|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Brazil Bans Pension Funds from Investing in Cryptocurrencies

Mar 31, 2025 at 10:16 pm

The National Monetary Council (CMN) forbade closed pension entities known as Entidades Fechadas de Previdência Complementar (EFPCs) from allocating any portion of their guarantee reserves into bitcoin (BTC) or other digital currencies.

Brazil's financial policy body has banned some pension funds from investing in cryptocurrencies because they are too risky, while several U.S. states are beginning to put some state pension money into crypto.

The National Monetary Council (CMN) ruled out any allocation to bitcoin (BTC) or other digital currencies for closed pension entities known as Entidades Fechadas de Previdência Complementar (EFPCs).

The EFPCs manage retirement savings for tens of thousands of unionized and company-employed workers and their reserves are typically made up of bonds and equities.

"The resolution also prohibits investments in virtual assets, considering their specific investment characteristics and associated risk," a Ministry of Finance notice circulating among local news outlets reads.

The ruling was published last week. It comes as the Central Bank of Brazil is preparing to launch a digital currency, known as the Real Digital, likely in 2024.

In contrast, last year British pension specialist Cartwright helped the country's first pension fund to make a bitcoin allocation, equal to 3% of the fund's total assets.

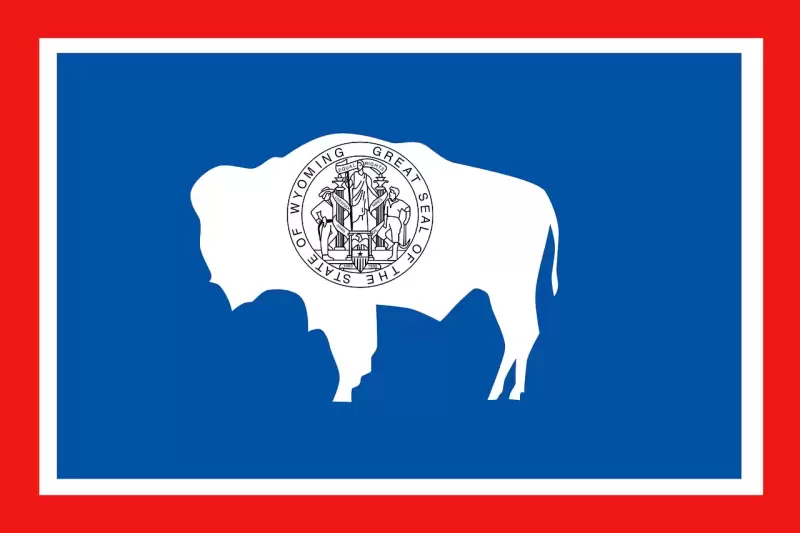

Several U.S. states have begun experimenting with crypto allocations for their pension systems, although there has been caution at the federal level.

Wisconsin's state investment board revealed in February that it had put $340 million into bitcoin through BlackRock's ETF (IBIT). The state had also invested $500 million in private equity to pursue tokenized asset opportunities.

The ruling does not appear to apply to open pension funds or individual retirement products sold by banks and insurers. These are regulated separately and may allow indirect investment through exchange-traded funds or tokenized asset platforms.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.