|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

香港有条件批准资产管理公司 Harvest Global Investments 和 HashKey Capital/Bosera Asset Management 推出现货比特币和以太币交易所交易基金 (ETF),此举提振了这些代币和更广泛的加密货币市场。香港的目标是将自己打造成与新加坡和迪拜并肩的数字资产中心。

Hong Kong Embraces Crypto Hub Aspirations with Conditional ETF Approvals

香港通过有条件 ETF 批准拥抱加密货币中心的愿望

In a significant development for the digital asset industry, Hong Kong has granted conditional approvals for spot-Bitcoin and Ether exchange-traded funds (ETFs). This move has injected enthusiasm into the crypto market, signaling Hong Kong's determination to establish itself as a global digital asset hub.

香港已有条件批准现货比特币和以太币交易所交易基金(ETF),这是数字资产行业的一项重大发展。此举为加密货币市场注入了热情,表明香港决心将自己打造成全球数字资产中心。

Harvest Global Investments and a partnership between HashKey Capital and Bosera Asset Management have received initial approvals, while China Asset Management's Hong Kong unit has secured approval for virtual asset management services. These approvals pave the way for the development and launch of spot-crypto ETFs in Hong Kong.

Harvest Global Investments 以及 HashKey Capital 和 Bosera Asset Management 之间的合作伙伴关系已获得初步批准,而华夏资产管理公司的香港子公司已获得虚拟资产管理服务的批准。这些批准为在香港开发和推出现货加密货币 ETF 铺平了道路。

Hong Kong's Securities & Futures Commission (SFC) issues conditional authorization letters to ETF applications that meet its general requirements. Applicants then submit these letters to Hong Kong Exchanges and Clearing Ltd. for listing approval.

香港证券及期货事务监察委员会(证监会)向符合其一般要求的 ETF 申请发出有条件授权书。然后,申请人将这些信件提交给香港交易及结算所有限公司以获得上市批准。

OSL Digital Securities will provide custodial services for Bitcoin and Ether products from China Asset Management and Harvest. This collaboration between established financial institutions and crypto custodians underscores the maturing infrastructure for digital asset trading.

OSL Digital Securities将为华夏基金和嘉实的比特币和以太币产品提供托管服务。成熟的金融机构和加密货币托管机构之间的合作凸显了数字资产交易基础设施的成熟。

Impact on Crypto Market

对加密货币市场的影响

The news of conditional ETF approvals has sent ripples through the crypto market, with Bitcoin and Ether experiencing notable gains. Bitcoin surged 4.3% to trade at $66,232, while Ether jumped 6.5% to $3,253 on Monday afternoon in Hong Kong. This rally reflects the market's anticipation of increased accessibility and institutional adoption of digital assets.

有条件 ETF 获批的消息在加密货币市场引起了轩然大波,比特币和以太币的涨幅显着。周一下午,香港比特币飙升 4.3%,至 66,232 美元,而以太币则上涨 6.5%,至 3,253 美元。此次上涨反映了市场对数字资产的可及性和机构采用率增加的预期。

Spot-Crypto ETFs: A Global Trend

现货加密 ETF:全球趋势

Spot-crypto ETFs have gained significant traction globally, with the United States leading the way. In January 2022, Bitcoin ETFs from BlackRock and Fidelity Investments debuted in the US, attracting over $12.5 billion in net inflow to date. This demand contributed to Bitcoin's record high of $73,798 in mid-March. The US market is still evaluating ETF applications for Ether, the second-largest digital asset.

现货加密货币 ETF 在全球范围内获得了巨大的关注,其中美国处于领先地位。 2022 年 1 月,贝莱德和富达投资的比特币 ETF 在美国首次亮相,迄今为止吸引了超过 125 亿美元的净流入。这种需求促使比特币在 3 月中旬创下 73,798 美元的历史新高。美国市场仍在评估第二大数字资产以太币的 ETF 申请。

Hong Kong's Unique Approach

香港独特的做法

In contrast to the cash redemption model employed by US ETF providers, HashKey Capital and Bosera's Hong Kong spot-ETFs will implement an in-kind subscription and redemption mechanism. This approach involves swapping the underlying crypto assets directly for ETF units, offering potential advantages in terms of simplicity and cost-effectiveness.

与美国ETF提供商采用的现金赎回模式不同,HashKey Capital和博时的香港现货ETF将实行实物申购和赎回机制。这种方法涉及将基础加密资产直接交换为 ETF 单位,在简单性和成本效益方面具有潜在优势。

Hong Kong's Broader Crypto Ambitions

香港更广泛的加密货币野心

Beyond ETFs, Hong Kong is actively pursuing a comprehensive digital asset strategy. It has already approved futures-based crypto ETFs and is reviewing additional applications for licensed digital asset exchanges. Additionally, Hong Kong is working on a regulatory framework for stablecoins, expanding the scope of its digital asset offerings.

除了ETF之外,香港还积极推行全面的数字资产战略。它已经批准了基于期货的加密 ETF,并正在审查获得许可的数字资产交易所的其他申请。此外,香港正在制定稳定币的监管框架,扩大其数字资产产品的范围。

Challenges and Opportunities

挑战与机遇

Despite its aspirations, Hong Kong faces challenges in its quest to become a leading crypto hub. The level of demand for its ETFs remains uncertain, particularly in comparison to the substantial inflows seen in the US. Additionally, the regulatory landscape for digital assets is constantly evolving, requiring Hong Kong to strike a balance between innovation and investor protection.

尽管有抱负,但香港在成为领先的加密货币中心的过程中面临着挑战。对其 ETF 的需求水平仍然不确定,特别是与美国的大量资金流入相比。此外,数字资产的监管环境不断变化,要求香港在创新和投资者保护之间取得平衡。

Nevertheless, the conditional ETF approvals represent a pivotal step towards solidifying Hong Kong's position as a global digital asset destination. By embracing crypto innovation while maintaining regulatory safeguards, Hong Kong aims to attract institutional capital and foster a robust and sustainable digital asset ecosystem.

尽管如此,有条件 ETF 的批准代表着巩固香港作为全球数字资产目的地的地位的关键一步。通过拥抱加密货币创新,同时维持监管保障,香港旨在吸引机构资本并培育强大且可持续的数字资产生态系统。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- 鲸鱼正在将稳定币转移到交易所,这一趋势可能会推高整个市场的加密货币价格

- 2024-12-28 10:35:01

- 加密货币市场目前出现了“鲸鱼将稳定币转移到交易所的令人鼓舞的趋势”,数据显示至少有七家

-

- 12月28日PEPE价格预测:反弹在即?

- 2024-12-28 10:35:01

- 在市场持续存在不确定性的情况下,全球第三大加密模因币佩佩(PEPE)正受到鲸鱼和交易者的极大关注。

-

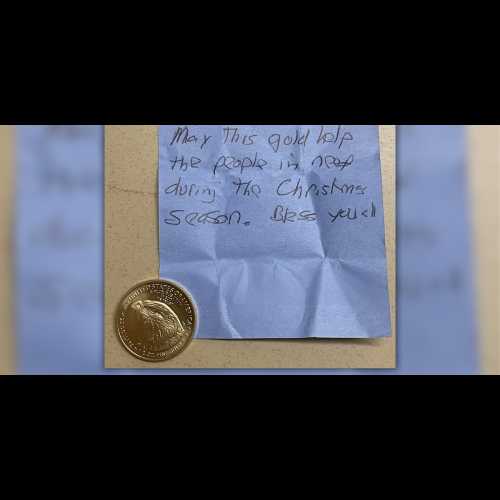

- 匿名捐赠者向凤凰城救世军红水壶赠送半盎司美国鹰金币

- 2024-12-28 10:35:01

- 凤凰城救世军雷和琼克罗克中心表示,其标志性的红色水壶收到了一枚半盎司美国鹰金币的捐赠。

-

-

- 阿肯色州 vs 德克萨斯理工大学 实时比分和更新

- 2024-12-28 10:35:01

- 关注阿肯色州在田纳西州孟菲斯对阵德克萨斯理工大学的自由碗比赛的实时更新。

-

-