|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Hong Kong's Securities Industry Champions Self-Regulation to Promote Growth and Competitiveness

Apr 22, 2024 at 11:34 pm

The Hong Kong Securities & Futures Professionals Association (HKSFPA) has urged crypto firms in the city to establish a self-regulatory organization to monitor compliance and maintain industry development. The move aims to balance supervision and growth in Hong Kong's virtual asset industry, which has seen tolerant regulation compared to other jurisdictions.

Hong Kong's Securities Industry Advocates for Self-Regulation to Spur Growth and Competitiveness

Amidst the evolving global crypto landscape, the Hong Kong Securities & Futures Professionals Association (HKSFPA) has issued a compelling recommendation for the establishment of a self-regulatory framework within the city's crypto industry. This move, the association argues, is crucial to maintaining Hong Kong's position as a leading international financial center and fostering the growth of its virtual asset sector.

In a comprehensive letter to the Securities & Futures Commission (SFC), the regulatory body overseeing Hong Kong's securities market, the HKSFPA outlined the potential benefits of a self-regulatory approach. The association emphasized the need for a balanced approach that promotes development while safeguarding investor interests.

The proposal recommends the creation of autonomous self-regulating bodies (SROs) for different industry segments, including futures, asset management, and virtual assets. These SROs would assume licensing responsibilities, enabling them to monitor compliance and enforce industry standards.

"The Hong Kong financial market industry has been overly focused on supervision," the HKSFPA stated, "but lacks an organization to guide its overall development." The association believes that self-regulation can address this gap, empowering industry stakeholders to shape their own future.

The SFC's role would evolve under this framework, as it would retain oversight of market conduct but delegate licensing authority to the SROs. This division of responsibilities, the HKSFPA argues, would enhance efficiency and foster a more collaborative relationship between regulators and industry participants.

The HKSFPA draws inspiration from a similar recommendation made in August 2022 and reiterates the importance of preventing "extreme supervision" that stifles innovation in the virtual assets industry.

Hong Kong's regulators have demonstrated a more progressive stance towards virtual asset firms compared to their counterparts in other jurisdictions. The SFC has already approved spot Bitcoin and Ether exchange-traded funds (ETFs) and granted licenses to crypto exchanges such as Hashkey and OSL.

In contrast, the U.S. Securities and Exchange Commission (SEC) has yet to approve a spot Ether ETF or offer specific licenses for crypto exchanges. The SEC's stance has raised concerns among industry experts about the United States falling behind in the global race to regulate digital assets.

The HKSFPA's proposal aligns with Hong Kong's broader commitment to maintaining its status as a leading financial hub. By embracing self-regulation, the city can foster a dynamic and innovative environment for virtual asset companies while ensuring the protection of investors.

Self-regulation, however, comes with its own set of risks. The recent tightening of crypto regulations in Lithuania following reports of compliance failures highlights the potential pitfalls. However, the HKSFPA is confident that Hong Kong's robust regulatory framework and experienced industry professionals can effectively mitigate these risks.

The association's recommendation has garnered support from industry heavyweights such as Dr. David Chin, Chairman of the HKSFPA. Chin emphasized the need to "embrace a forward-looking regulatory approach that supports innovation while protecting investors."

The HKSFPA's proposal is a significant development that could shape the future of Hong Kong's crypto industry. By empowering industry participants to take ownership of their regulation, the city can create a more sustainable and competitive ecosystem that attracts global talent and capital. As the global crypto landscape continues to evolve, Hong Kong's bold embrace of self-regulation may well serve as a model for other jurisdictions seeking to harness the transformative potential of digital assets.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

-

- XYZ: The New Meme Coin Heavyweight Aiming to Outperform PEPE and SHIB

- Dec 23, 2024 at 11:35 pm

-

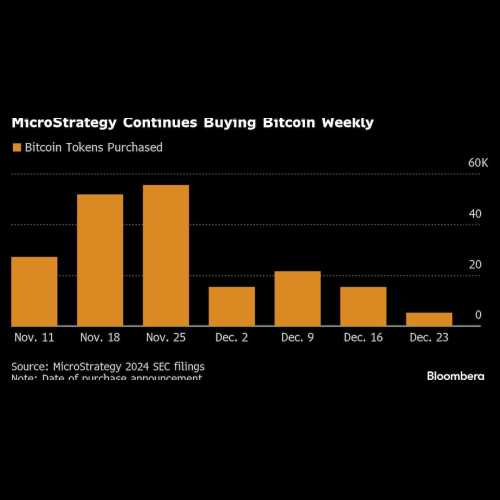

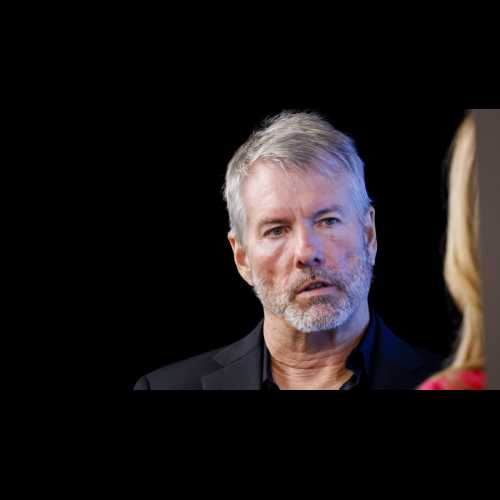

- Michael Saylor, the Bitcoin Maximalist Who Pitched Microsoft on the Future of Digital Money

- Dec 23, 2024 at 11:25 pm

- e