|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

聯準會的點陣圖描繪了政策制定者的未來利率預期,顯示明年降息的預測從四次下調至兩次。

The Federal Reserve's latest decision to lower its policy rate to the 4.25-4.5% range has sent shockwaves through financial markets, including a significant impact on the crypto sector.

聯準會最新決定將政策利率降低至 4.25-4.5% 範圍,給金融市場帶來了衝擊,其中對加密貨幣產業產生了重大影響。

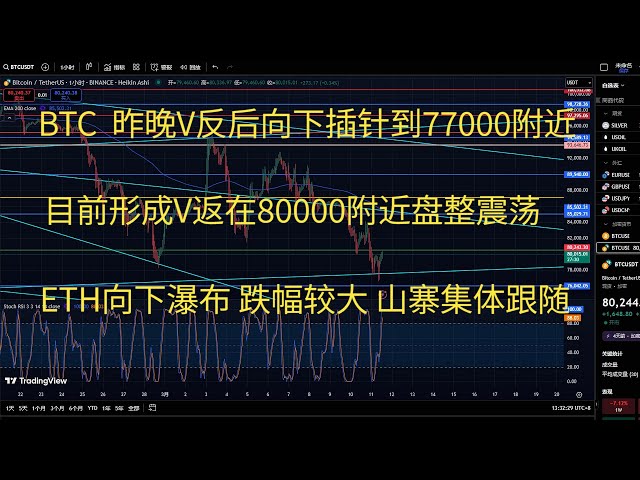

Bitcoin, which has often been touted as a hedge against inflation, fell sharply in the wake of the Fed’s announcement, dropping below $100,000 for the first time in weeks. The cryptocurrency sank by over 5%, though it has since pared some losses to sit 3.21% lower in the last 24 hours, marking an 8% decline from recent highs. Altcoins fared even worse, with Ethereum and Solana losing over 4%, and Dogecoin down 7%. From their respective highs, BTC, ETH, SOL, XRP, DOGE and HYPE are down -8%, -11%, -23%, -13%, -23% and -17%.

經常被吹捧為對沖通膨的比特幣在聯準會宣布這一消息後大幅下跌,幾週來首次跌破 10 萬美元。該加密貨幣下跌超過 5%,但在過去 24 小時內收復了部分跌幅,跌幅為 3.21%,較近期高點下跌 8%。山寨幣的表現更糟,以太幣和 Solana 下跌超過 4%,狗狗幣下跌 7%。 BTC、ETH、SOL、XRP、DOGE 和 HYPE 較各自高點下跌了 -8%、-11%、-23%、-13%、-23% 和 -17%。

Overall, the global crypto market cap fell to as low as $3.42 trillion, a 7.18% decline in 24 hours, per Coinmarketcap data, but it now stands at $3.51 trillion, a 3.89% decline in 24 hours.

總體而言,根據 Coinmarketcap 數據,全球加密貨幣市值跌至 3.42 兆美元,24 小時內下跌 7.18%,但目前為 3.51 兆美元,24 小時內下跌 3.89%。

In total, over $709 million in liquidations occurred within the last 24 hours, with $612 million of those being long positions. The sharp sell-off underscores the fragile sentiment in the crypto market, which has been grappling with macroeconomic uncertainty and regulatory pressures.

過去 24 小時內總共發生了超過 7.09 億美元的清算,其中 6.12 億美元為多頭部位。急劇的拋售凸顯了加密市場的脆弱情緒,該市場一直在應對宏觀經濟的不確定性和監管壓力。

The Fed's dot plot, which maps policymakers’ future rate expectations, revealed a reduced forecast for rate cuts next year, down from four to just two. Powell emphasized that further rate adjustments will depend on measurable progress in curbing inflation, which is expected to remain above the 2% target through 2025, Reuters reported.

聯準會的點陣圖描繪了政策制定者的未來利率預期,顯示明年降息的預測從四次下調至兩次。根據路透社報道,鮑威爾強調,進一步的利率調整將取決於抑制通膨的可衡量進展,預計到 2025 年通膨率將保持在 2% 的目標之上。

The Fed began its easing cycle with a 50 basis points (bps) cut in September, and followed up with a 25 bps cut last month. The Fed chair noted that inflation had improved from its 2022 peak but warned that core inflation, particularly shelter costs, remains sticky.

聯準會於 9 月降息 50 個基點 (bps),開始了寬鬆週期,並於上個月降息 25 個基點。聯準會主席指出,通膨已較 2022 年的峰值有所改善,但警告說,核心通膨,尤其是住房成本,仍然具有黏性。

"The extent and timing of additional adjustments to the target range will depend on incoming data, the evolving outlook, and the balance of risks," Powell stated, signaling a cautious path forward.

鮑威爾表示:「對目標範圍進行額外調整的程度和時間將取決於傳入的數據、不斷變化的前景以及風險的平衡。」他表示,未來的道路將保持謹慎。

Moreover, Powell dismissed any immediate changes to laws prohibiting the Federal Reserve from holding Bitcoin, reinforcing the central bank’s focus on traditional monetary policy tools.

此外,鮑威爾拒絕立即修改禁止聯準會持有比特幣的法律,這強化了央行對傳統貨幣政策工具的關注。

The incoming Trump administration adds a layer of unpredictability to the economic landscape, with promises of tax cuts, higher tariffs, and tighter immigration policies potentially fueling inflationary pressures. While the Fed has begun incorporating preliminary assumptions about these policies into its projections, Powell cautioned that their full impact remains highly uncertain.

即將上任的川普政府為經濟格局增添了一層不可預測性,減稅、提高關稅和收緊移民政策的承諾可能會加劇通膨壓力。儘管聯準會已開始將這些政策的初步假設納入其預測中,但鮑威爾警告說,它們的全面影響仍然高度不確定。

For the crypto market, the message is clear: tighter monetary policy for longer poses a significant headwind for digital assets, particularly speculative altcoins.

對於加密貨幣市場來說,訊息很明確:長期收緊的貨幣政策對數位資產(尤其是投機性山寨幣)構成了重大阻力。

With inflation still above target and rate cuts now expected to proceed more slowly, the crypto market faces heightened volatility in the near term. Inflation data on Friday and the Fed’s January meeting will provide further clues on monetary policy direction.

由於通膨仍高於目標,且降息預計將更加緩慢,加密貨幣市場短期內面臨更大的波動性。週五的通膨數據和聯準會1月會議將為貨幣政策方向提供進一步線索。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 病毒視頻顯示了恒河水從河岸消退後如何發掘金,銀和硬幣

- 2025-03-12 03:10:49

- 病毒式視頻顯示了恒河水從河岸消退後如何發掘金,銀和硬幣。

-

-

- LEDGITY收益率和連鎖鏈接實驗室宣布擁有獨家X空間

- 2025-03-12 03:10:49

- RWA代表在區塊鏈上具有標誌性的有形資產(房地產,債券,商品)。它們提高了投資的流動性,可及性和透明度

-

-

-

- 雷的硬幣和郵票 - 硬幣收集的遺產

- 2025-03-12 03:10:49

- 2024年11月22日,我收到了有關硬幣文章的第一封信。發送這封信的善良紳士給了我我收藏中最古老的硬幣。

-

- 加密鯨累積樂觀(OP),運動(移動)和瑪瑙幣(XCN)

- 2025-03-12 03:10:49

- 加密鯨一直在積累樂觀(OP),移動(移動)和Onyxcoin(XCN),儘管最近的市場進行了糾正,但仍有信號。

-

-