|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

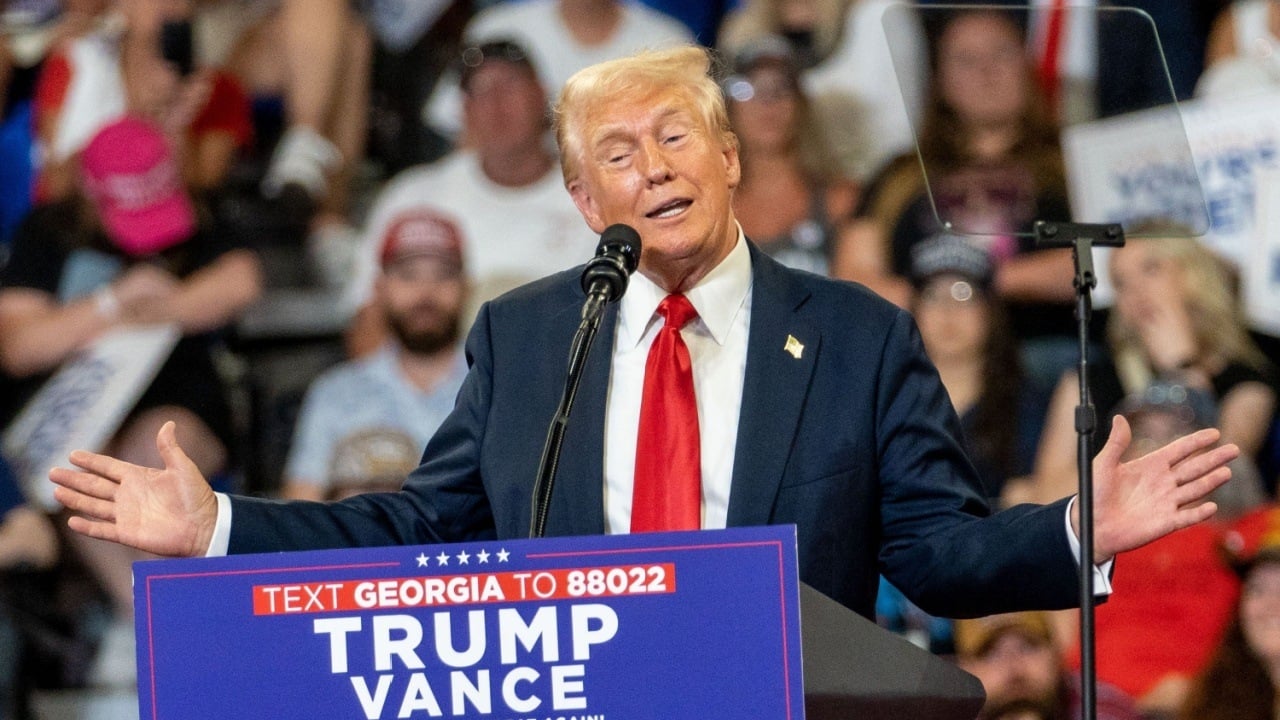

隨著下周美國總統大選的到來,市場將繼續消化川普獲勝的結果,而不僅僅是在美國。

U.S. presidential elections are just around the corner and markets seem to be pricing in a Trump victory. But not just in the U.S. A Chinese software company that builds air control programs, called Wisesoft, has seen its share prices double in the last month due to the association of its Chinese name with Trump’s victory.

美國總統大選即將來臨,市場似乎正在消化川普的勝利。但不僅僅是在美國,由於其中文名稱與川普的勝利聯繫在一起,一家名為 Wisesoft 的空中控制項目中國軟體公司的股價在上個月上漲了一倍。

But what if Trump wins and Bitcoin goes down – a so-called “Trump dump”?

但如果川普獲勝而比特幣下跌——所謂的「川普暴跌」怎麼辦?

Well, first up is Peter Schiff, who I described in this week’s episode of Token Narratives as a lamprey feeding off of Bitcoin. Ever the Bitcoin permabear, Schiff believes that since Bitcoin’s performance hasn’t shared the upward momentum of other Trump-related assets, it indicates that even if he wins Bitcoin won’t benefit.

首先是 Peter Schiff,我在本週的 Token Narratives 節目中將他描述為以比特幣為食的七鰓鰻。作為比特幣的永久看跌者,希夫認為,由於比特幣的表現並沒有分享其他與川普相關的資產的上漲勢頭,這表明即使他獲勝,比特幣也不會受益。

Thegiver, a great follow on X, laid out his Bitcoin-Trump thesis in this thread, which basically says that recent BTC inflows are sticky capital. As soon as the election is over, the money will vacate, tanking the price. Also, the kind of liquidity injections necessary to cause a significant price rise are not coming any time soon, let alone in the last quarter of this year.

Thegiver 是 X 的忠實追隨者,他在這個帖子中闡述了他的比特幣-川普論點,該論點基本上說,最近的 BTC 流入是黏性資本。一旦選舉結束,資金就會撤離,從而導致價格下跌。此外,導致價格大幅上漲所需的流動性注入不會很快出現,更不用說在今年最後一個季度了。

Finally, there’s the idea that if Trump wins and institutes tariff’s resembling his rhetoric, it will cause goods inflation for the foreseeable future until the U.S. reshores the manufacturing capacity. This could cause the Fed to pause or reverse monetary easing, which would not be good for risk assets such as Bitcoin and crypto.

最後,還有一種觀點認為,如果川普獲勝並徵收類似於他的言論的關稅,這將在可預見的未來導致商品通膨,直到美國將製造能力回流。這可能會導緻聯準會暫停或逆轉貨幣寬鬆政策,對比特幣和加密貨幣等風險資產不利。

I personally think the likelihood of a Trump victory followed by a dump is unlikely. Dare I say, markets agree.

我個人認為川普獲勝後又暴跌的可能性不大。我敢說,市場也同意這一點。

Bitcoin made significant headlines this week as it approached its all-time high, breaching $73,500 on Tuesday, just shy of the previous record set in March 2024. This surge marked the first time Bitcoin breached the $73,000 level in over seven months, reflecting strong market momentum and investor interest, particularly in light of recent institutional investments and next week’s election.

比特幣本周成為頭條新聞,接近歷史新高,週二突破73,500 美元,略低於2024 年3 月創下的上一個紀錄。強勁的市場勢頭和投資者興趣,特別是考慮到最近的機構投資和下週的選舉。

Michael Saylor’s Microstrategy, which could be characterized as an institution-like Bitcoin investment vehicle, announced a $42 billion plan to accelerate bitcoin purchases, aiming to strengthen its reserves and position itself as a leader in digital asset investment. Crypto Twitter received this news well, of course, but there were critics.

Michael Saylor 的 Microstrategy 可以被稱為類似機構的比特幣投資工具,該公司宣布了一項 420 億美元的加速比特幣購買計劃,旨在加強其儲備,並將自己定位為數位資產投資的領導者。當然,加密推特對這一消息的反應很好,但也有批評者。

While Bitcoin flirted and ultimately failed at breaking the all-time high, Ethereum did what it has done best this year – underperformed. Amidst the agony of Ethereum’s lackluster showing, I thought Jon Charbonneau’s thread on X making the case for Bitcoin’s L2 ecosystem over Ethereum’s, was really twisting the knife into Ethereum bag holders like myself.

雖然比特幣猶豫不決並最終未能突破歷史新高,但以太坊卻做了今年做得最好的事情——表現不佳。在以太坊表現平淡的痛苦中,我認為 Jon Charbonneau 在 X 上的帖子為比特幣 L2 生態系統優於以太坊提供了理由,這確實是在向像我這樣的以太坊包持有者擰刀。

Then I read Bankless’ Ryan Adams’ reply, which had me laughing in a macabre, bear-cycle kind of way. Let’s hope Ryan’s counter bet, that the ETH FUD is way overplayed, comes true!

然後我讀了 Bankless 的 Ryan Adams 的回复,這讓我以一種可怕的、熊循環的方式大笑。讓我們希望 Ryan 的反賭注,即 ETH FUD 被誇大了,能夠成真!

Adams wrote:

亞當斯寫道:

We’ve really moved to bearish [ETH] no matter what szn … like not only is Ethereum losing to Solana in every way now it’s probably going to lose all it’s L2s to Bitcoin … Counterbet: the [ETH FUD] is way overplayed and Ethereum has a dominant role in the future.

無論 szn 怎麼樣,我們確實已經轉向看跌 [ETH]……以太坊不僅在各方面都輸給了 Solana,現在它可能會失去所有 L2 給比特幣……反擊:[ETH FUD] 被誇大了,以太坊未來具有主導地位。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 查爾斯·霍斯金森提議布萊恩·阿姆斯壯在白宮監督加密貨幣政策

- 2024-11-22 03:55:02

- 據報道,當選總統唐納德·川普的過渡團隊正在考慮設立一個專門的白宮職位來監督加密貨幣政策

-

-

-

- ETF 跨越 1000 億美元的歷史里程碑

- 2024-11-22 03:55:02

- 本週三,美國批准的 12 隻比特幣現貨 ETF 管理資產總計達到 1,005.5 億美元

-

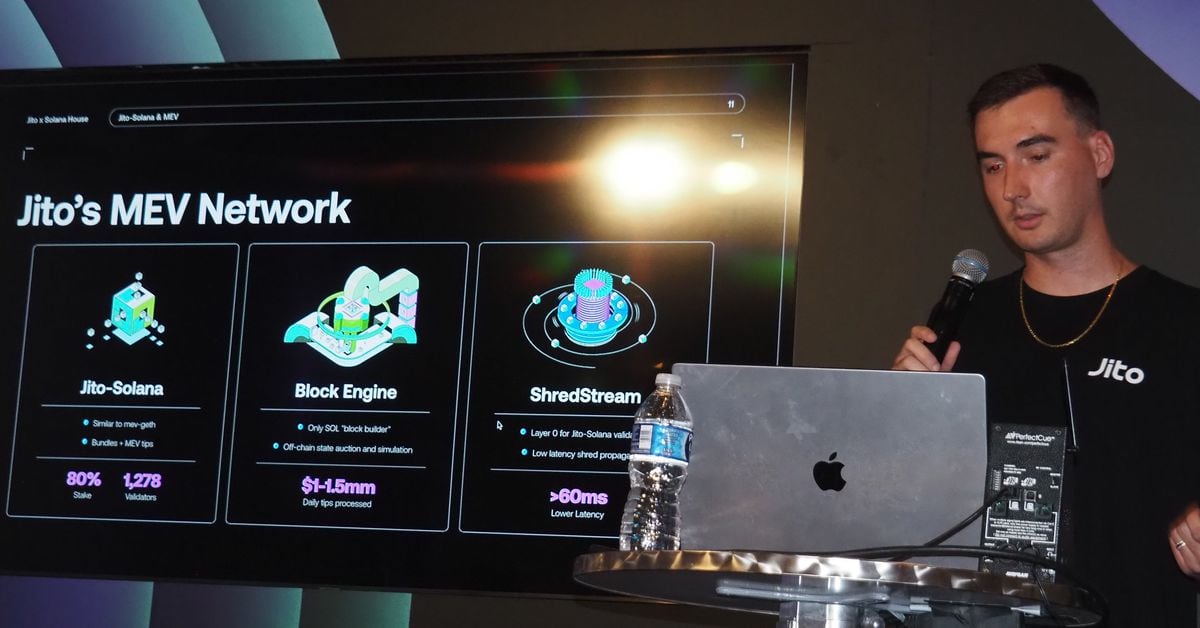

- Jito 代幣持有者將根據 TipRouter 提案獲得發薪日

- 2024-11-22 03:55:02

- Jito 經濟軌道的重組正在進行中。

-

-

-

-