|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

與比特幣相比,以太坊的價值最近觸及三年低點,但川普當選後可能出現逆轉。

The value of ethereum relative to bitcoin has recently hit a three-year low, but a reversal could be on the horizon following Trump’s election victory.

以太坊相對於比特幣的價值最近觸及三年低點,但川普當選後可能出現逆轉。

The second-largest cryptocurrency by market cap behind bitcoin, ethereum has historically followed bitcoin’s price movements against the U.S. dollar with more volatility.

作為市值僅次於比特幣的第二大加密貨幣,以太坊歷史上一直跟隨比特幣兌美元的價格走勢,波動性更大。

This graphic uses data from TradingView to show the ETH/BTC ratio, a key barometer of the cryptocurrency market’s interest and demand for altcoins (alternative cryptocurrencies besides bitcoin and ethereum), which can be purchased using ETH on the Ethereum blockchain.

該圖使用來自TradingView 的數據顯示ETH/BTC 比率,這是加密貨幣市場對山寨幣(比特幣和以太坊以外的替代加密貨幣)興趣和需求的關鍵晴雨表,山寨幣可以在以太坊區塊鏈上使用ETH 購買。

As the second-largest cryptocurrency, ethereum has returned 32% year-to-date against the U.S. dollar, while bitcoin has climbed 83% to reach about $77,000 as of November 8th.

作為第二大加密貨幣,以太幣兌美元今年迄今已上漲 32%,截至 11 月 8 日,比特幣已上漲 83%,達到約 77,000 美元。

The ETH/BTC ratio has declined sharply from its highs in September 2022, when the Ethereum blockchain transitioned to a proof-of-stake network to enhance security and energy efficiency.

ETH/BTC 比率已從 2022 年 9 月的高點急劇下降,當時以太坊區塊鏈過渡到權益證明網路以增強安全性和能源效率。

While institutional investors have largely focused on bitcoin, ethereum has attracted comparatively less interest, despite its centrality to decentralized finance.

雖然機構投資者主要關注比特幣,但以太坊吸引的興趣相對較少,儘管它是去中心化金融的核心。

Driving ethereum’s significant price gains against bitcoin is the increasing prevalence of initial coin offerings and decentralized applications (DApps) that operate on the Ethereum blockchain.

以太坊相對於比特幣價格大幅上漲的推動因素是在以太坊區塊鏈上運行的初始代幣發行和去中心化應用程式(DApp)的日益普及。

In 2021, the ETH/BTC soared to 0.87 as interest in DApps gained renewed momentum. By the end of 2021, there were 2.7 million unique active wallets connecting to DApps, and of the broader decentralized finance space, 60% were built on the Ethereum blockchain.

2021 年,隨著人們對 DApp 的興趣重新燃起,ETH/BTC 飆升至 0.87。到 2021 年底,有 270 萬個獨特的活躍錢包連接到 DApp,而在更廣泛的去中心化金融領域,60% 是建立在以太坊區塊鏈上的。

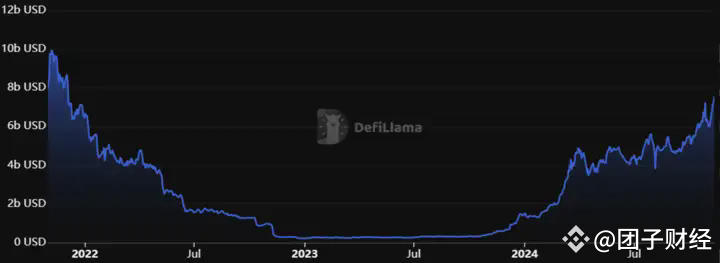

Fast-forward to today, bitcoin still leads the crypto landscape; bitcoin ETF assets are valued at roughly $70 billion, having more than doubled over the past year. In contrast, ethereum ETF assets under management have declined from nearly $10 billion to $7 billion as of early November. However, since November 6, ETF inflows have surged by $132 million in two days, indicating bullish sentiment among investors.

快進到今天,比特幣仍然引領著加密貨幣領域。比特幣 ETF 資產價值約為 700 億美元,在過去一年中增長了一倍多。相較之下,截至 11 月初,以太坊 ETF 管理資產已從近 100 億美元下降至 70 億美元。然而,自11月6日以來,ETF資金流入在兩天內激增1.32億美元,顯示投資者的看漲情緒。

To learn more about this topic from an ownership perspective, check out this graphic on the largest corporate holders of bitcoin.

要從所有權角度了解有關此主題的更多信息,請查看這張關於最大的比特幣公司持有者的圖表。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 卡爾達諾 (ADA) 價格瞄準高位,ADA 目標價為 10 美元

- 2024-11-13 03:45:02

- 卡爾達諾價格引發了新的樂觀情緒,分析師最近將其目標從 0.349 美元調整為雄心勃勃的 10 美元

-

-

-

-

-

- 俄羅斯政府批准了一項對該國加密貨幣徵稅的法案

- 2024-11-13 02:15:01

- 根據該法案,數位貨幣被賦予財產地位,並引入了單獨的稅基計算,稅基定義為資產價值超過其購買或提取成本的部分。

-

- 隨著選舉集會的延長,比特幣取代白銀成為世界第八大資產

- 2024-11-13 02:15:01

- 白銀上週下跌 6.24%,市值達到 1.732 兆美元,而比特幣同期成長了約 30%。

-

-