|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

所有投资者请注意:在这个前所未有的牛市中,如果您没有最大化您的加密货币利润,您将犯下严重错误。尽管认识到比特币的潜力,但许多人在出售比特币时却没有意识到即将到来的通胀危机及其带来的机遇。随着法定货币日益受到主要经济集团的贬低,精明的投资者正在将他们的财富转移到加密货币上,以保持他们的购买力。请记住,最好的加密货币策略是那些在市场反弹期间继续表现的策略,因此请抵制获利了结的冲动,而增加您在这些资产中的头寸。随着主权债务泡沫破裂,牛市只会加剧,吸引机构投资者并推高价格。

(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions nor be construed as a recommendation or advice to engage in investment transactions.)

(以下观点均为作者个人观点,不应构成投资决策的依据,也不应被视为进行投资交易的推荐或建议。)

WE INTERRUPT REGULAR BULL MARKET PROGRAMMING FOR THIS IMPORTANT MESSAGE:

我们中断常规的牛市规划,以传达以下重要信息:

You’re fucking up!

你他妈的!

How, you ask?

你问如何?

Some of you think you are masters of the universe right now because you bought Solana sub $10 and sold it at $200. Others did the smart thing and sold fiat for crypto during the 2021 to 2023 bear market but lightened up as prices surged in the first quarter of this year. If you sold shitcoins for Bitcoin, you get a pass. Bitcoin is the hardest money ever created. If you sold shitcoins for fiat that you don’t immediately need for living expenses, you are fucking up. Fiat will continue to be printed ad infinitum until the system resets.

你们中的一些人认为自己现在是宇宙的主人,因为您以低于 10 美元的价格购买了 Solana,并以 200 美元的价格出售了它。其他人则做了聪明的事,在 2021 年至 2023 年的熊市期间出售法币换取加密货币,但随着今年第一季度价格飙升而减仓。如果你用垃圾币换取比特币,你就会获得通行证。比特币是有史以来最难创造的货币。如果你把垃圾币卖给了你不需要立即支付生活费用的法定货币,那你就完蛋了。菲亚特将继续无限打印,直到系统重置。

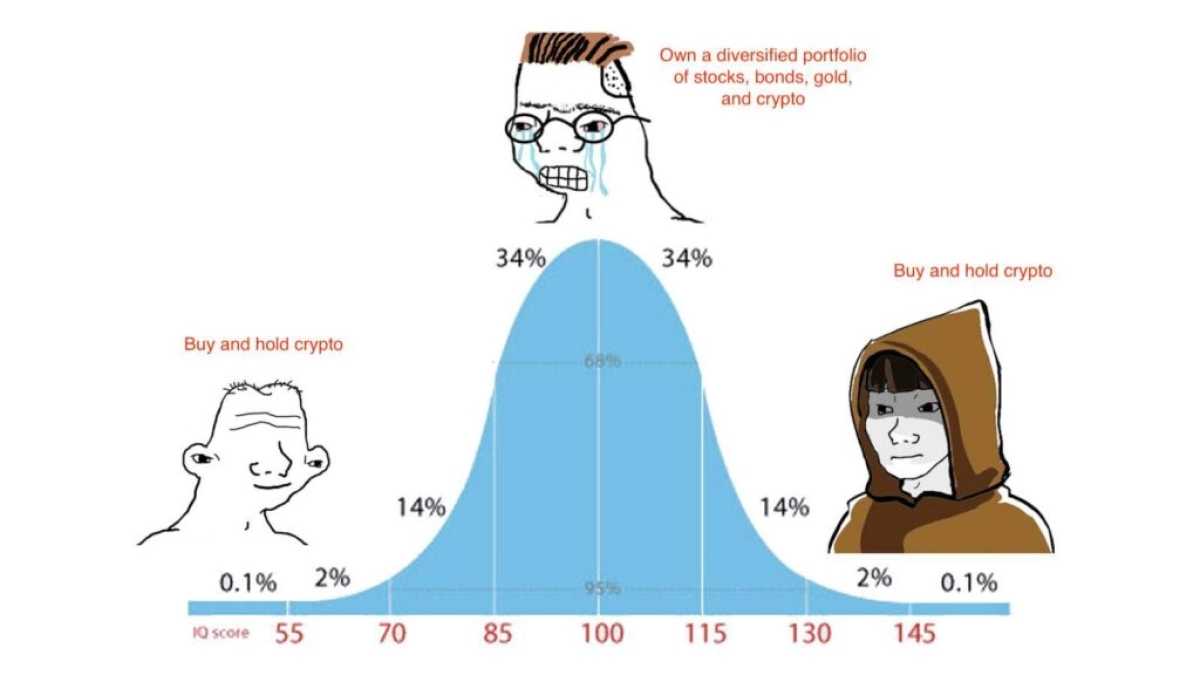

Bull markets don’t come often; it is a travesty when you make the right call but do not maximise your profit potential. Too many of us try to exist in the centre of the bell curve and reason with the bull market. The true crypto legends and degens Left Curve it. They just buy, hodl, and buy some more as long as the bull market is pumping.

牛市并不经常出现;当你做出了正确的决定却没有最大化你的利润潜力时,这就是一种讽刺。我们中有太多人试图存在于钟形曲线的中心并与牛市推理。真正的加密传奇和堕落者左曲线它。只要牛市还在继续,他们就会买入、持有、再买入。

I sometimes catch myself thinking like a beta cuck loser. And when I do, I must remind myself of the overarching macro theme that the entire retail and institutional investing world is starting to believe. That is, all the major economic blocs (US, China, European Union “EU” and Japan) are debasing their currencies to deleverage their government’s balance sheet. Now that TradFi has a direct way to profit off of this narrative via US and soon-to-be UK and Hong Kong spot Bitcoin ETFs, they are pushing their clients to preserve the energy purchasing power of their wealth using these crypto-derivative products.

有时我发现自己像个失败者一样思考。当我这样做时,我必须提醒自己整个零售和机构投资界开始相信的总体宏观主题。也就是说,所有主要经济集团(美国、中国、欧盟和日本)都在贬值本国货币,以降低政府资产负债表的杠杆率。现在,TradFi 可以通过美国以及即将推出的英国和香港现货比特币 ETF 直接从这种叙述中获利,他们正在敦促客户使用这些加密衍生产品来保持其财富的能源购买力。

I want to quickly step through the fundamental reason why crypto is rallying aggressively against fiat. Of course, there will come a time when this narrative loses its potency, but that time is not now. At this moment, I will resist the urge to take chips off the table. I will encourage myself to add more to the winners. I will exist purely in the Left Curve.

我想快速解释一下加密货币对法定货币积极反弹的根本原因。当然,这种叙述总有一天会失去效力,但那个时候还不是现在。此时此刻,我会抑制住把筹码从桌上拿走的冲动。我会鼓励自己为获奖者添加更多。我将纯粹存在于左曲线中。

As we exit the window of weakness that I forecasted would occur due to April 15th US tax payments and the Bitcoin halving, I want to remind readers why the bull market will continue and prices will get sillier on the upside. Rarely in markets do the things that got you here (Bitcoin from zero in 2009 to $70,000 in 2024), get you there (Bitcoin to $1,000,000). However, the macro setup that created the fiat liquidity surge that powered Bitcoin’s ascent will only get more pronounced as the sovereign debt bubble begins to burst.

当我们退出我预测由于 4 月 15 日美国纳税和比特币减半而出现的疲软窗口时,我想提醒读者为什么牛市将继续,价格将变得更加愚蠢。在市场上很少有什么事情能让你到达这里(比特币从 2009 年的零到 2024 年的 70,000 美元),让你到达那里(比特币到 1,000,000 美元)。然而,随着主权债务泡沫开始破裂,导致法定流动性激增、推动比特币上涨的宏观环境只会变得更加明显。

Nominal Gross Domestic Product (GDP)

名义国内生产总值(GDP)

What is the purpose of a government? The government provides common goods like roads, education, healthcare, social order, etc. Obviously, that’s an aspirational wish list for many governments who instead provide death and despair… but I digress. In return for these services, we, the citizenry, pay taxes. A government with a balanced budget provides as many services as possible for a given amount of tax receipts.

政府的目的是什么?政府提供道路、教育、医疗保健、社会秩序等公共物品。显然,这是许多政府的愿望清单,但它们却提供死亡和绝望……但我离题了。作为这些服务的回报,我们公民纳税。预算平衡的政府在一定数额的税收收入下提供尽可能多的服务。

However, sometimes, there are situations where the government borrows money to do something it believes will have a long-term positive value without raising taxes.

然而,有时,政府会借钱来做一些它认为会产生长期正价值而不加税的事情。

For example:

例如:

A hydroelectric dam that is expensive to construct. Instead of raising taxes, the government issues bonds to pay for the dam. The hope is that the economic return of the dam meets or exceeds the bond’s yield. The government entices citizens to invest in the future by paying a yield close to the economic growth the dam will create. If, in 10 years, the dam will grow the economy by 10%, then government bond yields should be at least 10% to entice investors. If the government pays less than 10%, it profits at the expense of the public. If the government pays more than 10%, the public profits at the government’s expense.

建造费用昂贵的水力发电大坝。政府没有提高税收,而是发行债券来支付大坝费用。希望大坝的经济回报达到或超过债券的收益率。政府通过支付接近大坝将创造的经济增长的收益率来吸引公民对未来进行投资。如果10年后,大坝将使经济增长10%,那么政府债券的收益率应该至少达到10%才能吸引投资者。如果政府支付的费用低于 10%,那么它的利润就会以公众的利益为代价。如果政府支付超过10%,公众的利润就会由政府承担。

Let’s zoom out a bit and talk about the economy at a macro level. The economic growth rate for a particular nation-state is its nominal GDP, which consists of inflation and real growth. If the government wants to run budget deficits to supercharge nominal GDP growth, it is natural and logical that investors should receive a yield equal to the nominal GDP growth rate.

让我们把目光放远一些,从宏观层面来谈谈经济。特定民族国家的经济增长率是其名义GDP,由通货膨胀和实际增长组成。如果政府希望通过预算赤字来推动名义GDP增长,那么投资者获得与名义GDP增长率相等的收益是很自然且合乎逻辑的。

While it is natural for investors to expect to receive a yield equal to nominal GDP growth, politicians would rather pay less than that. If politicians can create a situation where government debt yields less than the nominal GDP growth rate, politicians can spend money faster than Sam Bankman-Fried at an Effective Altruism charity event. The best part is that taxes do not need to be raised to pay for this spending.

虽然投资者期望获得相当于名义 GDP 增长的收益是很自然的,但政客们宁愿支付低于这个数字的收益。如果政客们能够创造一种政府债务收益率低于名义 GDP 增长率的局面,那么政客们就能比山姆·班克曼-弗里德 (Sam Bankman-Fried) 在有效利他主义慈善活动中花钱更快。最好的部分是不需要提高税收来支付这笔支出。

How does a politician create such a utopia? They financially repress savers with the help of the TradFi banking system. The easiest way to ensure government bond yields are less than nominal GDP growth is to instruct the central bank to print money, buy government bonds, and artificially reduce government bond yields. Then, the banks are instructed that government bonds are the only “suitable” investments for the public. In that way, the public’s savings are surreptitiously funnelled into low-yielding government debt.

政治家如何创造这样一个乌托邦?他们借助 TradFi 银行系统在经济上压制储户。确保国债收益率低于名义GDP增长的最简单方法就是指示央行印钞、购买国债,人为降低国债收益率。然后,银行被告知政府债券是公众唯一“合适”的投资。这样,公众的储蓄就被秘密地投入到低收益的政府债务中。

The problem with artificially lowering government bond yields is that it promotes malinvestment. The first projects are usually worthy. However, as politicians strive to create growth in order to get re-elected, the quality of projects declines. At this point, the government debt rises faster than the nominal GDP. Politicians now have a tough decision to make. The malinvestment losses must be recognised today via an acute financial crisis or tomorrow via low to no growth. Typically, politicians choose a long, drawn-out period of economic stagnation because the future occurs after they are out of office.

人为降低政府债券收益率的问题在于它会促进不当投资。第一个项目通常是值得的。然而,随着政客们为了连任而努力创造增长,项目的质量却下降了。此时,政府债务的增长速度快于名义GDP的增长速度。政客们现在需要做出艰难的决定。今天必须通过严重的金融危机或明天通过低增长甚至零增长来认识到不当投资损失。通常,政治家会选择长期的经济停滞期,因为未来发生在他们卸任后。

A good example of malinvestment would be green energy projects that are only possible because of government subsidies. After many years of generous subsidies, some projects cannot earn their return on invested capital and/or the real cost to consumers is prohibitive. Predictably, once government support is removed, demand wanes and projects falter. Read this story about changes to California electricity grid prices as an example of what happens when government support is provided then removed.

不当投资的一个很好的例子是绿色能源项目,这些项目只有通过政府补贴才能实现。经过多年的慷慨补贴,一些项目无法获得投资资本回报和/或消费者的实际成本过高。可以预见的是,一旦政府支持被取消,需求就会减弱,项目也会陷入停滞。阅读这篇关于加州电网价格变化的故事,作为一个例子,说明当政府提供支持然后取消支持时会发生什么。

During the bad times, bond yields become even more distorted as the central bank presses the Brrrr button harder than Lord Ashdrake pounds the sell button. Government bond yields are kept below the nominal GDP growth rate so that the government’s debt load is inflated away.

在经济不景气的时期,当央行按“Brrrr”按钮的力度比阿什德拉克勋爵按“卖出”按钮的力度更大时,债券收益率就会变得更加扭曲。政府债券收益率保持在名义GDP增长率以下,从而使政府的债务负担被通货膨胀所抵消。

Identification

鉴别

The crucial task for investors is to understand when government bonds are a good investment or not. The simplest way to do that is to look at the nominal YoY GDP growth rate compared to a 10-year government bond’s yield. The 10-year bond yield is supposed to be a market signal that informs us about the future expectation for nominal growth.

投资者的关键任务是了解政府债券何时是一项好的投资。最简单的方法是比较名义 GDP 同比增长率与 10 年期政府债券的收益率。 10年期债券收益率应该是一个市场信号,让我们了解未来名义增长的预期。

Real Yield = 10-year Government Bond Yield – Nominal GDP Growth Rate

实际收益率=10年期政府债券收益率-名义GDP增长率

When the real yield is positive, government bonds are a good investment. The government is usually the most creditworthy borrower because it has a monopoly on violence. When citizens refuse to pay their taxes, a bullet in the head or a prison stint is on the table.

当实际收益率为正时,政府债券是一项不错的投资。政府通常是最有信誉的借款人,因为它垄断了暴力行为。当公民拒绝缴税时,头部中弹或入狱就可能发生。

When the real yield is negative, government bonds are terrible investments. The trick is for the investor to find assets outside of the banking system that can grow faster than inflation.

当实际收益率为负时,政府债券是糟糕的投资。投资者的诀窍在于寻找银行体系之外增长速度快于通货膨胀的资产。

All four major economic blocks enact policies to financially repress savers and engineer negative real yields. China, the EU, and Japan ultimately take their monetary policy cues from the US. Therefore, I will focus on the US’s past and future monetary and fiscal situation. As the US engineers loosen financial conditions, the rest of the world will follow suit.

所有四个主要经济体都制定了政策,在经济上压制储户并导致实际收益率为负。中国、欧盟和日本最终都从美国获得了货币政策线索。因此,我将重点关注美国过去和未来的货币和财政状况。随着美国工程师放松金融条件,世界其他地区也将效仿。

‘Murica

'杀了我

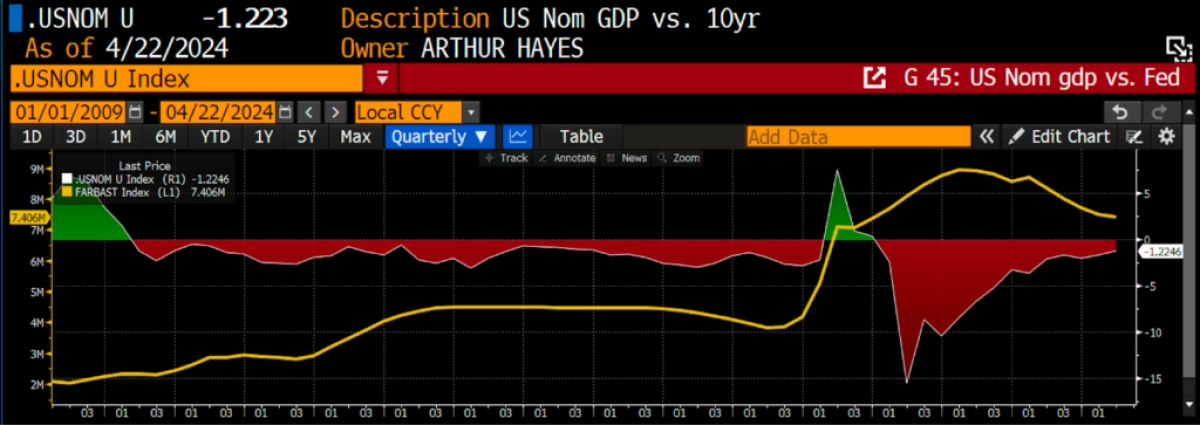

This chart shows the real yield (.USNOM Index) in white vs. the Federal Reserve’s (Fed) balance sheet in yellow. I started in 2009 because that is when Satoshi, our Lord and Savior, launched Bitcoin’s genesis block.

该图表以白色显示实际收益率(.USNOM 指数),以黄色显示美联储 (Fed) 资产负债表。我从 2009 年开始,因为那一年我们的主和救世主中本聪推出了比特币的创世区块。

As you can see, after the 2008 Global Financial Crisis deflationary shock, the real yield swung from positive to negative. It went positive again, briefly, due to the deflationary shock of COVID. The boomers decided to lock everyone up so they didn’t die of the flu, and the economy cratered as a result.

正如你所看到的,在2008年全球金融危机的通货紧缩冲击之后,实际收益率从正转为负。由于新冠疫情的通货紧缩冲击,该指数再次短暂转为正值。婴儿潮一代决定把所有人都关起来,以免他们死于流感,结果经济陷入困境。

A deflationary shock is when real yields spike because economic activity declines sharply.

通货紧缩冲击是指实际收益率因经济活动急剧下降而飙升。

Apart from 2009 and 2020, government bonds have been terrible investments vs. stocks, real estate, crypto, etc. Bond investors only did well by juicing their trades with insane amounts of leverage. That is the essence of risk parity for readers who are hedge fund muppets.

除了 2009 年和 2020 年之外,与股票、房地产、加密货币等相比,政府债券一直是糟糕的投资。债券投资者只有通过使用疯狂的杠杆来进行交易才能获得良好的表现。对于对冲基金傀儡读者来说,这就是风险平价的本质。

This unnatural state of the world could only happen because the Fed grew its balance sheet by purchasing government bonds with printed money, a process called quantitative easing (QE).

这种不自然的世界状态只能发生,因为美联储通过用印钞购买政府债券来扩大资产负债表,这一过程称为量化宽松(QE)。

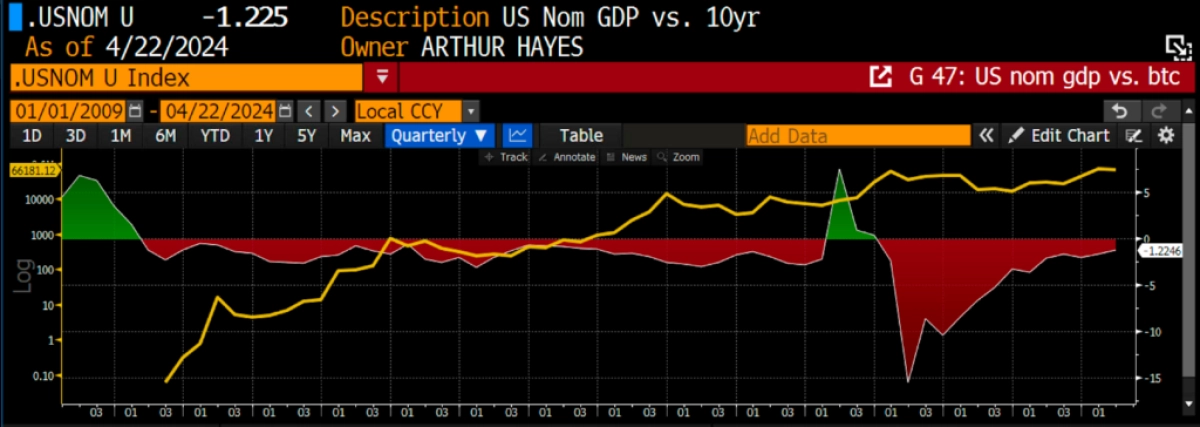

The escape valve for this period of negative real yields was and is Bitcoin (yellow). Bitcoin is rising in a non-linear fashion on a log chart. Bitcoin’s rise is purely a function of an asset with a finite quantity being priced in depreciating fiat dollars.

这一时期实际收益率为负的逃生阀过去和现在都是比特币(黄色)。比特币在对数图表上以非线性方式上涨。比特币的上涨纯粹是一种以法定美元贬值定价的有限数量资产的函数。

That explains the past, but markets are forward-looking. Why should you Left Curve your crypto investments and feel confident that this bull market is only getting started?

这解释了过去的情况,但市场是具有前瞻性的。为什么你应该左转你的加密货币投资,并对这个牛市才刚刚开始充满信心?

Free Shit

免费的狗屎

Everyone wants to get something for nothing. Obviously, the universe never offers such a bargain, but that doesn’t stop politicians from promising goodies without raising the tax rates to pay for them. Support for any politician, be it at the ballot box in a democracy or implied support in a more autocratic system, stems from the ability of a politician to create economic growth. When the easy and obvious growth-supporting policies have been enacted, politicians reach for the printing press to funnel money to their preferred constituency at the expense of the entire populace.

每个人都想不劳而获。显然,宇宙永远不会提供如此便宜的东西,但这并不能阻止政客们在不提高税率的情况下承诺提供好处。对任何政治家的支持,无论是在民主国家的投票箱还是在更加专制的制度中的隐含支持,都源于政治家创造经济增长的能力。当简单而明显的增长支持政策颁布后,政客们就会动用印钞机,以牺牲全体民众的利益为代价,将资金输送到他们喜欢的选区。

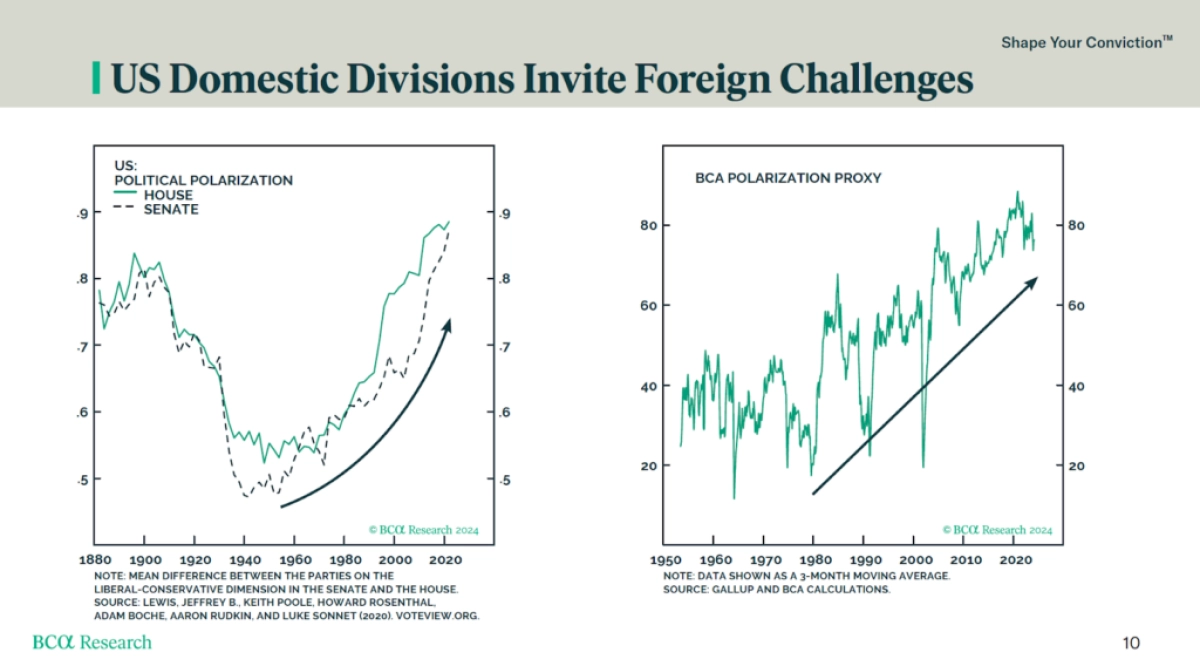

Politicians can offer their supporters free shit as long as the government borrows at a negative real yield. Therefore, the more partisan and polarised the nation-state, the more incentive the ruling party has to enhance their re-election odds by spending money they don’t have.

只要政府以负实际收益率借款,政客们就可以向他们的支持者提供免费的东西。因此,民族国家的党派性和两极分化程度越高,执政党就越有动力通过花他们没有的钱来提高连任几率。

2024 is a critical year for the world as many large nation-states will hold presidential elections. The US election is crucial globally as the ruling Democratic party will do anything in their power to stay in office (as evidenced by the fact that they have done some dubious things to the Republicans since the Orange Man “lost” the previous election). A large percentage of the American population believes that the Democrats kinda sorta cheated Trump out of a victory. Regardless of whether you believe that is the truth, the fact that a large percentage of the population holds that view ensures that the stakes of this election are incredibly high. As I said before, Pax Americana’s fiscal and monetary policy will be aped by China, the EU, and Japan, which is why it is important to follow the election.

2024年对世界来说是关键的一年,许多大国将举行总统选举。美国大选在全球范围内至关重要,因为执政的民主党将竭尽全力保住职位(自从橙人“输掉”上一次选举以来,他们对共和党做了一些可疑的事情就证明了这一点)。很大一部分美国人认为,民主党有点欺骗了特朗普,使其未能获胜。不管你是否相信这是事实,很大一部分人持有这种观点的事实确保了这次选举的赌注非常高。正如我之前所说,美国治下的和平的财政和货币政策将被中国、欧盟和日本效仿,这就是为什么关注大选很重要。

The above is a chart from BCA Research showing US political polarisation over time. As you can see, the electorate hasn’t been this polarised since the late 19th century. This makes it winner-take-all from an election perspective. The Democrats know that if they lose, the Republicans will reverse many of their policies. The next question is, what is the easiest way to ensure re-election?

上图是 BCA Research 的图表,显示了美国随时间的政治极化。正如你所看到的,自 19 世纪末以来,选民还没有出现过如此两极分化的情况。从选举的角度来看,这使得赢家通吃。民主党知道,如果他们输了,共和党将扭转他们的许多政策。下一个问题是,确保连任最简单的方法是什么?

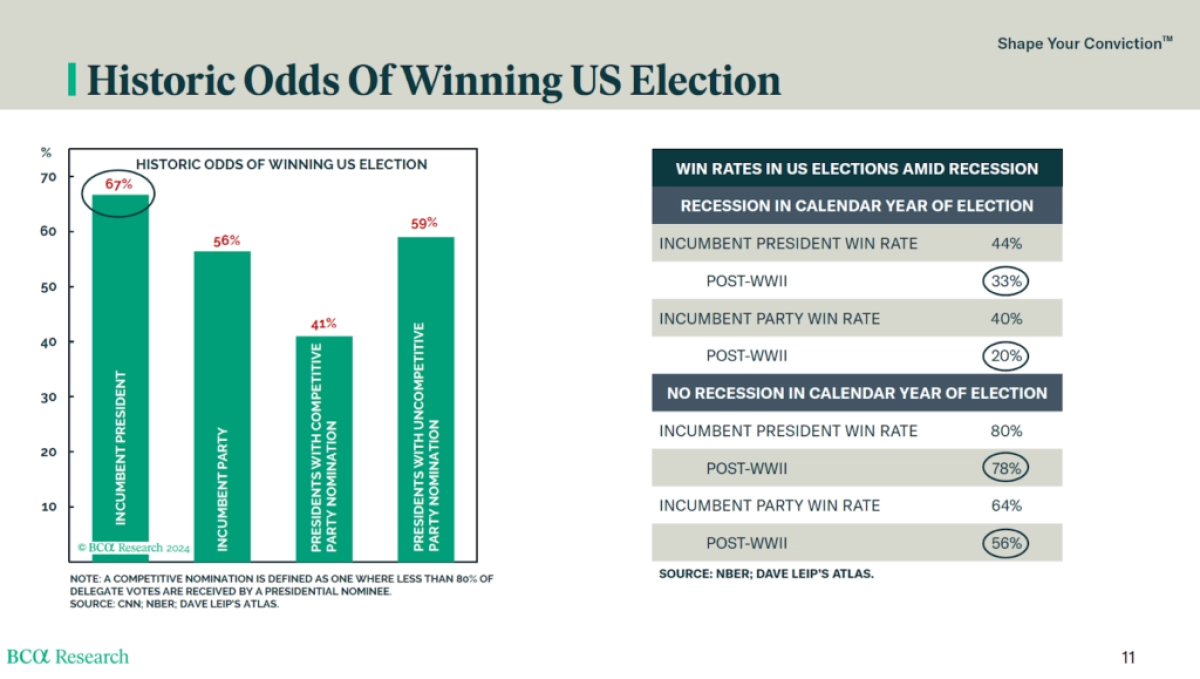

It’s the economy, stupid. The undecided voters who determine the electoral winners do so based on how they feel about the economy. As the above chart depicts, an incumbent President’s re-election odds drop from 67% to 33% if the general population feels the economy is in a recession during an election year. How does a ruling party with control of monetary and fiscal policy ensure that there will be no recession?

这是经济,愚蠢的。尚未决定选举获胜者的选民根据他们对经济的看法来决定。如上图所示,如果选举年期间公众认为经济陷入衰退,现任总统的连任几率将从 67% 降至 33%。一个掌握货币和财政政策的执政党如何确保不出现衰退?

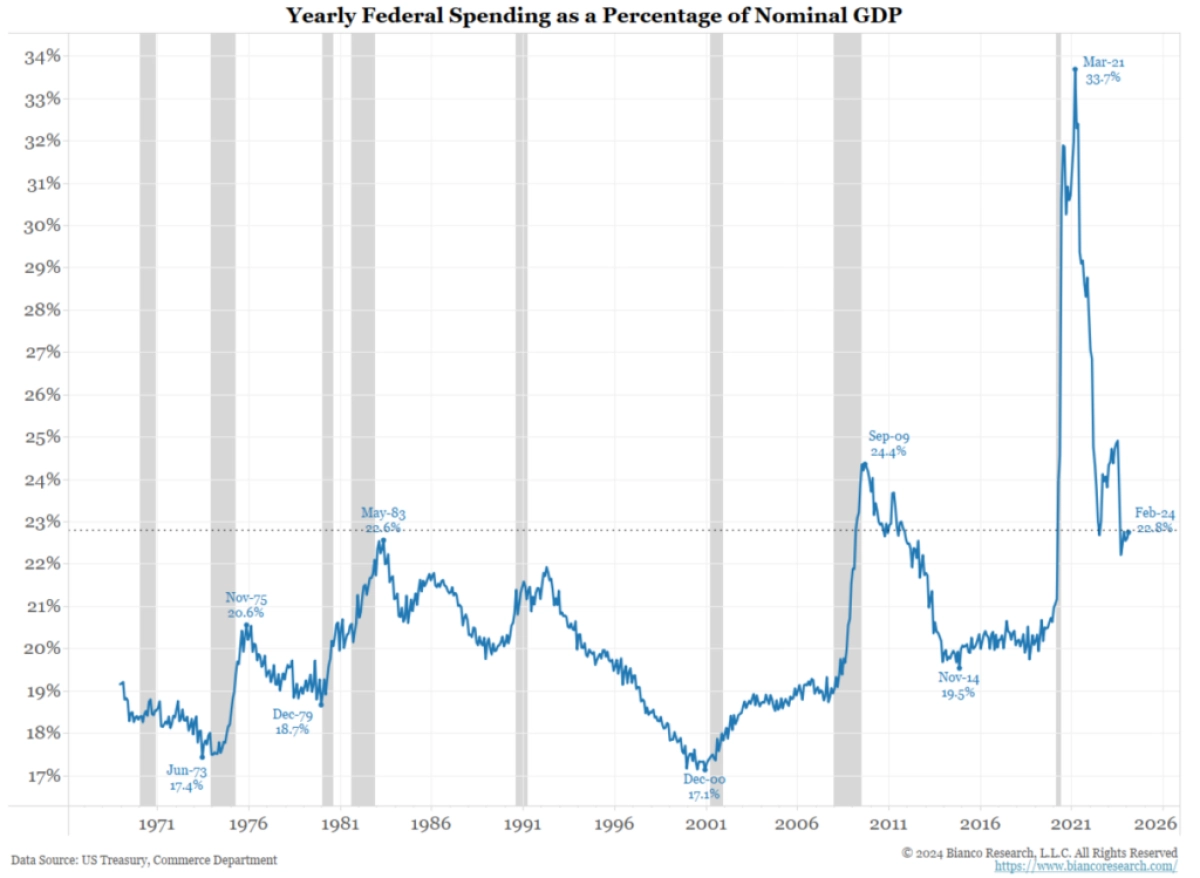

Nominal GDP growth is directly impacted by government spending. As you can see from this Bianco Research chart, the US government’s spending accounts for 23% of nominal GDP. That means the ruling party can print GDP wherever they please, so long as they are willing to borrow enough money to fund the required level of spending. GDP is now a political variable. The US is following in the footsteps of the Chinese Communist Party.

名义GDP增长直接受到政府支出的影响。从这张 Bianco Research 图表中可以看出,美国政府的支出占名义 GDP 的 23%。这意味着执政党可以随心所欲地印制GDP,只要他们愿意借足够的钱来满足所需的支出水平。 GDP现在是一个政治变量。美国正在追随中国共产党的脚步。

In China, the politburo determines the GDP growth rate every year. The banking system then creates enough credit to power the desired level of economic activity. For many Western-trained economists, the “strength” of the US economy is perplexing because many of the leading economic variables they monitor point to an impending recession. But as long as the ruling political party can borrow at negative rates, it will create the economic growth necessary to remain in power.

在中国,政治局每年都会决定GDP增长率。然后,银行系统创造足够的信贷来推动经济活动达到所需的水平。对于许多受过西方训练的经济学家来说,美国经济的“实力”令人困惑,因为他们监测的许多主要经济变量都表明经济衰退即将来临。但只要执政党能够以负利率借款,它就能创造继续执政所需的经济增长。

The above is why the Democrats, led by US President Biden, will do all they can to increase government spending. It is then up to US Treasury Secretary Bad Gurl Yellen and her beta cuck towel boy Fed President Jerome Powell to ensure that US Treasury bond yields are markedly below nominal GDP growth. I don’t know what money-printing euphemism they will create to ensure negative real yields persist, but I am confident that they will do what is necessary to get their boss and his party re-elected.

以上就是美国总统拜登领导的民主党为何会竭尽全力增加政府支出的原因。然后,美国财政部长巴德·古尔·耶伦和她的美联储主席杰罗姆·鲍威尔就需要确保美国国债收益率明显低于名义GDP增长。我不知道他们会创造什么样的印钞委婉说法来确保负实际收益率持续存在,但我相信他们会采取必要措施让他们的老板和他的政党连任。

However, the Orange Man might take the prize. In this scenario, what would happen to government spending?

然而,橙人可能会获奖。在这种情况下,政府支出会发生什么变化?

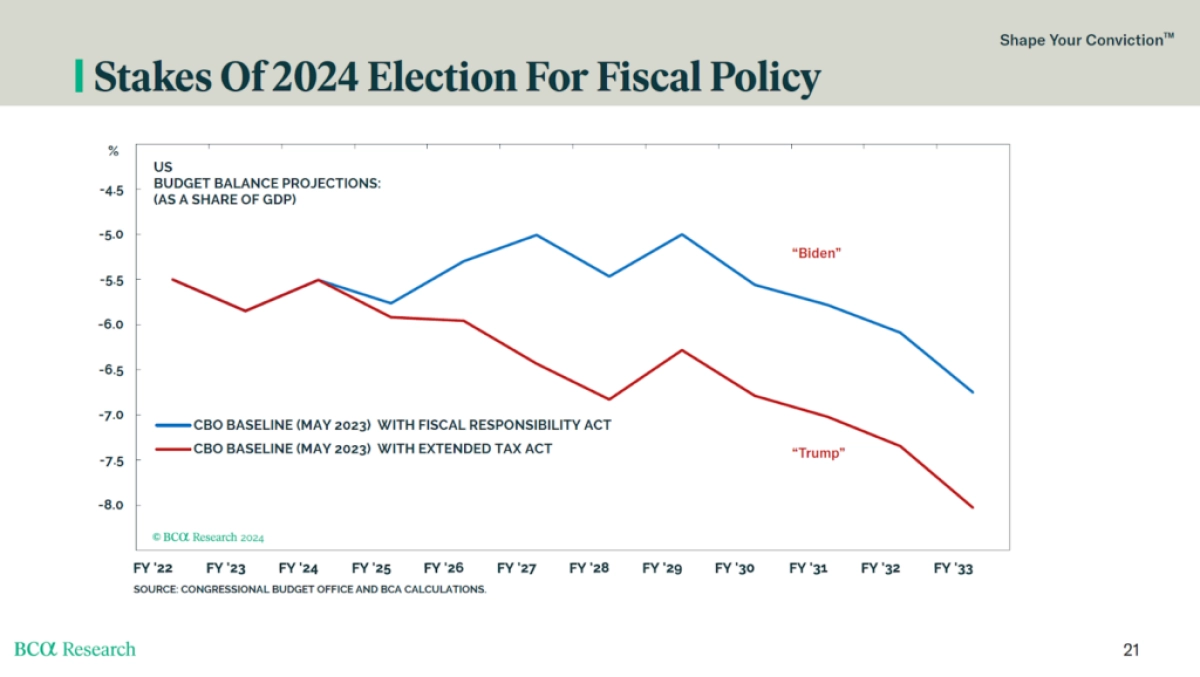

Nothing. The above chart estimates the deficit under a Biden or Trump presidency from 2024 onwards. As you can see, Trump is forecasted to spend even more than Slow Joe. Trump is campaigning on another round of tax cuts, which would further inflate the deficit. Whichever senile geriatric clown is the chosen one, rest assured government spending will not decline.

没有什么。上图估计了 2024 年以来拜登或特朗普担任总统期间的赤字。正如你所看到的,特朗普的支出预计会比慢速乔还要多。特朗普正在竞选另一轮减税,这将进一步扩大赤字。无论选择哪一位老年小丑,请放心,政府支出不会下降。

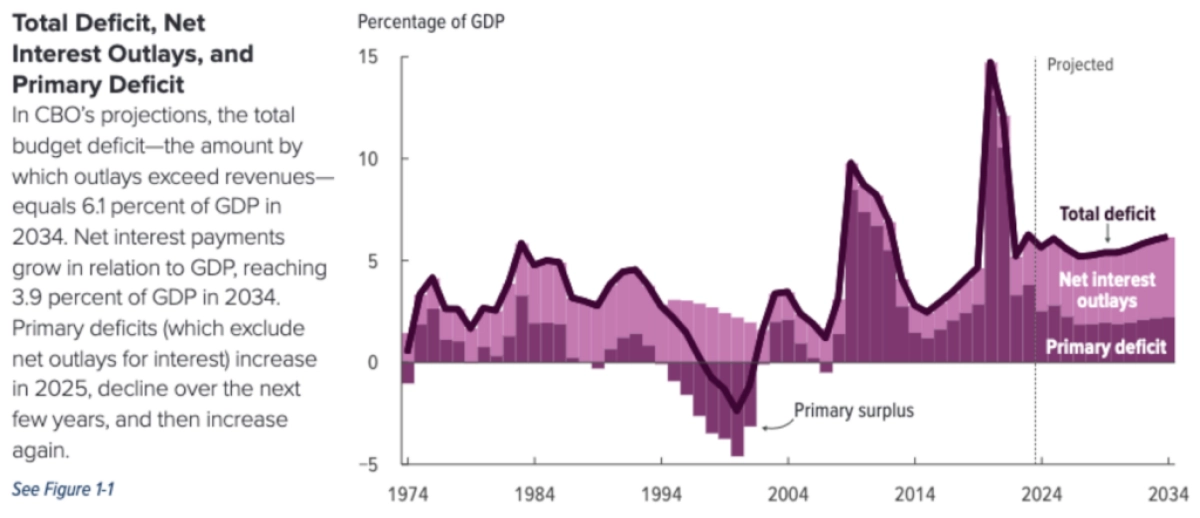

The Congressional Budget Office (CBO) forecasts government deficits based on the current and assumed future political environment. Massive deficits are forecast for as far as the eye can see. At a fundamental level, if politicians can create 6% growth by borrowing at 4%, why would they ever stop spending?

国会预算办公室(CBO)根据当前和假设的未来政治环境预测政府赤字。据预测,预计将出现大规模赤字。从根本上讲,如果政客们可以通过 4% 的借贷创造 6% 的增长,他们为什么要停止支出呢?

As explained above, the political situation in the US gives me extreme confidence that the money printer will go Brrrr. If you thought it was absurd what the US monetary and political elite did to “solve” the 2008 GFC and COVID, you ain’t seen nothing yet.

如上所述,美国的政治局势让我对印钞机的发展充满信心。如果你认为美国货币和政治精英为“解决”2008年全球金融危机和新冠疫情所做的事情是荒谬的,那么你还什么也没看到。

The wars on the Pax Americana periphery continue to chug along primarily in the Ukraine / Russia and Israel / Iran theatres. As expected, the warmongers from both political parties are content to continue funding their proxies with borrowed billions of cash money. The cost will only increase as the conflicts escalate and more countries are drawn into the melee.

美式和平外围的战争继续主要在乌克兰/俄罗斯和以色列/伊朗战场上进行。正如预期的那样,两个政党的战争贩子都满足于继续用借来的数十亿现金资助他们的代理人。随着冲突升级以及更多国家卷入混战,成本只会增加。

Chop Chop Chop

砍砍砍

As we enter the northern hemispheric summer and decision-makers enjoy a respite from reality, crypto volatility will decline. This is the perfect time to take advantage of the recent crypto dip to slowly add to positions. I have my shopping list of shitcoins that got pummelled over the last week. I will talk about them in upcoming essays. There will also be many token launches that won’t pop as much as they would have had the launch occurred in the first quarter. This gives those who are not pre-sale investors a great entry point. Whatever the flavour of crypto risk excites you, the next few months will present a golden opportunity to add to positions.

随着我们进入北半球的夏季,决策者从现实中得到喘息的机会,加密货币的波动性将会下降。这是利用最近的加密货币下跌来缓慢增加头寸的最佳时机。我有上周遭受重创的垃圾币购物清单。我将在接下来的文章中讨论它们。还会有许多代币的发布,但不会像第一季度发布那样流行。这为那些不是预售投资者的人提供了一个很好的切入点。无论加密货币风险的味道如何让您兴奋,接下来的几个月都将提供一个增加头寸的黄金机会。

Calling all degens to the Left Curve. Your hunch that money printing will accelerate as politicians spend money on handouts and wars is correct. Do not underestimate the desire to remain in office of the incumbent elites. If real rates become positive, then re-assess your crypto conviction. But until that time, let your winners run, you glorious degenerate piece of shit.

号召所有堕落者走向左曲线。你的预感是,随着政客们把钱花在施舍和战争上,印钞将会加速,这是正确的。不要低估现任精英继续留任的愿望。如果实际利率变为正数,则重新评估您的加密货币信念。但在那之前,让你的胜利者逃跑吧,你这个光荣的堕落狗屎。

The post Left Curve appeared first on BitMEX Blog.

Left Curve 的帖子首先出现在 BitMEX 博客上。

阅读 BitMEX 投资免责声明

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- XRP导航挥发性水域,针对其范围的突破

- 2025-04-03 15:35:27

- Ripple的XRP正在贯穿一个动荡的阶段,随着更广泛的加密市场经历的湍流,努力保持至关重要的支持水平。

-

-

-

-

-

-

-

-