|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

U.S. stock futures surge as Republican Donald Trump is projected to win the U.S. presidential election

Nov 06, 2024 at 08:08 pm

Major U.S. stock indexes are poised to open sharply higher Wednesday as Republican Donald Trump has been projected to win the U.S. presidential election.

Major U.S. stock indexes are set to open sharply higher Wednesday as Republican Donald Trump has been projected to win the U.S. presidential election.

Futures tied to the Dow Jones Industrial Average are up 3.1%, while those linked to the S&P 500 and Nasdaq are up 2.2% and 1.7%, respectively, about 45 minutes before the opening bell. The indexes, which gained on Tuesday ahead of the results, are on track to hit record highs today after the surprisingly decisive victory for the former President over his Democratic opponent, Vice President Kamala Harris.

Tesla (TSLA) is among the big gainers in premarket trading Wednesday, with shares rising 12%. Tesla CEO Elon Musk has been a vocal supporter of Trump and campaigned alongside the former President in recent weeks. Shares of Trump Media (DJT), the parent of the Truth Social platform, are up nearly 30% this morning.

Shares of companies tied to cryptocurrency are also surging after bitcoin rose to record highs above $75,000 amid optimism that the asset class will get a boost from a Trump presidency. MicroStrategy (MSTR), one of the world's biggest holders of bitcoin, cyrpto exchange Coinbase (COIN) and bitcoin miner Marathon Digital (MARA) are all up more than 8%.

Banking stocks are also up across the board amid expectations that a Trump presidency could lead to regulatory changes and more deal-making. Bank of America (BAC), JPMorgan Chase (JPM), Wells Fargo (WFC), Citigroup (C), Goldman Sachs (GS) and Morgan Stanley (MS) are all up more than 7%.

AI investor favorite Nvidia (NVDA) and Alphabet (GOOGL) are up 1% and 2%, respectively, while Facebook parent Meta Platforms (META) slid nearly 1%.

Among other noteworthy movers Wednesday morning, shares of CVS Health (CVS) are up 12% after the pharmacy and insurance company released its earnings report. Super Micro Computer (SMCI) shares fell nearly 20% after the struggling server maker provided preliminary results that missed expectations and said it’s unable to predict when it will file its delayed annual report.

Treasury yields, which have been rising in recent weeks as investors have scaled back their expectations for how aggressive the Federal Reserve will be in cutting interest rates, are at 4.40%, up from 4.29% on Tuesday but down from a high of 4.48% this morning. The Fed, which cut rates in September for the first time in four years, is expected to trim its benchmark lending rate by a quarter percentage point at the end of its policy meeting Thursday.

Gold futures are down 3% to around $2,670 an ounce, while crude oil futures also fell about 3%.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

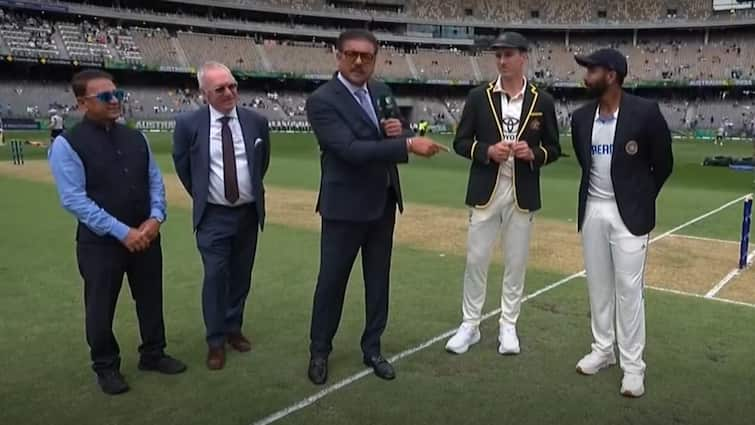

- Border-Gavaskar Trophy 2024-25: India are batting first in the first Test match of the Border-Gavaskar Trophy 2024-25 series at Optus Stadium in Perth after Jasprit Bumrah won the coin toss, and there are some fesh faces to be seen in action today.

- Nov 22, 2024 at 02:30 pm

- The reigning BGT champions have handed debuts to all-rounder Nitish Kumar Reddy and pacer Harshit Rana, and Devdutt Paddikal comes in place of injured Shubman Gill.

-

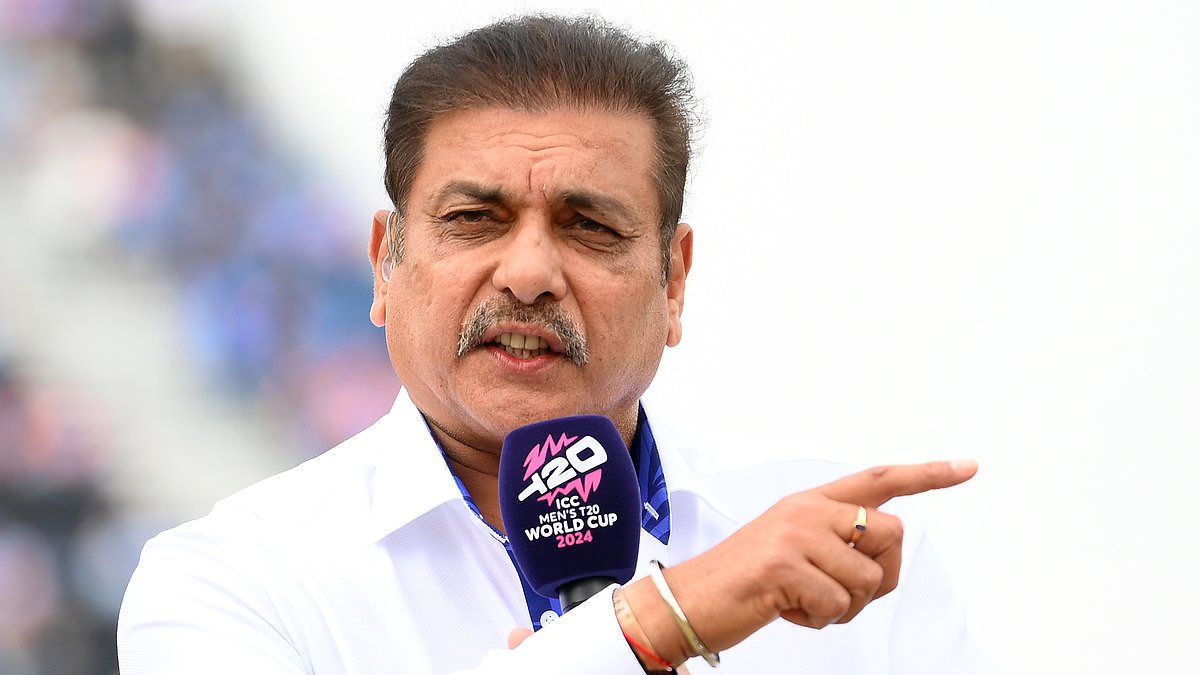

- Ravi Shastri steals the show with over-the-top theatrics at the toss that has cricket fans in splits

- Nov 22, 2024 at 02:30 pm

- The highly anticipated Test series between India and Australia got off to an incredible start before a ball had even been bowled on Friday courtesy of a head-turning performance by the legendary Ravi Shastri.

-

-

-

- Rollblock (RBLK) Presale Skyrockets 260% Amidst Growing Anticipation in the Crypto Market

- Nov 22, 2024 at 02:25 pm

- Rollblock's unique revenue-sharing mechanism offers consistent passive income for investors, a feature Ethereum and Avalanche lack. Rollblock's deflationary tokenomics creates scarcity, boosting value over time. With seamless integration of over 20 cryptocurrencies and 7,000 games, Rollblock delivers unmatched utility. Rollblock's rapid growth positions it as a standout in the crypto market and GambleFi sector.

-

-

-

-