|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

紐約證券交易所正在對市場參與者進行調查,以了解過渡到 24/7 交易的可行性,以反映加密貨幣的全天候運作。由於 Covid-19 大流行期間加密貨幣交易的興起和散戶投資者活動的增加,這種轉變受到了關注。

NYSE Explores 24/7 Stock Trading, Seeking Market Feedback Amidst Growing Demand

紐約證券交易所探索 24/7 股票交易,在需求不斷增長的情況下尋求市場反饋

The New York Stock Exchange (NYSE), a bastion of American finance since its inception in the 18th century, is venturing into uncharted territory by soliciting opinions from market participants on the potential adoption of 24/7 stock trading. This audacious move signals a tectonic shift in the traditional market landscape, driven by the burgeoning popularity of cryptocurrencies and the exponential growth of retail investor activity.

紐約證券交易所 (NYSE) 自 18 世紀成立以來一直是美國金融的堡壘,目前正在向市場參與者徵求關於可能採用 24/7 股票交易的意見,從而進入未知領域。在加密貨幣的快速普及和散戶投資者活動的指數增長的推動下,這一大膽的舉動標誌著傳統市場格局的結構性轉變。

The pandemic-induced surge in cryptocurrency trading, coupled with a remarkable boom in retail investor engagement, propelled the concept of round-the-clock trading into the spotlight. The NYSE, renowned for its iconic bell-ringing ceremonies demarcating the start and end of the trading day, is now considering extending its operations beyond these hallowed hours.

疫情引發的加密貨幣交易激增,加上散戶參與度的顯著增長,使全天候交易的概念成為人們關注的焦點。紐約證券交易所因其標誌性的交易日開始和結束敲鐘儀式而聞名,現在正在考慮將其業務擴展到這些神聖的時間之外。

The catalyst behind this seismic shift is a startup called 24 Exchange, backed by none other than billionaire hedge fund maestro Steve Cohen. This trailblazing platform is poised to become the first stock exchange to facilitate 24/7 trading, pushing the boundaries of accessibility in the financial markets.

這一巨大轉變背後的催化劑是一家名為 24 Exchange 的新創公司,該公司的支持者正是億萬富翁對沖基金大師 Steve Cohen。這個開創性的平台有望成為第一個促進 24/7 交易的證券交易所,突破金融市場可及性的界限。

Moreover, several retail brokers, such as the ubiquitous Robinhood, have already adopted round-the-clock trading models, further fueling the demand for extended market hours. As Dmitri Galin, founder and CEO of 24 Exchange, astutely observed in 2023, "Anyone who wants to trade crypto 24/7 would also like to trade Apple or Microsoft 24/7."

此外,一些零售經紀商,例如無處不在的Robinhood,已經採用了全天候交易模式,進一步刺激了延長市場交易時間的需求。正如 24 Exchange 創始人兼首席執行官 Dmitri Galin 在 2023 年敏銳地觀察到的那樣,“任何想要 24/7 交易加密貨幣的人也想交易 Apple 或 Microsoft 24/7。”

Undoubtedly, the allure of 24/7 trading stems from the uninterrupted availability of trading opportunities. It caters to the globalized nature of today's markets, where investors from diverse time zones seek seamless access to financial assets. Furthermore, the influx of investors from Asia and Europe into U.S. financial markets has exacerbated the need for extended trading hours.

毫無疑問,24/7 交易的吸引力源自於不間斷的交易機會。它迎合了當今市場的全球化性質,來自不同時區的投資者尋求無縫獲取金融資產。此外,來自亞洲和歐洲的投資者湧入美國金融市場,加劇了延長交易時間的需求。

Brian Hyndman, chief executive of Blue Ocean, an overnight-trading provider, succinctly captured the prevailing sentiment in a recent interview with the Financial Times: "The world changed with the pandemic and with crypto trading 24/7. Everybody has the infrastructure and the support to handle trading overnight now."

隔夜交易提供者Blue Ocean 的執行長 Brian Hyndman 在最近接受《金融時報》採訪時簡潔地捕捉到了普遍的情緒:「世界因疫情和24/7 加密貨幣交易而改變。

The NYSE's survey delves into the intricacies of round-the-clock trading, seeking insights from market participants on various aspects. One key area of exploration centers on the preferred format of overnight trading, namely, whether it should operate seven days a week or adopt a more tailored approach. The survey also delves into the crucial question of investor protection during extended trading hours, ensuring adequate safeguards against price fluctuations. Staffing arrangements for these overnight sessions are another critical consideration being scrutinized by the NYSE.

紐約證券交易所的調查深入研究了全天候交易的複雜性,尋求市場參與者對各個方面的見解。探索的一個關鍵領域集中在隔夜交易的首選形式上,即是否應該每週運行 7 天,還是採取更有針對性的方法。該調查還深入探討了延長交易時間內投資者保護的關鍵問題,確保針對價格波動提供足夠的保障。這些隔夜會議的人員安排是紐約證券交易所正在審查的另一個重要考慮因素。

The Securities and Exchange Commission (SEC), the regulatory behemoth overseeing the U.S. securities industry, holds the key to the fate of 24/7 stock trading. The SEC is currently reviewing 24 Exchange's application, and a decision is expected within the next several months. The outcome of this application will undeniably shape the future of stock trading in the United States.

美國證券交易委員會 (SEC) 作為監管美國證券業的監管巨頭,掌握著 24/7 股票交易命運的關鍵。 SEC 目前正在審查 24 Exchange 的申請,預計將在未來幾個月內做出決定。無可否認,該申請的結果將塑造美國股票交易的未來。

24/7 stock trading presents both unparalleled opportunities and significant challenges. The NYSE's exploration of this novel concept underscores its commitment to adapting to the evolving financial landscape and meeting the growing demands of market participants. As the SEC contemplates its decision, the industry eagerly awaits the verdict that will determine the future of stock trading in the digital age.

24/7 股票交易既帶來了無與倫比的機遇,也帶來了重大挑戰。紐約證券交易所對這一新穎概念的探索突顯了其致力於適應不斷變化的金融格局並滿足市場參與者不斷增長的需求的承諾。在美國證券交易委員會考慮其決定之際,整個產業都在熱切等待這項裁決,該裁決將決定數位時代股票交易的未來。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

-

- XY礦工雲採礦服務允許用戶在沒有昂貴設備的情況下開採比特幣,狗狗和其他加密貨幣

- 2025-04-17 18:45:12

- 隨著區塊鏈技術的快速發展和日益熱的比特幣市場,越來越多的人開始關注數字貨幣投資。

-

- 儘管最近的市場不確定性在廣泛,但加密貨幣交易員設法賺了66.6萬美元

- 2025-04-17 18:45:12

- 儘管最近的市場不確定性在廣泛,但加密貨幣交易員已設法從僅4.5萬美元的投資中賺了66.6萬美元

-

-

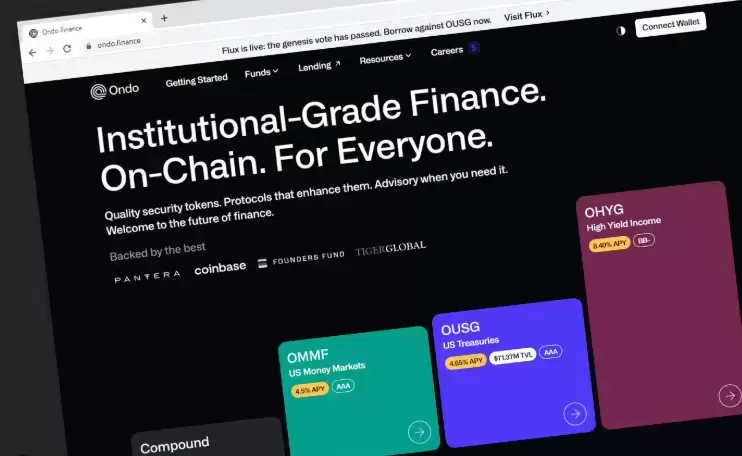

- RWA:Ondo Finance將用萬事達卡征服美國國庫債券市場

- 2025-04-17 18:40:12

- Onda Finance將以萬事達卡征服美國國庫債券市場。

-