|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在比特幣最近飆升至超過 7 萬美元之際,經濟學家 Peter Schiff 警告年輕投資者不要優先考慮加密貨幣而不是黃金。希夫將他們對比特幣的偏好歸因於缺乏經驗和缺乏智慧,這表明隨著他們的成熟,他們最終可能會認識到黃金的持久價值。儘管他不斷批評比特幣,但比特幣在 2024 年經歷了看漲行情,而希夫則堅持認為,由於其依賴購買壓力,其長期生存能力仍不確定。

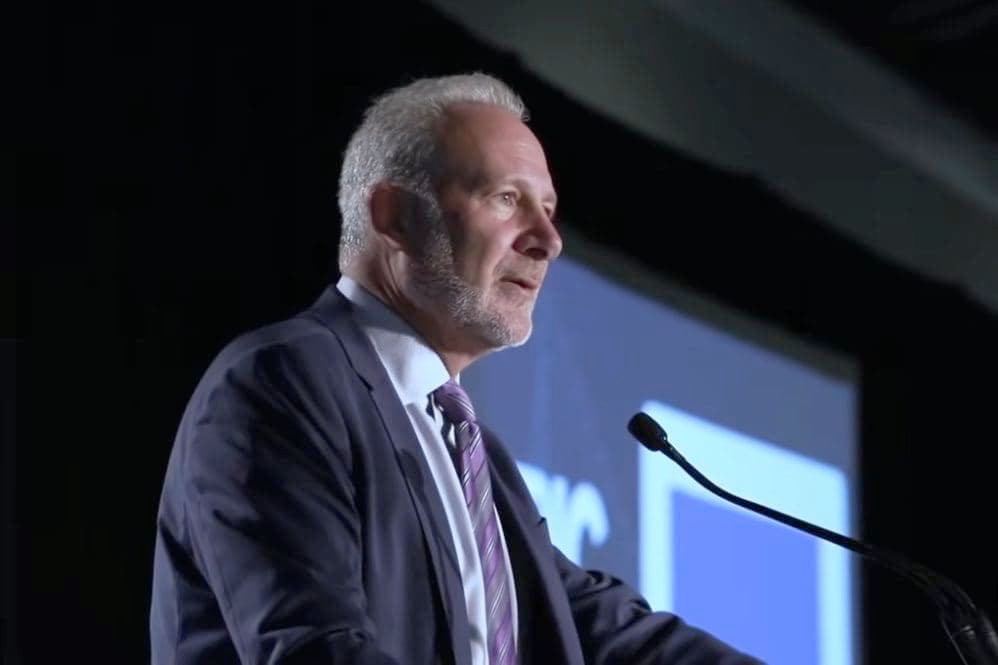

Bitcoin's Popularity Among the Youth Faces Scrutiny from Economist Peter Schiff

比特幣在年輕人中的受歡迎程度面臨經濟學家彼得·希夫的審視

Bitcoin (BTC), the pioneering cryptocurrency, has soared in value over the years, recently eclipsing the $70,000 mark in its pursuit of another all-time high. Throughout its trajectory, Bitcoin has been primarily associated with the younger generation, attributed to its digital nature.

比特幣(BTC)作為一種開創性的加密貨幣,其價值多年來一直在飆升,最近突破了 70,000 美元大關,再創歷史新高。縱觀其發展軌跡,由於其數位本質,比特幣主要與年輕一代聯繫在一起。

However, economist and outspoken Bitcoin skeptic Peter Schiff has issued a warning to young people, cautioning that their preference for the digital asset over gold could bear negative consequences in the long run.

然而,經濟學家、直言不諱的比特幣懷疑論者彼得希夫向年輕人發出警告,警告他們對數位資產而非黃金的偏好從長遠來看可能會帶來負面後果。

In a post on the social media platform X (formerly Twitter) on March 31, Schiff attributed the surge in Bitcoin's popularity among the youth primarily to "ignorance and lack of experience."

3 月 31 日,希夫在社交媒體平台 X(前身為 Twitter)上發帖,將比特幣在年輕人中的受歡迎程度飆升主要歸因於「無知和缺乏經驗」。

Schiff emphasized the significance of wisdom acquired with age, suggesting that as young investors mature, they may gravitate towards gold as a more enduring asset. "The reason young people prefer #Bitcoin to #gold, other than ignorance and lack of experience, is that during their short lifetimes, Bitcoin is up much more than gold. But by the time they gain the wisdom that comes with age, Bitcoin will have collapsed and they will prefer gold," he stated.

希夫強調了隨著年齡的增長而獲得的智慧的重要性,這表明隨著年輕投資者的成熟,他們可能會傾向於黃金作為更持久的資產。 「年輕人更喜歡#Bitcoin而不是#gold,除了無知和缺乏經驗之外,還在於在他們短暫的一生中,比特幣的漲幅遠遠超過黃金。但當他們隨著年齡的增長而獲得智慧時,比特幣將會上漲已經崩潰了,他們會更喜歡黃金,」他表示。

Notably, despite the prevalence of Bitcoin among the youth, similar demographics are also demonstrating a growing interest in precious metals. As reported by Finbold, young Chinese investors are acquiring gold bars and other gold jewelry as a means of safeguarding their wealth, particularly amidst China's ongoing regulatory scrutiny of cryptocurrencies.

值得注意的是,儘管比特幣在年輕人中很流行,但類似的人口統計數據也顯示對貴金屬的興趣日益濃厚。根據 Finbold 報道,年輕的中國投資者正在購買金條和其他黃金首飾,作為保護自己財富的手段,特別是在中國持續對加密貨幣進行監管審查的情況下。

Schiff's unwavering Bitcoin criticism aligns with his long-held advocacy for gold as a dependable store of value. Despite his ongoing skepticism, Bitcoin has experienced a bullish surge in 2024, reaching two all-time highs within a matter of days.

希夫對比特幣堅定不移的批評與他長期以來主張黃金作為可靠的價值儲存手段是一致的。儘管他一直持懷疑態度,但比特幣在 2024 年經歷了牛市飆升,在幾天之內達到了兩個歷史新高。

Nevertheless, Schiff maintains that while Bitcoin's price performance may appear impressive, its long-term viability and intrinsic value remain questionable. He argues that Bitcoin's success hinges on sustained buying pressure, rendering it a riskier investment compared to tangible assets like real estate.

儘管如此,希夫堅持認為,雖然比特幣的價格表現可能令人印象深刻,但其長期生存能力和內在價值仍然值得懷疑。他認為,比特幣的成功取決於持續的購買壓力,這使其成為與房地產等有形資產相比風險更高的投資。

Schiff has consistently asserted that Bitcoin is not an asset like real estate, which generates rental income, or stocks and bonds, which pay dividends and interest. He believes that Bitcoin's appreciation solely relies on the inflow of new buyers.

希夫一直堅稱,比特幣不像房地產那樣可以產生租金收入,也不像股票和債券那樣可以支付股息和利息。他認為,比特幣的升值完全依賴新買家的流入。

"The truth is the real success of Bitcoin rests on more people buying it. If you own it, you need to get many of your friends or colleagues to buy it because that's the only way its prices go up," Schiff remarked.

「事實是,比特幣的真正成功取決於更多的人購買它。如果你擁有它,你需要讓你的許多朋友或同事購買它,因為這是其價格上漲的唯一途徑,」希夫說。

In a previous statement, Schiff expressed regret for not purchasing Bitcoin in 2010 when it was significantly undervalued. His primary motivation at that time was to profit from its potential appreciation.

在先前的聲明中,希夫對沒有在 2010 年比特幣被嚴重低估時購買比特幣表示遺憾。他當時的主要動機是從其潛在的升值中獲利。

Schiff's warnings and skepticism towards Bitcoin serve as a reminder to investors, particularly young ones, to proceed with caution when venturing into the volatile cryptocurrency market. It is essential to conduct thorough research, consider alternative investment options, and maintain a balanced portfolio to mitigate risk.

希夫對比特幣的警告和懷疑提醒投資者,尤其是年輕人,在冒險進入動盪的加密貨幣市場時要謹慎行事。必須進行徹底的研究,考慮替代投資選擇,並保持平衡的投資組合以降低風險。

While Bitcoin's rapid ascent has captured the attention of many, it remains uncertain whether its dominance will endure in the long run. The cryptocurrency market is subject to fluctuations and unforeseen events, and investors should exercise prudence in their decision-making.

儘管比特幣的快速崛起引起了許多人的關注,但從長遠來看,其主導地位是否能持續仍不確定。加密貨幣市場存在波動和不可預見事件,投資者應謹慎決策。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- Solana 佔據 NFT 版稅市場 51% 的份額,超過以太坊

- 2024-11-07 18:10:02

- Solana 在 NFT 領域的快速崛起可歸因於其獨特的功能,特別是其低廉的交易費用和快速的處理時間。

-

-

-

-

-

-

-

-

- 導致 XRP 價格爆炸的因素

- 2024-11-07 16:25:02

- 這位分析師列出了可能導致 XRP 價格爆炸的四個因素。首先,正如美國證券交易委員會 (SEC) 的文件所示,XRP 的法律地位不再受到爭議