|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

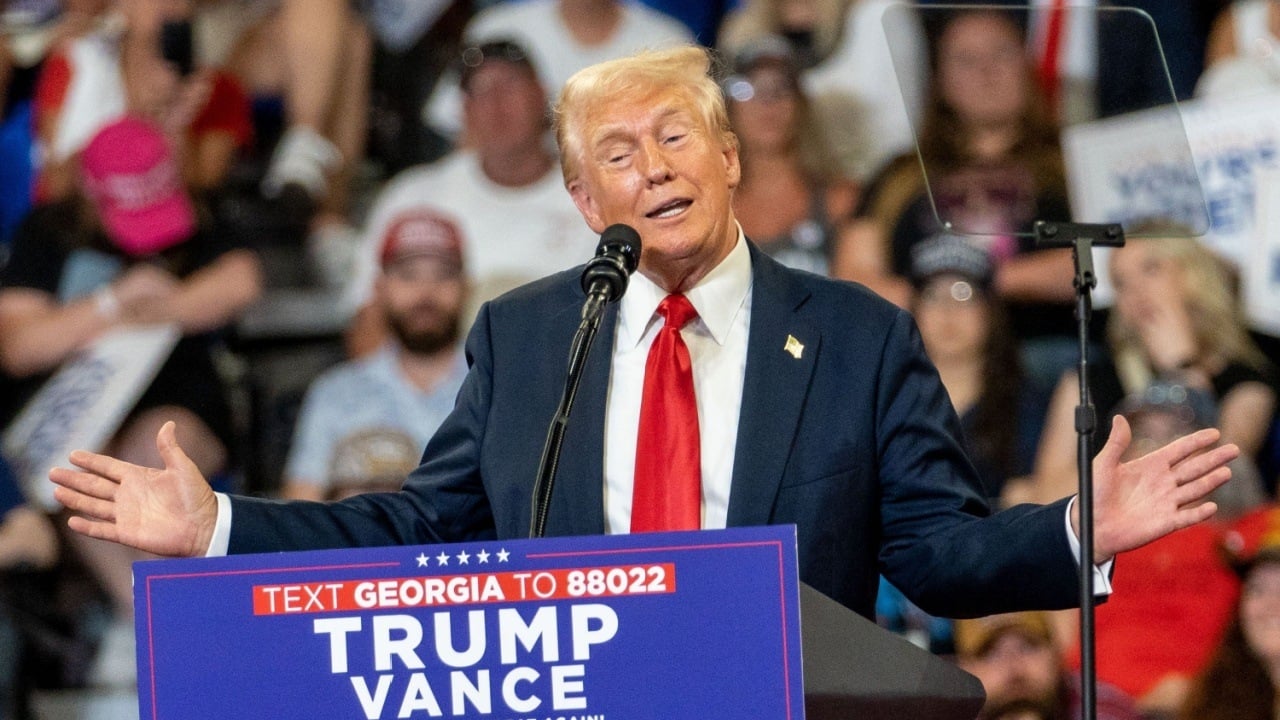

With the U.S. presidential election next week, markets continue to price in a Trump victory, not just in the U.S. either.

U.S. presidential elections are just around the corner and markets seem to be pricing in a Trump victory. But not just in the U.S. A Chinese software company that builds air control programs, called Wisesoft, has seen its share prices double in the last month due to the association of its Chinese name with Trump’s victory.

But what if Trump wins and Bitcoin goes down – a so-called “Trump dump”?

Well, first up is Peter Schiff, who I described in this week’s episode of Token Narratives as a lamprey feeding off of Bitcoin. Ever the Bitcoin permabear, Schiff believes that since Bitcoin’s performance hasn’t shared the upward momentum of other Trump-related assets, it indicates that even if he wins Bitcoin won’t benefit.

Thegiver, a great follow on X, laid out his Bitcoin-Trump thesis in this thread, which basically says that recent BTC inflows are sticky capital. As soon as the election is over, the money will vacate, tanking the price. Also, the kind of liquidity injections necessary to cause a significant price rise are not coming any time soon, let alone in the last quarter of this year.

Finally, there’s the idea that if Trump wins and institutes tariff’s resembling his rhetoric, it will cause goods inflation for the foreseeable future until the U.S. reshores the manufacturing capacity. This could cause the Fed to pause or reverse monetary easing, which would not be good for risk assets such as Bitcoin and crypto.

I personally think the likelihood of a Trump victory followed by a dump is unlikely. Dare I say, markets agree.

Bitcoin made significant headlines this week as it approached its all-time high, breaching $73,500 on Tuesday, just shy of the previous record set in March 2024. This surge marked the first time Bitcoin breached the $73,000 level in over seven months, reflecting strong market momentum and investor interest, particularly in light of recent institutional investments and next week’s election.

Michael Saylor’s Microstrategy, which could be characterized as an institution-like Bitcoin investment vehicle, announced a $42 billion plan to accelerate bitcoin purchases, aiming to strengthen its reserves and position itself as a leader in digital asset investment. Crypto Twitter received this news well, of course, but there were critics.

While Bitcoin flirted and ultimately failed at breaking the all-time high, Ethereum did what it has done best this year – underperformed. Amidst the agony of Ethereum’s lackluster showing, I thought Jon Charbonneau’s thread on X making the case for Bitcoin’s L2 ecosystem over Ethereum’s, was really twisting the knife into Ethereum bag holders like myself.

Then I read Bankless’ Ryan Adams’ reply, which had me laughing in a macabre, bear-cycle kind of way. Let’s hope Ryan’s counter bet, that the ETH FUD is way overplayed, comes true!

Adams wrote:

We’ve really moved to bearish [ETH] no matter what szn … like not only is Ethereum losing to Solana in every way now it’s probably going to lose all it’s L2s to Bitcoin … Counterbet: the [ETH FUD] is way overplayed and Ethereum has a dominant role in the future.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Former China Securities Regulatory Commission Director Yao Qian Accused of Accepting Bribes via Cryptocurrency Transactions

- Nov 22, 2024 at 09:40 am

- Yao Qian, former director at the China Securities Regulatory Commission (CSRC), has been accused of accepting bribes through cryptocurrency transactions

-

-

-

-

- Chris Giancarlo Rumors Fuel Gensler Crypto Pump: Bitcoin Price Hits $98K – But Which Meme Coin Will Hit $1?

- Nov 22, 2024 at 09:15 am

- Crypto markets are entering a frenzy following the resignation of Securities and Exchange Commission (SEC) Chairman Gary Gensler. Hyped-up volatility stemming from Chris Giancarlo rumors has seen Bitcoin price hit a new all-time high above $98K. As cat meme coins go crazy, which meme coin will hit $1?

-

-

-

- Bitcoin Nears US$100,000 as Trump Presidency Promises to Usher in Crypto Boom

- Nov 22, 2024 at 09:05 am

- Bitcoin closed in on the historic US$100 000 level, fuelled by optimism that President-elect Donald Trump’s support for crypto heralds a boom as the US pivots to friendly regulations in place of a crackdown.

-