|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

儘管 10 月是加密資產歷史上表現強勁的月份,但期權交易員預計未來幾週將進一步下跌,選舉後將出現反彈

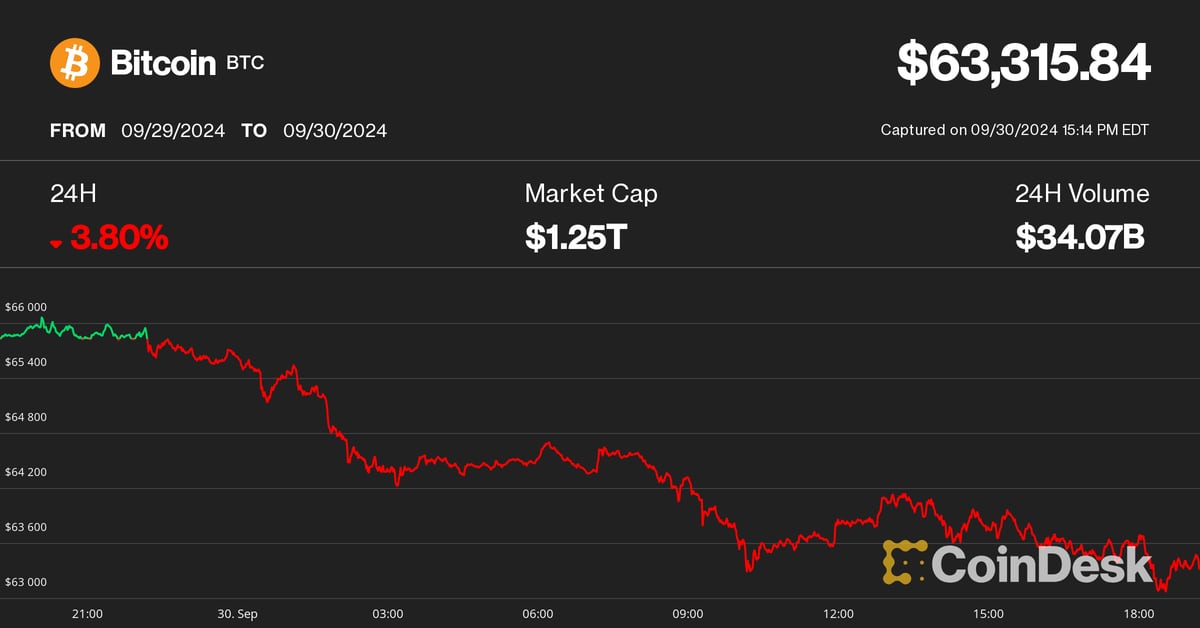

Cryptocurrencies fell sharply on Monday with bitcoin (BTC) nearing the $63,000 level during the U.S. session, finishing on a sour note of what otherwise was a surprisingly stellar September for digital assets.

週一,加密貨幣大幅下跌,比特幣 (BTC) 在美國交易時段接近 63,000 美元水平,在數位資產令人驚訝的 9 月收盤時表現不佳。

BTC dipped 3.7% over the past 24 hours, while ether (ETH) and solana (SOL) held up relatively well with 2.8% and 1.9% declines, respectively. Several altcoin majors in the broad-market CoinDesk 20 index tumbled more than 5% during the same period, including Ripple (XRP), Cardano (ADA), Polkadot (DOT) and Chainlink (LINK).

BTC 在過去 24 小時內下跌了 3.7%,而以太坊 (ETH) 和 solana (SOL) 則表現相對較好,分別下跌了 2.8% 和 1.9%。大市場 CoinDesk 20 指數中的幾個主要山寨幣同期下跌超過 5%,包括 Ripple (XRP)、Cardano (ADA)、Polkadot (DOT) 和 Chainlink (LINK)。

Crypto-related stocks also got slammed lower, with multiple bitcoin miners including Marathon Digital (MARA), Bitdeer (BTDR), Hut 8 (HUT) and CleanSpark (CLSK) plunging 5%-10%. Crypto exchange Coinbase (COIN) fell over 6%, while MicroStrategy (MSTR) was more than 3% lower shortly before the close of trade.

加密相關股票也大幅下跌,包括 Marathon Digital (MARA)、Bitdeer (BTDR)、Hut 8 (HUT) 和 CleanSpark (CLSK) 在內的多家比特幣礦工暴跌 5%-10%。加密貨幣交易所 Coinbase (COIN) 下跌超過 6%,而 MicroStrategy (MSTR) 在收盤前不久下跌超過 3%。

A glance at traditional markets showed U.S. equity indexes flatlining for most of the day before heading lower towards the later hours of the session, while key European markets sold off 1%-2%.

縱觀傳統市場,美國股指當天大部分時間持平,隨後在盤中尾盤走低,而歐洲主要市場則下跌 1%-2%。

Meanwhile, Japan's incoming prime minister Shigeru Ishiba said that "monetary policy must remain accommodative as a trend," according to a Reuters report. His comments came after his surprise weekend elevation to the PM role set off a 5% plunge in the Nikkei on Monday.

同時,根據路透社報道,日本即將上任的首相石破茂表示,「貨幣政策必須保持寬鬆的趨勢」。在他發表上述言論之前,他週末出人意料地晉升為總理,導致週一日經指數暴跌 5%。

In the U.S., Federal Reserve Chair Jerome Powell tempered expectations on Monday that future rate cuts will be as aggressive as September's 50 basis point cut.

在美國,聯準會主席鮑威爾週一緩和了未來降息幅度將與 9 月降息 50 個基點一樣激進的預期。

“Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance. But we are not on any preset course,” Powell said. “The risks are two-sided, and we will continue to make our decisions meeting by meeting.”

「展望未來,如果經濟大體按照預期發展,政策將隨著時間的推移轉向更中性的立場。但我們沒有走任何預設路線,」鮑威爾說。 “風險是雙向的,我們將繼續在一次又一次的會議上做出決定。”

When might bitcoin truly break out?

比特幣什麼時候才能真正爆發?

Even with today's dip in crypto prices, bitcoin is on track to finish with a solid positive return in September despite its reputation for being an adverse month. BTC was up just shy of 7% through the month at prices a few hours before UTC midnight, booking its best September performance since 2013, per CoinGlass data.

儘管今天的加密貨幣價格下跌,但比特幣仍有望在 9 月獲得穩健的正回報,儘管該月被認為是不利的月份。根據 CoinGlass 的數據,以 UTC 午夜前幾個小時的價格計算,BTC 本月上漲了近 7%,創下了自 2013 年以來的最佳 9 月表現。

September's positive return could bode well for October, with every previous green September having been followed by more gains the next month. October is also historically one of the strongest months for bitcoin, earning its nickname "Uptober," by recording positive monthly returns 9 times out of 11 since 2013.

九月的正回報可能是十月的好兆頭,之前每一個綠色的九月都會在下個月出現更多的漲幅。歷史上,10 月也是比特幣表現最強勁的月份之一,自 2013 年以來,11 個月中有 9 次月度回報為正值,因此贏得了「Uptober」的綽號。

However, Charlie Morris, founder of investment manager ByteTree, contemplated whether the expectation of a strong October is so widespread that it may throw a curveball to investors.

然而,投資管理公司 ByteTree 的創始人 Charlie Morris 思考,人們對 10 月表現強勁的預期是否如此普遍,以至於可能會給投資者帶來麻煩。

"The contrarian will always be cautious of an idea that has become too popular because popularity means the money is already invested ahead of the event," Morris wrote in a Monday report.

莫里斯在周一的報告中寫道:“逆向投資者總是會對過於流行的想法持謹慎態度,因為流行意味著資金已經在活動之前投入。”

His report further noted that BTC's price historically consolidated for roughly six months after halvings before making new highs, and the current price action is in line with that pattern. Given that this year's event happened on April 19, a breakout to new highs may happen towards the end of October if the pattern holds up.

他的報告進一步指出,從歷史上看,比特幣的價格在減半後大約會盤整六個月,然後再創新高,而當前的價格走勢也符合這種模式。鑑於今年的事件發生在 4 月 19 日,如果該模式持續下去,可能會在 10 月底突破新高。

Options traders, however, expect that a bigger rally will only come after the U.S. elections in November, and are thus positioning for further weakness in the coming weeks, according to Jake Ostrovskis, OTC trader at crypto market maker Wintermute.

然而,加密貨幣做市商Wintermute 的場外交易員傑克·奧斯特洛夫斯基斯(Jake Ostrovskis) 表示,期權交易員預計,只有在11 月美國大選之後才會出現更大的反彈,因此預計未來幾週將進一步走軟。

"With spot trading dipping below $65,000, the volatility surface indicates a bias toward the downside until late October and November, when the market begins to favor calls over put protection," Ostrovskis said. "Current positioning suggests support for a post-election rally."

Ostrovskis 表示:“隨著現貨交易跌破 65,000 美元,波動性表面顯示出下行傾向,直到 10 月底和 11 月,屆時市場開始青睞看漲期權而非看跌期權保護。” “目前的定位表明支持選舉後的集會。”

Sandor reported earlier this month on Deribit bitcoin options data showing a preference for downside protection, via puts, over upside exposure, via calls.

Sandor 本月稍早報導的 Deribit 比特幣選擇權數據顯示,人們更傾向於透過看跌期權來進行下行保護,而不是透過看漲期權來進行上行敞口。

Options traders are also largely betting on bitcoin to stay within a range of $58,000 to $72,000 by the Oct. 23 expiration, with open interest concentrated at strikes of $60,000 and $70,000.

選擇權交易員也主要押注比特幣在 10 月 23 日到期前將維持在 58,000 美元至 72,000 美元的範圍內,未平倉合約集中在 60,000 美元和 70,000 美元的行使價。

Institutions are buying bitcoin again, Grayscale data showsInstitutions are buying bitcoin again, Grayscale data shows

灰階數據顯示,機構再次購買比特幣 灰階數據顯示,機構再次購買比特幣

Institutions are buying bitcoin again, Grayscale data shows

灰階數據顯示,機構再次購買比特幣

Insそれにしてもinstitutions are buying bitcoin again, according to the latest data from Grayscale.

根據灰階的最新數據,機構再次購買比特幣。

The world's largest digital asset manager saw inflows of $224 million into its Grayscale Bitcoin Trust (GBTC) during the week ended Sept. 25, a reversal from the outflows seen in the prior week.

截至 9 月 25 日的一周內,全球最大的數位資產管理公司的灰階比特幣信託基金 (GBTC) 流入了 2.24 億美元,與前一周的流出相反。

The inflows were driven by demand from hedge funds and other institutional investors, according to Grayscale, which noted

Grayscale 表示,資金流入是由對沖基金和其他機構投資者的需求所推動的。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- 比特幣:基礎知識及其他

- 2024-11-06 02:26:16

- 比特幣因其革命性金融的潛力而經常引發人們的好奇心。但比特幣到底是什麼?讓我們簡單地分解一下。

-

-

-

-

-

-