|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

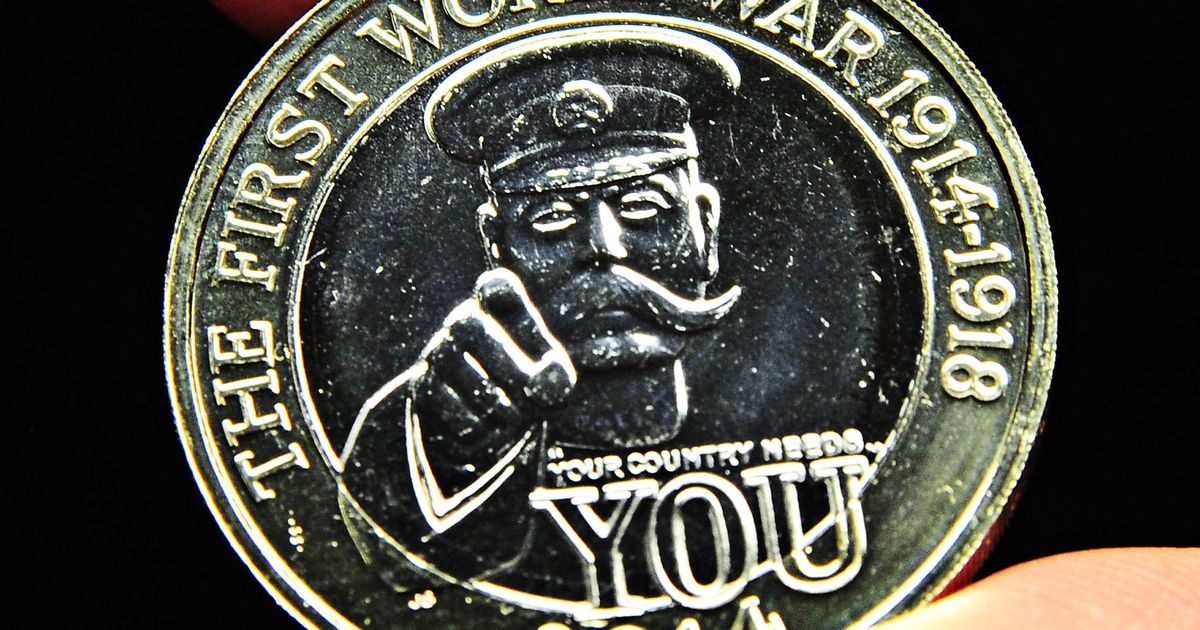

在約翰·格里沙姆小說中典型的誘騙行動中,美國證券交易委員會指控 ZM Quant Investment Ltd.(一家英屬維京群島實體)操縱市場並提供未經註冊的證券。

The SEC has recently taken several enforcement actions against companies and individuals involved in manipulating the markets for crypto assets that are offered and sold as securities. These actions highlight the SEC’s focus on protecting investors from fraud and market misconduct in the digital asset space.

美國證券交易委員會最近對參與操縱作為證券提供和出售的加密資產市場的公司和個人採取了幾項執法行動。這些行動凸顯了 SEC 致力於保護投資者免受數位資產領域的詐欺和市場不當行為的影響。

In one case, the SEC charged ZM Quant Investment Ltd., a British Virgin Islands entity, and two of its employees with manipulating the markets for several crypto assets, including Saitama Inu and SaitaRealty. The SEC alleges that ZM Quant engaged in wash trading and other deceptive practices to artificially inflate the price and trading volume of its clients’ tokens.

在一個案例中,美國證券交易委員會指控英屬維京群島實體 ZM Quant Investment Ltd. 及其兩名員工操縱多種加密資產的市場,其中包括 Saitama Inu 和 SaitaRealty。 SEC 指控 ZM Quant 從事清洗交易和其他欺騙行為,人為抬高客戶代幣的價格和交易量。

According to the SEC's complaint, ZM Quant was also involved in an undercover operation with NexFundAI, a fictitious crypto project created by the FBI. During the sting, ZM Quant agreed to generate artificial trading volume to boost the token’s appeal, unaware it was part of an active federal investigation.

根據 SEC 的投訴,ZM Quant 也參與了 NexFundAI(FBI 創建的虛構加密項目)的臥底行動。在誘騙期間,ZM Quant 同意產生人為交易量以提高代幣的吸引力,但不知道這是正在進行的聯邦調查的一部分。

The SEC’s complaint further alleges that ZM Quant’s manipulative trading practices led to extreme, unsustainable spikes in trading volume for several tokens, including Saitama Inu and SaitaRealty. In the case of SaitaReality, the trading volume increased from de minimis levels to quadrillions of individual trades and billions of dollars in daily volume within 24 hours. As a result of ZM Quant's manipulative trading, SaitaRealty saw a 412,000,000,000 percent increase in transaction quantity.

SEC 的投訴進一步指控 ZM Quant 的操縱交易行為導致包括 Saitama Inu 和 SaitaRealty 在內的多種代幣交易量出現極端且不可持續的激增。以 SaitaReality 為例,交易量在 24 小時內從最低水準增加到千萬億個單筆交易和數十億美元的每日交易量。由於ZM Quant的操縱交易,SaitaRealty的交易量增加了412,000,000,000%。

The SEC's complaint seeks permanent injunctions to prevent further investor harm and outlines the ongoing threat posed by such deceptive market practices.

美國證券交易委員會的投訴尋求永久性禁令,以防止投資者受到進一步傷害,並概述了此類欺騙性市場行為所構成的持續威脅。

In another enforcement action, the SEC charged Gotbit Consulting LLC, a Belize-based entity, and its employee Vy Pham with orchestrating a market manipulation scheme involving the crypto asset “Robo Inu.” The SEC alleges that Gotbit, a self-proclaimed market maker, created a deceptive trading environment for Robo Inu, aiming to lure retail investors into buying the token by fabricating the illusion of a vibrant market.

在另一項執法行動中,美國證券交易委員會指控總部位於伯利茲的實體 Gotbit Consulting LLC 及其員工 Vy Pham 策劃了涉及加密資產「Robo Inu」的市場操縱計劃。 SEC 指控,自稱做市商的 Gotbit 為 Robo Inu 創造了欺騙性的交易環境,旨在透過製造市場活躍的假象來吸引散戶投資者購買該代幣。

According to the SEC's complaint, Pham enlisted Gotbit for what can be described as “market manipulation-as-a-service.” Gotbit allegedly used wash trading to inflate the trading volume of Robo Inu, making it appear far more popular than it was. The scheme, powered by trading algorithms and bots, at times generated over $1 million in fake trading volume per day, misleading investors into believing in the asset's legitimacy and market demand.

根據 SEC 的投訴,Pham 招募 Gotbit 的目的是所謂的「市場操縱即服務」。據稱,Gotbit 使用清洗交易來誇大 Robo Inu 的交易量,使其看起來比實際更受歡迎。該計劃由交易演算法和機器人驅動,有時每天會產生超過 100 萬美元的虛假交易量,誤導投資者相信該資產的合法性和市場需求。

As evidence of Gotbit's bad faith, the SEC noted that “[i]n pitching their market-manipulation services to potential clients, Gotbit employees touted their ability to pump a token’s price and volume and explained how much token offerors stood to profit from this market manipulation.”

作為Gotbit 惡意的證據,美國證券交易委員會指出,「在向潛在客戶推銷其市場操縱服務時,Gotbit 員工吹捧他們推高代幣價格和交易量的能力,並解釋了代幣發行者可以從這個市場中獲利多少”操縱。”

The SEC's complaint alleges that Gotbit's market manipulation scheme ultimately deceived investors into buying Robo Inu at inflated prices, causing them to suffer losses when the scheme collapsed.

美國證券交易委員會的投訴稱,Gotbit 的市場操縱計畫最終欺騙投資者以虛高的價格購買 Robo Inu,導致他們在該計畫失敗時蒙受損失。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

-

- 比特幣(BTC)價格預測:漲勢會持續嗎?

- 2024-11-15 00:20:02

- 11 月 14 日星期四,比特幣 (BTC) 交易價格為 91,200 美元,今年迄今漲幅達 115%。

-

-

-

-