|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Solana 的代幣(SOL)從11 月5 日到11 日上漲了35%,達到222 美元的峰值,為2021 年12 月以來的最高水平。美元的歷史新高,尤其是作為機構資本隨著比特幣接近 90,000 美元,比特幣價格趨於穩定,對美國監管更明確的預期也在增長。

Solana's native token (SOL) has surged 35% from November 5 to 11, reaching a peak of $222, the highest since December 2021. The rally had traders speculating whether Bitcoin will rise to an all-time high of $260, especially as institutional capital stabilizes and expectations for clearer U.S. regulation grow following Bitcoin's approach to $90,000.

Solana 的原生代幣(SOL)從11 月5 日到11 日飆升了35%,達到222 美元的峰值,為2021 年12 月以來的最高水平。美元的歷史高點,尤其是作為機構資本隨著比特幣接近 90,000 美元,比特幣價格趨於穩定,對美國監管更加明確的預期也隨之增長。

SOL has outperformed the broader altcoin market, rising 33% in the same period ending October 11. Part of the investor optimism towards SOL can be attributed to the expanding collaborative activity on the Solana network, as measured by the total value locked (TVL).

SOL 的表現優於更廣泛的山寨幣市場,截至10 月11 日的同期上漲了33%。 ) 衡量)。

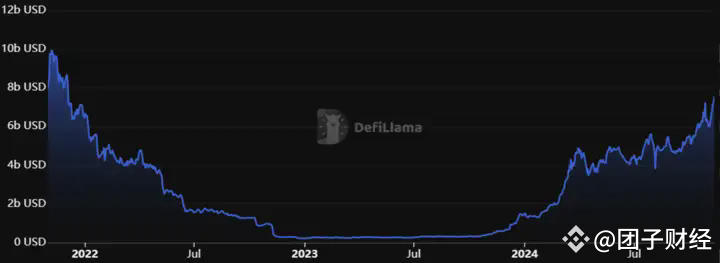

Solana's TVL increased to $7.6 billion on November 10, reaching the highest level since December 2021. Major decentralized applications (DApps) like Jito, Raydium, and Drift, along with Binance's Liquid Stake, have contributed significantly to a 36% growth in deposits.

Solana 的TVL 於11 月10 日增至76 億美元,達到2021 年12 月以來的最高水平。做出了巨大貢獻。

But Solana's activity surge isn't limited to memecoin trading.

但 Solana 的活動激增並不僅限於 memecoin 交易。

Solana has faced criticism for its reliance on memecoins, including Dogwifhat (WIF), Bonk (BONK), and Popcat (POPCAT), all of which have a market capitalization above the $1.5 billion threshold. Decentralized token creation platforms like Pump have been a key driving force behind Solana's decentralized exchange (DEX) trading volume.

Solana 因其對 memecoin 的依賴而面臨批評,其中包括 Dogwifhat (WIF)、Bonk (BONK) 和 Popcat (POPCAT),所有這些貨幣的市值均超過 15 億美元。 Pump 等去中心化代幣創建平台一直是 Solana 去中心化交易所 (DEX) 交易量背後的關鍵驅動力。

For the week ending November 2, Solana's weekly DEX trading volume surged to $17.1 billion, the highest level since March 2024, accounting for 26% of market share, surpassing Ethereum—the blockchain focused on leading DApps. Solana also charged $8.82 million in monthly fees, which is crucial for addressing network security issues.

截至11 月2 日的一周,Solana 的每週DEX 交易量飆升至171 億美元,為2024 年3 月以來的最高水平,佔市場份額的26%,超過了專注於領先DApp 的區塊鏈以太坊。 Solana 還收取 882 萬美元的月費,這對於解決網路安全問題至關重要。

Meanwhile, the Ethereum network, with a TVL seven times higher than Solana, earns $131.6 million in fees every month. Similarly, another blockchain focused on foundational scalability, Tron, has collected $49.1 million in fees over the past 30 days. These figures do not include revenue from the broader ecosystem, where Jito contributed $100.2 million and Raydium contributed $83 million.

同時,以太坊網路的 TVL 是 Solana 的 7 倍,每月賺取 1.316 億美元的費用。同樣,另一個專注於基礎可擴展性的區塊鏈 Tron 在過去 30 天內收取了 4,910 萬美元的費用。這些數字不包括更廣泛的生態系統的收入,其中 Jito 貢獻了 1.002 億美元,Raydium 貢獻了 8300 萬美元。

Evaluating platforms solely based on TVL and fees can be misleading, as not all DApps require high transaction volumes to be significant. However, these factors are critical for attracting new users, paving the way for sustainability, and increasing the demand for accumulating and using SOL.

僅根據 TVL 和費用來評估平台可能會產生誤導,因為並非所有 DApp 都需要高交易量才能達到顯著水準。然而,這些因素對於吸引新用戶、為永續發展鋪平道路以及增加累積和使用 SOL 的需求至關重要。

Magic Eden (Solana's leading NFT marketplace) recorded 77,160 active addresses in the past 30 days. In contrast, OpenSea (a similar service on the Ethereum network) had 37,940 active addresses during the same period.

Magic Eden(Solana 領先的 NFT 市場)在過去 30 天內記錄了 77,160 個活躍地址。相較之下,OpenSea(以太坊網路上的類似服務)在同一時期擁有 37,940 個活躍地址。

The data provides conclusive evidence that the Solana network has attracted users beyond the memecoin craze, suggesting that the SOL price may continue to benefit. However, it is essential to analyze SOL perpetual futures contracts to determine if traders are using excessive leverage.

這些數據提供了確鑿的證據,表明 Solana 網路已經吸引了 memecoin 熱潮之外的用戶,這表明 SOL 價格可能會繼續受益。然而,分析 SOL 永續期貨合約以確定交易者是否使用過度槓桿至關重要。

Positive funding rates indicate that long positions are paying leverage costs; in a neutral market, leverage costs typically range from 0% to 2% monthly. A recent spike to 5% on November 10 shows temporary excitement, but the latest data from November 11 indicates that leverage costs have returned to a neutral level of 1.8%.

正的資金費率顯示多頭頭寸正在支付槓桿成本;在中性市場中,每月槓桿成本通常在 0% 到 2% 之間。最近11月10日飆升至5%顯示出暫時的興奮,但11月11日的最新數據顯示槓桿成本已恢復至1.8%的中性水平。

In terms of on-chain and derivatives metrics, SOL appears poised to reach new historical highs, supported by increased network activity without signs of excessive leverage.

就鏈上和衍生性商品指標而言,SOL 似乎有望達到新的歷史高點,這得益於網路活動增加且沒有過度槓桿的跡象。

doge to $1

多吉至 1 美元

Dogecoin (DOGE) has continued to maintain strong upward momentum for four consecutive days, with prices rising nearly 50% in the past 24 hours, sparking expectations of reaching the $1 target price.

狗狗幣(DOGE)連續四天持續保持強勁上漲勢頭,過去24小時價格上漲近50%,引發達到1美元目標價的預期。

Today, DOGE has broken above $0.41 for the first time since hitting an all-time high of over $0.70 in May 2021. Data shows that over the past week, DOGE has provided investors with more than 150% returns and has nearly doubled in value over the past 30 days.

如今,DOGE 自 2021 年 5 月觸及 0.70 美元以上的歷史高點以來,首次突破 0.41 美元。數據顯示,過去一周,DOGE 為投資者提供了超過 150% 的回報,價值近一倍過去 30 天。

Futures contracts associated with DOGE have accumulated losses exceeding $68 million. This marks the largest liquidation of the token this year, with the number of open contracts approaching the highest level since April, most of which are liquidated short orders anticipating a decline in DOGE's price.

與 DOGE 相關的期貨合約累計損失超過 6,800 萬美元。這標誌著該代幣今年最大規模的清算,未平倉合約數量接近 4 月以來的最高水平,其中大部分是預計 DOGE 價格下跌而被清算的空頭訂單。

The current rally is largely driven by Musk's optimistic sentiment towards the Trump administration. Musk has discussed establishing a 'Department of Government Efficiency' (abbreviated as DOGE) to enhance the efficiency of government spending. This has sparked traders' expectations that mainstream media and retail trading circles will pay more attention to DOGE.

目前的上漲很大程度上是由馬斯克對川普政府的樂觀情緒所推動的。馬斯克曾討論建立「政府效率部」(簡稱DOGE),以提高政府支出的效率。這引發了交易者對於主流媒體和散戶交易界將更關注DOGE的預期。

Recent price trends have prompted some cryptocurrency traders to set a price target of $1 for DOGE—this target has been anticipated since the token traded

最近的價格趨勢促使一些加密貨幣交易者將 DOGE 的目標價設定為 1 美元——自從該代幣交易以來,這一目標就已被預期

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 由於造成的錯誤,一群林肯便士價值數千美元。

- 2025-04-03 13:40:12

- 今天,硬幣的一些極少數變化可能正在流通,找到一個可以帶給您大筆錢。

-

-

- 瓜達錢包評論:最好的比特幣錢包和總體最好的加密錢包

- 2025-04-03 13:35:13

- 如果您想變得環保,您需要做很多事情。如果您使用加密貨幣,這將變得更加困難。

-

- 與大多數XRP持有人不同

- 2025-04-03 13:35:13

- PALADININGING CLOUD採礦服務提供商在人群中脫穎而出,成為XRP投資者的最佳選擇。

-

- 加密交易所Kraken已在加拿大註冊為受限制的經銷商

- 2025-04-03 13:30:12

- 該註冊於週二宣布,是在需要交流的多年過程之後,以符合更高的投資者保護和治理標準。

-

- 3個加密貨幣爆炸,因為比特幣保持強大,而山寨幣則顯示出野生鞦韆

- 2025-04-03 13:30:12

- 加密價格最近在各地都在彈跳,但是一件事很明顯 - 要努力追捕穩固的項目,這是一件很明顯的錢

-

- 加密貨幣剛打電話。

- 2025-04-03 13:25:12

- BlockDag的第三個主題演講不僅丟棄更新,還觸發了資金。在僅48小時內,超過500萬美元湧入,該項目的預售總計超過2.1億美元。

-

- BlockDag(BDAG)在2025年的加密貨幣市場上占主導地位

- 2025-04-03 13:25:12

- 加密貨幣領域在2025年正在迅速發展,投資者積極尋求下一個可以帶來巨大回報的大加密貨幣。

-