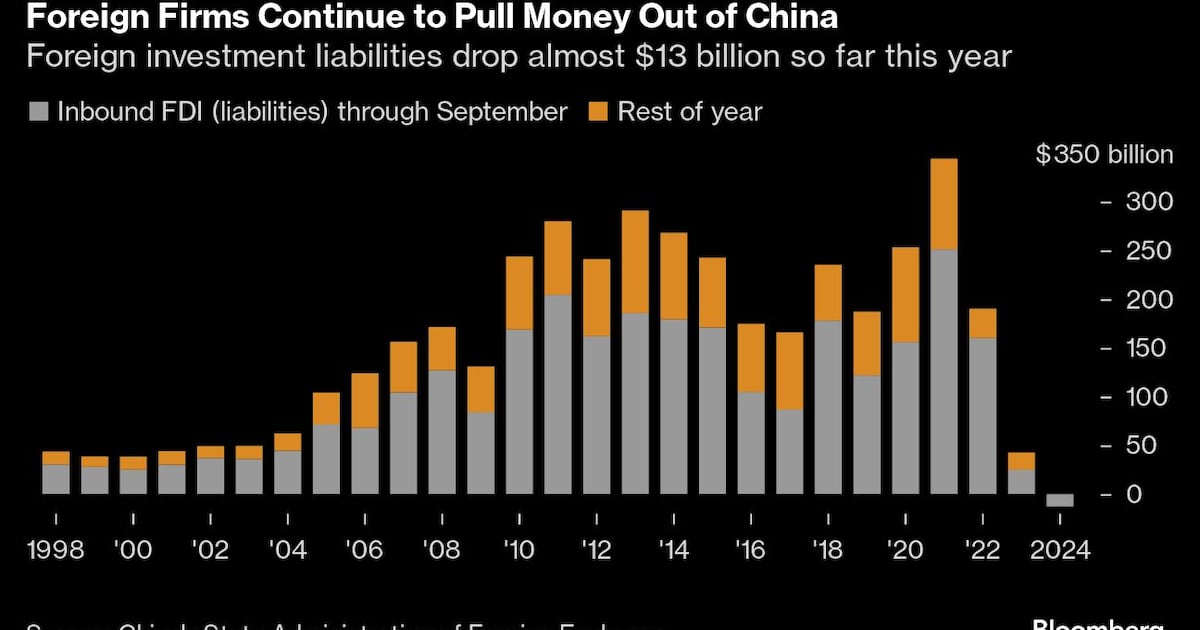

Meantime, sentiment toward China is faltering as foreign direct investment slumps amid geopolitical tensions, competition from domestic industries and concerns over the nation’s economic outlook. Consumer inflation eased closer to zero in October, suggesting the government’s latest round of stimulus is far from sufficient to free the economy from the grip of deflation.

与此同时,由于地缘政治紧张、国内产业竞争以及对国家经济前景的担忧,外国直接投资大幅下滑,人们对中国的信心正在动摇。十月份消费者通胀率降至接近于零的水平,这表明政府的最新一轮刺激措施远远不足以使经济摆脱通缩的束缚。

“Many feel that China is keeping its tactical powder in play for such time as the Trump-China tariff negotiations build, and they can respond in a more targeted fashion to stem the likely economic fallout,” Chris Weston, head of research at Pepperstone Group in Melbourne, wrote in a note. “In the short-term, however, it does suggest downside risk to China/Hong Kong equity and the yuan.”

Pepperstone Group 研究主管克里斯·韦斯顿 (Chris Weston) 表示:“许多人认为,随着特朗普与中国的关税谈判的展开,中国正在保持其战术优势,他们可以以更有针对性的方式做出反应,以遏制可能的经济影响。”在墨尔本,在一张纸条中写道。 “然而,从短期来看,这确实表明中国/香港股市和人民币面临下行风险。”

The dollar edged higher against major peers in early Asian trading, extending last week’s gain amid concerns that Trump’s fiscal policies will stoke inflation. While the US Treasury yield curve flattened Friday, firms including BlackRock, JPMorgan Chase, and TCW Group are warning that the bond market selloff is likely far from over. Cash Treasuries are closed Monday for a holiday.

由于担心特朗普的财政政策将引发通胀,美元兑主要货币在亚洲早盘小幅走高,延续了上周的涨势。虽然美国国债收益率曲线周五趋于平缓,但贝莱德、摩根大通和 TCW 集团等公司警告称,债券市场抛售可能远未结束。现金国债周一因假期休市。

Federal Reserve Bank of Minneapolis President Neel Kashkari indicated at the weekend the central bank could ease rates less than previously expected amid a strong US economy. Kashkari emphasized, however, that it’s too early to determine the impact of Trump’s policies.

明尼阿波利斯联邦储备银行行长尼尔·卡什卡利周末表示,在美国经济强劲的情况下,央行的降息幅度可能会低于此前的预期。然而卡什卡利强调,现在确定特朗普政策的影响还为时过早。

Oil was little changed near $70 a barrel in early Asian trading after falling 2.7% on Friday amid disappointment over China’s stimulus measures. Gold was steady.

由于对中国刺激措施的失望,周五油价下跌 2.7%,亚洲早盘油价在每桶 70 美元附近变化不大。黄金表现稳定。

This week, traders will be parsing data from Australian jobs to Chinese retail sales and industrial production, inflation from the US and Eurozone as well as growth readings in the UK and Japan. A swath of Federal Reserve officials are scheduled to speak which may help indicate the central bank’s thinking following the election result.

本周,交易员将解析澳大利亚就业数据、中国零售销售和工业生产数据、美国和欧元区的通胀数据以及英国和日本的增长数据。一系列美联储官员计划发表讲话,这可能有助于表明美联储在选举结果后的想法。

Some of the major moves in markets:

市场的一些重大变动:

Stocks

股票

Nikkei futures fell 0.2%

日经指数期货下跌 0.2%

Topix futures lost 0.1%

东证期货下跌 0.1%

S&P 500 futures rose 0.1%

标准普尔 500 指数期货上涨 0.1%

Nasdaq 100 futures gained 0.1%

纳斯达克100指数期货上涨0.1%

Australian equities decreased 0.3%

澳大利亚股市下跌 0.3%

Hong Kong futures declined 0.3%

香港期货下跌0.3%

Shanghai Composite down 0.1%

上证综合指数下跌0.1%

MSCI All-Country World Index futures were steady

MSCI 全球指数期货稳定

Currencies

货币

Dollar Index advanced 0.1% to 94.206

美元指数上涨0.1%至94.206

Bloomberg Dollar Spot Index rose 0.1%

彭博美元现货指数上涨 0.1%

Euro slipped 0.1% to $1.0866

欧元下跌 0.1% 至 1.0866 美元

Yen was flat at 113.81 per dollar

日元兑美元汇率持平于 113.81

Offshore yuan gained 0.1% to 7.0108 against the dollar

离岸人民币兑美元汇率上涨0.1%至7.0108

Cryptocurrencies

加密货币

Bitcoin soared 0.6% to $81,184.9

比特币飙升 0.6% 至 81,184.9 美元

Ethereum gained 0.2% to $2,226.08

以太坊上涨 0.2% 至 2,226.08 美元

Bonds

债券

Indicative 10-year Treasury yields were steady at 1.62%

指示性 10 年期国债收益率稳定在 1.62%

Australia’s 3-year yield decreased two basis points to 0.85%

澳大利亚3年期国债收益率下跌2个基点至0.85%

Commodities

商品

West Texas Intermediate crude was at $70.03 a barrel

西德克萨斯中质原油价格为每桶 70.03 美元

Brent crude steadied at $73.68 a barrel

布伦特原油稳定在每桶 73.68 美元

Gold was at $1,768

黄金价格为 1,768 美元

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- Pump.Fun面临第二起诉讼,指控欺诈活动和违反证券

- 2025-02-01 18:30:55

- Pump.Fun的困境,即允许在Solana上推出模因硬币的平台,请继续堆积。对该平台提起了第二起诉讼

-

-

- NFT销售额下降 +2025年1月24%

- 2025-02-01 18:30:55

- 在最初的市场炒作促进了2024年11月的首次市场炒作后,不可杀死的代币市场在一月份暴跌。

-

- 5个最佳新模因硬币,具有100倍的潜力来改变您的投资组合

- 2025-02-01 18:30:55

- 从预售的兴奋到游戏对 - 欧文(P2E)游戏的刺激潜力,这些硬币充满了能量和诺言。