|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在加密貨幣市場固有的波動性中,投資者應該意識到與特定項目相關的潛在風險。 Coinphony 確定了下週避免交易的三種著名加密貨幣:Solana (SOL)、XRP 和 Uniswap (UNI)。 SOL 一直面臨持續的網路擁塞,XRP 每月代幣發行異常延遲引發擔憂,UNI 面臨 SEC 的法律審查。這些因素造成了不確定性,並要求尋求降低加密貨幣領域風險的交易者保持謹慎。

The Precarious State of Cryptocurrency: Solana's Network Woes, Ripple's Unusual Activity, and Uniswap's Legal Setback

加密貨幣的不穩定狀態:Solana 的網路困境、Ripple 的異常活動以及 Uniswap 的法律挫折

The cryptocurrency market, heavily influenced by news, technological advancements, and economic factors, can occasionally present uncertainty for projects. Notably, Coinphony has identified three prominent cryptocurrencies that are best avoided for trading next week, given their atypical risks.

加密貨幣市場深受新聞、技術進步和經濟因素的影響,有時會為專案帶來不確定性。值得注意的是,Coinphony 已經確定了三種著名的加密貨幣,鑑於其非典型風險,下週最好避免進行交易。

Solana: Network Congestion and Transaction Failures Abound

Solana:網路擁塞和交易失敗比比皆是

Solana (SOL), the reputedly high-performance Layer 1 blockchain and a popular Ethereum (ETH) rival, finds itself in a state of network congestion, with a rising rate of failed transactions. Notably, over half of the transactions received by Solana's validators fail to reach consensus and are thus not finalized.

Solana (SOL) 是公認的高效能第 1 層區塊鏈,也是受歡迎的以太坊 (ETH) 競爭對手,但它發現自己處於網路擁塞狀態,交易失敗率不斷上升。值得注意的是,Solana 驗證者收到的交易中有一半以上未能達成共識,因此尚未最終確定。

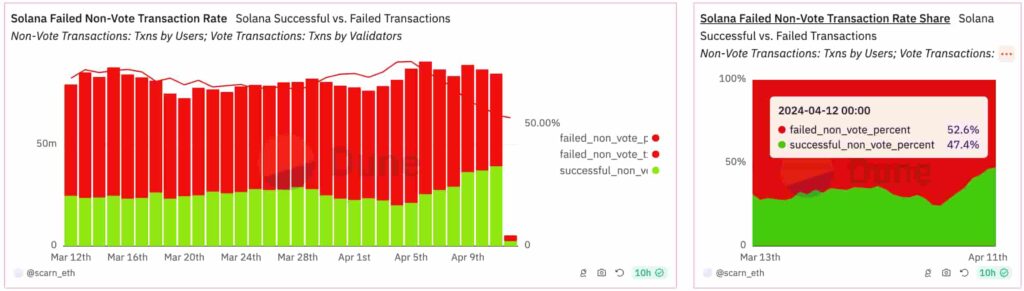

At the time of writing, on April 12, the transaction failure rate stood at 52.6%, according to a Dune Analytics dashboard by scar_eth. This level has persisted for over a month and has previously exceeded 75%.

根據scar_eth 的 Dune Analytics 儀表板,截至 4 月 12 日撰寫本文時,交易失敗率為 52.6%。這一水準已經持續了一個多月,此前曾超過75%。

Despite this, SOL remains the fifth-largest cryptocurrency by market capitalization, trading at $173, which correlates with the cryptocurrency market cap index on TradingView. This suggests that Solana traders have yet to price in the network's poor conditions, introducing uncertainty into the asset's future price action.

儘管如此,以市值計算,SOL 仍然是第五大加密貨幣,交易價格為 173 美元,這與 TradingView 上的加密貨幣市值指數相關。這表明 Solana 交易者尚未對網路的惡劣狀況進行定價,從而為該資產的未來價格走勢帶來了不確定性。

XRP: Ripple's Unusual Inactivity Raises Concerns

XRP:Ripple 異常不活躍引發擔憂

Traders would also be well-advised to avoid trading the XRP token next week, given Ripple's atypical delay in its monthly April token sale.

鑑於 Ripple 在 4 月代幣銷售中非典型的延遲,交易者也最好避免下週交易 XRP 代幣。

As reported by Coinphony, Ripple unlocked 1 billion XRP on April 1. The company then moved 200 million tokens, worth $120 million, to its Escrow account, preparing for the month's sale.

根據 Coinphony 報道,Ripple 於 4 月 1 日解鎖了 10 億 XRP。該公司隨後將 2 億枚代幣(價值 1.2 億美元)轉移到其託管帳戶,為本月的銷售做準備。

However, the 'Ripple (1)' address has not executed any payments as of press time. This is unusual for a company that has consistently sold its initial token offering within the first 11 days of each month.

然而,截至發稿時,「Ripple (1)」地址尚未執行任何付款。對於一家始終在每月前 11 天內出售首次代幣發行的公司來說,這是不尋常的。

Historically, these sales have preceded notable price drops for XRP, as illustrated by the year-to-date daily chart. The token currently trades at $0.608, seemingly poised for a significant price move.

從歷史上看,這些銷售發生在 XRP 價格顯著下跌之前,如年初至今的日線圖所示。該代幣目前的交易價格為 0.608 美元,似乎即將出現重大價格波動。

Uniswap: SEC Legal Pressure Weighs Heavily

Uniswap:SEC 法律壓力沉重

Finally, Uniswap (UNI), the largest decentralized exchange protocol by trading volume, faces potential legal pressure from the United States Securities and Exchange Commission (SEC).

最後,交易量最大的去中心化交易協議 Uniswap (UNI) 面臨來自美國證券交易委員會 (SEC) 的潛在法律壓力。

In a notable development, Uniswap creator Hayden Adams stated that the company is willing to take on the SEC.

值得注意的是,Uniswap 創辦人 Hayden Adams 表示該公司願意與 SEC 競爭。

"Today @Uniswap Labs received a Wells notice from the SEC.

「今天@Uniswap Labs 收到了來自 SEC 的 Wells 通知。

I'm not surprised. Just annoyed, disappointed, and ready to fight.

我不驚訝。只是生氣、失望,準備戰鬥。

I believe the products we've built are lawful and in the best interest of history. But it has been clear for a while that instead of...

— hayden.eth 🦄 (@haydenzadams) April 10, 2024"

我相信我們製造的產品是合法的並且符合歷史的最大利益。但有一段時間已經很清楚了,而不是… hayden.eth 🦄 (@haydenzadams) 2024 年 4 月 10 日”

As a result, UNI has experienced a sell-off this week. The Uniswap governance token has plunged from around $11.5 to $9.0, a 20% loss in four days.

因此,UNI 本週經歷了拋售。 Uniswap 治理代幣已從 11.5 美元左右暴跌至 9.0 美元,四天內下跌了 20%。

Cautious Trading Amid Network Issues, Regulatory News, and Market Volatility

網路問題、監管新聞和市場波動中交易需謹慎

In summary, cryptocurrency traders must remain aware of network issues, regulatory developments, and economic news to successfully navigate this market. Cryptocurrencies are inherently volatile, but external factors can introduce additional risks that warrant avoiding certain assets for trading purposes.

總之,加密貨幣交易者必須隨時了解網路問題、監管發展和經濟新聞,才能成功駕馭這個市場。加密貨幣本質上具有波動性,但外部因素可能會帶來額外的風險,因此需要避免某些資產用於交易目的。

Disclaimer: The information provided in this article is not intended as investment advice. Investing involves risk. Cryptocurrency investments are highly speculative and volatile, and there is a significant risk of loss associated with them.

免責聲明:本文提供的資訊並非旨在作為投資建議。投資涉及風險。加密貨幣投資具有高度投機性和波動性,並且有重大損失風險。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- 比特幣算力和價格創下新紀錄,標誌著數位貨幣領域的主導地位日益增強

- 2024-11-24 15:15:01

- 比特幣剛剛實現了兩個重要里程碑,反映出其在數位貨幣領域日益增長的主導地位。 11月21日,加密貨幣算力

-

-

-

- 狗狗幣(Big Dog)的隱藏優勢和 1 美元目標中的市場希望

- 2024-11-24 14:25:02

-

-

-