|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

毫无疑问,电动汽车在全球汽车销量中所占的比例将继续增长,但这并不意味着每家电动汽车公司都值得购买。

Electric vehicles are continuing to grow in popularity, but that doesn't mean every EV company is worth buying. In fact, some of these companies are facing some serious challenges.

电动汽车持续流行,但这并不意味着每家电动汽车公司都值得购买。事实上,其中一些公司正面临着一些严峻的挑战。

One company that has seen its stock price plummet is Lucid (NASDAQ: LCID). The stock is now trading at just $2.01 per share, down from its 52-week high of $42.34.

Lucid(纳斯达克股票代码:LCID)是股价暴跌的公司之一。该股目前的交易价格仅为每股 2.01 美元,低于 42.34 美元的 52 周高点。

So, what's the big deal? Is Lucid's stock really a buy at this price? Let's take a closer look.

那么,有什么大不了的呢? Lucid 的股票真的值得以这个价格买入吗?让我们仔细看看。

The biggest challenge for Lucid is competition. The EV market is becoming increasingly crowded, with new companies entering the fray all the time. This is putting pressure on prices and margins.

Lucid 面临的最大挑战是竞争。电动汽车市场变得越来越拥挤,不断有新公司加入竞争。这给价格和利润带来了压力。

To illustrate this point, let's take a look at Tesla (NASDAQ: TSLA), the company that Lucid would most like to be like.

为了说明这一点,我们来看看 Lucid 最希望成为的公司——特斯拉(纳斯达克股票代码:TSLA)。

As you can see in the chart below, Tesla's gross margins were highest during the pandemic when the supply of vehicles was low. However, in 2023, the company had to cut prices to maintain sales and, as a result, margins were crushed.

如下图所示,特斯拉的毛利率在疫情期间车辆供应量较低时最高。然而,到了 2023 年,该公司不得不降价以维持销售,结果利润率受到挤压。

TSLA Gross Profit Margin data by YCharts

YCharts 提供的 TSLA 毛利率数据

This is the challenge for automakers. A hard good like an automobile has high marginal costs, inventory costs are high, and supply and demand are very real dynamics. As the supply of EVs goes up, demand hasn't kept pace, pushing prices and margins lower.

这是汽车制造商面临的挑战。像汽车这样的硬商品的边际成本很高,库存成本也很高,而且供给和需求是非常真实的动态。随着电动汽车供应量的增加,需求却未能跟上,导致价格和利润率下降。

Now, Tesla's challenges are still relatively minor compared to Lucid's. For example, Tesla has positive gross margins and free cash flow. However, Lucid's challenges are much bigger.

现在,与 Lucid 相比,特斯拉面临的挑战仍然相对较小。例如,特斯拉拥有正的毛利率和自由现金流。然而,Lucid 面临的挑战要大得多。

In fact, as you can see below, Lucid's gross margins are negative 106% and show no signs of an inflection.

事实上,正如您在下面看到的,Lucid 的毛利率为负 106%,并且没有任何变化的迹象。

LCID Revenue (TTM) data by YCharts

YCharts 提供的 LCID 收入 (TTM) 数据

This is a huge problem and one that doesn't seem to be getting any better.

这是一个大问题,而且似乎没有任何改善。

Another problem for Lucid is that its vehicles are expensive. The starting price for a Lucid vehicle is $69,900, which puts it out of reach of the average buyer. This makes it difficult to scale because there's not enough demand beyond the 9,000 vehicles expected to be produced this year. It's hard to sell a vehicle for $70,000 when there are options for half that.

Lucid 的另一个问题是其车辆价格昂贵。 Lucid 车辆的起价为 69,900 美元,这超出了普通买家的承受范围。这使得规模化变得困难,因为除了今年预计生产的 9,000 辆汽车之外,没有足够的需求。当有一半的选择时,很难以 70,000 美元的价格出售一辆车。

Finally, another big challenge for Lucid is costs, which haven't come down nearly fast enough given the company's scale. Playing in the luxury market is inherently a low-volume market, and if a company can't make money at small volumes at these price points, it's a difficult road ahead.

最后,Lucid 面临的另一个重大挑战是成本,考虑到该公司的规模,成本下降的速度还不够快。奢侈品市场本质上是一个小批量市场,如果一家公司无法在这些价位上小批量赚钱,那么前进的道路就会很困难。

Overall, I think the challenges for Lucid are too great to ignore. The company isn't profitable, it has a lot of debt, and the competitive environment is getting tougher.

总的来说,我认为 Lucid 面临的挑战太大,不容忽视。该公司没有盈利,负债累累,竞争环境变得更加严峻。

I don't see a recovery ahead for Lucid and I think the risks are too high to bet on. I would avoid the stock at this price.

我认为 Lucid 不会复苏,而且我认为风险太高,无法押注。我会避开这个价格的股票。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 柴犬对全球经济和文化的巨大影响

- 2024-11-24 02:30:02

- 在不断发展的加密货币世界中,柴犬(SHIB)不仅因其市场创新而且因其对全球生活的影响而掀起波澜。

-

-

-

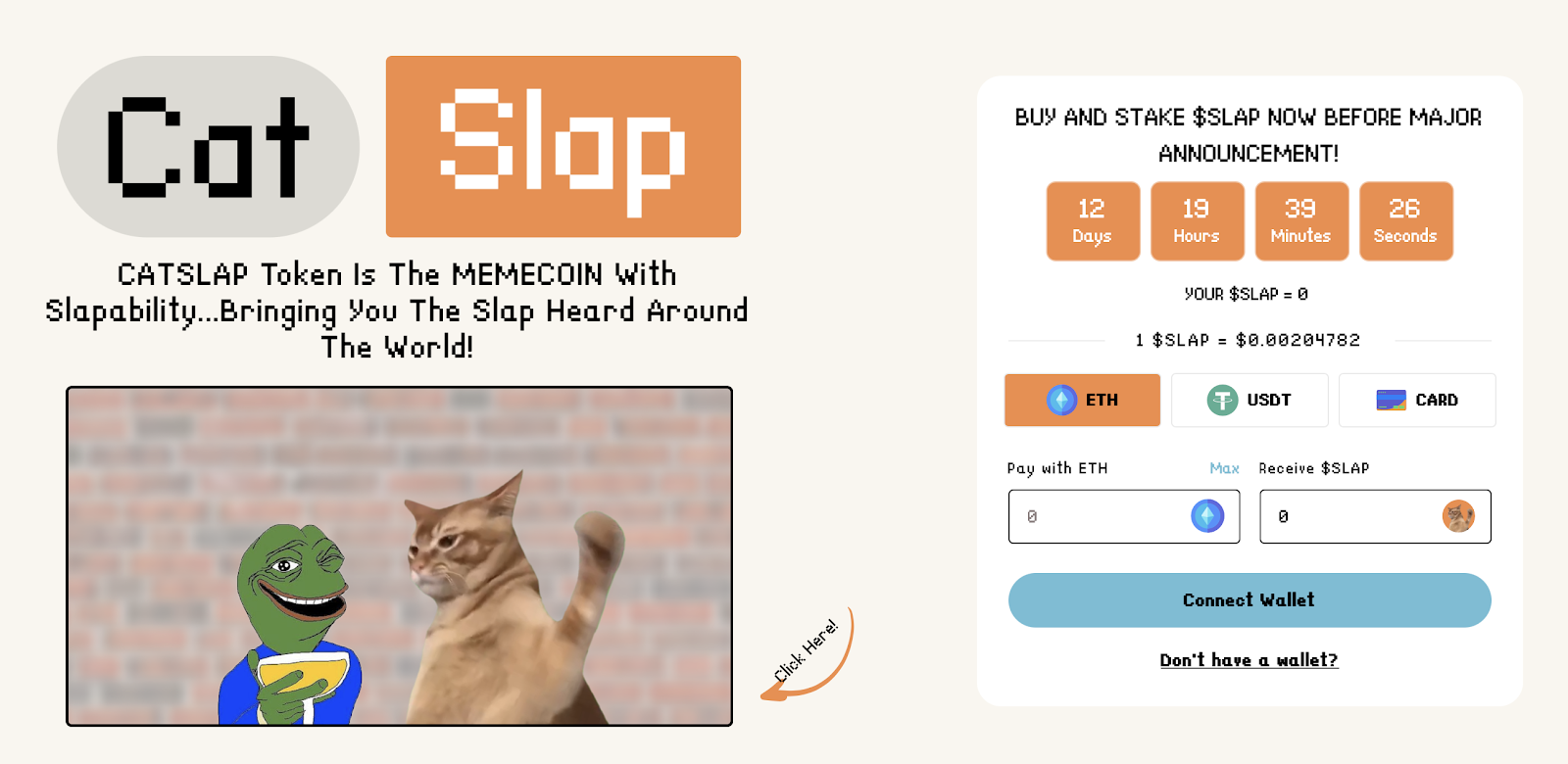

- CatSlap ($SLAP) 是一款震撼加密货币的病毒模因币!

- 2024-11-24 02:30:02

- 了解如何加入行动、获取代币并驾驭下一个大趋势。

-

- BTFD 币:2025 年最热门的 Meme 币

- 2024-11-24 02:30:02

- 过去几年,Meme 币已成为加密货币世界的一种文化现象。最初的一个玩笑已经演变成一项严肃的投资

-

-

-

- 山寨币本周与比特币一样成为焦点,为加密货币市场带来新的兴奋

- 2024-11-24 02:30:02

- 山寨币本周与比特币一样受到关注,为加密货币市场带来了新的兴奋。虽然比特币正在迈向 10 万美元的里程碑