|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

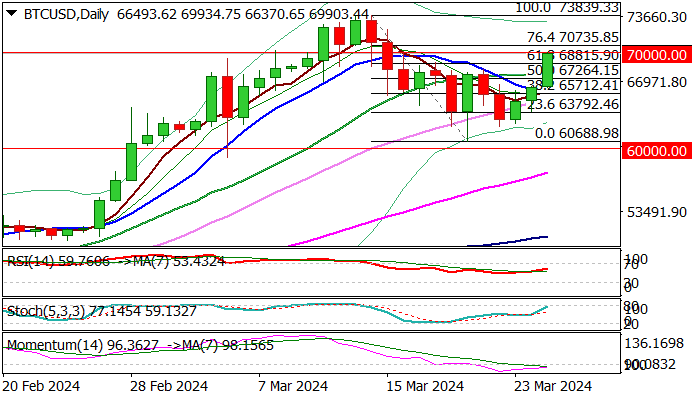

從修正低點(60688 美元)的復甦持續到第三天,週一的加速進一步表明,從新紀錄高點(73839 美元)開始的修正階段可能已經結束。

Has the Dow Jones Industrial Average Turned the Corner?

道瓊工業指數已經走出困境了嗎?

The Dow Jones Industrial Average (DJIA) has been rallying for the third consecutive day, extending its recovery from its recent correction low of $60,688. The surge on Monday has strengthened the signals that the corrective phase from its record high of $73,839 may be coming to an end.

道瓊工業指數 (DJIA) 連續第三天上漲,延續了從近期修正低點 60,688 美元的反彈勢頭。週一的飆升強化了這樣的訊號:自歷史高點 73,839 美元開始的修正階段可能即將結束。

Fibonacci Retracement and Psychological Barriers

斐波那契回檔與心理障礙

The latest advance has pushed the DJIA above the 61.8% Fibonacci retracement of the $73,839/$60,688 pullback. It is now approaching the psychological $70,000 barrier.

最新的上漲推動道瓊指數突破 73,839 美元/60,688 美元回檔的 61.8% 斐波那契回檔位。目前已逼近 7 萬美元的心理關卡。

Technical Analysis

技術分析

Improving daily technical indicators support the current rally, but the 14-day momentum remains negative, warranting caution. The broken 20-day moving average ($67,933) has turned into support, and a daily close above this level is crucial to maintain the bullish momentum.

日線技術指標改善支撐當前漲勢,但14日動能仍為負面,需謹慎。突破的 20 日移動均線(67,933 美元)已轉變為支撐位,日收盤價高於該水平對於維持看漲勢頭至關重要。

Key Levels

關鍵層級

A breakout above the $70,000 pivot would generate a positive signal for a potential retest of the $73,839 peak. Conversely, dips should remain shallow and ideally be contained by the broken 50% retracement level ($67,264). Only a decline below the 10-day moving average ($66,300) would sideline the bulls.

突破 70,000 美元支點將產生可能重新測試 73,839 美元峰值的正面訊號。相反,下跌應該保持較淺,理想情況下會被突破的 50% 回檔位(67,264 美元)所遏制。只有跌破 10 日移動均線(66,300 美元),多頭才會離場。

Resistance and Support

阻力與支撐

Resistance levels include $70,735, $71,000/72,406, and $73,839. Support levels include $68,815, $67,933, $66,300, and $65,712.

阻力位包括 70,735 美元、71,000 美元/72,406 美元和 73,839 美元。支撐位包括 68,815 美元、67,933 美元、66,300 美元和 65,712 美元。

Conclusion

結論

The DJIA's recent rally suggests that the corrective phase may be nearing its end. However, caution is warranted as the negative momentum remains. A daily close above the 20-day moving average and a breakout above $70,000 would strengthen the bullish case. Dips should be shallow and ideally contained above the 50% retracement level. Only a decline below the 10-day moving average would indicate a setback for the bulls.

道瓊指數最近的反彈顯示修正階段可能已接近尾聲。然而,由於負面勢頭依然存在,因此需要謹慎行事。每日收盤價高於 20 日移動均線且突破 70,000 美元將強化看漲理由。下跌應該是淺的,並且最好控制在 50% 回撤水平之上。只有跌破 10 日移動均線才表示多頭受挫。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 快速跟踪的臨時加密監管框架可以在美國加密貨幣行業內加強創新

- 2025-04-12 12:40:13

- 這可能是SEC尋求“長期解決方案”的短期答案,在SEC成員和加密行業高管的圓桌會議上

-

- 特朗普模因硬幣向其團隊解鎖了價值3.216億美元的代幣

- 2025-04-12 12:40:13

- 特朗普在就職之前提出的特朗普模因硬幣背後的成員將獲得價值3.216億美元的代幣解鎖

-

- 本週要購買的Altcoins的最終清單(每天更新)

- 2025-04-12 12:35:14

- 隨著加密貨幣空間嗡嗡作響和主要的高壓動力移動,在此陣容中跳出來可能會感到非常遺憾。

-

- 日本金融服務局建立了監管系統來對數字資產進行分類

- 2025-04-12 12:35:14

- 日本金融服務局建立了一個監管系統,該制度對兩個不同類別之間的數字資產進行了分類。

-

-

- 加密貨幣中的新潮汐浪潮:特朗普硬幣釋放

- 2025-04-12 12:30:14

- 在政治和加密貨幣的十字路口,自稱為模因硬幣即將再次激發市場。唐納德·特朗普總統隨著特朗普硬幣的推出進入數字貨幣領域

-

-

-

- 立即購買的頂級模因硬幣:Hege,Coco Coin和Maneki

- 2025-04-12 12:20:13

- 455%的增長,312%的年收益和每日17%的共同點有什麼共同點?

![otaku的加密貨幣 - 加密混亂! 83k比特幣!加密集會! XCN,茉莉,swftc鉛! ! ! [第228集] otaku的加密貨幣 - 加密混亂! 83k比特幣!加密集會! XCN,茉莉,swftc鉛! ! ! [第228集]](/uploads/2025/04/12/cryptocurrencies-news/videos/crypto-otaku-crypto-chaos-k-bitcoin-crypto-rally-xcn-jasmy-swftc-lead-episode/image-1.webp)