|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

去中心化交易所 (DEX) 具有增強隱私、所有權和控制權以及存取多樣化資產等優勢。他們依靠智慧合約和自我託管錢包來降低中心化交易風險,減少潛在的漏洞。然而,DEX 可能面臨智慧合約安全、使用者複雜性和流動性問題的挑戰。本文探討了 DEX 的優缺點,比較了 Solana 的頂級平台,並深入了解了它們的主要功能、費用和支援的錢包。

Table of Contents

- Quick Navigation

- Should You Trade on a DEX?

- Advantages of Decentralized Exchanges (DEXs)

- Ownership & Enhanced Security

- Privacy

- Accessibility

- Asset Diversity

- Disadvantages of decentralized exchanges (DEX).

- Smart Contract Vulnerabilities

- Complexity

- Liquidity Issues

- Comparison of the Top Solana DEXs

- The 5 Best Solana DEXs

- Jupiter: Most Popular Solana DEX

- Raydium: Veteran Solana DEX

- Drift Protocol

- Orca

- Zeta Markets

- Is Trading on DEXs Safe?

- Frequently Asked Questions

- Which Solana DEX has the most volume?

- What is the first DEX on Solana?

- What is the best Solana DEX?

- What is the best DEX crypto?

- Best Solana DEXs – Final Thoughts

The Solana blockchain is home to hundreds of decentralized applications (dApp) that leverage the blockchain’s high throughput, scalability, and composability.

目錄 快速導航 您應該在 DEX 上交易嗎?去中心化交易所(DEX)的優點 所有權和增強的安全性 隱私 可訪問性 資產多樣性 去中心化交易所(DEX)的缺點。智慧合約漏洞 複雜性 流動性問題 頂級 Solana DEX 的比較 5 個最佳 Solana DEX Jupiter:最受歡迎的 Solana DEX Raydium:老牌 Solana DEX 漂移協議 Orca Zeta 市場 在 DEX 上交易安全嗎?常見問題 哪一個 Solana DEX 的交易量最大? Solana 上的第一個 DEX 是什麼?最好的 Solana DEX 是什麼?最好的 DEX 加密貨幣是什麼?最佳 Solana DEX – 最後的想法 Solana 區塊鏈是數百個去中心化應用程式 (dApp) 的所在地,這些應用程式利用了區塊鏈的高吞吐量、可擴展性和可組合性。

There’s a reason it’s one of the largest DeFi ecosystems, with billions in total value locked.

它是最大的 DeFi 生態系統之一,鎖定了數十億美元的總價值,這是有原因的。

Decentralized exchanges (DEXs) underpin this bustling community and account for the lion’s share of the TVL on Solana. They provide users with the necessary tools to trade on-chain, swap between different tokens, offer liquidity, and much more.

去中心化交易所 (DEX) 支撐著這個繁華的社區,並佔 Solana 上 TVL 的最大份額。它們為用戶提供必要的工具來進行鏈上交易、不同代幣之間的交換、提供流動性等等。

In the following, we attempt to provide comprehensive information on the best Solana DEXs, including important information about their protocols, but also:

在下文中,我們嘗試提供有關最佳 Solana DEX 的全面信息,包括有關其協議的重要信息,而且:

- Key features

- Trading fees: critical detail when trading on-chain

- Supported self-custody wallets and more

Solana has several aspects that make it an ideal chain for DEXs. It has given birth to some of the best-known decentralized trading platforms, not just within its own ecosystem but within the entire industry.

主要特點交易費用:鏈上交易時的關鍵細節支援的自我託管錢包等Solana 有幾個方面使其成為 DEX 的理想鏈。它催生了一些最著名的去中心化交易平台,不僅在其自己的生態系統內,而且在整個產業內。

Quick Navigation

- Should You Trade on a DEX?

- Advantages of Decentralized Exchanges

- Disadvantages of Decentralized Exchanges

- Comparison of the Top Solana DEXs

- Top 5 Best Solana DEXs

- Jupiter: Most Popular Solana DEX

- Raydium: Veteran Solana DEX

- Drift Protocol

- Orca

- Zeta Markets

- Future Outlook for Solana DEXs

- Is Trading on DEXs Safe?

- Frequently Asked Questions

- Best Solana DEXs – Final Thoughts

Should You Trade on a DEX?

Decentralized exchanges (DEXs) offer several advantages over traditional exchanges, like enhanced privacy and autonomy, as well as access to a broader range of tokens.

快速導航您應該在DEX 上進行交易嗎? OrcaZeta 市場Solana DEX 的未來展望DEX 交易安全嗎? ,例如增強的隱私性和自治性,以及訪問更廣泛的代幣的權限。

Unlike centralized exchanges (CEXs), DEXs are non-custodial and don’t need to individually verify tokens for compliance with regulations before listing them. This means you could find new projects on DEXs far before they are listed on a centralized exchange, offering traders opportunities for early access.

與中心化交易所(CEX)不同,DEX 是非託管的,在上市之前不需要單獨驗證代幣是否符合法規。這意味著您可以在新項目在中心化交易所上市之前就在 DEX 上找到它們,為交易者提供早期訪問的機會。

Decentralized exchanges can offer innovative trading features and incentive mechanisms not found in their centralized counterparts, such as yield farming, automated trading pools, and much more.

去中心化交易所可以提供中心化交易所所沒有的創新交易功能和激勵機制,例如流動性挖礦、自動交易池等等。

If you prioritize security, privacy, and control over your crypto, DEXs might be a good fit. They’re also useful for trading niche tokens unavailable on CEXs. There is, however, a learning curve to DEX trading, so make sure you’re well aware of the intricacies.

如果您優先考慮安全、隱私和對加密貨幣的控制,DEX 可能是個不錯的選擇。它們對於交易 CEX 上不可用的利基代幣也很有用。然而,DEX 交易有一個學習曲線,因此請確保您充分了解其中的複雜性。

Note: One thing to consider, though, is that you will need a self-custody wallet if you want to use a DEX. We have a comprehensive guide on the top Solana wallets that you can read and choose the one that best serves your needs.

注意:不過,需要考慮的一件事是,如果您想使用 DEX,您將需要一個自我託管錢包。我們有一份關於頂級 Solana 錢包的綜合指南,您可以閱讀並選擇最適合您需求的一款。

Let’s have a condensed look at their advantages and disadvantages because there are some.

讓我們濃縮它們的優點和缺點,因為確實有一些。

Advantages of Decentralized Exchanges (DEXs)

DEXs have several pros and cons to them, and it’s important for users to look at both sides of the picture to make an informed decision.

去中心化交易所 (DEX) 的優點 去中心化交易所有很多優點和缺點,用戶必須從兩方面考慮才能做出明智的決定。

Ownership & Enhanced Security

DEXs mitigate security risks associated with centralized exchanges by not having centralized systems privy to internal issues or external exploits. A centralized exchange holds users’ funds, making them vulnerable to certain risks, including:

所有權和增強的安全性DEX 透過不讓中心化系統了解內部問題或外部漏洞來降低與中心化交易所相關的安全風險。中心化交易所持有用戶的資金,使他們容易受到某些風險的影響,包括:

- Cybersecurity attacks

- Custodial risks, censorship, and account banning

- Your funds could be exposed or trapped in the platform.

- Privacy is severely compromised since exchanges store and manage your personal information.

Instead, DEXs leverage smart contracts for trade execution and recording on the blockchain, ensuring trustless transactions. Moreover, you’re solely responsible for your coins since you manage your wallet.

網路安全攻擊保管風險、審查和帳戶禁止您的資金可能會暴露或被困在平台中。執行和記錄交易,確保交易不可信。此外,由於您管理您的錢包,因此您對您的硬幣負全部責任。

Privacy

DEXs offer increased privacy since users maintain control of their crypto wallets externally. This eliminates the need for traders to disclose private keys and relieves DEXs of liability for funds.

PrivacyDEX 提供了更高的隱私性,因為使用者在外部保持對其加密錢包的控制。這消除了交易者揭露私鑰的需要,並減輕了 DEX 的資金責任。

Furthermore, DEX users are not typically required to undergo Know Your Customer (KYC) or Anti-Money Laundering (AML) procedures, which can be convenient but may pose legal challenges in certain contexts.

此外,DEX 使用者通常不需要接受了解你的客戶(KYC)或反洗錢(AML)程序,這可能很方便,但在某些情況下可能會帶來法律挑戰。

In essence, DEXs provide the potential for heightened security through decentralization and offer greater privacy by not mandating users to disclose sensitive information such as emails, addresses, phone numbers, etc. However, this may raise regulatory concerns in certain countries with unclear crypto regulations.

從本質上講,DEX 通過去中心化提供了增強安全性的潛力,並通過不強制用戶披露電子郵件、地址、電話號碼等敏感信息來提供更大的隱私。法規不明確的國家引起監管擔憂。

Accessibility

DEXs offer global accessibility, allowing users worldwide to access them as long as they have an internet connection and a compatible wallet. There are usually no jurisdiction-based restrictions.

AccessibilityDEX 提供全球可訪問性,只要擁有網路連線和相容的錢包,世界各地的用戶都可以存取它們。通常沒有基於司法管轄區的限制。

Asset Diversity

Likewise, DEXs boast a larger table of cryptocurrencies than their centralized counterparts. They are more open to smaller or lesser-known projects, enabling users to explore a broader range of assets.

資產多樣性同樣,去中心化交易所擁有比中心化交易所更大的加密貨幣表。他們對較小或鮮為人知的項目更加開放,使用戶能夠探索更廣泛的資產。

Disadvantages of decentralized exchanges (DEX).

Let’s explore the cons of DEXs below, starting with smart contract security.

去中心化交易所 (DEX) 的缺點。

Smart Contract Vulnerabilities

While smart contracts create a trustless environment and eliminate third parties, they can be subject to code bugs or vulnerabilities that hackers can exploit.

智能合約漏洞雖然智能合約創建了一個無需信任的環境並消除了第三方,但它們可能會受到駭客可以利用的程式碼錯誤或漏洞的影響。

Complexity

DEXs can be challenging for beginners to navigate, with less intuitive user interfaces and a requirement for greater technical knowledge to execute trades.

ComplexityDEX 對於初學者來說可能具有挑戰性,其使用者介面不太直觀,並且需要更多的技術知識來執行交易。

Fewer users also means there’s a smaller pool of buyers and sellers for any given token, making it harder to find a good match for your trade. While DEXs use AMMs, these ultimately can’t replicate the efficiency of matching specific buy and sell orders directly.

用戶較少也意味著任何給定代幣的買家和賣家數量較少,更難找到適合您交易的合適人選。雖然 DEX 使用 AMM,但它們最終無法複製直接匹配特定買賣訂單的效率。

Liquidity Issues

DEXs may suffer from lower liquidity, particularly for less popular tokens, potentially hindering trade execution at desired prices. Lower liquidity on DEXs can lead to higher slippage, meaning you might end up paying more (or receiving less) than you anticipated.

流動性問題去中心化交易所可能會受到流動性較低的影響,特別是對於不太受歡迎的代幣,這可能會阻礙以預期的價格執行交易。去中心化交易所的流動性較低可能會導致更高的滑點,這意味著您最終可能會比預期支付更多(或收到更少)。

Comparison of the Top Solana DEXs

The following is a summarized and comprehensive visual representation of their features and other characteristics.

頂級 Solana DEX 的比較以下是對其功能和其他特徵的總結和全面的直觀表示。

The 5 Best Solana DEXs

With all of the above out of the way, let’s explore the best Solana DEXs.

5 個最佳 Solana DEX 排除了上述所有內容,讓我們來探索最好的 Solana DEX。

The protocols were chosen based on trading volume, foundations, competitive features and fees, TVL, market capitalization, and other important components.

協議的選擇是基於交易量、基礎、競爭特徵和費用、TVL、市值和其他重要組成部分。

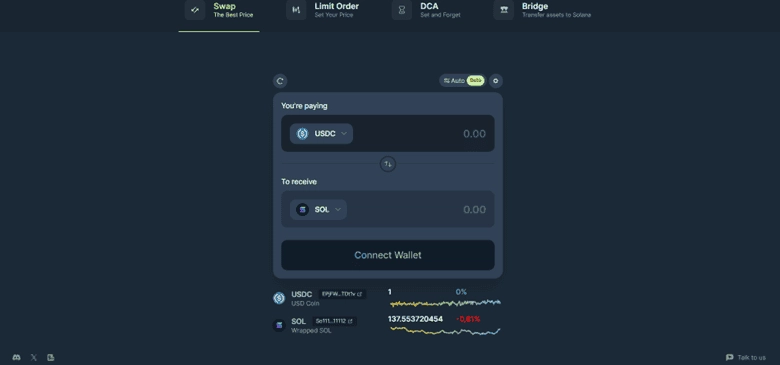

Jupiter: Most Popular Solana DEX

Quick summary:

Jupiter:最受歡迎的 Solana DEX 快速摘要:

- The most popular DEX on Solana. It’s behind one of the largest airdrops in crypto history: the JUP token.

- Leading DEX by total value locked (TVL).

- Leading DEX by derivatives volume.

Solana 上最受歡迎的 DEX。它是加密史上最大的空投之一:JUP 代幣的幕後黑手。

Jupiter is a decentralized exchange aggregator. That means it cross-checks and gathers prices across different DEXs to provide users with the best prices in the market. Its popularity is such that a lot of Solana DEX trades go through Jupiter, highlighting the protocol’s efficiency, low swap fees, and liquidity.

Jupiter 是一個去中心化的交易聚合器。這意味著它會交叉檢查並收集不同 DEX 的價格,為用戶提供市場上最優惠的價格。它的受歡迎程度使得許多 Solana DEX 交易都透過 Jupiter 進行,凸顯了協議的效率、低交換費用和流動性。

Jupiter started as a liquidity provider, similar to 1inch on Ethereum. However, the business model changed last year as the protocol decided to provide derivatives trading similar to GMX and dYdX.

Jupiter 一開始是作為流動性提供者,類似於以太坊上的 1inch。然而,去年商業模式發生了變化,協議決定提供類似 GMX 和 dYdX 的衍生性商品交易。

JUP is the governance token that allows users to vote in favor or against all aspects and changes taking place on Jupiter. It’s also used as a discount fee for traders. The JUP token might be remembered for its massive airdrop, in which over 40% of the 10 billion minted tokens were allocated to the community and distributed periodically.

JUP 是一種治理代幣,允許用戶投票贊成或反對 Jupiter 上發生的所有方面和變化。它也用作交易者的折扣費。 JUP 代幣可能因其大規模空投而被人們所銘記,其中 100 億枚代幣中超過 40% 被分配給社區並定期分發。

Key Features of Jupiter

Jupiter is considered one of the best Solana DEXs, designed to facilitate token swaps with minimal slippage and affordable fees. Its user-friendly interface caters to both beginners and experienced traders, supporting over hundreds of tokens and thousands of trading pairs.

Jupiter 的主要特點Jupiter 被認為是最好的 Solana DEX 之一,旨在以最小的滑點和實惠的費用促進代幣交換。其用戶友好的介面適合初學者和經驗豐富的交易者,支援數百種代幣和數千種交易對。

Here’s a quick rundown of Jupiter’s key features:

以下是木星主要功能的快速概述:

- Limit Order: This feature enables users to place buy or sell orders at specific levels, aiding traders in avoiding slippage and securing optimal prices.

- DCA (Dollar-Cost Averaging): Permits users to purchase a fixed amount of tokens within a specified price range over a set period, offering flexibility in time intervals (minutes, hours, days, weeks, or months).

- Bridge: Facilitates bridging tokens from EVM blockchains like Ethereum, BNB Chain, Arbitrum, or non-EVM blockchains like Tron to Solana, ensuring optimal routes for low slippage and transaction fees.

- Perpetual: This feature allows users to trade futures contracts for supported tokens with a maximum leverage of up to x100. It is powered by Pyth Network, Solana’s biggest oracle network.

Moreover, the exchange also focuses on developer tools, making it easier to integrate DApps and interfaces. There are dozens of tools, documentation resources, and programs designed for developers, including:

限價單:此功能使用戶能夠在特定水平下達買入或賣出訂單,幫助交易者避免滑點並確保最佳價格。幣設定的時間段,提供時間間隔(分鐘、小時、天、週或月)的彈性。如Tron)到Solana 的橋接代幣,確保最佳低滑點和低交易費用的路線。它由 Solana 最大的預言機網路 Pyth Network 提供支援。有數十種為開發人員設計的工具、文件資源和程序,包括:

- Jupiter Terminal, which allows DEXs to integrate the Jupiter UI

- A payments API, which allows users to pay for anything with any SPL token by using Jupiter and SolanaPay

- An open-source referral program to provide referral fees for projects integrating Jupiter Swap and Jupiter Limit Order

What are the Jupiter Fees?

Jupiter does not charge transaction fees, but certain fees apply to other important features within the protocol. Here’s the breakdown:

Jupiter Terminal,允許 DEX 整合 Jupiter UIA 支付 API,該 API 允許用戶使用 Jupiter 和 SolanaPay 使用任何 SPL 代幣支付任何費用一個開源推薦計劃,為集成 Jupiter Swap 和 Jupiter Limit Order 的項目提供推薦費有哪些Jupiter 費用? Jupiter 不收取交易費用,但協議內的其他重要功能會收取一定費用。詳細情況如下:

- Limit order fees: 0.2% on taker (partners integrating Jupiter Limit Order are entitled to a share of 0.1% referral fees. Jupiter collects the other 0.1% as platform fees, according to Jupiter’s documentation page).

- Jupiter DCA fee: 0.1% on order completion.

Which Wallets Does Jupiter Support?

Jupiter is compatible with most reputable wallets, including those from Solana and Ethereum. Some examples are:

限價訂單費用:接受者0.2%(整合Jupiter 限價訂單的合作夥伴有權分享0.1% 的推薦費。根據Jupiter 的文件頁面,Jupiter 收取另外0.1% 作為平台費用)。 %完成。一些例子是:

- OKX Wallet

- Phantom

- Ethereum Wallet

- Solflare

- Coinbase Wallet

- Trust

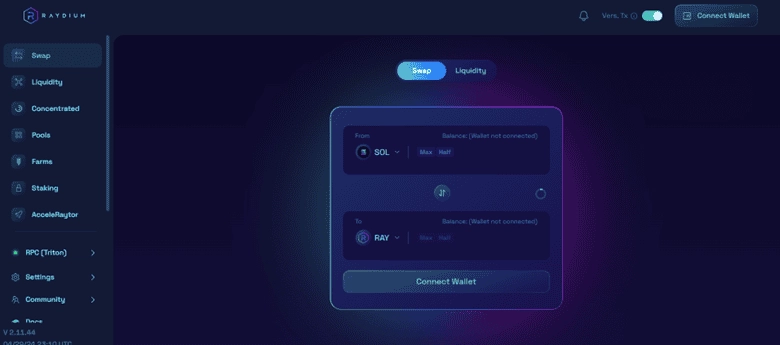

Raydium: Veteran Solana DEX

Quick summary:

OKX 錢包Phantom以太坊錢包SolflareCoinbase 錢包TrustRaydium:老手 Solana DEX快速摘要:

- Top Solana DEX by trading volume — $109B.

- Largest DEX on Solana by TVL —$850M

- RAY market capitalization: $410M

以成交量排名的 Solana DEX — $109B。

Raydium (RAY) is a close contender to Jupiter in terms of trading volume. Both often surpass each other in terms of daily trading volume. It’s known for its slick, user-friendly design, low fees, and support for hundreds, if not thousands, of cryptocurrencies.

Raydium (RAY) 就交易量而言是 Jupiter 的有力競爭者。兩者在日交易量方面經常相互超越。它以其流暢、用戶友好的設計、低廉的費用以及對數百種甚至數千種加密貨幣的支持而聞名。

Main Features

Raydium facilitates token swaps, liquidity provision, and yield farming for users. The protocol facilitates asset trading using an automated market maker (AMM) algorithm. It also features Acceleraytor, a launchpad that hosts initial DEX offerings (IDOs) for new Solana projects.

主要特點Raydium 為用戶提供代幣交換、流動性提供和流動性挖礦便利。該協議使用自動做市商(AMM)演算法促進資產交易。它還具有 Acceleraytor,這是一個為新 Solana 專案託管初始 DEX 產品(IDO)的啟動板。

What sets Raydium apart is its integration with OpenBook’s central limit order book. This allows users and liquidity pools on Raydium to tap into the broader liquidity and order flow of the entire OpenBook ecosystem and vice versa.

Raydium 的與眾不同之處在於它與 OpenBook 的中央限價訂單簿的整合。這使得 Raydium 上的用戶和流動性池能夠利用整個 OpenBook 生態系統更廣泛的流動性和訂單流,反之亦然。

Raydium also allows anyone to create a liquidity pool for a token pair, allowing for permissionless participation and enhancing liquidity within the ecosystem.

Raydium 還允許任何人為代幣對創建流動性池,允許無需許可的參與並增強生態系統內的流動性。

What are Raydium Fees?

Raydium has a complex fee structure. It charges a small trading fee for each swap in a pool, which is typically 0.25% taken on the trade. The fee is then divided to reward liquidity providers, conduct RAY buybacks, and contribute to the Raydium treasury.

什麼是 Raydium 費用?它對池中的每個掉期收取少量交易費,通常為交易的 0.25%。然後,該費用將用於獎勵流動性提供者、進行 RAY 回購以及向 Raydium 金庫捐款。

Treasury fees from CLMM pool trades are automatically converted to USDC and transferred to another designated address controlled by the Squads Multi-sig, which is used to cover RPC expenses.

CLMM 礦池交易產生的財務費用會自動轉換為 USDC,並轉移到 Squads Multi-sig 控制的另一個指定地址,用於支付 RPC 費用。

For Concentrated Liquidity (CLMM) pools, the trading fee varies across four tiers: 100 bps, 25 bps, 5 bps, or 1 bp. Liquidity providers receive 84% of the fee, while 12% is allocated to RAY buybacks and the remaining 4% to the treasury.

對於集中流動性 (CLMM) 池,交易費用分為四個等級:100 bps、25 bps、5 bps 或 1 bps。流動性提供者收取 84% 的費用,12% 分配給 RAY 回購,其餘 4% 分配給國庫。

Users who want to create a standard AMM pool must pay a fee of 0.4 SOL. This is done to discourage pool spamming and support the protocol’s sustainability.

想要建立標準AMM池的使用者必須支付0.4 SOL的費用。這樣做是為了阻止礦池垃圾郵件並支持協議的可持續性。

What Wallets Does Raydium Support?

Raydium supports several wallets, including hardware wallets such as Ledger. Here’s a quick breakdown:

Raydium 支援哪些錢包?這是一個快速細分:

- Solflare

- Phantom

- OKX Wallet

- Trust Wallet

- Sollet

- Exodus

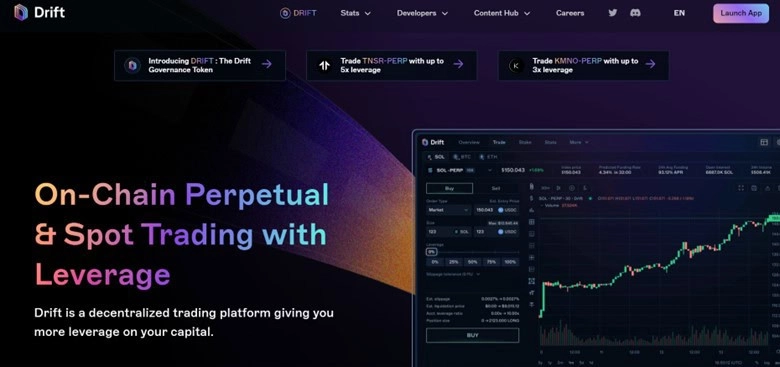

Drift Protocol

Quick summary:

SolflarePhantomOKX 錢包Trust 錢包SolletExodusDrift 協定快速摘要:

- It has raised over $23 million, with lead investors including Multicoin Capital and Jump Capital.

- Focus on both spot and derivatives DEX Trading

- Cumulative volume of over $22B as of April 2024.

它已籌集了超過 2300 萬美元,主要投資者包括 Multicoin Capital 和 Jump Capital。

Drift Protocol is one of the largest Solana DEXs. It is designed as an open-source, non-custodial, and capital-efficient platform for those seeking spot and perpetuals trading.

Drift Protocol 是最大的 Solana DEX 之一。它被設計為一個開源、非託管且資本高效的平台,適合那些尋求現貨和永續合約交易的人。

It offers many features: spot and perpetuals trading, lending and borrowing, and passive liquidity provision. Naturally, most of the attention gravitates towards perpetuals. Users can long or short supported assets with up to 10x leverage.

它提供許多功能:現貨和永續合約交易、借貸以及被動流動性提供。當然,大部分注意力都集中在永續債券上。使用者可以以高達 10 倍的槓桿做多或做空受支援的資產。

Key Features of Drift Protocol

Drift Protocol uses a cross-margined risk engine, a keeper network, and multiple liquidity mechanisms, enabling the platform to provide users with low fees, minimal slippage, and high performance.

Drift Protocol 的主要特點Drift Protocol 採用跨保證金風險引擎、keeper 網路和多種流動性機制,使平台能夠為用戶提供低費用、最小滑點和高效能。

Moreover, it provides features such as automatic deposit yield and leveraged staking with annual yields of up to 10% (subject to fluctuations).

此外,它還提供自動存款收益率和槓桿質押等功能,年化收益率高達10%(有波動)。

Drift v2 employs a series of complex trading and liquidity mechanisms to deliver a seamless experience for users. Some of its key components are:

Drift v2 採用一系列複雜的交易和流動性機制,為使用者提供無縫的體驗。它的一些關鍵組件是:

- Drift v2 AMM uses an external Backstop AMM Liquidity (BAL), which, in simple terms, allows users to provide backstop liquidity to specific markets, increasing the depth and collateralization within the market and earning them a rebate from taker fees.

- Drift’s decentralized orderbook (DLOB): Limit orders are executed in two ways: they either match opposing orders at the same price or trigger against the Automated Market Maker (AMM) under specific conditions.

- Keepers: They listen for, store, organize, and execute valid limit orders, compiling them into off-chain order books. Each Keeper maintains its own decentralized order book. They execute trades by matching crossing and limit orders against the AMM when certain conditions are met. They earn fees for executing trades.

What are Drift Protocol Fees?

Drift has a complex structure that uses the maker-taker fee model. Fees are calculated on a per-trade basis and the user’s position size. Review the documentation page for more information.

Drift v2 AMM 使用外部Backstop AMM 流動性(BAL),簡單來說,它允許用戶向特定市場提供Backstop 流動性,增加市場內的深度和抵押品,並為他們賺取接受者費用的回扣。去中心化訂單簿( DLOB):限價訂單以兩種方式執行:它們要么以相同的價格匹配相反的訂單,要么在特定條件下觸發自動做市商(AMM)。 、組織和執行有效的限價訂單,將它們編譯成鏈下訂單簿。每個 Keeper 都維護自己的去中心化訂單簿。當滿足某些條件時,他們透過將交叉訂單和限價訂單與 AMM 進行配對來執行交易。他們透過執行交易賺取費用。費用根據每筆交易和用戶的頭寸規模計算。查看文件頁面以取得更多資訊。

What Wallet Does Drift Protocol Support?

Drift Protocol supports multiple crypto wallets, including:

Drift Protocol 支援哪些錢包?

- Phantom

- Solflare

- Trust Wallet

- WalletConnect

- Coin98.

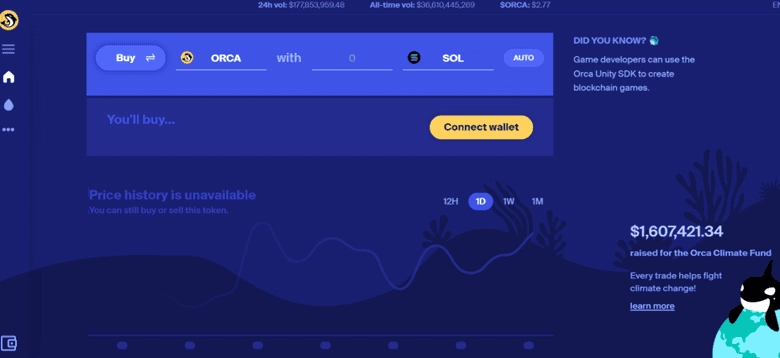

Orca

Quick summary:

PhantomSolflareTrust WalletWalletConnectCoin98.Orca快速摘要:

- One of Solana’s biggest DEX by TVL

- ORCA’s market capitalization surpassed $133M

- Only DEX on Solana to use a CLAMM (concentrated liquidity AMM)

Solana 最大的 DEX 之一(TVLORCA 市值超過 133 美元)僅 Solana 上的 DEX 使用 CLAMM(集中流動性 AMM)

Orca is a decentralized exchange praised for its simplicity and user-friendly interface launched in February 2021.

Orca 是一家去中心化交易所,於 2021 年 2 月推出,因其簡單性和用戶友好的介面而受到好評。

The DEX stands out for its deep liquidity across multiple pools. This has been known to attract a lot of traders who are looking to optimize their overall DEX trading performance.

DEX 因其跨多個池的深度流動性而脫穎而出。眾所周知,這吸引了許多尋求優化整體 DEX 交易表現的交易者。

Key Features of Orca

Orca enables token swapping and provides a share of trading fees through its aquafarms. This concept of liquidity pooling for trading originated from Ethereum’s decentralized exchanges like Uniswap.

OrcaOrca 的主要功能支援代幣交換,並透過其水產養殖場提供部分交易費用。這種交易流動性池的概念起源於以太坊的去中心化交易所,如Uniswap。

Despite similarities with other Solana exchanges, Orca stands out due to several distinctive features.

儘管與其他 Solana 交易所有相似之處,Orca 仍因幾個獨特的功能而脫穎而出。

- Orca’s interface includes a Fair Price Indicator, aligning with its trader-centric design philosophy. This tool helps traders ensure that a cryptocurrency’s price remains within 1% of CoinGecko’s aggregated exchange prices, offering a comprehensive market overview within a single interface.

- The protocol provides a convenient panel displaying user balances without requiring separate browser extensions.

- Another key feature is the Magic Bar, a user-friendly search feature enabling quick access to desired token pairs by typing their tickers.

It should be evident by now that Orca’s approach is to simplify things for traders and liquidity providers, highlighting its user-centered approach.

Orca 的介麵包括公平價格指示器,符合其以交易者為中心的設計理念。此工具可協助交易者確保加密貨幣的價格保持在CoinGecko 總交易價格的1% 以內,從而在單一介面中提供全面的市場概覽。顯示用戶餘額。的事情,突出其以用戶為中心的方法。

An interesting feature of Orca is that every trade made on the network contributes to the Orca Climate Fund, an autonomous enterprise that invests in climate-friendly technologies and innovations.

Orca 的一個有趣的特點是,網路上進行的每筆交易都會向 Orca 氣候基金做出貢獻,這是一家投資於氣候友善技術和創新的自主企業。

What are Orca Fees?

Fees on the Orca DEX vary, depending on the percentage each pool charges independently.

Orca 費用是多少?

Pools with a fee tier of ≥0.3%:

費用等級≥0.3%的礦池:

- 87% of the trading fee goes to the maker (Liquidity Provider)

- 12% is allocated to the DAO treasury.

- 1% is contributed to the Climate Fund.

Pools with a fee tier of <0.3%:

交易費用的 87% 歸製造商(流動性提供者)12% 分配給 DAO 金庫。

- All fees are paid to the maker (aka the liquidity provider).

Overall, this fee distribution model aims to incentivize liquidity provision while supporting the platform’s governance and contributing to environmental initiatives through the Climate Fund.

所有費用均支付給製造商(又稱流動性提供者)。

What Wallet Does Orca Support?

Orca supports multiple wallets, including hardware wallets like Ledger. Here’s a quick rundown:

Orca 支援哪些錢包?以下是一個簡短的概述:

- Trust Wallet

- OKX Wallet

- Phantom

- Solflare

- SafePal

- BitGet

Zeta Markets

Quick summary:

Trust WalletOKX WalletPhantomSolflareSafePalBitGetZeta Markets快速摘要:

- Backed by prominent VCs, including Solana Ventures

- Has raised over $23M in funding

- Near-zero gas fees and up to 20x leverage

由包括 Solana Ventures 在內的知名創投公司支持已籌集超過 2,300 萬美元的資金近乎零的汽油費和高達 20 倍的槓桿

Zeta Markets is a perpetuals exchange powered by the Solana blockchain. It was launched in 2021 and is backed by prominent venture capital (VC) investors, including Jump Capital, Wintermute, and Solana Ventures.

Zeta Markets 是一個由 Solana 區塊鏈提供支援的永續合約交易所。它於 2021 年推出,並得到了著名創投 (VC) 投資者的支持,包括 Jump Capital、Wintermute 和 Solana Ventures。

Key Features of Zeta Markets

Zeta Markets leverages the Solana blockchain to allow fast transactions and trade orders without compromising security. Here’s a rundown of the protocol’s main features:

Zeta Markets 的主要特點Zeta Markets 利用 Solana 區塊鏈實現快速交易和交易訂單,而不會影響安全性。以下是該協議主要功能的概述:

- Security: Users have full control over their assets with self-custody, and trading is margined in USDC, enhancing safety.

- Capital Efficiency: Traders can access up to 10x leverage through cross-margining, optimizing capital utilization.

- Decentralized Price Discovery: The exchange employs a fully on-chain limit order book (CLOB), ensuring price discovery without centralization.

- Institutional Liquidity: Zeta Markets facilitates programmatic connectivity through its SDK/CPI programs, enabling smart contract integration for Market Makers and other institutional players.

- Gamification: The platform introduces gamified elements such as leaderboards, referral programs, and trading rewards, enhancing user engagement and interaction

What are Zeta Market Fees?

Zeta Markets uses fee tiers. You can view them on the Fee Tiers documentation page. Note that fees are notably lower compared to other derivatives exchanges on Solana.

安全性:使用者完全掌控自己的資產並自行託管,交易以USDC 進行保證金,增強了安全性。價格發現:交易所採用完全鏈上限價訂單簿(CLOB),確保價格發現無需中心化。智慧合約整合。您可以在費用等級文件頁面上查看它們。請注意,與 Solana 上的其他衍生性商品交易所相比,費用明顯較低。

What Wallet Does Zeta Markets Support?

Compared to other DEXs, the wallet options are somewhat limited, as the protocol only supports Solflare, WalletConnect, Backpack, OKX Wallet, and Phantom.

Zeta Markets 支援哪些錢包?

Future Outlook for Solana DEXs

With the exception of Solana’s downturn in 2021 and 2022, largely induced by FTX’s downfall, the network and its token have performed very well, more or less, since their inception.

Solana DEX 的未來展望 除了 Solana 在 2021 年和 2022 年的低迷(主要是由 FTX 的垮台引起)之外,該網絡及其代幣自成立以來或多或少都表現得非常好。

Recall that FTX was a strong backer of Solana, holding many SOL tokens. Once the exchange defaulted following SBF’s fiasco, many SOL investors reduced or eliminated their exposure out of fear for the entire network because of FTX’s influence.

回想一下,FTX 是 Solana 的堅定支持者,持有許多 SOL 代幣。一旦 SBF 慘敗導致交易所違約,許多 SOL 投資者就會因為 FTX 的影響而對整個網路感到擔憂,從而減少或消除了自己的風險敞口。

However, the protocol itself has since proven resilient. Solana has successfully decoupled from the impact of FTX and proved that this wouldn’t have a long-term impact on it.

然而,該協議本身已被證明具有彈性。 Solana 已成功擺脫 FTX 的影響,並證明這不會對其產生長期影響。

As a result, the network has been thriving, as it can be seen in multiple components, including but not limited to:

因此,網路一直在蓬勃發展,這可以從多個組件中看出,包括但不限於:

- SOL’s price

- Transaction count on Solana

- New addresses on Solana

- Development activity and more

A lot of it is owed to the success of the teams behind the best Solana decentralized exchanges because they underpin the entire local DeFi ecosystem.

SOL 的價格 Solana 上的交易依賴 Solana 上的新地址開發活動等很大程度上要歸功於最好的 Solana 去中心化交易所背後團隊的成功,因為他們支撐著整個本地 DeFi 生態系統。

If protocol developers continue to deliver and improve the capabilities of Solana, it’s perhaps justified to assume that the future for Solana DEXs is looking bright.

如果協議開發人員繼續提供和改進 Solana 的功能,那麼可以合理地假設 Solana DEX 的未來看起來很光明。

Is Trading on DEXs Safe?

To answer this question, we must first make a few important clarifications.

在 DEX 上交易安全嗎?

First, trading on a DEX requires more technical knowledge and preparation, compared to trading on a centralized exchange. You have to have your own self-custody wallet, which can present certain challenges on its own.

首先,與中心化交易所交易相比,在 DEX 上交易需要更多的技術知識和準備。您必須擁有自己的自我託管錢包,這本身就會帶來一定的挑戰。

However, if you are confident in your ability to maneuver in an on-chain environment, trading on a DEX can be safer. This is because you, as a trader, are in complete control over your funds—there is no central party that can censor your transactions, block your deposits or withdrawals, or impact your trading activities in any way.

然而,如果您對自己在鏈上環境中的操作能力充滿信心,那麼在 DEX 上進行交易可能會更安全。這是因為,作為交易者,您可以完全控制您的資金——沒有任何中央機構可以審查您的交易、阻止您的存款或提款或以任何方式影響您的交易活動。

All things considered, though, the majority of users are not as technical and might encounter challenges when trading on a DEX. That’s why it’s highly recommended to make sure that you are entirely aware of their intricacies so you don’t end up paying for high slippage or worse – put your coins in jeopardy.

但總的來說,大多數用戶的技術水平不高,在 DEX 上交易時可能會遇到挑戰。這就是為什麼強烈建議您確保完全了解它們的複雜性,這樣您就不會最終為高滑點或更糟糕的情況付出代價 - 讓您的代幣處於危險之中。

Frequently Asked Questions

Which Solana DEX has the most volume?

Jupiter is ranked as the Solana DEX with the most daily trading volume, but the spot is highly contested by Raydium, which is typically regarded as the second-largest DEX on Solana.

常見問題哪一個 Solana DEX 的交易量最大?

What is the first DEX on Solana?

Solar Dex is the first DEX on Solana. This has become somewhat of a crypto memorabilia because Solar Dex is not amongst the top decentralized exchanges any more.

Solana 上的第一個 DEX 是什麼?這已經成為某種加密貨幣紀念品,因為 Solar Dex 不再是頂級去中心化交易所之一。

What is the best Solana DEX?

The best Solana DEX is the one that serves your particular needs. If you are looking for spot trades, perhaps Raydium is your choice. If you want more capabilities such as limit orders and DCA – maybe you should turn to Jupiter.

最好的 Solana DEX 是什麼?如果您正在尋找現貨交易,也許 Raydium 是您的選擇。如果您想要更多功能,例如限價訂單和 DCA – 也許您應該轉向 Jupiter。

What is the best DEX crypto?

DEX cryptocurrencies usually refer to the native coins underpinning the decentralized exchange’s ecosystem and governance

什麼是最好的 DEX 加密貨幣?

Best Solana DEXs – Final Thoughts

In conclusion, the Solana ecosystem boasts several prominent DEXs, each offering unique features and advantages.

最佳 Solana DEX – 最後的想法 總之,Solana 生態系統擁有幾個著名的 DEX,每個都提供獨特的功能和優勢。

The network continues to thrive in most measurable metrics, and DEX development has undoubtedly been a major part of it.

這個網絡在大多數可衡量指標上繼續蓬勃發展,而 DEX 開發無疑是其中的重要組成部分。

The teams compete to bring new and exciting features for traders, such as limit orders, on-chain derivatives trading, dynamic pools, and more—all of which are bound to attract traders as the ecosystem grows in the future.

這些團隊競相為交易者帶來令人興奮的新功能,例如限價訂單、鏈上衍生性商品交易、動態池等,隨著生態系統未來的發展,所有這些都必將吸引交易者。

The post Top Solana Decentralized Exchanges (DEXs) to Watch in 2024 appeared first on CryptoPotato.

《2024 年最值得關注的 Solana 去中心化交易所 (DEX)》一文首先出現在 CryptoPotato 上。

閱讀 CryptoPotatoInvestment 免責聲明

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

-

-

- PI網絡(PI)未能第二次進行Binance的“投票”活動

- 2025-04-03 15:15:12

- 加密貨幣社區一直在討論,因為全球最大的加密貨幣交易所Binance舉行了備受期待的“投票列出”活動。

-

-

-