|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

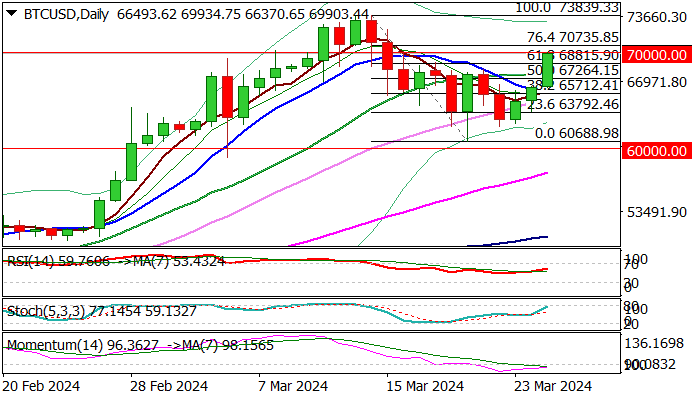

从修正低点(60688 美元)的复苏持续到第三天,周一的加速进一步表明,从新纪录高点(73839 美元)开始的修正阶段可能已经结束。

Has the Dow Jones Industrial Average Turned the Corner?

道琼斯工业平均指数已经走出困境了吗?

The Dow Jones Industrial Average (DJIA) has been rallying for the third consecutive day, extending its recovery from its recent correction low of $60,688. The surge on Monday has strengthened the signals that the corrective phase from its record high of $73,839 may be coming to an end.

道琼斯工业平均指数 (DJIA) 连续第三天上涨,延续了从近期修正低点 60,688 美元的反弹势头。周一的飙升强化了这样的信号:自历史高点 73,839 美元开始的修正阶段可能即将结束。

Fibonacci Retracement and Psychological Barriers

斐波那契回撤和心理障碍

The latest advance has pushed the DJIA above the 61.8% Fibonacci retracement of the $73,839/$60,688 pullback. It is now approaching the psychological $70,000 barrier.

最新的上涨推动道指突破 73,839 美元/60,688 美元回调的 61.8% 斐波那契回撤位。目前已逼近 70,000 美元的心理关口。

Technical Analysis

技术分析

Improving daily technical indicators support the current rally, but the 14-day momentum remains negative, warranting caution. The broken 20-day moving average ($67,933) has turned into support, and a daily close above this level is crucial to maintain the bullish momentum.

日线技术指标改善支撑当前涨势,但14日动能仍为负面,需谨慎。突破的 20 日移动均线(67,933 美元)已转变为支撑位,日收盘价高于该水平对于维持看涨势头至关重要。

Key Levels

关键级别

A breakout above the $70,000 pivot would generate a positive signal for a potential retest of the $73,839 peak. Conversely, dips should remain shallow and ideally be contained by the broken 50% retracement level ($67,264). Only a decline below the 10-day moving average ($66,300) would sideline the bulls.

突破 70,000 美元支点将产生一个可能重新测试 73,839 美元峰值的积极信号。相反,下跌应该保持较浅,理想情况下会被突破的 50% 回撤位(67,264 美元)所遏制。只有跌破 10 日移动均线(66,300 美元),多头才会离场。

Resistance and Support

阻力与支撑

Resistance levels include $70,735, $71,000/72,406, and $73,839. Support levels include $68,815, $67,933, $66,300, and $65,712.

阻力位包括 70,735 美元、71,000 美元/72,406 美元和 73,839 美元。支撑位包括 68,815 美元、67,933 美元、66,300 美元和 65,712 美元。

Conclusion

结论

The DJIA's recent rally suggests that the corrective phase may be nearing its end. However, caution is warranted as the negative momentum remains. A daily close above the 20-day moving average and a breakout above $70,000 would strengthen the bullish case. Dips should be shallow and ideally contained above the 50% retracement level. Only a decline below the 10-day moving average would indicate a setback for the bulls.

道指最近的反弹表明修正阶段可能已接近尾声。然而,由于负面势头依然存在,因此需要谨慎行事。每日收盘价高于 20 日移动均线且突破 70,000 美元将强化看涨理由。下跌应该是浅的,并且最好控制在 50% 回撤水平之上。只有跌破 10 日移动均线才表明多头受挫。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 快速跟踪的临时加密监管框架可以在美国加密货币行业内加强创新

- 2025-04-12 12:40:13

- 这可能是SEC寻求“长期解决方案”的短期答案,在SEC成员和加密行业高管的圆桌会议上

-

- 特朗普模因硬币向其团队解锁了价值3.216亿美元的代币

- 2025-04-12 12:40:13

- 特朗普在就职之前提出的特朗普模因硬币背后的成员将获得价值3.216亿美元的代币解锁

-

- 本周要购买的Altcoins的最终清单(每天更新)

- 2025-04-12 12:35:14

- 随着加密货币空间嗡嗡作响和主要的高压动力移动,在此阵容中跳出来可能会感到非常遗憾。

-

- 日本金融服务局建立了监管系统来对数字资产进行分类

- 2025-04-12 12:35:14

- 日本金融服务局建立了一个监管系统,该制度对两个不同类别之间的数字资产进行了分类。

-

-

- 加密货币中的新潮汐浪潮:特朗普硬币释放

- 2025-04-12 12:30:14

- 在政治和加密货币的十字路口,自称为模因硬币即将再次激发市场。唐纳德·特朗普总统随着特朗普硬币的推出进入数字货币领域

-

-

-

- 立即购买的顶级模因硬币:Hege,Coco Coin和Maneki

- 2025-04-12 12:20:13

- 455%的增长,312%的年收益和每日17%的共同点有什么共同点?

![otaku的加密货币 - 加密混乱! 83k比特币!加密集会! XCN,茉莉,swftc铅!!! [第228集] otaku的加密货币 - 加密混乱! 83k比特币!加密集会! XCN,茉莉,swftc铅!!! [第228集]](/uploads/2025/04/12/cryptocurrencies-news/videos/crypto-otaku-crypto-chaos-k-bitcoin-crypto-rally-xcn-jasmy-swftc-lead-episode/image-1.webp)