|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

复合年增长率 (CAGR) 复合年增长率是一个指标,表示投资在特定时期内从初始值增长到最终值所需的恒定回报率,考虑到复合年回报率的影响。它提供了投资随时间的增长率的简化衡量标准,便于不同投资之间的比较,无论年回报率如何波动。

« Back to Dictionary IndexWhat is Compound Annual Growth Rate (CAGR)?

The Compound Annual Growth Rate represents o income necessary for an investment to evolve from its initial value to its final value, considering that the gains were reapplied at the end of each year of the investment period.

«返回字典索引什么是复合年增长率 (CAGR)?复合年增长率代表一项投资从其初始值发展到其最终值所需的收入,考虑到收益在每年年底重新应用投资期限。

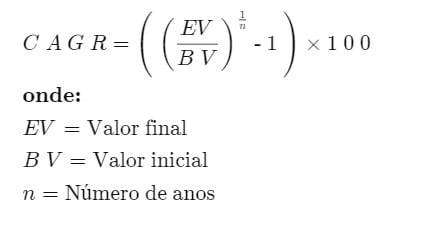

How to Calculate Compound Annual Growth Rate (CAGR)

To determine the CAGR of an investment, follow the steps below:

如何计算复合年增长率 (CAGR) 要确定投资的复合年增长率,请按照以下步骤操作:

- Calculate the ratio between the final value of the investment and its initial value.

- Raise this ratio to the power of one over the number of years in the period.

- Deduce one from the result found.

- Transform the final result into a percentage by multiplying it by 100.

Meaning of CAGR

Although CAGR does not reflect the true rate of return, it does offer a representative measure. It works as an index that indicates the speed at which an investment would have expanded if it had maintained a constant rate of annual growth, with income reinvested at the end of each year.

计算投资的最终价值与其初始价值之间的比率。将该比率乘以该期间年数的 1 次方。从找到的结果中减去 1。将最终结果乘以百分比,将其转换为百分比100.复合年增长率的含义虽然复合年增长率并不反映真实的回报率,但它确实提供了一个具有代表性的衡量标准。它作为一个指数,表明如果投资保持恒定的年增长率,并且收入在每年年底进行再投资,那么投资将扩大的速度。

Due to actual annual performance variations, achieving this uniform growth is atypical. However, CAGR serves to level returns, making it easier to understand in contrast to other methods.

由于实际的年度业绩差异,实现这种均匀增长是不典型的。然而,复合年增长率有助于平衡回报,与其他方法相比更容易理解。

Practical example of using CAGR

Consider an initial investment of $10.000 in a portfolio that yielded the following returns:

使用 CAGR 的实际示例考虑投资组合的初始投资为 10.000 美元,该投资组合产生以下回报:

- From January 1, 2018 to January 1, 2019, the portfolio value increased to $13.000, representing 30% growth in the first year.

- As of January 1, 2020, the portfolio was worth $14.000, which is a 7,69% increase from January 2019 to January 2020.

- As of January 1, 2021, the final value was $19.000, marking 35,71% growth from January 2020 to January 2021.

The portfolio's annual returns varied significantly, depending on the percentages indicated. However, by applying CAGR, a unified view of investment performance is obtained, disregarding annual fluctuations. In this case, the CAGR for the three-year period was 23,86%, providing a simplified comparison basis for the investor to evaluate different resource allocation options or project future values.

从2018年1月1日到2019年1月1日,投资组合价值增加至13.000美元,第一年增长30%。截至2020年1月1日,投资组合价值14.000美元,较1月份增长7.69% 2019 年至 2020 年 1 月。截至 2021 年 1 月 1 日,最终价值为 19.000 美元,从 2020 年 1 月到 2021 年 1 月增长了 35.71%。投资组合的年回报率差异很大,具体取决于所示的百分比。然而,通过应用复合年增长率,可以获得投资业绩的统一视图,忽略年度波动。在这种情况下,三年期间的复合年增长率为23.86%,为投资者评估不同的资源配置方案或预测未来价值提供了简化的比较基础。

For example, when comparing two distinct investments, where one may appreciate while the other depreciates in a given year, as would be the case when comparing high-yield bonds with stocks or real estate investments with emerging markets, the CAGR helps to level out annual returns, simplifying the comparison between alternatives.

例如,在比较两种不同的投资时,一种投资可能在某一年升值,另一种则贬值,就像将高收益债券与股票或房地产投资与新兴市场进行比较时的情况一样,复合年增长率有助于平衡年增长率回报,简化了替代方案之间的比较。

Another example would be an investor who purchased 55 shares of Amazon.com in December 2017 for $1.180 each, for a total investment of $64.900. Three years later, in December 2020, the shares appreciated to $3.200 each, bringing the value of the investment to $176.000.

另一个例子是,一位投资者于 2017 年 12 月以每股 1.180 美元的价格购买了 55 股 Amazon.com 股票,总投资为 64.900 美元。三年后,即 2020 年 12 月,每股股票升值至 3,200 美元,投资价值达到 176,000 美元。

What is CAGR?

To understand CAGR, let’s consider a practical example with the following data:

什么是复合年增长率?为了理解复合年增长率,让我们考虑一个包含以下数据的实际示例:

- Final investment value: $176.000

- Initial investment value: $64.900

- Duration of investment: 3 years

Applying this information to the CAGR formula, we have:

最终投资价值:176.000 美元初始投资价值:64.900 美元投资期限:3 年将此信息应用于 CAGR 公式,我们有:

[($176.000 / $64.900) ^ (1/3)] – 1 = 39,5%.Additional CAGR Applications

CAGR is useful in determining the average annual growth of an investment. This proves especially valuable in volatile market scenarios, where the return on an investment can vary significantly from year to year.

[($176.000 / $64.900) ^ (1/3)] – 1 = 39,5%。其他复合年增长率应用复合年增长率可用于确定投资的平均年增长率。事实证明,这在波动的市场情况下尤其有价值,因为投资回报率每年都可能存在很大差异。

For example, it may happen that an investment appreciates by 8% in one year, depreciates by 2% in the following year, and appreciates again by 5% in the following year. CAGR helps normalize returns, providing a more stable and understandable view of the growth trajectory, even when these rates are volatile and inconsistent.

例如,一项投资可能在一年内升值8%,第二年贬值2%,第二年又升值5%。复合年增长率有助于回报正常化,即使这些比率波动且不一致,也能提供更稳定、更易于理解的增长轨迹。

Investment Comparison

CAGR provides a means of comparing the performance of different types of investments. Imagine an investor who, in 2015, invested $10.000 in a savings account with fixed annual interest of 1%, and an equal amount in a stock mutual fund, whose return tends to be more irregular over time.

投资比较复合年增长率提供了一种比较不同类型投资绩效的方法。想象一下,一位投资者在 2015 年将 10,000 美元投资于储蓄账户,固定年利率为 1%,并将同等金额投资于股票共同基金,随着时间的推移,其回报往往更加不规律。

At the end of five years, suppose the savings account has reached a balance of $10.510,10 and the stock fund, despite uneven growth, has reached $15.348,52. At first glance, the equity fund appears to be the most profitable investment, with a significantly higher return compared to the savings account.

五年结束时,假设储蓄账户余额达到 10.510,10 美元,股票基金尽管增长不平衡,但已达到 15.348,52 美元。乍一看,股票基金似乎是最赚钱的投资,与储蓄账户相比,回报率明显更高。

However, CAGR, by offering an average of returns, does not reveal the volatility or risk associated with the equity fund. Despite this limitation, CAGR can be incorporated into the MAR index, which adjusts results to risk, thus providing a more balanced analysis.

然而,复合年增长率通过提供平均回报率,并没有揭示与股票基金相关的波动性或风险。尽管存在这一限制,CAGR 仍可以纳入 MAR 指数,根据风险调整结果,从而提供更平衡的分析。

Performance Monitoring

CAGR is also applicable in monitoring the performance of different business aspects, whether of a single company or comparing several. For example, if the CAGR for big-box market share is 1,82% over five years, while the CAGR for customer satisfaction is -0,58% over the same period, this comparison reveals valuable insights into the strengths and weaknesses of the company.

绩效监控CAGR还适用于监控不同业务方面的绩效,无论是单个公司还是比较多个公司。例如,如果五年内大型机市场份额的复合年增长率为 1.82%,而同期客户满意度的复合年增长率为 -0.58%,则这种比较揭示了有关大型机的优势和劣势的宝贵见解。公司。

Assessment of Strengths and Weaknesses

Analyzing the CAGRs of competing companies' business operations offers an effective means of identifying relative advantages and disadvantages. A clear example of this can be seen when comparing Big-Sale's customer satisfaction CAGR with that of SuperFast Cable, which recorded a customer satisfaction CAGR of -6,31% in the same time frame. Such a comparison allows a detailed assessment of the strengths and weaknesses between competitors.

优势和劣势评估分析竞争公司业务运营的复合年增长率提供了识别相对优势和劣势的有效方法。将 Big-Sale 的客户满意度复合年增长率与 SuperFast Cable 的客户满意度复合年增长率进行比较即可看到一个明显的例子,后者在同一时间范围内的客户满意度复合年增长率为 -6.31%。这种比较可以详细评估竞争对手之间的优势和劣势。

Use of CAGR by Investors

Mastering the CAGR formula opens the door to several other applications used by investors to analyze past returns and project future profits. Algebraic manipulation of the CAGR formula can make it easier to calculate the present or future value of money, or determine a minimum required rate of return.

投资者使用复合年增长率掌握复合年增长率公式为投资者打开了通往其他几种应用程序的大门,投资者可以使用这些应用程序来分析过去的回报并预测未来的利润。 CAGR 公式的代数运算可以更轻松地计算货币的当前或未来价值,或确定最低所需回报率。

Consider, for example, an investor who needs to accumulate US$50.000 for a child's college education in 18 years, currently having US$15.000 to invest. To calculate the average rate of return necessary to achieve this objective, one can resort to calculating the CAGR, adapting the formula to find the required rate.

例如,一位投资者需要在 18 年内为孩子的大学教育积累 50,000 美元,目前有 15,000 美元可供投资。为了计算实现这一目标所需的平均回报率,可以通过计算复合年增长率,调整公式来找到所需的回报率。

This adaptation is nothing more than a rearranged version of the present value and future value equations. If an investor aims to achieve an amount of $50.000, assuming an expected annual return of 8% on the investment, he can use this version of the CAGR formula to calculate the initial amount needed to reach his goal.

这种调整只不过是现值和未来值方程的重新排列版本。如果投资者的目标是达到 50,000 美元,假设投资的预期年回报率为 8%,他可以使用此版本的 CAGR 公式来计算达到目标所需的初始金额。

Adjustments to the CAGR Formula

Investments are rarely made precisely at the beginning and sold precisely at the end of a calendar year. Suppose an investor wants to calculate the CAGR of an investment of US$10.000 made on June 1, 2013 and settled for US$16.897,14 on September 9, 2018.

CAGR FormulaInvestments 的调整很少在年初进行精确调整,并在日历年年底精确出售。假设投资者想要计算 2013 年 6 月 1 日投资 10,000 美元并于 2018 年 9 月 9 日结算为 16,897,14 美元的复合年增长率。

To calculate the CAGR, it is initially necessary to determine the exact fraction of the investment period. The investment lasted 213 days in 2013, followed by full years until 2017, and a further 251 days in 2018, totaling an investment period of approximately 5,271 years, calculated as follows:

要计算复合年增长率,首先需要确定投资期的准确比例。 2013年投资持续213天,随后持续至2017年全年,2018年又持续251天,总计投资期限约5,271年,计算如下:

- 2013: 213 days

- 2014 to 2017: 365 days each year

- 2018: 251 days

The total number of days on which the investment was maintained totals 1.924. Dividing this total by 365, we obtain 5,271 years, the total duration of the investment.

2013年:213天2014年至2017年:每年365天2018年:251天投资维持天数总计1.924天。将这个总数除以 365,我们得到 5,271 年,即投资的总期限。

This exact period, expressed in years, is then applied to the denominator of the exponent in the CAGR formula to obtain the adjusted calculation.

然后,将这一以年为单位的精确周期应用于 CAGR 公式中指数的分母,以获得调整后的计算结果。

Moderation in Growth Rate with CAGR

The main restriction of CAGR lies in the fact that it calculates a moderate rate of growth over a specific period, disregarding volatility and assuming constant growth during that time. This contrasts with the reality of investments, whose returns tend to vary significantly, except for fixed income investments such as held-to-maturity bonds or bank deposits.

复合年增长率的适度增长率复合年增长率的主要限制在于,它计算特定时期内的适度增长率,忽略波动性并假设该时期内持续增长。这与投资的实际情况形成鲜明对比,投资的回报往往差异很大,但持有至到期债券或银行存款等固定收益投资除外。

Additionally, the CAGR does not take into account any contributions or withdrawals of resources by the investor in their portfolio during the period analyzed. For example, if an investor were to make additional contributions to the portfolio over five years, the resulting CAGR could be overestimated. The formula calculates the rate of return based on the initial and final values during the five-year period, unduly considering contributions as part of annual growth, which distorts reality.

此外,复合年增长率并未考虑投资者在分析期间对其投资组合的任何资源贡献或提取。例如,如果投资者在五年内向投资组合做出额外贡献,则由此产生的复合年增长率可能会被高估。该公式根据五年期间的初值和终值计算回报率,不适当地将贡献视为年度增长的一部分,扭曲了现实。

Other Limitations of CAGR

In addition to its growth smoothing characteristic, CAGR has other limitations. One of them is the impossibility of guaranteeing the continuity of past performance in the future. The reliability of the CAGR decreases the shorter the period considered for the analysis, reducing the chances that the projected CAGR corresponds to that actually realized, based on historical data.

CAGR 的其他限制 除了其增长平滑特性之外,CAGR 还有其他限制。其中之一是无法保证过去业绩在未来的连续性。分析所考虑的时间越短,复合年增长率的可靠性就越低,从而减少了根据历史数据预测的复合年增长率与实际实现的复合年增长率相对应的机会。

Another limitation concerns its representativeness. Considering an investment fund that was worth $100.000 in 2016, fell to $71.000 in 2017, declined further to $44.000 in 2018, rose to $81.000 in 2019, and reached $126.000 in 2020. If, in 2021, it were disclosed that the fund's CAGR over the past three years was a significant 42,01%, the information would be technically correct. However, it would be omitting crucial aspects of the fund's trajectory, such as the modest 4,73% rate over five years.

另一个限制在于其代表性。考虑到一只投资基金在 2016 年价值 100,000 美元,2017 年跌至 71,000 美元,2018 年进一步跌至 44,000 美元,2019 年升至 81,000 美元,2020 年达到 126,000 美元。如果在 2021 年披露该基金的复合年增长率超过过去三年显着为 42.01%,该信息在技术上是正确的。然而,这将忽略该基金发展轨迹的关键方面,例如五年内 4.73% 的温和利率。

CAGR vs. IRR

While CAGR offers a measure of an investment's return over a given period, Internal Rate of Return (IRR) provides a more comprehensive view of investment performance and is more versatile than CAGR.

CAGR 与 IRR 虽然 CAGR 提供了给定时期内投资回报的衡量标准,但内部回报率 (IRR) 提供了更全面的投资绩效视图,并且比 CAGR 更通用。

The main distinction between the two lies in the simplicity of CAGR, which allows for manual calculation. On the other hand, for more complex investments or projects, with multiple inflow and outflow transactions, the IRR is more appropriate. Determining the IRR generally requires the use of a financial calculator, spreadsheets such as Excel, or specialized portfolio management systems.

两者之间的主要区别在于 CAGR 的简单性,允许手动计算。另一方面,对于更复杂的投资或项目,有多个流入和流出交易,IRR 更合适。确定 IRR 通常需要使用金融计算器、Excel 等电子表格或专门的投资组合管理系统。

Individuals interested in deepening their knowledge of CAGR and other financial topics can benefit from exploring some of the best investment courses available on the market today.

有兴趣加深复合年增长率和其他金融主题知识的个人可以从探索当今市场上的一些最佳投资课程中受益。

Conclusion

The Compound Annual Growth Rate (CAGR) emerges as a fundamental analytical tool for investors and financial analysts, providing a clear, composite view of an investment's growth over time. When considering the effect of compounding, CAGR provides a smoothed and consistent measure that can be compared across different investment options, regardless of annual fluctuations.

结论复合年增长率 (CAGR) 已成为投资者和金融分析师的基本分析工具,为投资随时间的增长提供清晰、综合的观点。在考虑复利的影响时,复合年增长率提供了一种平滑且一致的衡量标准,可以在不同的投资选择之间进行比较,无论年度波动如何。

While CAGR offers numerous advantages, such as the ability to level out the volatility of returns and provide a long-term perspective on growth, it is not without limitations. Its smoothing approach can hide periods of underperformance and does not account for capital movements during the analysis period, such as contributions or withdrawals. Furthermore, CAGR's effectiveness as an indicator of future financial performance is limited, as it cannot predict changes in market conditions or a company's management.

虽然复合年增长率具有许多优势,例如能够消除回报波动并提供长期增长视角,但它并非没有局限性。其平滑方法可以隐藏表现不佳的时期,并且不会考虑分析期间的资本流动,例如捐款或取款。此外,复合年增长率作为未来财务业绩指标的有效性是有限的,因为它无法预测市场状况或公司管理层的变化。

The distinction between CAGR and other metrics, such as Internal Rate of Return (IRR) and simple growth rates, highlights the importance of selecting the most appropriate analysis tool for each specific situation. By adjusting CAGR for risk factors, investors can obtain a more accurate assessment of the risk-adjusted performance of their investments.

CAGR 与内部回报率 (IRR) 和简单增长率等其他指标之间的区别凸显了针对每种具体情况选择最合适的分析工具的重要性。通过调整风险因素的复合年增长率,投资者可以更准确地评估其投资的风险调整后业绩。

FAQ

What is an example of a Compound Annual Growth Rate (CAGR)?

CAGR is a key indicator used by investors to analyze the evolution of the value of an investment over time. The inclusion of the word “compound” reflects CAGR's ability to incorporate the effect of capitalization, that is, the reinvestment of earnings over a period. Imagine, for example, that a company saw an increase in revenue from $3 million to $30 million in ten years. In this case, the CAGR would be around 25,89%.

常见问题复合年增长率 (CAGR) 的示例是什么?复合年增长率是投资者用来分析投资价值随时间变化的关键指标。 “复合”一词的加入反映了复合年增长率纳入资本化效应的能力,即一段时间内收益的再投资。例如,假设一家公司的收入在十年内从 300 万美元增加到 3000 万美元。在这种情况下,复合年增长率约为 25.89%。

What constitutes a good CAGR?

A “good” CAGR varies depending on the specific context, including factors such as opportunity cost and risk associated with the investment. For example, an annual growth rate of 25% could be considered modest in an industry where the average is 30%, but impressive in a market where the average is 10% to 15%. Generally speaking, a higher CAGR is preferable.

什么是良好的复合年增长率?“良好”的复合年增长率取决于具体情况,包括机会成本和与投资相关的风险等因素。例如,在平均增长率为 30% 的行业中,25% 的年增长率可能被认为是适度的,但在平均增长率为 10% 至 15% 的市场中却令人印象深刻。一般来说,复合年增长率越高越好。

Difference between CAGR and Growth Rate

The main distinction between CAGR and a simple growth rate lies in the fact that CAGR assumes a constant, annually compounded growth rate, whereas a standard growth rate assumes no such constancy. CAGR is often preferred by investors for its ability to even out fluctuations in growth rates from year to year, providing a more stable view of a company's growth over time, even if there are years of lower performance.

CAGR 和增长率之间的区别 CAGR 和简单增长率之间的主要区别在于,CAGR 假定恒定的年复合增长率,而标准增长率则不假定这种恒定性。复合年增长率通常受到投资者的青睐,因为它能够平衡每年增长率的波动,从而为公司随时间的增长提供更稳定的视角,即使多年来业绩较低。

Can CAGR be negative?

Yes, it is possible for the CAGR to be negative, which indicates a reduction in the value of the investment over the analyzed period, rather than an increase.

复合年增长率可以为负吗?是的,复合年增长率有可能为负,这表明在分析期间投资价值减少而不是增加。

What does risk adjusted CAGR mean?

Investors looking to evaluate the performance of different investment options considering both returns and associated risks can turn to risk-adjusted CAGR. This calculation is performed by multiplying the CAGR by (1 – the standard deviation of the return on investment). If the standard deviation is zero, the risk-adjusted CAGR will be the same as the unadjusted CAGR. However, a higher standard deviation results in a lower risk-adjusted CAGR, reflecting the increased risk.

风险调整后复合年增长率是什么意思?希望在考虑回报和相关风险的情况下评估不同投资选择的表现的投资者可以转向风险调整后复合年增长率。该计算方法是将复合年增长率乘以(1 – 投资回报率的标准差)。如果标准差为零,则风险调整后的复合年增长率将与未调整的复合年增长率相同。然而,较高的标准差会导致较低的风险调整复合年增长率,反映了风险的增加。

类别:区块链词典« 返回词典索引

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- MEXC、USDf 和交易量:深入探讨最新动态

- 2025-11-04 18:00:00

- 探索 MEXC、USDf 和交易量的最新动态,重点关注近期活动和合作伙伴关系的主要趋势和见解。

-

- Meme 币和市场动态:驾驭 2025 年末的加密货币格局

- 2025-11-04 17:56:55

- 探索最新的模因代币趋势、狗狗币 11 月的潜在反弹以及 Solana 的价格走势。探讨加密货币市场的主要发展。

-

-

-

- Solana ETF、机构之争和西联汇款:加密货币新时代?

- 2025-11-04 17:50:03

- Solana ETF 的批准引发了机构兴趣、华尔街摊牌以及西联汇款的区块链飞跃。

-

- XRP ETF 热议:价格即将飙升吗?

- 2025-11-04 17:48:41

- XRP ETF 势头强劲,但监管障碍和市场动态是否会推动价格飙升?

-

- XRP 的死亡交叉:看跌预兆还是买入机会?

- 2025-11-04 17:47:14

- XRP 正在闪烁死亡十字图案,引发了关于其未来的争论。这是进一步下跌的迹象,还是逢低买入的机会?

-

- XRP、日本和市场情绪:看涨酝酿中

- 2025-11-04 17:46:29

- 探索围绕 XRP 的积极情绪、日本对加密货币的进步立场以及对数字资产格局的潜在影响的融合。