|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

What Is the Compound Annual Growth Rate (CAGR)?

Mar 28, 2024 at 02:06 pm

Compound Annual Growth Rate (CAGR)CAGR is a metric that represents the constant rate of return required for an investment to grow from its initial value to its final value over a specific period, considering the effect of compounding annual returns. It provides a simplified measure of an investment's growth rate over time, facilitating comparisons between different investments, regardless of fluctuations in annual returns.

« Back to Dictionary IndexWhat is Compound Annual Growth Rate (CAGR)?

The Compound Annual Growth Rate represents o income necessary for an investment to evolve from its initial value to its final value, considering that the gains were reapplied at the end of each year of the investment period.

How to Calculate Compound Annual Growth Rate (CAGR)

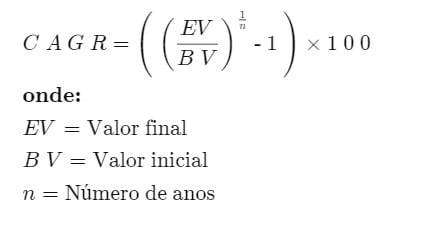

To determine the CAGR of an investment, follow the steps below:

- Calculate the ratio between the final value of the investment and its initial value.

- Raise this ratio to the power of one over the number of years in the period.

- Deduce one from the result found.

- Transform the final result into a percentage by multiplying it by 100.

Meaning of CAGR

Although CAGR does not reflect the true rate of return, it does offer a representative measure. It works as an index that indicates the speed at which an investment would have expanded if it had maintained a constant rate of annual growth, with income reinvested at the end of each year.

Due to actual annual performance variations, achieving this uniform growth is atypical. However, CAGR serves to level returns, making it easier to understand in contrast to other methods.

Practical example of using CAGR

Consider an initial investment of $10.000 in a portfolio that yielded the following returns:

- From January 1, 2018 to January 1, 2019, the portfolio value increased to $13.000, representing 30% growth in the first year.

- As of January 1, 2020, the portfolio was worth $14.000, which is a 7,69% increase from January 2019 to January 2020.

- As of January 1, 2021, the final value was $19.000, marking 35,71% growth from January 2020 to January 2021.

The portfolio's annual returns varied significantly, depending on the percentages indicated. However, by applying CAGR, a unified view of investment performance is obtained, disregarding annual fluctuations. In this case, the CAGR for the three-year period was 23,86%, providing a simplified comparison basis for the investor to evaluate different resource allocation options or project future values.

For example, when comparing two distinct investments, where one may appreciate while the other depreciates in a given year, as would be the case when comparing high-yield bonds with stocks or real estate investments with emerging markets, the CAGR helps to level out annual returns, simplifying the comparison between alternatives.

Another example would be an investor who purchased 55 shares of Amazon.com in December 2017 for $1.180 each, for a total investment of $64.900. Three years later, in December 2020, the shares appreciated to $3.200 each, bringing the value of the investment to $176.000.

What is CAGR?

To understand CAGR, let’s consider a practical example with the following data:

- Final investment value: $176.000

- Initial investment value: $64.900

- Duration of investment: 3 years

Applying this information to the CAGR formula, we have:

[($176.000 / $64.900) ^ (1/3)] – 1 = 39,5%.Additional CAGR Applications

CAGR is useful in determining the average annual growth of an investment. This proves especially valuable in volatile market scenarios, where the return on an investment can vary significantly from year to year.

For example, it may happen that an investment appreciates by 8% in one year, depreciates by 2% in the following year, and appreciates again by 5% in the following year. CAGR helps normalize returns, providing a more stable and understandable view of the growth trajectory, even when these rates are volatile and inconsistent.

Investment Comparison

CAGR provides a means of comparing the performance of different types of investments. Imagine an investor who, in 2015, invested $10.000 in a savings account with fixed annual interest of 1%, and an equal amount in a stock mutual fund, whose return tends to be more irregular over time.

At the end of five years, suppose the savings account has reached a balance of $10.510,10 and the stock fund, despite uneven growth, has reached $15.348,52. At first glance, the equity fund appears to be the most profitable investment, with a significantly higher return compared to the savings account.

However, CAGR, by offering an average of returns, does not reveal the volatility or risk associated with the equity fund. Despite this limitation, CAGR can be incorporated into the MAR index, which adjusts results to risk, thus providing a more balanced analysis.

Performance Monitoring

CAGR is also applicable in monitoring the performance of different business aspects, whether of a single company or comparing several. For example, if the CAGR for big-box market share is 1,82% over five years, while the CAGR for customer satisfaction is -0,58% over the same period, this comparison reveals valuable insights into the strengths and weaknesses of the company.

Assessment of Strengths and Weaknesses

Analyzing the CAGRs of competing companies' business operations offers an effective means of identifying relative advantages and disadvantages. A clear example of this can be seen when comparing Big-Sale's customer satisfaction CAGR with that of SuperFast Cable, which recorded a customer satisfaction CAGR of -6,31% in the same time frame. Such a comparison allows a detailed assessment of the strengths and weaknesses between competitors.

Use of CAGR by Investors

Mastering the CAGR formula opens the door to several other applications used by investors to analyze past returns and project future profits. Algebraic manipulation of the CAGR formula can make it easier to calculate the present or future value of money, or determine a minimum required rate of return.

Consider, for example, an investor who needs to accumulate US$50.000 for a child's college education in 18 years, currently having US$15.000 to invest. To calculate the average rate of return necessary to achieve this objective, one can resort to calculating the CAGR, adapting the formula to find the required rate.

This adaptation is nothing more than a rearranged version of the present value and future value equations. If an investor aims to achieve an amount of $50.000, assuming an expected annual return of 8% on the investment, he can use this version of the CAGR formula to calculate the initial amount needed to reach his goal.

Adjustments to the CAGR Formula

Investments are rarely made precisely at the beginning and sold precisely at the end of a calendar year. Suppose an investor wants to calculate the CAGR of an investment of US$10.000 made on June 1, 2013 and settled for US$16.897,14 on September 9, 2018.

To calculate the CAGR, it is initially necessary to determine the exact fraction of the investment period. The investment lasted 213 days in 2013, followed by full years until 2017, and a further 251 days in 2018, totaling an investment period of approximately 5,271 years, calculated as follows:

- 2013: 213 days

- 2014 to 2017: 365 days each year

- 2018: 251 days

The total number of days on which the investment was maintained totals 1.924. Dividing this total by 365, we obtain 5,271 years, the total duration of the investment.

This exact period, expressed in years, is then applied to the denominator of the exponent in the CAGR formula to obtain the adjusted calculation.

Moderation in Growth Rate with CAGR

The main restriction of CAGR lies in the fact that it calculates a moderate rate of growth over a specific period, disregarding volatility and assuming constant growth during that time. This contrasts with the reality of investments, whose returns tend to vary significantly, except for fixed income investments such as held-to-maturity bonds or bank deposits.

Additionally, the CAGR does not take into account any contributions or withdrawals of resources by the investor in their portfolio during the period analyzed. For example, if an investor were to make additional contributions to the portfolio over five years, the resulting CAGR could be overestimated. The formula calculates the rate of return based on the initial and final values during the five-year period, unduly considering contributions as part of annual growth, which distorts reality.

Other Limitations of CAGR

In addition to its growth smoothing characteristic, CAGR has other limitations. One of them is the impossibility of guaranteeing the continuity of past performance in the future. The reliability of the CAGR decreases the shorter the period considered for the analysis, reducing the chances that the projected CAGR corresponds to that actually realized, based on historical data.

Another limitation concerns its representativeness. Considering an investment fund that was worth $100.000 in 2016, fell to $71.000 in 2017, declined further to $44.000 in 2018, rose to $81.000 in 2019, and reached $126.000 in 2020. If, in 2021, it were disclosed that the fund's CAGR over the past three years was a significant 42,01%, the information would be technically correct. However, it would be omitting crucial aspects of the fund's trajectory, such as the modest 4,73% rate over five years.

CAGR vs. IRR

While CAGR offers a measure of an investment's return over a given period, Internal Rate of Return (IRR) provides a more comprehensive view of investment performance and is more versatile than CAGR.

The main distinction between the two lies in the simplicity of CAGR, which allows for manual calculation. On the other hand, for more complex investments or projects, with multiple inflow and outflow transactions, the IRR is more appropriate. Determining the IRR generally requires the use of a financial calculator, spreadsheets such as Excel, or specialized portfolio management systems.

Individuals interested in deepening their knowledge of CAGR and other financial topics can benefit from exploring some of the best investment courses available on the market today.

Conclusion

The Compound Annual Growth Rate (CAGR) emerges as a fundamental analytical tool for investors and financial analysts, providing a clear, composite view of an investment's growth over time. When considering the effect of compounding, CAGR provides a smoothed and consistent measure that can be compared across different investment options, regardless of annual fluctuations.

While CAGR offers numerous advantages, such as the ability to level out the volatility of returns and provide a long-term perspective on growth, it is not without limitations. Its smoothing approach can hide periods of underperformance and does not account for capital movements during the analysis period, such as contributions or withdrawals. Furthermore, CAGR's effectiveness as an indicator of future financial performance is limited, as it cannot predict changes in market conditions or a company's management.

The distinction between CAGR and other metrics, such as Internal Rate of Return (IRR) and simple growth rates, highlights the importance of selecting the most appropriate analysis tool for each specific situation. By adjusting CAGR for risk factors, investors can obtain a more accurate assessment of the risk-adjusted performance of their investments.

FAQ

What is an example of a Compound Annual Growth Rate (CAGR)?

CAGR is a key indicator used by investors to analyze the evolution of the value of an investment over time. The inclusion of the word “compound” reflects CAGR's ability to incorporate the effect of capitalization, that is, the reinvestment of earnings over a period. Imagine, for example, that a company saw an increase in revenue from $3 million to $30 million in ten years. In this case, the CAGR would be around 25,89%.

What constitutes a good CAGR?

A “good” CAGR varies depending on the specific context, including factors such as opportunity cost and risk associated with the investment. For example, an annual growth rate of 25% could be considered modest in an industry where the average is 30%, but impressive in a market where the average is 10% to 15%. Generally speaking, a higher CAGR is preferable.

Difference between CAGR and Growth Rate

The main distinction between CAGR and a simple growth rate lies in the fact that CAGR assumes a constant, annually compounded growth rate, whereas a standard growth rate assumes no such constancy. CAGR is often preferred by investors for its ability to even out fluctuations in growth rates from year to year, providing a more stable view of a company's growth over time, even if there are years of lower performance.

Can CAGR be negative?

Yes, it is possible for the CAGR to be negative, which indicates a reduction in the value of the investment over the analyzed period, rather than an increase.

What does risk adjusted CAGR mean?

Investors looking to evaluate the performance of different investment options considering both returns and associated risks can turn to risk-adjusted CAGR. This calculation is performed by multiplying the CAGR by (1 – the standard deviation of the return on investment). If the standard deviation is zero, the risk-adjusted CAGR will be the same as the unadjusted CAGR. However, a higher standard deviation results in a lower risk-adjusted CAGR, reflecting the increased risk.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.