|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

分析機構 Messari 最近的報告強調了 Hedera 在關鍵財務指標方面的進展。

Hedera (HBAR) had a stellar second quarter (Q2) in comparison with the broader crypto market, which confronted a downturn. A latest report by Messari highlights key developments in Hedera’s performance.

與面臨低迷的更廣泛的加密貨幣市場相比,Hedera (HBAR) 第二季度 (Q2) 表現出色。 Messari 的最新報告強調了 Hedera 業績的關鍵發展。

Hedera’s Q2 Momentum

Ivy第二季度的勢頭

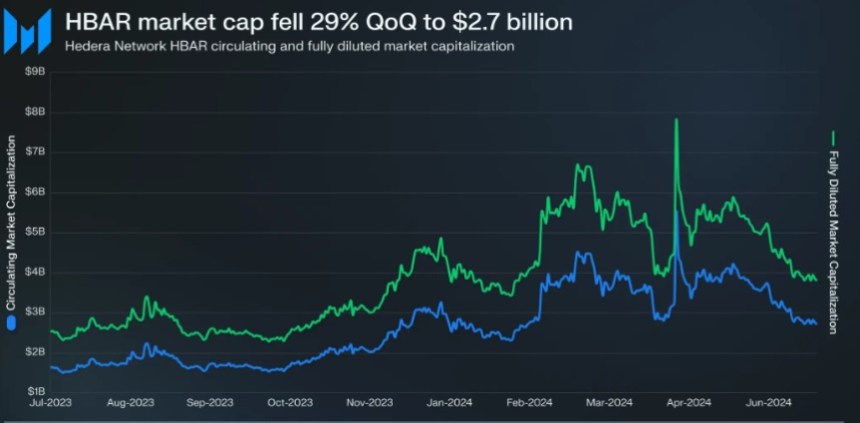

One of many highlights of Hedera’s Q2 was the efficiency in essential monetary metrics. Regardless of a 29% quarter-over-quarter (QoQ) lower in circulating market cap to $2.7 billion, HBAR managed to climb six spots from 36 to 30 amongst all tokens, outperforming similarly valued cryptocurrencies.

Hedera 第二季的眾多亮點之一是基本貨幣指標的效率。儘管流通市值環比下降 29% 至 27 億美元,但 HBAR 在所有代幣中的排名從第 36 位上升到第 30 位,表現優於同等價值的加密貨幣。

One other optimistic signal was income, which grew to become a beacon of success for Hedera throughout Q2. The community witnessed a 26% uptick in USD income, reaching $1.4 million. Moreover, income in HBAR surged by 19% quarter-over-quarter to 14.6 million.

另一個樂觀信號是收入,它在整個第二季度成為 Hedera 的成功燈塔。該社區的美元收入成長了 26%,達到 140 萬美元。此外,HBAR 的收入環比飆升 19% 至 1,460 萬。

Associated Studying:

相關學習:

One other spotlight was the tempo of HBAR issuance and circulation. Of the whole 50 billion HBAR, 72% was in circulation on the finish of Q2. The quarterly distribution of HBAR indicated the discharge of an extra 1.5 billion HBAR within the upcoming quarter, with a major allocation of 94% earmarked for ecosystem and open supply improvement initiatives.

另一個焦點是 HBAR 的發行和流通節奏。在 500 億個 HBAR 總量中,72% 已在第二季末流通。 HBAR 的季度分配表明,下一季將額外釋放 15 億個 HBAR,其中 94% 的主要分配用於生態系統和開放供應改善計劃。

Whereas every day accounts created elevated 31% sequentially to 11,100, every day lively addresses declined 37% to 10,600, reflecting a blended image of development and engagement inside the community. Transaction exercise rebounded in Q2, as common every day transactions elevated 46% to 132.9 million, pushed primarily by the Hedera Consensus service.

雖然每日創建的帳戶數量環比增長 31% 至 11,100 個,但每日活躍地址數量下降 37% 至 10,600 個,反映出社區內部發展和參與的混合形象。第二季交易活動反彈,每日交易量成長 46% 至 1.329 億,這主要是由 Hedera Consensus 服務推動的。

Staking Surge And DeFi Fluctuations

質押激增和 DeFi 波動

The report additional highlighted staking within the community, which emerged as a major development inside the ecosystem. Of the circulating provide, 62.2% was staked, indicating a excessive degree of engagement from entities like Swirlds and Swirlds Labs.

該報告還強調了社區內的質押,這是生態系統內的重大發展。在流通量中,62.2% 被質押,這表明 Swirlds 和 Swirlds Labs 等實體的參與程度過高。

Nevertheless, the decentralized finance (DeFi) panorama on Hedera witnessed fluctuations in Q2. Complete Worth Locked (TVL) skilled a decline in each USD and HBAR metrics.

然而,Hedera 上的去中心化金融(DeFi)全景在第二季度出現了波動。總價值鎖定 (TVL) 的美元和 HBAR 指標均下降。

Regardless of the decline, initiatives just like the HBAR Basis’ DeFi TVL development program have injected vitality into the ecosystem, driving liquidity and consciousness. Liquid staking, however, noticed a resurgence in Q2, with Stader’s TVL rising by 41% in HBAR phrases.

儘管有所下降,像 HBAR Basis 的 DeFi TVL 開發計劃這樣的舉措已經為生態系統注入了活力,推動了流動性和意識。然而,流動質押在第二季出現復甦,根據 HBAR 計算,Stader 的 TVL 成長了 41%。

Associated Studying:

相關學習:

Lastly, Hedera’s decentralized alternate (DEX) volumes additionally noticed a dip within the second quarter after a bullish first quarter, in keeping with Messari, however it has remained sturdy year-over-year (YoY).

最後,根據 Messari 的說法,Hedera 的去中心化交易所 (DEX) 交易量在第一季看漲後第二季也有所下降,但同比仍保持強勁。

On the time of writing, HBAR data a major 22% drop in value over the previous month, at the moment buying and selling at $0.050 amid the overall market uncertainty led by elevated volatility of the biggest cryptocurrencies available on the market Bitcoin (BTC) and Ethereum (ETH) (ETH).

截至本文撰寫時,HBAR 數據比上個月大幅下跌22%,目前買賣價格為0.050 美元,原因是市場上最大的加密貨幣比特幣(BTC) 和比特幣(BTC) 的波動性加劇導致整體市場不確定性。

Moreover, CoinGecko information reveals that the token has seen a notable lower in buying and selling quantity over the previous 48 hours, dropping by 35%. Most significantly, HBAR continues to be 91% under its all-time excessive of $0.056 reached in September 2021.

此外,CoinGecko 資訊顯示,該代幣的買賣量在過去 48 小時內明顯下降,下降了 35%。最重要的是,HBAR 仍處於 91% 的水平,低於 2021 年 9 月達到的歷史最高水準 0.056 美元。

Characteristic picture from DALL-E, chart from TradingView.com

特徵圖片來自 DALL-E,圖表來自 TradingView.com

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- 卡爾達諾 (ADA) 反彈,模仿 2020 年以來 2,680% 的牛市

- 2024-11-22 22:25:49

- 卡爾達諾(ADA)反彈,在不到一個月的時間內收復了兩年半的損失,過去三週飆升了 174%。

-

-

-

- DOGE 再次引人注目,分析師預測可能飆升至 4 美元

- 2024-11-22 22:25:02

- $DOGE 再次引人注目,分析師預測其價格可能飆升至 4 美元,這一里程碑可能會鞏固其作為加密貨幣巨頭的地位。

-

-

-