|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Falls to $92,000 as U.S. Stock Market Falters in Year-End Profit-Taking Sales

Dec 31, 2024 at 12:37 pm

Bitcoin also fell to $92,000 as the U.S. stock market faltered in year-end profit-taking sales. The Bitcoin Spot Exchange Traded Fund (ETF) listed on the U.S. stock market also experienced a large net outflow.

Bitcoin fell below the $92,000 mark on Friday morning as the U.S. stock market faltered in year-end profit-taking sales.

The Bitcoin Spot Exchange Traded Fund (ETF) listed on the U.S. stock market also experienced a large net outflow.

However, MicroStrategy and Tether said they bought a large amount of Bitcoin.

On the 31st, Bitcoin is trading at $92,492, down 1.09% from 24 hours ago, on Binance, the world's largest coin exchange, as of 11:30 a.m. that day.

Bitcoin closed at $92,792, down 1.01% the previous day.

Bitcoin showed high volatility, falling to the $91,000 mark at midnight, rising to $95,000 at 5 o’clock, and falling back to the $91,000 mark at 6 o’clock.

As bitcoin weakened, altcoins were also sluggish.

Ethereum was up 0.16% the day before, while Solana was up 0.76%.

Bitcoin also appears to have fallen as the U.S. stock market weakens.

On the New York Stock Exchange, the Dow Jones fell 418.48 points (0.97%) to 42,573.73.

The S&P 500 index also fell 63.9 points, or 1.07%, to 5,906.94.

The Nasdaq fell 235.25 points, or 1.19%, to close at 19,486.78.

Concerns are growing in some markets that the stock market is losing momentum.

It is pointed out that it will be difficult for Big Tech shares to rise indefinitely without continuous innovation in the artificial intelligence (AI) industry.

In particular, there are concerns that the U.S. domestic economy will inevitably stagnate if tariffs and immigration sanctions begin with the second Trump period.

The Bitcoin spot ETF also had a net outflow of 378.6 million dollars.

There seems to have been no significant net inflow from BlackRock’s IBIT and Invesco’s BTCO, which have not yet been counted.

Recently, net outflows have occurred for two consecutive trading days in Bitcoin spot ETFs.

MicroStrategy, which holds the largest number of Bitcoin by a single company, said Thursday that it has bought 2,138 more Bitcoin.

The average purchase price is $97,837.

According to Michael Saylor, founder of MicroStrategy, the company currently has 446,400 BTC with an average purchase price of $62,428.

According to blockchain analysis company Arkham, USDT’s issuer Tether also bought 7,629 Bitcoin worth about $700 million on the same day.

Tether said it would use up to 15% of its 2023 proceeds to buy Bitcoin.

Tether’s Bitcoin holdings are worth $7.6 billion.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Gravity (G) Token - The Next Big Thing in Layer 1 Blockchains?

- Jan 05, 2025 at 04:45 pm

- Gravity is a layer 1 blockchain created by Galxe that provides a ZK proof and recovery-driven architecture. Gravity enables cross-chain transactions and verification with near-instant finality, supports EVM compatibility, and interacts seamlessly with existing decentralized applications.

-

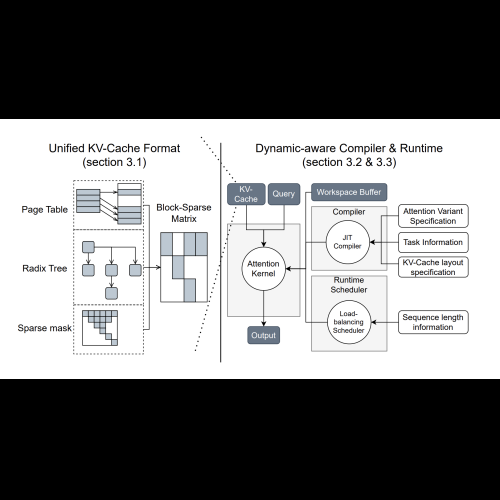

- FlashInfer: An AI Library and Kernel Generator Tailored for LLM Inference

- Jan 05, 2025 at 04:45 pm

- Large Language Models (LLMs) have become an integral part of modern AI applications, powering tools like chatbots and code generators. However, the increased reliance on these models has revealed critical inefficiencies in inference processes. Attention mechanisms, such as FlashAttention and SparseAttention, often struggle with diverse workloads, dynamic input patterns, and GPU resource limitations. These challenges, coupled with high latency and memory bottlenecks, underscore the need for a more efficient and flexible solution to support scalable and responsive LLM inference.

-

- isfaction guarantee further underscore the company's confidence in its product. While Prostazen is not FDA approved, it adheres to Good Manufacturing Practices (GMP) to ensure quality and safety during production.output: title: Prostazen: Take Control

- Jan 05, 2025 at 04:45 pm

- Prostate health is a topic of increasing concern for many men, especially as they age. With statistics indicating that a significant number of men experience prostate-related issues, it’s crucial to explore effective solutions.

-

-