|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

香港证券及期货专业协会(HKSFPA)敦促该市的加密货币公司建立自律组织,以监控合规性并维护行业发展。此举旨在平衡香港虚拟资产行业的监管和增长,与其他司法管辖区相比,香港虚拟资产行业的监管较为宽松。

Hong Kong's Securities Industry Advocates for Self-Regulation to Spur Growth and Competitiveness

香港证券业倡导自律以刺激增长和竞争力

Amidst the evolving global crypto landscape, the Hong Kong Securities & Futures Professionals Association (HKSFPA) has issued a compelling recommendation for the establishment of a self-regulatory framework within the city's crypto industry. This move, the association argues, is crucial to maintaining Hong Kong's position as a leading international financial center and fostering the growth of its virtual asset sector.

在不断变化的全球加密货币格局中,香港证券及期货专业协会(HKSFPA)发布了一项令人信服的建议,要求在香港加密货币行业内建立自律框架。该协会认为,此举对于维持香港作为领先国际金融中心的地位并促进其虚拟资产行业的增长至关重要。

In a comprehensive letter to the Securities & Futures Commission (SFC), the regulatory body overseeing Hong Kong's securities market, the HKSFPA outlined the potential benefits of a self-regulatory approach. The association emphasized the need for a balanced approach that promotes development while safeguarding investor interests.

HKSFPA 在致香港证券市场监管机构证券及期货事务监察委员会(SFC)的一封综合信中概述了自我监管方法的潜在好处。该协会强调需要采取平衡的方法,在促进发展的同时维护投资者利益。

The proposal recommends the creation of autonomous self-regulating bodies (SROs) for different industry segments, including futures, asset management, and virtual assets. These SROs would assume licensing responsibilities, enabling them to monitor compliance and enforce industry standards.

该提案建议为不同的行业领域(包括期货、资产管理和虚拟资产)创建自主的自我监管机构(SRO)。这些 SRO 将承担许可责任,使他们能够监控合规性并执行行业标准。

"The Hong Kong financial market industry has been overly focused on supervision," the HKSFPA stated, "but lacks an organization to guide its overall development." The association believes that self-regulation can address this gap, empowering industry stakeholders to shape their own future.

香港金融市场协会表示,“香港金融市场行业一直过于注重监管,但缺乏一个组织来指导其整体发展”。该协会认为,自我监管可以弥补这一差距,使行业利益相关者能够塑造自己的未来。

The SFC's role would evolve under this framework, as it would retain oversight of market conduct but delegate licensing authority to the SROs. This division of responsibilities, the HKSFPA argues, would enhance efficiency and foster a more collaborative relationship between regulators and industry participants.

证监会的角色将在此框架下演变,因为它将保留对市场行为的监督,但将发牌权下放给自律组织。 HKSFPA 认为,这种职责分工将提高效率并促进监管机构和行业参与者之间更具协作性的关系。

The HKSFPA draws inspiration from a similar recommendation made in August 2022 and reiterates the importance of preventing "extreme supervision" that stifles innovation in the virtual assets industry.

HKSFPA 从 2022 年 8 月提出的类似建议中汲取灵感,重申了防止“极端监管”扼杀虚拟资产行业创新的重要性。

Hong Kong's regulators have demonstrated a more progressive stance towards virtual asset firms compared to their counterparts in other jurisdictions. The SFC has already approved spot Bitcoin and Ether exchange-traded funds (ETFs) and granted licenses to crypto exchanges such as Hashkey and OSL.

与其他司法管辖区的监管机构相比,香港监管机构对虚拟资产公司表现出更为进步的立场。证监会已批准现货比特币和以太币交易所交易基金(ETF),并向 Hashkey 和 OSL 等加密货币交易所授予牌照。

In contrast, the U.S. Securities and Exchange Commission (SEC) has yet to approve a spot Ether ETF or offer specific licenses for crypto exchanges. The SEC's stance has raised concerns among industry experts about the United States falling behind in the global race to regulate digital assets.

相比之下,美国证券交易委员会 (SEC) 尚未批准现货以太坊 ETF 或为加密货币交易所提供特定许可证。美国证券交易委员会的立场引起了行业专家的担忧,他们担心美国在全球数字资产监管竞赛中落后。

The HKSFPA's proposal aligns with Hong Kong's broader commitment to maintaining its status as a leading financial hub. By embracing self-regulation, the city can foster a dynamic and innovative environment for virtual asset companies while ensuring the protection of investors.

HKSFPA 的提议符合香港维持其领先金融中心地位的更广泛承诺。通过自我监管,该市可以为虚拟资产公司营造一个充满活力和创新的环境,同时确保投资者的保护。

Self-regulation, however, comes with its own set of risks. The recent tightening of crypto regulations in Lithuania following reports of compliance failures highlights the potential pitfalls. However, the HKSFPA is confident that Hong Kong's robust regulatory framework and experienced industry professionals can effectively mitigate these risks.

然而,自我监管也有其自身的风险。在出现合规失败的报道后,立陶宛最近收紧了加密货币监管,这突显了潜在的陷阱。不过,香港SFPA相信香港健全的监管架构和经验丰富的行业专业人士能够有效降低这些风险。

The association's recommendation has garnered support from industry heavyweights such as Dr. David Chin, Chairman of the HKSFPA. Chin emphasized the need to "embrace a forward-looking regulatory approach that supports innovation while protecting investors."

该协会的建议得到了香港SFPA主席钱大卫博士等行业重量级人物的支持。 Chin 强调需要“采用前瞻性的监管方法,支持创新,同时保护投资者。”

The HKSFPA's proposal is a significant development that could shape the future of Hong Kong's crypto industry. By empowering industry participants to take ownership of their regulation, the city can create a more sustainable and competitive ecosystem that attracts global talent and capital. As the global crypto landscape continues to evolve, Hong Kong's bold embrace of self-regulation may well serve as a model for other jurisdictions seeking to harness the transformative potential of digital assets.

HKSFPA 的提议是一项重大进展,可能会塑造香港加密货币行业的未来。通过赋予行业参与者自主监管权,该市可以创建一个更具可持续性和竞争力的生态系统,吸引全球人才和资本。随着全球加密货币格局的不断发展,香港大胆实行自我监管很可能成为其他寻求利用数字资产变革潜力的司法管辖区的典范。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

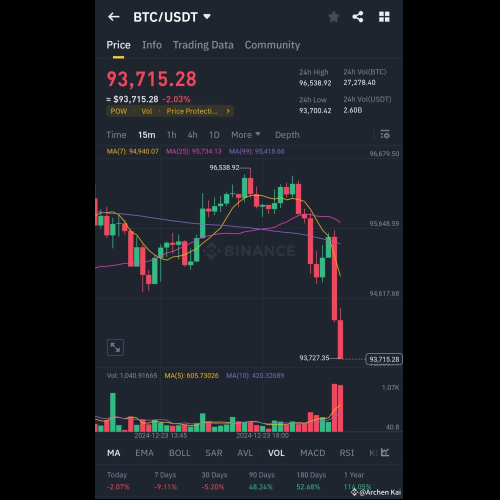

- 比特币($BTC)短期分析

- 2024-12-24 03:20:01

- 当前价格:$93,715

-

-

-

-

-

-

-

-