|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

知情人士透露,嘉实基金管理公司与博时资产管理公司和 HashKey Capital 一起,其现货比特币和以太币 ETF 提案即将获得监管机构批准。这一发展强调了监管实体和市场利益相关者之间在塑造不断发展的虚拟资产格局方面的合作方式。预计将于 4 月底获得批准,这可能为最早于周一首次推出香港比特币 ETF 铺平道路。即将到来的批准对加密货币生态系统具有重大影响,有望促进市场活动增加并吸引投资者的兴趣。

Hong Kong Poised to Grant Landmark Approval for Spot Bitcoin and Ether Exchange-Traded Funds (ETFs)

香港准备对现货比特币和以太币交易所交易基金(ETF)给予里程碑式的批准

In a significant development, Harvest Fund Management, in partnership with Bosera Asset Management and HashKey Capital, is expected to receive regulatory approval for its spot Bitcoin and Ether ETF applications by the end of April.

作为一项重大进展,嘉实基金管理公司与博时资产管理公司和 HashKey Capital 合作,预计其现货比特币和以太币 ETF 申请将在 4 月底获得监管部门的批准。

This green light, poised to be granted by the Securities and Futures Commission (SFC), represents a collaborative effort between regulatory bodies and market players to navigate the evolving landscape of virtual assets. While the exact timeline remains uncertain, industry experts anticipate potential approval as early as Monday, including for Hong Kong Bitcoin ETFs.

这一绿灯即将获得证券及期货事务监察委员会(SFC)的批准,代表监管机构和市场参与者之间的合作努力,以应对不断变化的虚拟资产格局。尽管确切的时间表仍不确定,但行业专家预计最早可能会在周一获得批准,包括香港比特币 ETF。

This move follows the regulatory approval of crypto-based ETFs in other jurisdictions, including CSOP Ether Futures and Samsung Bitcoin Futures, which have garnered significant traction in the market with an estimated combined value of $170 million.

在此之前,包括 CSOP 以太期货和三星比特币期货在内的其他司法管辖区监管机构批准了基于加密货币的 ETF,这些ETF在市场上获得了巨大的吸引力,估计总价值达 1.7 亿美元。

The impending approval holds profound implications for the cryptocurrency ecosystem, expected to ignite a surge in market activity. Since the start of the year, Bitcoin ETFs have emerged as catalysts for growth, invigorating digital asset markets. As of mid-April, the total assets under management for the 11 ETFs are projected to soar to a record $73 billion, with a remarkable $59 billion already raised.

即将到来的批准对加密货币生态系统产生深远影响,预计将引发市场活动激增。自今年年初以来,比特币 ETF 已成为增长的催化剂,活跃了数字资产市场。截至 4 月中旬,11 只 ETF 管理的总资产预计将飙升至创纪录的 730 亿美元,其中已筹集了 590 亿美元。

Blackrock's iSharesBitcoin Trust stands out with net flows exceeding $15 billion in just three months, reflecting the growing appetite among investors for exposure to cryptocurrencies through the structured framework of ETFs.

Blackrock 的 iSharesBitcoin Trust 在短短三个月内净流量超过 150 亿美元,脱颖而出,反映出投资者对通过 ETF 结构化框架投资加密货币的兴趣日益增长。

Within this context, Harvest's anticipated approval to launch a spot Bitcoin ETF in Hong Kong assumes greater significance. The recent nod from the SFC for Harvest and China Asset Management to provide virtual asset fund management services further reinforces the regulators' commitment to fostering a supportive environment for cryptocurrency investment.

在此背景下,嘉实预计获准在香港推出现货比特币 ETF 具有更大的意义。证监会最近批准嘉实和华夏基金提供虚拟资产基金管理服务,进一步强化了监管机构为加密货币投资营造支持环境的承诺。

Harvest Fund Management, alongside Bosera Asset Management and HashKey Capital, awaits approval for its spot Bitcoin and Ether ETF applications. The SFC is reportedly collaborating with Hong Kong Exchanges & Clearing Ltd to finalize the approval process, with high expectations for a positive outcome by the end of April.

嘉实基金管理公司、博时资产管理公司和 HashKey Capital 正在等待其现货比特币和以太币 ETF 申请的批准。据报道,证监会正在与香港交易及结算所有限公司合作敲定审批程序,人们对四月底前取得积极成果寄予厚望。

This development follows the regulatory approval of several crypto-based ETFs, including CSOP Ether Futures, Samsung Bitcoin Futures, and CSOP Bitcoin Futures, with a combined value of approximately $170 million. With the potential introduction of Bitcoin and Ether ETFs into the Hong Kong market, investors will gain access to new avenues for exposure to digital assets, further diversifying their portfolios in an evolving financial landscape.

这一进展是在监管部门批准多只基于加密货币的 ETF 后进行的,其中包括 CSOP 以太期货、三星比特币期货和 CSOP 比特币期货,总价值约为 1.7 亿美元。随着比特币和以太坊 ETF 可能引入香港市场,投资者将获得投资数字资产的新途径,在不断变化的金融环境中进一步实现投资组合的多元化。

Julia Leung, deputy chief executive director of intermediaries for the SFC, emphasized the regulator's proactive stance in enabling investor access to spot ETFs. The SFC "is actively seeking to set up a regime to empower retail investors to participate directly in this emerging asset class," Leung remarked.

证监会中介机构副行政总裁梁凤仪强调,监管机构在让投资者投资现货ETF方面采取积极主动的立场。梁振英表示,证监会“正在积极寻求建立一种制度,让散户投资者能够直接参与这一新兴资产类别”。

As Hong Kong embraces cryptocurrency ETFs, market observers anticipate a ripple effect beyond its borders. The impending approval not only underscores the growing mainstream acceptance of cryptocurrencies but also heralds a new era of democratized access to digital assets.

随着香港拥抱加密货币 ETF,市场观察人士预计会产生超出香港范围的连锁反应。即将到来的批准不仅突显了主流对加密货币的接受度不断提高,而且预示着数字资产民主化的新时代的到来。

In conclusion, Hong Kong's imminent approval of Bitcoin and Ether ETFs marks a watershed moment for the cryptocurrency industry. As investors eagerly await the dawn of a new era in digital asset investment, regulatory clarity and market innovation converge to unlock unprecedented opportunities on a global scale.

总而言之,香港即将批准比特币和以太坊 ETF,标志着加密货币行业的一个分水岭。随着投资者热切等待数字资产投资新时代的到来,监管的明确性和市场创新的融合将在全球范围内释放前所未有的机遇。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

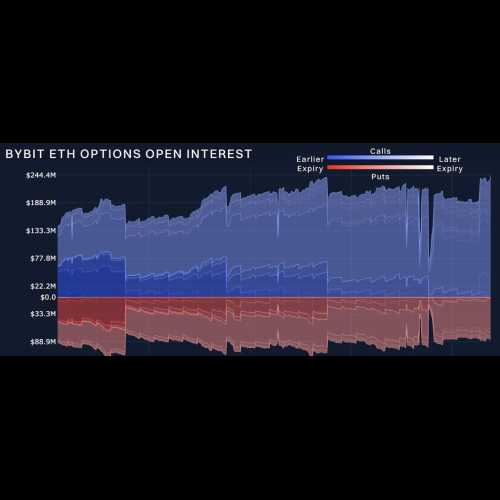

- 市场在年底期权到期前表现出弹性:Bybit x Block Scholes 加密衍生品报告

- 2024-12-27 01:05:02

-

-