|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

川普的當選引發了加密貨幣市場的反彈,為多種資產注入了新的活力,甚至為那些低迷的資產帶來了新的收益。

The United States presidential election results have breathed new life into several crypto assets, driving fresh gains for even those that have experienced a slump recently. From Bitcoin (BTC) to memecoins, all-time highs and significant upticks have been recorded across the board, fueling overall increased market activity.

美國總統選舉結果為多種加密資產注入了新的活力,甚至為那些最近經歷了低迷的加密資產帶來了新的收益。從比特幣(BTC)到迷因幣,全面創下歷史新高並顯著上漲,推動了整體市場活動的增加。

As the dust settles and the victor becomes clear, here’s a closer look at how the crypto market has reacted to the Trump election win.

隨著塵埃落定,勝利者逐漸明朗,下面我們來仔細看看加密貨幣市場對川普當選的反應。

Bitcoin, Ethereum See Fresh Gains

比特幣、以太幣迎來新的漲幅

Following a period of hovering below $2,500, Ethereum has seen a surge in price. The token is trading around $2,950 at press time, thanks to a 6% increase in the last 24 hours.

在徘徊在 2,500 美元以下一段時間後,以太幣的價格出現了飆升。截至發稿時,該代幣的交易價格約為 2,950 美元,過去 24 小時內上漲了 6%。

Though modest, the gains build on a days-long positive run, bringing the token’s gains in the past week to 14%. This marks Ethereum’s highest value in over 30 days, signaling improved performance following its struggle to uphold positive momentum.

儘管漲幅不大,但其漲幅建立在連續幾天的積極運行基礎上,使該代幣在過去一周的漲幅達到 14%。這標誌著以太坊 30 多天以來的最高價值,表明其在努力維持積極勢頭後表現有所改善。

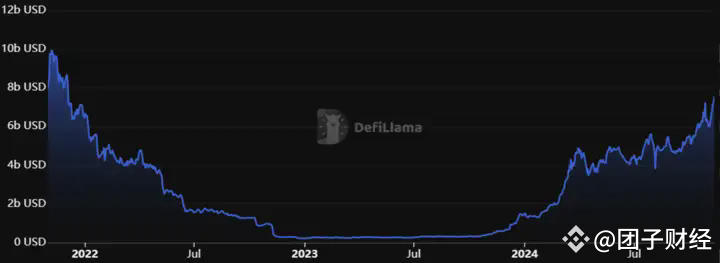

However, the token’s upward dance is not all isolated. It coincides with a surge in inflows into exchange-traded funds tied to the asset. Recently, ETH ETFs recorded almost $80 million in inflows, marking their third-highest single-day inflow since launch.

然而,代幣的上漲並非都是孤立的。同時,與該資產相關的交易所交易基金的資金流入激增。最近,ETH ETF 錄得近 8,000 萬美元的資金流入,創下自推出以來的第三高單日流入量。

The increase in inflows also marks the reversal of weeks of fund underperformance, suggesting a parallel uptick in the ETF market and Ethereum’s price performance.

資金流入的增加也標誌著基金連續幾週表現不佳的情況出現逆轉,顯示 ETF 市場和以太坊的價格表現同步上漲。

Meanwhile, Ether ETFs are not the only ones performing impressively in the exchange-traded funds world.

同時,以太坊 ETF 並不是交易所交易基金領域唯一表現出色的ETF。

Bitcoin ETFs Hit All-Time High on November 7

比特幣 ETF 於 11 月 7 日創下歷史新高

The present boost in investor confidence and overall positive market sentiment triggered an all-time high record in the Bitcoin ETF sector on November 7, when BlackRock’s Bitcoin ETF IBIT saw inflows reaching $1.12 billion.

當前投資者信心的增強和整體積極的市場情緒在 11 月 7 日觸發了比特幣 ETF 領域的歷史新高,貝萊德的比特幣 ETF IBIT 資金流入達到 11.2 億美元。

IBIT’s record inflows dominated the total $1.38 billion recorded across all issuers, evidencing increased market interest, particularly as Bitcoin surges to a new $75,000 all-time high.

IBIT 創紀錄的資金流入佔所有發行人記錄的 13.8 億美元總額的主導地位,這證明了市場興趣的增加,特別是在比特幣飆升至 75,000 美元的歷史新高之際。

Other issuers also recorded impressive inflows. These include Fidelity’s FBTC, Grayscale’s Mini Bitcoin Trust (BTC), and Ark Invest’s ARKB, which drew $190.92 million, $20.38 million, and $17.61 million, respectively.

其他發行人也錄得可觀的資金流入。其中包括 Fidelity 的 FBTC、Grayscale 的迷你比特幣信託(BTC)和 Ark Invest 的 ARKB,分別吸引了 1.9,092 億美元、2,038 萬美元和 1,761 萬美元。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

- 俄羅斯政府批准了一項對該國加密貨幣徵稅的法案

- 2024-11-13 02:15:01

- 根據該法案,數位貨幣被賦予財產地位,並引入了單獨的稅基計算,稅基定義為資產價值超過其購買或提取成本的部分。

-

- 隨著選舉集會的延長,比特幣取代白銀成為世界第八大資產

- 2024-11-13 02:15:01

- 白銀上週下跌 6.24%,市值達到 1.732 兆美元,而比特幣同期成長了約 30%。

-

-

-

- Bitwise資產管理宣布推出全球首個Aptos Stake ETP

- 2024-11-13 02:15:01

- 該金融工具將於 2024 年 11 月 19 日在瑞士第六交易所上市,股票代號為 APTB。

-