|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

The Crypto Market Is Derisking Ahead of Today's Fed Rate Decision

Dec 18, 2024 at 07:59 pm

Everyone's buzzing about the likelihood of another rate cut that will supposedly galvanize risk-taking in the economy and financial markets.

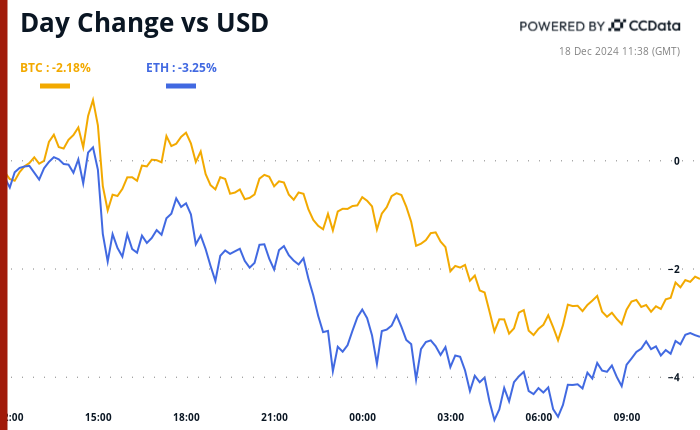

The crypto market is showing signs of risk aversion ahead of the Federal Reserve's interest rate decision today. Everyone is talking about the possibility of another rate cut, which is expected to stimulate risk-taking in the economy and financial markets.

But here's the catch: the central bank is expected to signal three rate cuts for 2025, not the four it projected in September, and revise growth and inflation forecasts higher. So, it comes as no surprise that bitcoin and ether are both trading nearly 2% lower, leading to bigger losses in small-cap tokens. Pudgy Penguins' PENGU token, for example, has crashed over 50% since Tuesday's airdrop.

The front-end call premiums in both BTC and ETH have already taken a hit, indicating a more cautious market sentiment. Traditional markets are also factoring in a hawkish cut.

However, experienced traders will tell you that when expectations are skewed too heavily in one direction, there's always potential for disappointment. To put it another way, if interest rate projections remain unchanged or Fed Chairman Jerome Powell eases concerns about sticky inflation during his press conference while maintaining a data-dependent approach, we could see a nice bump in risk assets — including cryptos.

If that happens, VIRTUAL, the native coin of AI and tokenization platform Virtuals Protocol, might stand out, having risen 11% in Asian hours. "AI within crypto is shaping up to be a fascinating trend, especially in social trading, where data-driven insights and automation can empower traders," said Neal Wen, head of global business development at Kronos Research.

Another candidate is leading on-chain perpetuals platform HyperLiquid's HYPE token, which is trading 4% higher at press time. According to social media chatter, the token's rally is being fueled by its limited exchange availability and traders' reluctance to sell.

That said, don't let your guard down. Some observers believe that the pace of future rate cuts will be largely determined by Friday's core PCE data, the Fed's preferred inflation measure.

As Valentin Fournier, an analyst at BRN, put it: "The Federal Reserve is set to announce a 25 basis-point interest-rate cut today — it's last for the year. Future cuts may rely heavily on Friday's Core PCE report, which is expected to hold steady at 3.3% year over year. Any surprises with rising inflation could rattle the markets, especially since bitcoin is already feeling some bearish pressure and is lacking the upward momentum."

Meanwhile, the Wall Street Journal is raising red flags over the decline in Chinese government bond yields, suggesting that the world's second-largest economy may be slipping into a depression, a prolonged period of sharp economic decline and rising unemployment.

These concerns could easily destabilize global markets, so it's a good time to stay alert.

What to Watch

Token Events

Conferences:

Early PENGU buyers are learning the perils of low liquidity the hard way.

The token of the Pudgy Penguins ecosystem dropped amid massive hype on Tuesday. Its charm was its association with an already popular NFT collection, leading to a buying frenzy by traders hoping for quick gains. But the token had garnered the necessary liquidity at launch, meaning early, enthusiastic buyers ended up buying the token at a 5 trillion market capitalization.

Liquidity is the ability to buy or sell an asset without causing a significant price change. For PENGU, the initial liquidity pools were shallow, meaning there weren't enough buyers and sellers to keep the price stable.

One unlucky trader lost big on the airdrop, turning $10,000 into less than $5 in seconds. Just before the official airdrop, they had swapped 45 wrapped Solana for PENGU but got only 78 tokens due to a glitch in Jupiter's decentralized exchange. The trade was sent to a low-liquidity pool on Raydium, inflating the token's price to an unrealistic $14 trillion market cap. This mishap was due to low liquidity, where even small trades can cause huge price swings.

The PENGU token was created weeks before its launch, leading to premature trading and significant losses for those who jumped in too early without checking the market cap.

Derivatives Positioning

Market Movements:

Bitcoin Stats:

Basket Performance

Technical Analysis

Crypto Equities

ETF Flows

Spot BTC ETFs:

Spot ETH ETFs

Source: Farside Investors

Overnight Flows

Chart of the Day

While You Were Sleeping

In the Ether

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- The Best Crypto to Buy Before Bitcoin's Halving Shakes Things Up

- Feb 24, 2025 at 03:20 am

- Every cycle, new opportunities pop up, and right now, Dawgz AI is leading the pack. Unlike most meme coins, this one actually does something - it runs high-frequency trading bots to make crypto token investing effortless.

-

-

-

![What Lies Ahead for XRP in ... [+] 2025? What Lies Ahead for XRP in ... [+] 2025?](/assets/pc/images/moren/280_160.png)

-

-

- Crypto Market Correction: Bitcoin, Ethereum, and Major Altcoins Face Decline Amid Market Correction, Regulatory Uncertainty, and Macroeconomic Pressures

- Feb 24, 2025 at 03:05 am

- Stay updated on the latest cryptocurrency market trends as Bitcoin, Ethereum, and major altcoins face a broad decline amid market correction, regulatory uncertainty, and macroeconomic pressures. Explore key price movements, investor sentiment, and upcoming events shaping the crypto landscape.

-

-

![What Lies Ahead for XRP in ... [+] 2025? What Lies Ahead for XRP in ... [+] 2025?](/uploads/2025/02/24/cryptocurrencies-news/articles/lies-ahead-xrp/img-1_800_559.44055944056.jpg)