|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特币在本周早些时候达到 109,000 美元以上的历史新高 (ATH) 后,目前似乎正在喘口气。截至目前,该资产已

After reaching a new all-time high (ATH) above $109,000 earlier this week, Bitcoin appears to be pausing for breath. So far this week, the asset has seen a slightly reduced upward momentum with the price hovering just above $104,000.

在本周早些时候达到 109,000 美元以上的历史新高 (ATH) 后,比特币似乎暂停了喘息。本周到目前为止,该资产的上涨势头略有减弱,价格徘徊在 104,000 美元上方。

However, despite the slowing upward momentum, Bitcoin’s recent performance has prompted renewed interest in the market. CryptoQuant analyst Burak Kesmeci recently shared his insights into Bitcoin’s price behavior and key market indicators, shedding light on potential future moves.

然而,尽管上涨势头放缓,比特币近期的表现还是引发了市场的新兴趣。 CryptoQuant 分析师 Burak Kesmeci 最近分享了他对比特币价格行为和关键市场指标的见解,揭示了未来潜在的走势。

In a recent post on the CryptoQuant QuickTake Platform, Kesmeci’s analysis focused on Binance Bitcoin Funding Rates, a metric that provides notable clues about market sentiment and dynamics.

在 CryptoQuant QuickTake 平台最近发表的一篇文章中,Kesmeci 的分析重点是币安比特币融资利率,该指标提供了有关市场情绪和动态的重要线索。

By reviewing historical data from previous bull cycles, he identified three distinct phases that can serve as a framework for interpreting the current market environment.

通过回顾之前牛市周期的历史数据,他确定了三个不同的阶段,可以作为解释当前市场环境的框架。

According to Kesmeci, during the 2020-2021 bull run, Binance Bitcoin Funding Rates moved through three distinct phases:

据 Kesmeci 称,在 2020 年至 2021 年牛市期间,币安比特币融资利率经历了三个不同的阶段:

Phase 1 (July 2020): Funding rates remained stable at 0.01 for several weeks before a surge in demand pushed them up. This phase acted as the “calm before the storm,” with Bitcoin rising from $9,000 to $12,000 as funding rates increased to 0.10.

第一阶段(2020 年 7 月):融资利率连续几周稳定在 0.01,之后需求激增推高融资利率。这一阶段相当于“暴风雨前的平静”,随着资金费率升至 0.10,比特币从 9,000 美元上涨至 12,000 美元。

Phase 2 (November 2020): After an initial rally, Bitcoin experienced a correction. Funding rates briefly turned negative before flipping positive again, supporting Bitcoin's climb from $12,000 to $19,000.

第二阶段(2020 年 11 月):在最初的反弹之后,比特币经历了回调。资金利率短暂转为负值,然后再次转为正值,支撑比特币从 12,000 美元攀升至 19,000 美元。

Phase 3 (December 2020): As Bitcoin crossed its previous highs and surged past the $60,000 mark, funding rates climbed significantly, indicating strong market support.

第三阶段(2020年12月):随着比特币突破前期高点并飙升至6万美元大关,资金费率大幅攀升,表明市场支撑强劲。

Currently, Kesmeci notes that Binance Bitcoin Funding Rates are at the baseline level of 0.01—consistent with the early stages of a bull cycle. The analyst noted, “Analyzing recent data, I believe we’ve completed the first two phases of this bull cycle. For the third phase, I’ll be watching closely to see if the Binance Bitcoin Funding Rates manage to climb above 0.01.”

目前,Kesmeci 指出,币安比特币融资利率处于 0.01 的基线水平,与牛市周期的早期阶段一致。这位分析师指出,“分析最近的数据,我相信我们已经完成了本轮牛市周期的前两个阶段。对于第三阶段,我将密切关注币安比特币融资利率是否能够攀升至 0.01 以上。”

The analyst mentioned that a sustained rise above the 0.01 level would suggest heightened futures market activity and could lead to another significant upward move.

该分析师提到,持续升至 0.01 上方将表明期货市场活动加剧,并可能导致另一次大幅上涨。

However, Kesmeci also cautions that elevated funding rates are often unsustainable, and markets tend to correct through “long squeeze” events that restore balance.

然而,凯斯梅奇也警告说,融资利率的升高往往是不可持续的,市场往往会通过“多头挤压”事件来恢复平衡。

Key Metrics And Divergences In The Market

市场的关键指标和差异

In a separate analysis, another CryptoQuant analyst, TraderOasis, explored several critical metrics, including the Coinbase Premium Index, open interest, and funding rates, to assess Bitcoin’s market health and potential direction.

在另一项分析中,另一位 CryptoQuant 分析师 TraderOasis 探讨了几个关键指标,包括 Coinbase 溢价指数、未平仓合约和融资利率,以评估比特币的市场健康状况和潜在方向。

TraderOasis highlighted a divergence between the Coinbase Premium Index and Bitcoin’s price movement. While the asset reached a new peak above $109,000, the Coinbase Premium Index formed a lower high. This lack of alignment raised concerns about the sustainability of the current price trend.

TraderOasis 强调了 Coinbase 溢价指数和比特币价格走势之间的差异。虽然该资产达到 109,000 美元以上的新高,但 Coinbase 溢价指数却形成了较低的高点。这种不一致引发了人们对当前价格趋势可持续性的担忧。

Furthermore, a divergence between open interest and price also suggested that the market might lack the robust foundation needed for continued upward momentum. According to TraderOasis, a healthy uptrend requires these metrics to be more closely aligned, which would signal strong investor confidence and a stable market structure.

此外,未平仓合约与价格之间的背离也表明市场可能缺乏持续上涨动力所需的坚实基础。根据 TraderOasis 的说法,健康的上升趋势需要这些指标更加紧密地结合,这将表明投资者信心强劲和市场结构稳定。

Finally, the analysis also touched upon funding rates, indicating a recent bearish sentiment among traders. However, TraderOasis noted that such conditions often precede sharp price movements.

最后,分析还涉及融资利率,表明交易员近期出现看跌情绪。然而,TraderOasis 指出,这种情况往往先于价格大幅波动。

The analysis suggested the possibility of an initial upward spike to shake out bearish positions, followed by a subsequent pullback. This pattern, if realized, could set the stage for a more sustainable long-term uptrend.

分析表明,最初的上涨可能会摆脱看跌头寸,随后出现回调。这种模式如果实现,可能会为更可持续的长期上升趋势奠定基础。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

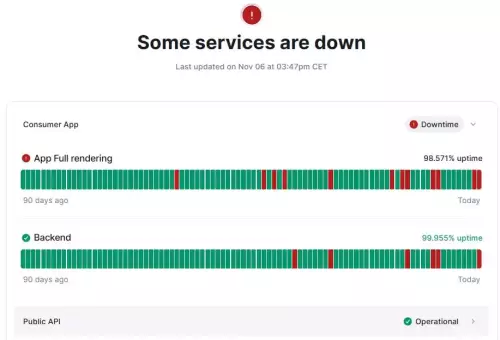

- Morpho Network DeFi可靠性测试:服务中断动摇用户信心

- 2025-11-07 03:59:51

- Morpho 网络最近的一次服务中断凸显了维持 DeFi 可靠性的挑战,影响了用户体验和信任。

-

- 比特币、以太坊和政府关门:应对不确定性

- 2025-11-07 03:55:22

- 加密货币市场面临着比特币的看跌信号和政府可能关闭的经济不确定性带来的阻力。以太坊质押提供了一个潜在的安全港。

-

- 山寨币、比特币和以太坊:应对 2025 年的加密货币寒冬

- 2025-11-07 03:34:00

- 分析 2025 年 11 月的山寨币市场低迷,重点关注比特币、以太坊以及向基本面健全的加密项目的转变。

-

- 稳定币与美元挂钩失去价值:加密世界的疯狂之旅

- 2025-11-07 03:29:10

- 稳定币应该是稳定的,对吗?让我们深入了解最近与美元挂钩的动摇事件,以及这对投资者意味着什么。

-

- 加密钱包:从比特币基础知识到人工智能驱动的未来迭代

- 2025-11-07 03:27:32

- 探索加密钱包的演变,从简单的存储到 DeFi 工具,并通过人工智能和传统金融集成窥探未来的迭代。

-

- Stellar 的市场转变:应对加密货币之路的坎坷

- 2025-11-07 03:23:48

- 恒星币(XLM)在交易量下降和价格波动的情况下面临市场波动。它能否通过创新和战略调整保持韧性?

-