Super Micro Computer shares plummeted 18% on Friday due to investor profit-taking ahead of the company's earnings report. Despite a 168% surge this year, Super Micro faces intense competition from Dell and Hewlett Packard, who plan to implement Nvidia's latest technology to gain market share. The company's departure from its practice of providing preliminary financial results and a highly competitive market environment contributed to the sharp decline.

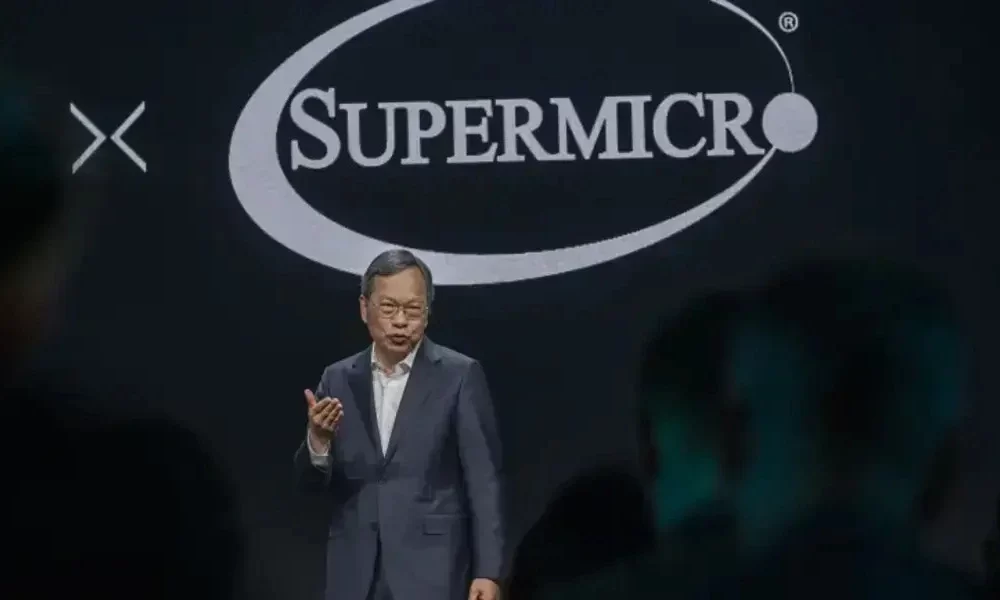

Super Micro Computer Shares Plummet 18% Amidst Earnings Anticipation and Market Competition

(CTN News) - Super Micro Computer, a prominent player in the technology sector, has witnessed a significant decline in its stock value, plummeting by 18% on Friday. This downturn is primarily attributed to investors reassessing their holdings ahead of the company's upcoming earnings report later this month.

Super Micro shares have experienced a remarkable surge of 168% so far this year, bolstered by its inclusion in the prestigious S&P 500 index in March. Despite this impressive growth, the company's stock remains 246% higher compared to the same period last year.

At the core of Super Micro's success lies its strategic partnership with NVIDIA, a pioneer in proprietary technology that forms the foundation of today's most advanced artificial intelligence (AI) models. NVIDIA's technology remains ubiquitous, powering the vast majority of AI implementations currently deployed.

The company's financial performance for the fiscal third quarter ending in April will be unveiled before the end of this month, as announced in its official press release on Friday. Notably, this announcement marks a departure from Super Micro's previous practice of providing preliminary results.

In a significant shift, Super Micro raised its revenue and earnings guidance for the second quarter of 2022, just 11 days after announcing its initial second-quarter results. This deviation from established practice has raised eyebrows among market observers.

While Super Micro has benefited from its association with NVIDIA, competition in the technology market remains fierce. Leading competitors, such as Dell and Hewlett Packard Enterprise, are poised to introduce systems that leverage NVIDIA's latest generation of Blackwell graphics processing units, intensifying the battle for market share.

Analysts caution that the recent decline in Super Micro's stock price could mirror the steep drop it experienced on February 16, when it plunged nearly 20%, sparking a downward trend. However, it is important to note that Super Micro's long-term prospects remain strong, given its strategic partnership with NVIDIA and its established position in the AI technology landscape.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any

investments made based on the information provided in this article. Cryptocurrencies are highly volatile

and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us

immediately (info@kdj.com) and we will delete it promptly.