|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Faces Turbulence as Trump's Tariff Plans Drive Bond Yields Higher

Jan 13, 2025 at 12:24 pm

Bitcoin's recent rise of over 45% following the November 5 presidential election has shown signs of slowing down. Analysts now anticipate a period of increased turbulence as a result of President-elect Trump's proposed tariff plans and robust employment figures. These developments are expected to drive bond yields higher, leading to a stronger dollar and putting pressure on digital assets.

“The main problem for bitcoin at the moment is the strong dollar,” Zach Pandl, head of research at Grayscale Investments, told CNBC, noting that the Fed’s recent signal helped in part strengthen the dollar.

According to CoinGecko, Bitcoin began the week on a strong note, reaching $102,000 on Monday. However, this rally was short-lived, with the flagship crypto asset dropping below $97,000 the following day and continuing its slide toward the end of the week.

“I would attribute the drawdown in the last two days largely to the market starting to appreciate that not every aspect of the Trump policy agenda is going to be positive for bitcoin,” Pandl said, regarding the recent decline, adding that Trump's proposed tariff plans are introducing uncertainty into the market.

According to CNN, Trump is considering declaring a national economic emergency to facilitate his plans for implementing universal tariffs. This, along with other economic policies, could lead to varying degrees of inflationary pressures. However, no final decision has yet been made regarding this declaration.

While there was initially optimism for a pro-crypto environment under Trump's administration, the varying signals about the extent of tariffs could lead to volatility and negatively impact risk assets like Bitcoin.

Continuing high interest rates

Stronger-than-expected payroll numbers for December 2024 indicate that the Fed may be less inclined to lower interest rates to stimulate the economy. Following the report, investors have scaled back their expectations for near-term interest rate cuts.

According to the latest data from the CME FedWatch Tool, market participants now overwhelmingly believe that the Fed will keep interest rates unchanged at its upcoming meeting on January 28-29, with a 97% probability.

Last month, the Fed cut rates by 25 basis points but also struck a hawkish tone, signaling a cautious approach moving forward. Due to ongoing inflationary pressures and economic conditions, the central bank now only anticipates two rate cuts this year, down from previous projections of more reductions.

“With the Fed on hold and uncertainties surrounding Trump's economic agenda, it's possible that risk assets will face choppiness over the near term, despite long-term structural tailwinds for bitcoin and digital assets remaining intact,” Alex Thorn, head of research at Galaxy Digital, stated.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

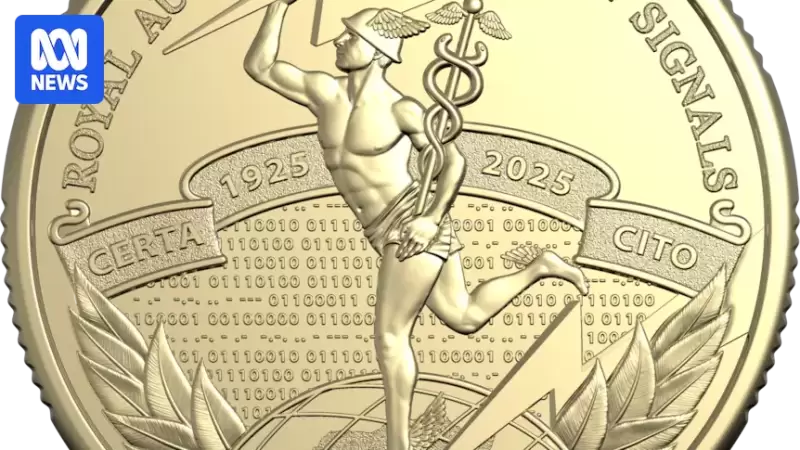

- New coin released by the Royal Australian Mint celebrates the Centenary of the Royal Australian Corps of Signals — but not all is as it seems.

- Apr 03, 2025 at 12:25 pm

- Beneath its golden facade, the $1 commemorative coin features a hidden message in code, just waiting to be cracked. By Tenzing Johnson.

-

-

-

-

- Coincodex's machine learning algorithm predicts Dogecoin (DOGE) price surge to $0.57

- Apr 03, 2025 at 12:15 pm

- The machine learning algorithm predicted that the Dogecoin price could surge $0.57 by April 28, later this month, representing a 229.55% gain for the foremost meme coin. This bullish prediction comes despite DOGE's decline, thanks to the broader crypto market crash, led by Bitcoin, which is attempting to test new lows.

-