|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Sinks the Most in More Than Three Months After Fed Signals Caution

Dec 19, 2024 at 08:11 am

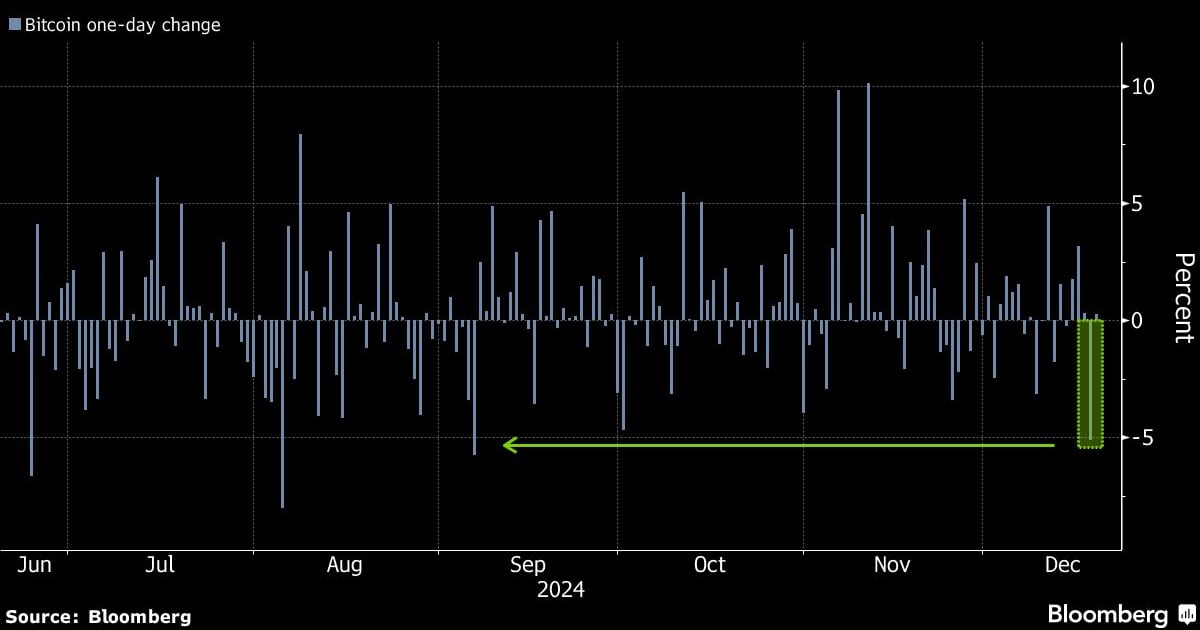

The more than 5% drop on Wednesday pushed the largest digital asset toward $100,000, a closely watched level.

Bitcoin sank the most in more than three months as part of a broader sell-off in speculative assets after the Federal Reserve signaled a more cautious approach to future interest-rate cuts.

The more than 5% drop on Wednesday brought the largest digital asset closer to the key $100,000 level. Bitcoin traded at $100,230 by 7:51 a.m. Thursday in Singapore, while other major tokens including Ether, XRP and meme-crowd favorite Dogecoin also slid.

Fed officials lowered borrowing costs for a third consecutive meeting but scaled back the number of cuts they expect in 2025. Chair Jerome Powell said further progress on inflation is needed before they can proceed with more rate reductions.

The outcome of the Fed meeting shouldn’t have surprised investors who were watching “the recent run of warm US inflation and activity data,” IG Australia Pty Market Analyst Tony Sycamore wrote in a note. “However, it has served as the catalyst to wash away some of the speculative excesses that flowed into risk assets, including stocks and Bitcoin, following the US election,” he said.

A dollar gauge surged while global stocks and bonds slid following the Fed decision. A spat over a funding bill added to nerves by raising the risk of a partial US government shutdown. US equity futures wavered early Thursday.

Bitcoin is up 50% since the Nov. 5 election and hit a record high of $108,316 earlier this week, buoyed by President-elect Donald Trump’s pledge to unfetter crypto in the US from regulatory shackles. The Republican has also backed the idea of creating a national strategic stockpile of the original cryptocurrency.

“All signs point to a good floor and outlook for Bitcoin” even if some traders were disappointed about the Fed meeting and took profits, said Paul Veradittakit, a managing partner at Pantera Capital.

Trump’s embrace of crypto has overshadowed warnings about stretched momentum and the lack of any traditional valuation tethers. President Joe Biden’s outgoing administration imposed a clampdown on the industry in the wake of a deep market rout in 2022 that exposed risky practices and fraud.

--With assistance from Olga Kharif.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- More and more Ethereum (ETH) investors are setting their sights on Mutuum Finance (MUTM) as a fresh DeFi alternative

- Mar 12, 2025 at 03:05 pm

- Rather than traditional staking or yield farming, these investors are drawn to Mutuum’s innovative lending protocol, which allows them to earn passive returns

-

-

-

-

-