|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

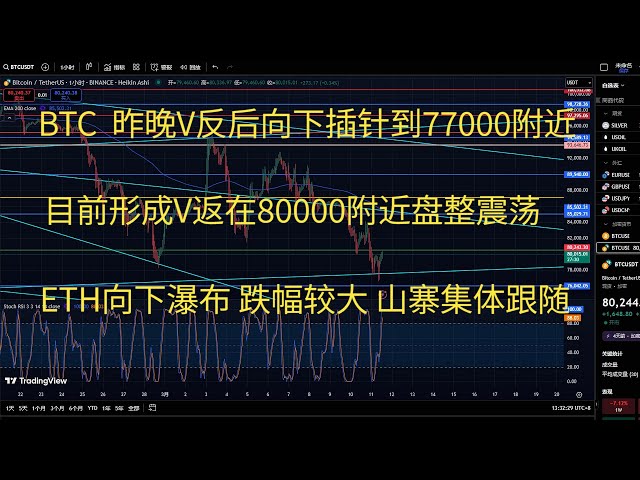

週三超過 5% 的跌幅將最大的數位資產推向 10 萬美元,這是一個備受關注的水平。

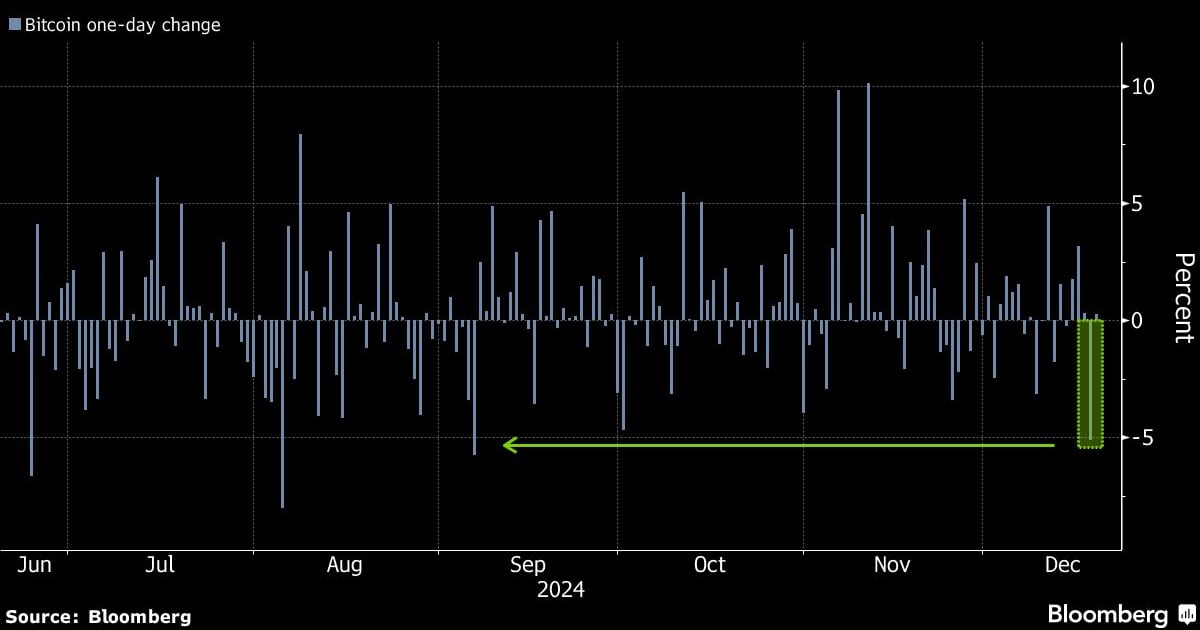

Bitcoin sank the most in more than three months as part of a broader sell-off in speculative assets after the Federal Reserve signaled a more cautious approach to future interest-rate cuts.

在聯準會暗示對未來降息採取更加謹慎的態度之後,作為投機性資產更廣泛拋售的一部分,比特幣創下了三個多月以來的最大跌幅。

The more than 5% drop on Wednesday brought the largest digital asset closer to the key $100,000 level. Bitcoin traded at $100,230 by 7:51 a.m. Thursday in Singapore, while other major tokens including Ether, XRP and meme-crowd favorite Dogecoin also slid.

週三超過 5% 的跌幅使最大的數位資產接近 10 萬美元的關鍵水平。截至週四上午 7:51,新加坡比特幣交易價格為 100,230 美元,而其他主要代幣,包括以太幣、XRP 和深受大眾喜愛的狗狗幣也出現下滑。

Fed officials lowered borrowing costs for a third consecutive meeting but scaled back the number of cuts they expect in 2025. Chair Jerome Powell said further progress on inflation is needed before they can proceed with more rate reductions.

聯準會官員連續第三次會議降低借貸成本,但縮減了他們預期的 2025 年降息次數。

The outcome of the Fed meeting shouldn’t have surprised investors who were watching “the recent run of warm US inflation and activity data,” IG Australia Pty Market Analyst Tony Sycamore wrote in a note. “However, it has served as the catalyst to wash away some of the speculative excesses that flowed into risk assets, including stocks and Bitcoin, following the US election,” he said.

IG Australia Pty市場分析師 Tony Sycamore在一份報告中寫道,聯準會會議的結果不應讓關注「近期美國通膨和活動數據強勁」的投資者感到意外。 「然而,在美國大選之後,它成為了沖走一些流入風險資產(包括股票和比特幣)的過度投機行為的催化劑,」他說。

A dollar gauge surged while global stocks and bonds slid following the Fed decision. A spat over a funding bill added to nerves by raising the risk of a partial US government shutdown. US equity futures wavered early Thursday.

聯準會決定後,美元指數飆升,而全球股市和債券下跌。圍繞一項融資法案的爭吵增加了美國政府部分關閉的風險,加劇了人們的緊張情緒。美國股指期貨週四早盤波動。

Bitcoin is up 50% since the Nov. 5 election and hit a record high of $108,316 earlier this week, buoyed by President-elect Donald Trump’s pledge to unfetter crypto in the US from regulatory shackles. The Republican has also backed the idea of creating a national strategic stockpile of the original cryptocurrency.

自11 月5 日大選以來,比特幣價格上漲了50%,並在本週稍早創下了108,316 美元的歷史新高,這得益於當選總統唐納德·川普承諾讓美國加密貨幣擺脫監管束縛。這位共和黨人還支持創建原始加密貨幣國家戰略儲備的想法。

“All signs point to a good floor and outlook for Bitcoin” even if some traders were disappointed about the Fed meeting and took profits, said Paul Veradittakit, a managing partner at Pantera Capital.

Pantera Capital 執行合夥人 Paul Veradittkit 表示,“所有跡像都表明比特幣的底部和前景良好”,儘管一些交易員對聯準會會議感到失望並獲利了結。

Trump’s embrace of crypto has overshadowed warnings about stretched momentum and the lack of any traditional valuation tethers. President Joe Biden’s outgoing administration imposed a clampdown on the industry in the wake of a deep market rout in 2022 that exposed risky practices and fraud.

川普對加密貨幣的擁抱掩蓋了有關勢頭疲軟和缺乏任何傳統估值束縛的警告。 2022 年市場嚴重暴跌,風險行為和詐欺行為暴露無遺,之後,喬·拜登總統即將卸任的政府對該行業實施了打壓。

--With assistance from Olga Kharif.

——在奧爾加·卡里夫的協助下。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 病毒視頻顯示了恒河水從河岸消退後如何發掘金,銀和硬幣

- 2025-03-12 03:10:49

- 病毒式視頻顯示了恒河水從河岸消退後如何發掘金,銀和硬幣。

-

-

- LEDGITY收益率和連鎖鏈接實驗室宣布擁有獨家X空間

- 2025-03-12 03:10:49

- RWA代表在區塊鏈上具有標誌性的有形資產(房地產,債券,商品)。它們提高了投資的流動性,可及性和透明度

-

-

-

- 雷的硬幣和郵票 - 硬幣收集的遺產

- 2025-03-12 03:10:49

- 2024年11月22日,我收到了有關硬幣文章的第一封信。發送這封信的善良紳士給了我我收藏中最古老的硬幣。

-

- 加密鯨累積樂觀(OP),運動(移動)和瑪瑙幣(XCN)

- 2025-03-12 03:10:49

- 加密鯨一直在積累樂觀(OP),移動(移動)和Onyxcoin(XCN),儘管最近的市場進行了糾正,但仍有信號。

-

-