|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Has the Dow Jones Industrial Average Hit the Reset Button?

Mar 26, 2024 at 01:02 am

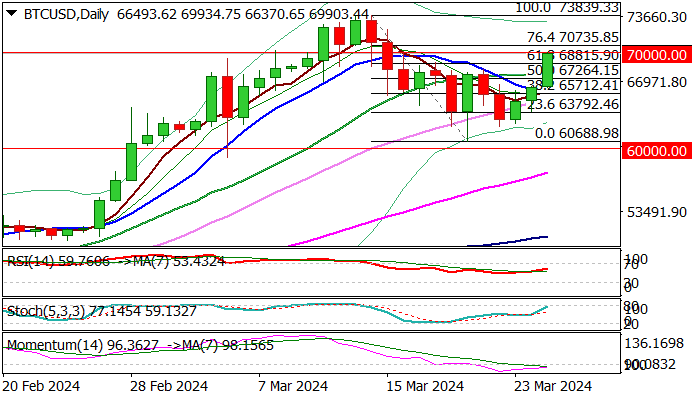

Recovery from the correction low ($60688) continues into its third day, with Monday's acceleration adding to indications that the corrective phase from the new record high ($73839) may be over.

Has the Dow Jones Industrial Average Turned the Corner?

The Dow Jones Industrial Average (DJIA) has been rallying for the third consecutive day, extending its recovery from its recent correction low of $60,688. The surge on Monday has strengthened the signals that the corrective phase from its record high of $73,839 may be coming to an end.

Fibonacci Retracement and Psychological Barriers

The latest advance has pushed the DJIA above the 61.8% Fibonacci retracement of the $73,839/$60,688 pullback. It is now approaching the psychological $70,000 barrier.

Technical Analysis

Improving daily technical indicators support the current rally, but the 14-day momentum remains negative, warranting caution. The broken 20-day moving average ($67,933) has turned into support, and a daily close above this level is crucial to maintain the bullish momentum.

Key Levels

A breakout above the $70,000 pivot would generate a positive signal for a potential retest of the $73,839 peak. Conversely, dips should remain shallow and ideally be contained by the broken 50% retracement level ($67,264). Only a decline below the 10-day moving average ($66,300) would sideline the bulls.

Resistance and Support

Resistance levels include $70,735, $71,000/72,406, and $73,839. Support levels include $68,815, $67,933, $66,300, and $65,712.

Conclusion

The DJIA's recent rally suggests that the corrective phase may be nearing its end. However, caution is warranted as the negative momentum remains. A daily close above the 20-day moving average and a breakout above $70,000 would strengthen the bullish case. Dips should be shallow and ideally contained above the 50% retracement level. Only a decline below the 10-day moving average would indicate a setback for the bulls.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- The Crypto Market's Been Cooking Up Fresh Narratives This Year—from Bitcoin Crossing All-Time Highs to Solana's Gasless Memecoin Mania

- Apr 12, 2025 at 12:30 pm

- The crypto market's been cooking up fresh narratives this year—from Bitcoin crossing all-time highs to Solana's gasless memecoin mania. But here's what's flying under the radar

-

-

- Today, the broader cryptocurrency market experienced a significant sell-off, erasing $314.69 million in liquidations.

- Apr 12, 2025 at 12:25 pm

- Today, the broader cryptocurrency market experienced a significant sell-off, erasing $314.69 million in liquidations. According to metrics shared by Phoenix Group, a total of 108138 traders were liquidated

-

-

-

-

![Crypto Otaku - CRYPTO CHAOS! 83K BITCOIN! CRYPTO RALLY!! XCN , JASMY , SWFTC LEAD!!! [Episode 228] Crypto Otaku - CRYPTO CHAOS! 83K BITCOIN! CRYPTO RALLY!! XCN , JASMY , SWFTC LEAD!!! [Episode 228]](/uploads/2025/04/12/cryptocurrencies-news/videos/crypto-otaku-crypto-chaos-k-bitcoin-crypto-rally-xcn-jasmy-swftc-lead-episode/image-1.webp)